-

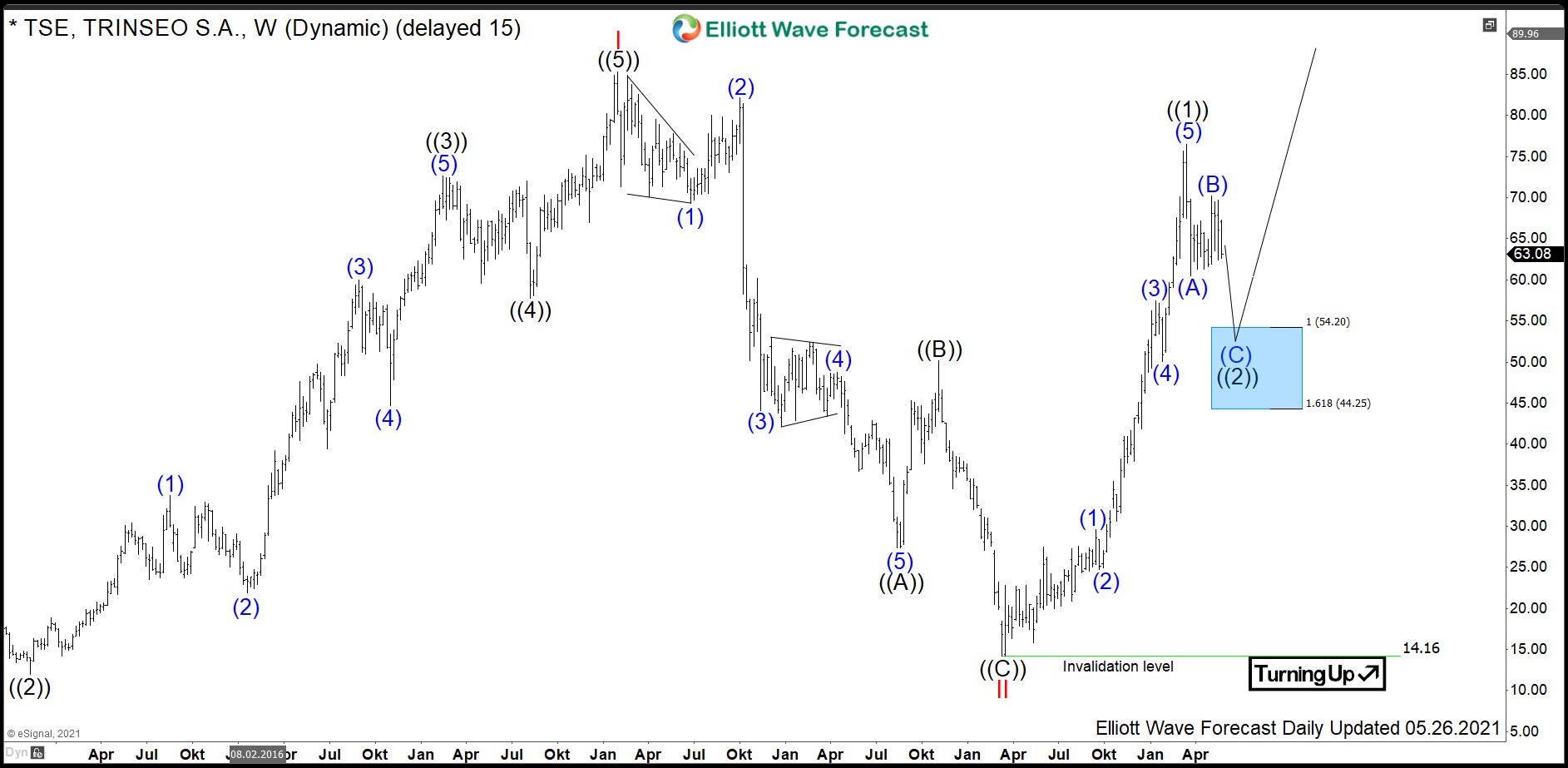

$TSE: Materials Manufacturer Trinseo Should Continue See Buyers

Read MoreTrinseo (formerly Styron) is a global materials company based in Berwyn, Pennsylvania, USA. The stock being a component of the Russel2000 index can be traded under ticker $TSE at NYSE. Trinseo offers a broad line of plastics, latex and synthetic rubber. The primary markets are automotive, appliances, electronics, packaging, tire industries, among others. Currently, we […]

-

$NEL : Energy Stock Nel ASA in front of a new bullish cycle

Read MoreNel ASA is a Norwegian heavy electrical equipment company. It provides solutions for production, storage and distribution of hydrogen from renewable energy sources. Founded in 1927 and headquartered in Oslo, Norway, it can be traded under the ticker $NEL at Oslo Stock Exchange. Nel is a part of OBX25 index. Nel ASA Weekly Elliott Wave Analysis […]

-

$RUB : Russian Rouble Should Continue Show Strength

Read MoreBack in December 2020, we presented within the main article both the monthly and the daily view in the USDRUB. Long-term, the pair should provide a resolution thrust higher out of multi-year triangle pattern. Medium-term, however, we saw Russian Rouble gaining strength as related to the US Dollar. Even though russian currency needed to tank, the idea […]

-

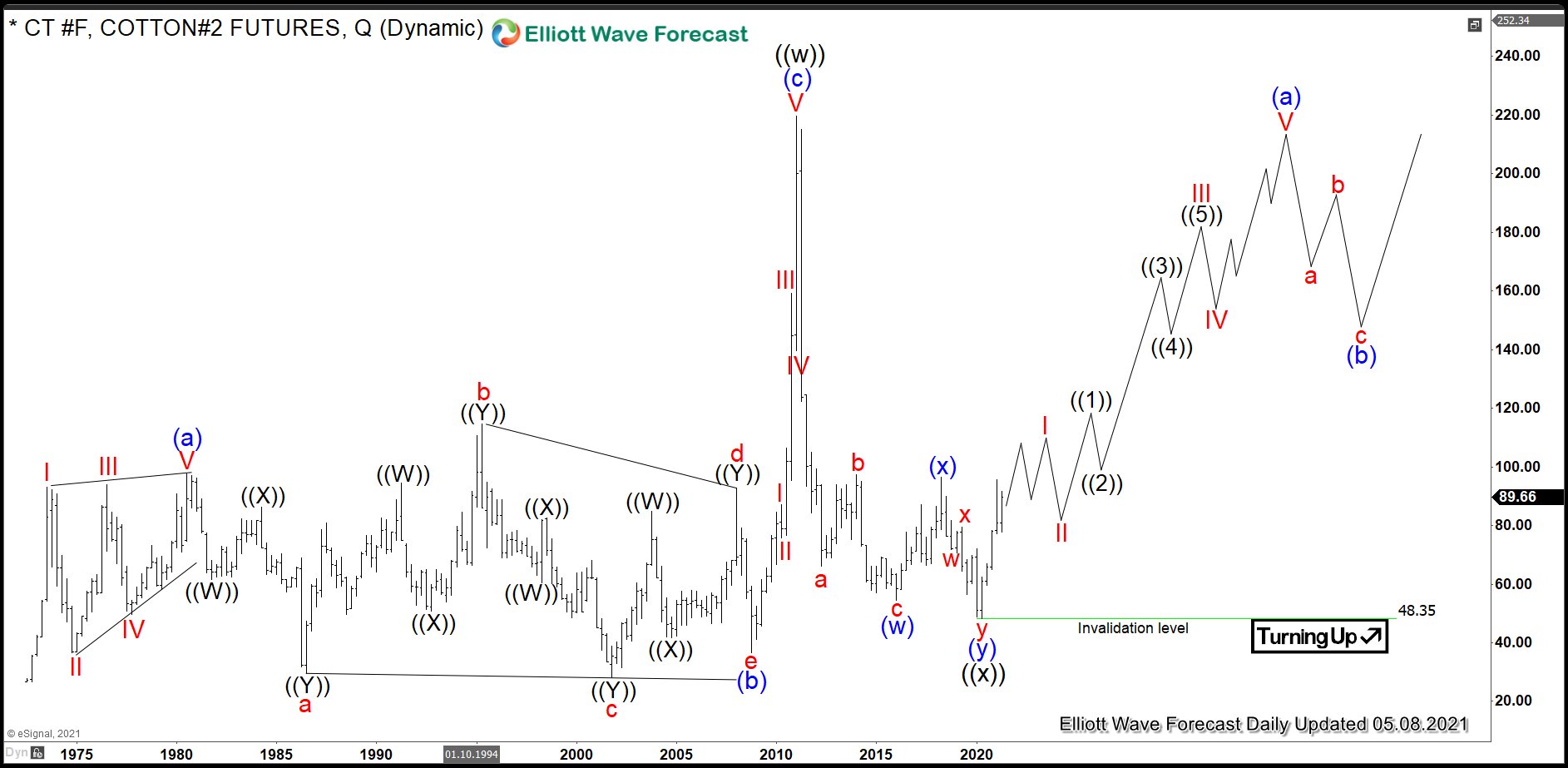

$CT #F: Cotton Started Multi-Decade Cycle Higher

Read MoreCotton is one of soft commodities, along with sugar, coffee, orange juice and cocoa. In early centuries, Alexander the Great has brought cotton from Pakistan to Europe. Much later and finally, it has obtained the dominance in textile manufacturing during the British industrial revolution in the 18th century. It was so critical that at times […]

-

$UFI: Textile Solutions Provider Unifi to Accelerate Higher

Read MoreUnifi Inc. is a global textile solutions provider based in Greensboro, North Carolina, USA. The stock being a component of the Russel3000 index can be traded under ticker $UFI at NYSE. Unifi is one of the world’s leading innovators in manufacturing synthetic and recycled performance fibers. The company is in a possession of proprietary technologies and […]

-

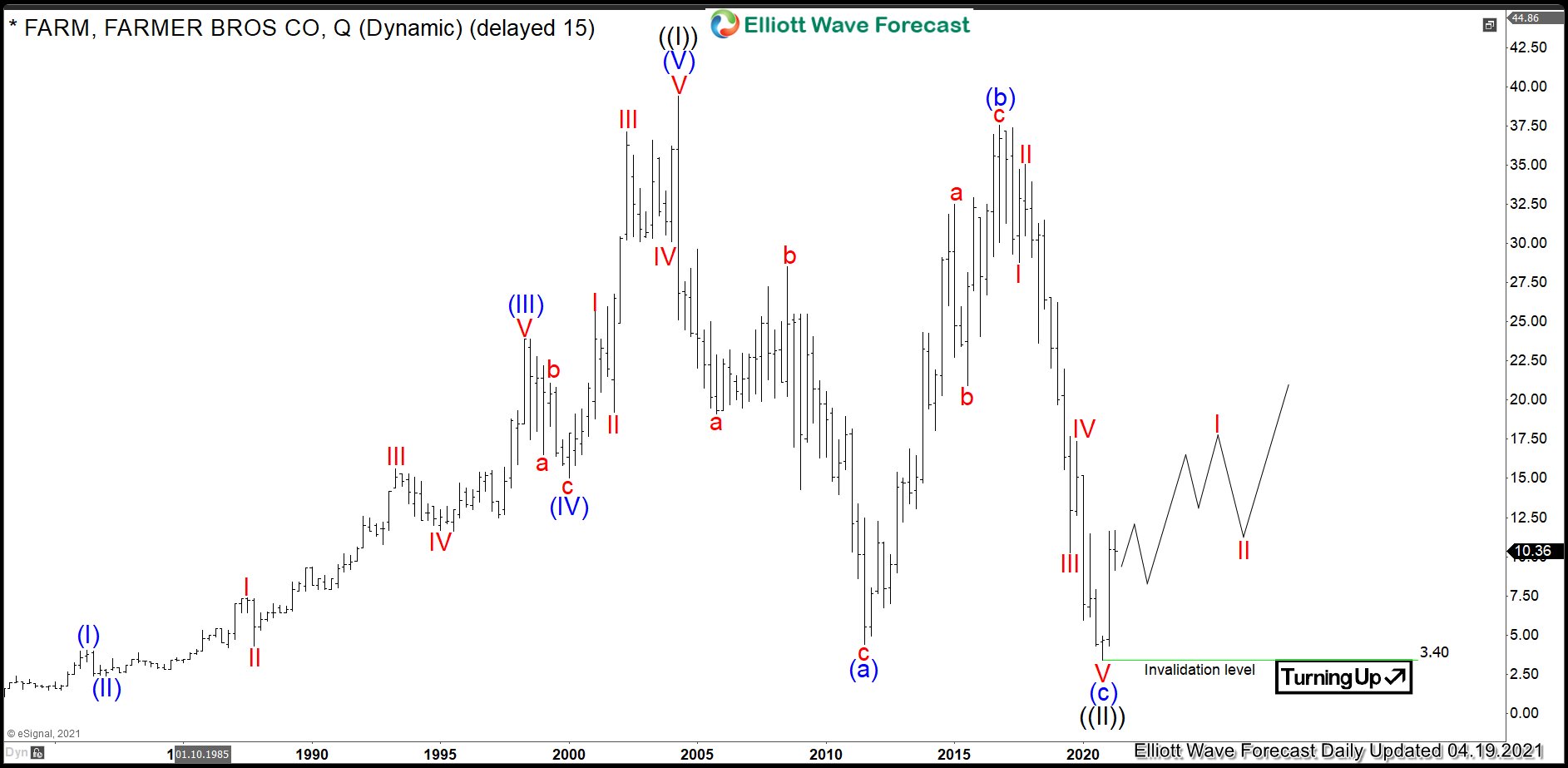

$FARM : Coffee Company Farmer Brothers Should See a Bullish Run

Read MoreFarmer Bros. Co is an U.S. american coffee foodservice company based in Nortlake, Texas, USA. Founded in 1912 and traded under tickers $FARM at Nasdaq, it is a component of the Russel2000 index. Farmer Brothers specializes in the manufacture and distribution of coffee, tea and other food items. Currently, we can see coffee and other […]