-

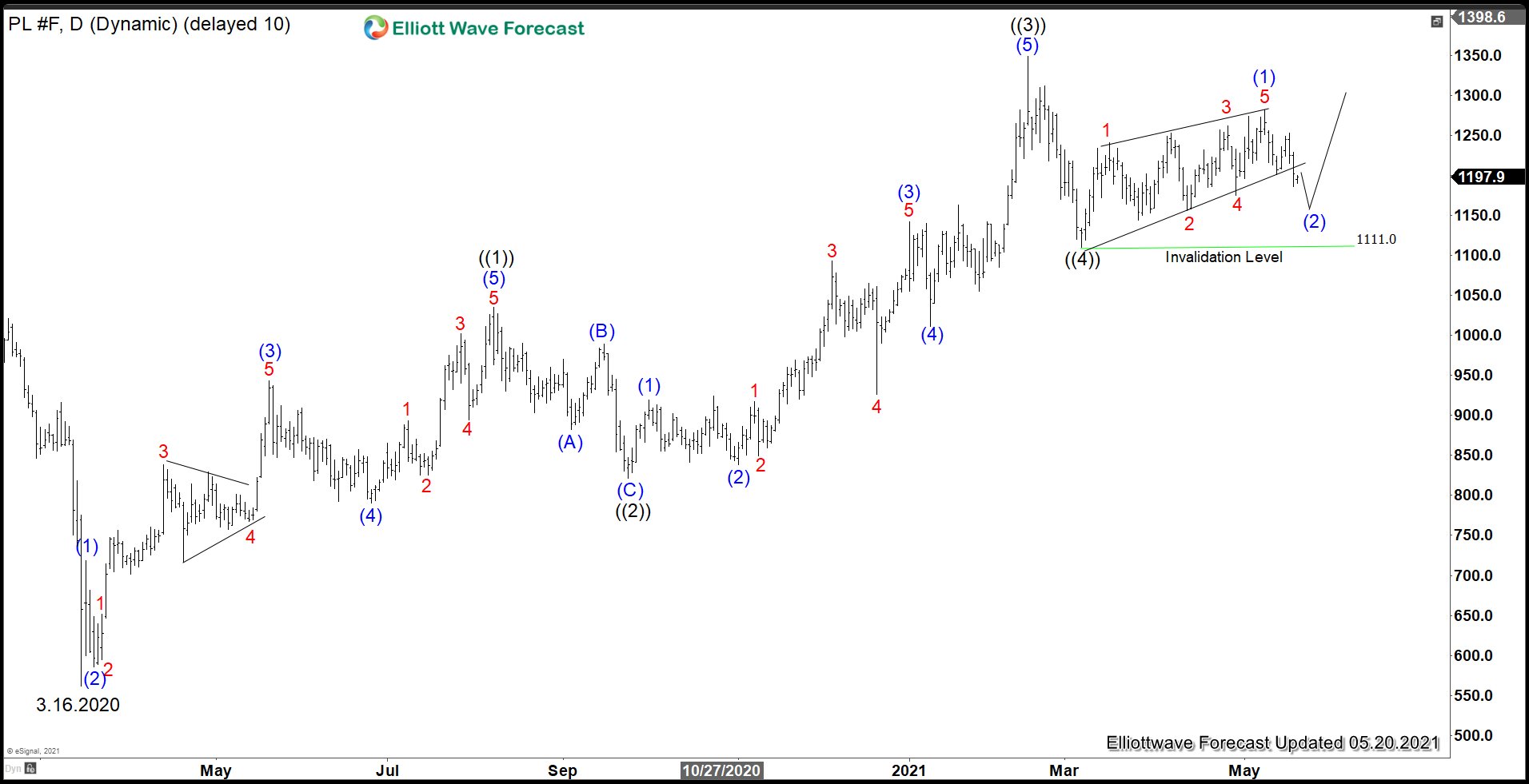

Platinum Looking for 5 Waves Rally

Read MorePost-pandemic economic rebound, government infrastructure spending, and green energy plan have driven the rally in industrial and precious metals in 2021. As governments globally are looking to curb climate change, demand for platinum may surge. The metal is used in catalysts in diesel vehicle engines to reduce carbon emissions. World Platinum Investment Council forecasts demand […]

-

Elliott Wave View: Ethereum (ETHUSD) Found Support After Massive Pullback

Read MoreEthereum (ETHUSD) sold off massively after forming all time high at 4380. This article and video look at the Elliott Wave path

-

Elliott Wave View: BAC (Bank of America) Wave 5 in Progress

Read MoreBank of America (BAC) has made a 12 year high and should see further upside. This article and video look at the Elliott Wave path.

-

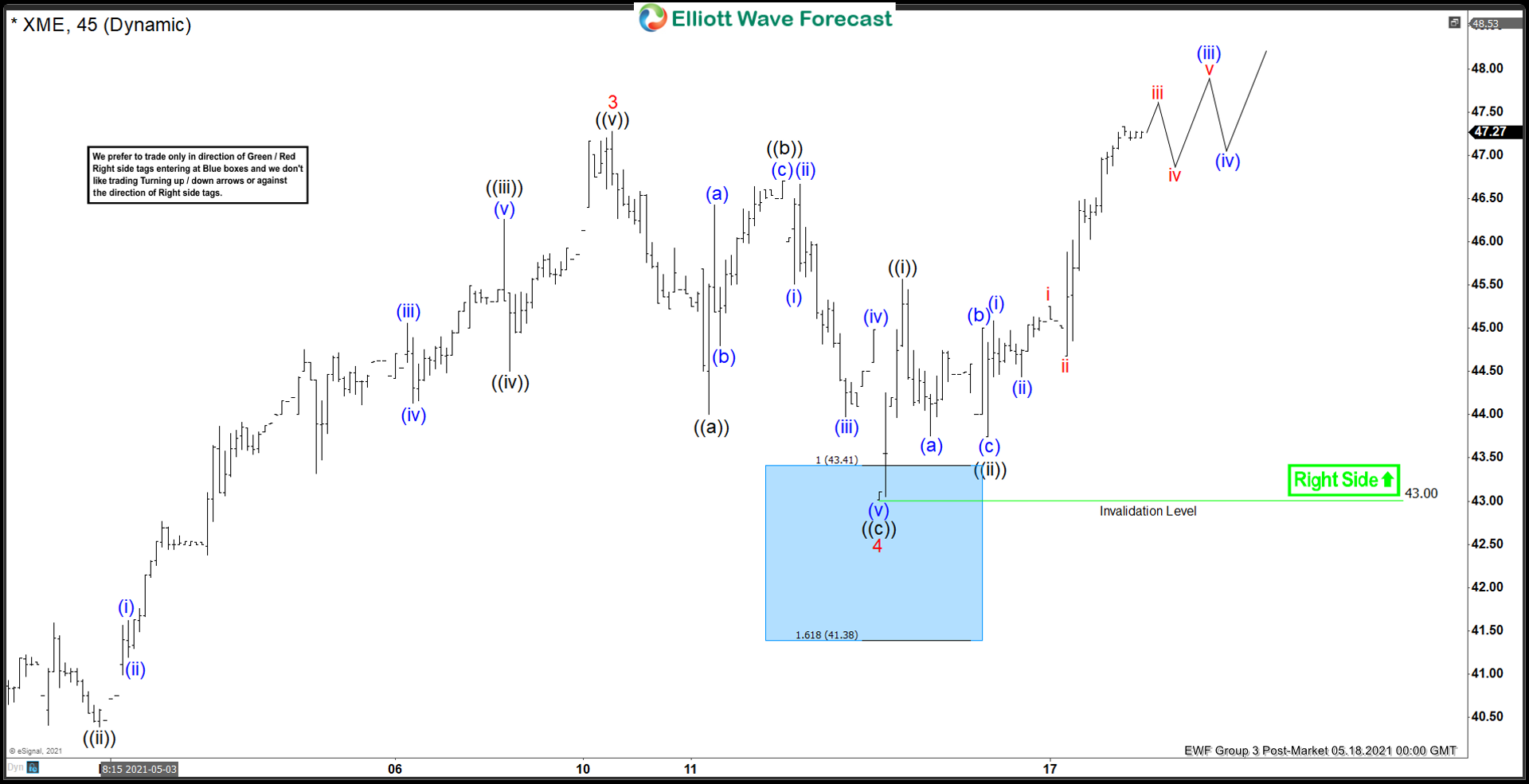

Elliott Wave View: XME Should See Further Upside

Read MoreXME (S&P Metals and Mining ETF) continues to extend higher and dips should be supported. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Oil May See Short Term Support Soon

Read MoreOil shows a 5 waves diagonal rally from March 24 low and dips can find support soon. This article and video look at the Elliott Wave path.

-

Global Sugar Supply Shortage Propels Price

Read MoreBrazil, top exporter of Sugar, experiences record prices of ethanol as Covid-19 restrictions ease. Consumers take advantage of the easing and start travelling again, increasing consumption of biofuel. This means that mills can start processing more sugar cane into ethanol, rather than into sweetener as it’s also generally more profitable. Severe droughts hitting Brazil has […]