-

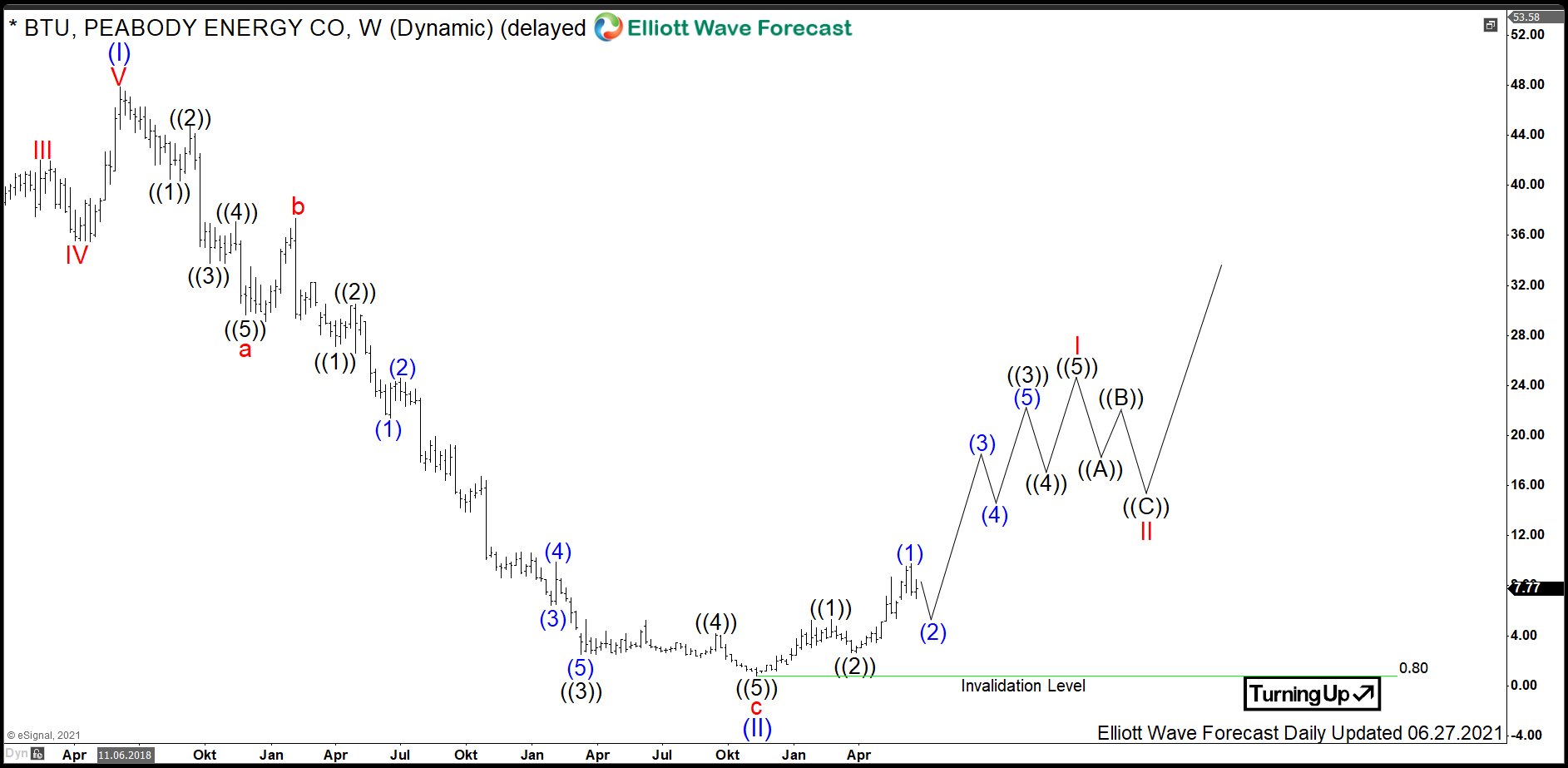

$BTU : Largest Private Coal Producer Peabody Energy Turns Higher

Read MorePeabody Energy, Inc. is the largest private sector coal company in the world. It mines, sales and distributes coal to such major markets like electricity generation and steel making. Founded in 1883, the company has its headquarters in St. Louis, Missouri, USA. Being part of the Russel2000 index, one can trade it under the ticker […]

-

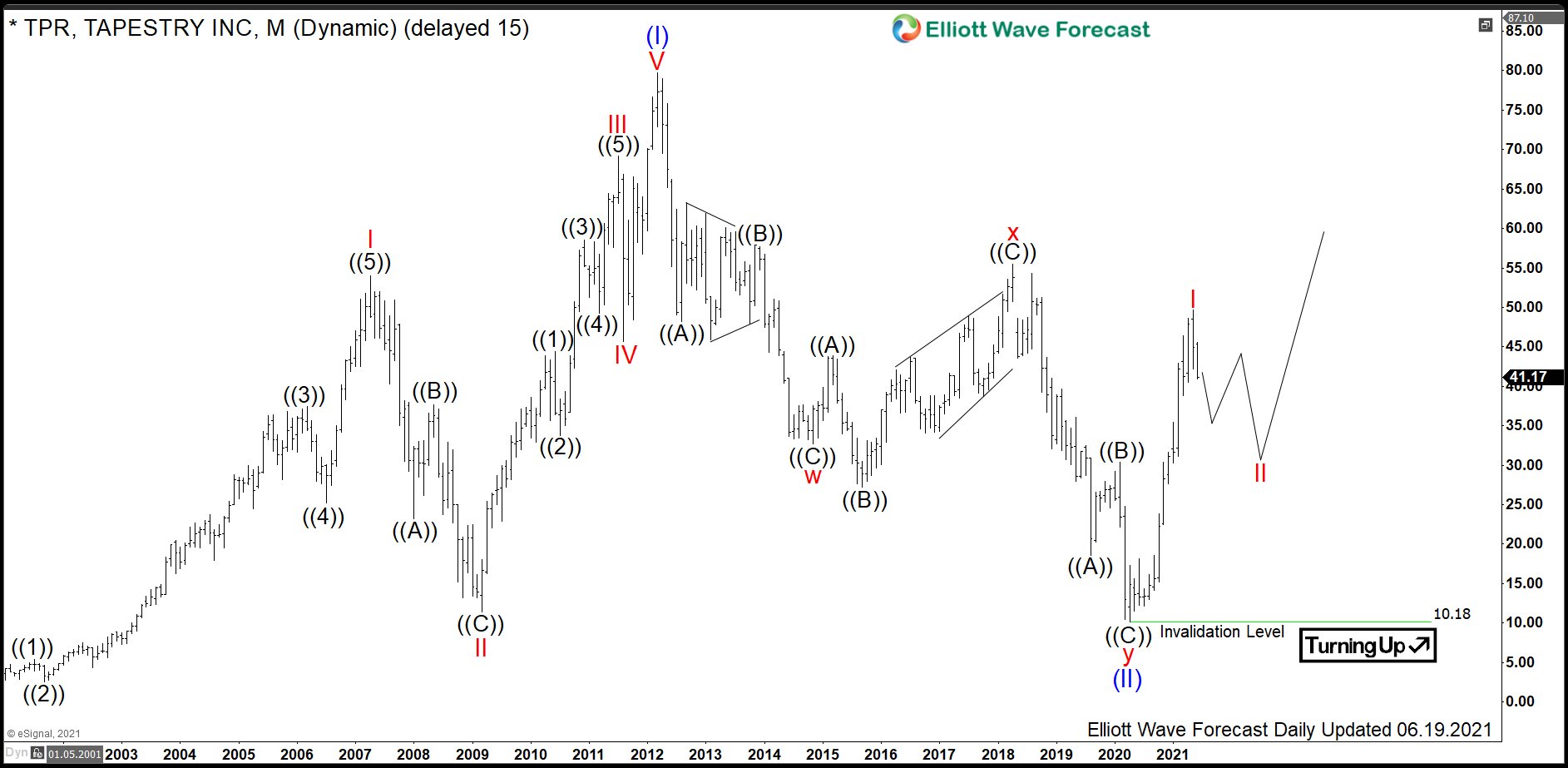

$TPR : Luxury Fashion Giant Tapestry Should Continue Higher

Read MoreTapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, […]

-

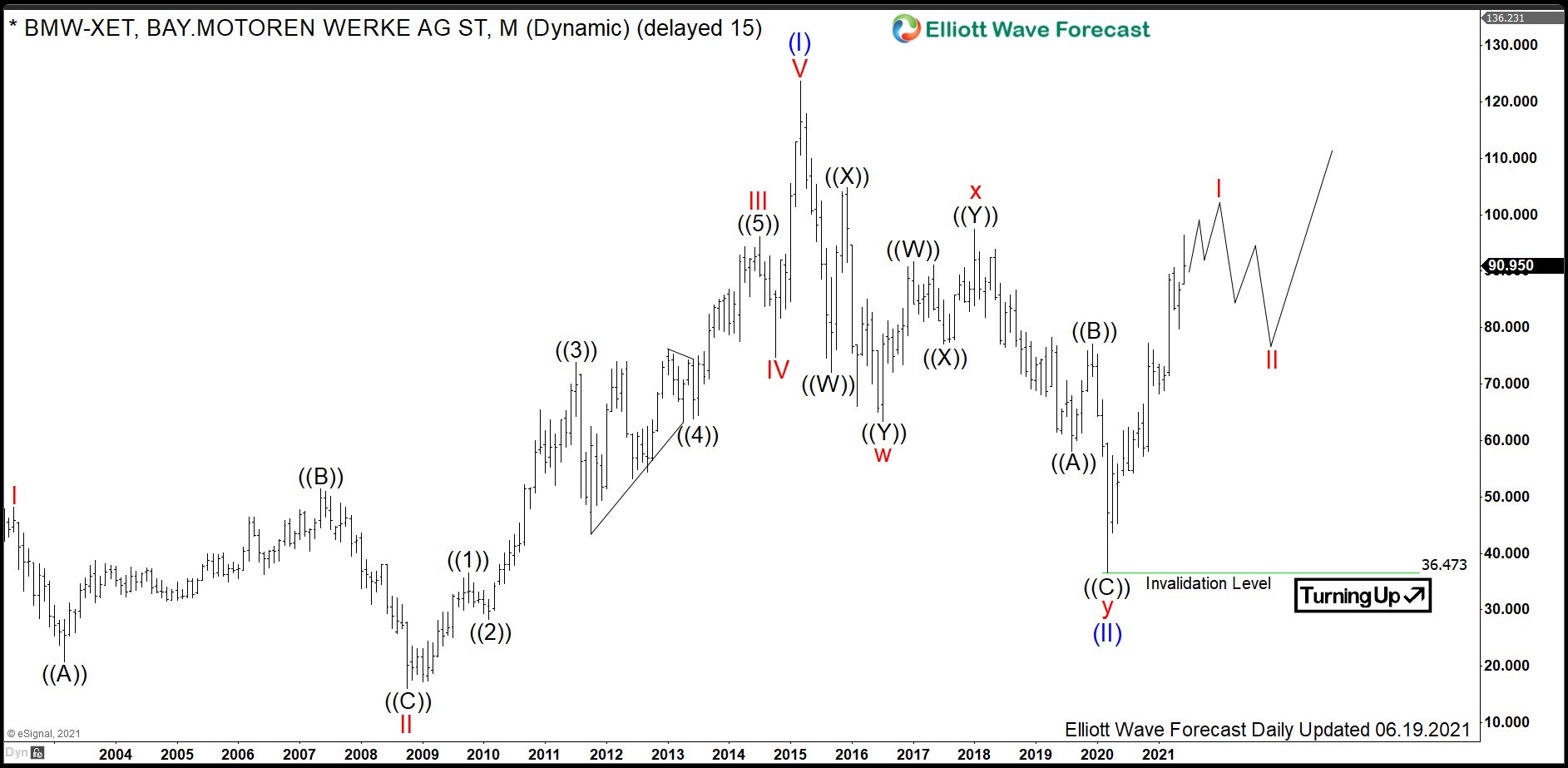

$BMW: What Expect from BMW after Strong Rally?

Read MoreBMW is one of the biggest german car manufacturers excelling in quality and technical characteristics. In April 2020, we were calling for a begin of a new cycle higher. We were right, the price has more than doubled. Now, medium-term cycle might be ending and many investors are asking themselves if there will be straight […]

-

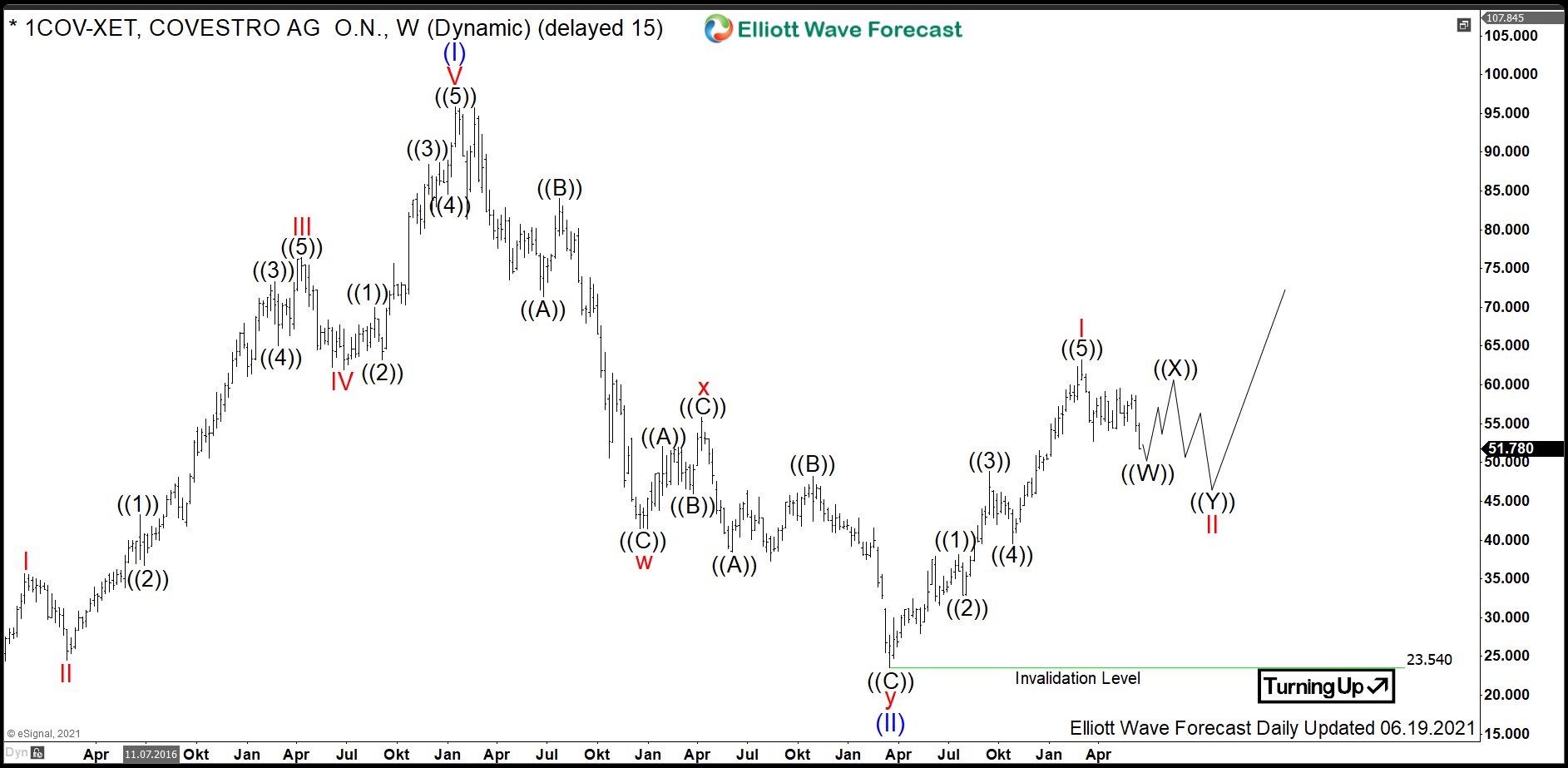

$1COV : Material Science Stock Covestro Offers a Great Opportunity

Read MoreCovestro AG (formerly, Bayer MaterialScience) is a German company which produces a variety of polycarbonate and polyurethane based raw materials. The products include coatings and adhesives, polyurethanes for thermal insulation and electrical housings, polycarbonate based highly impact-resistant plastics (Makrolon) and more. Formed in 2015 as a spin off from Bayer, Covestro is headquartered in Leverkusen, […]

-

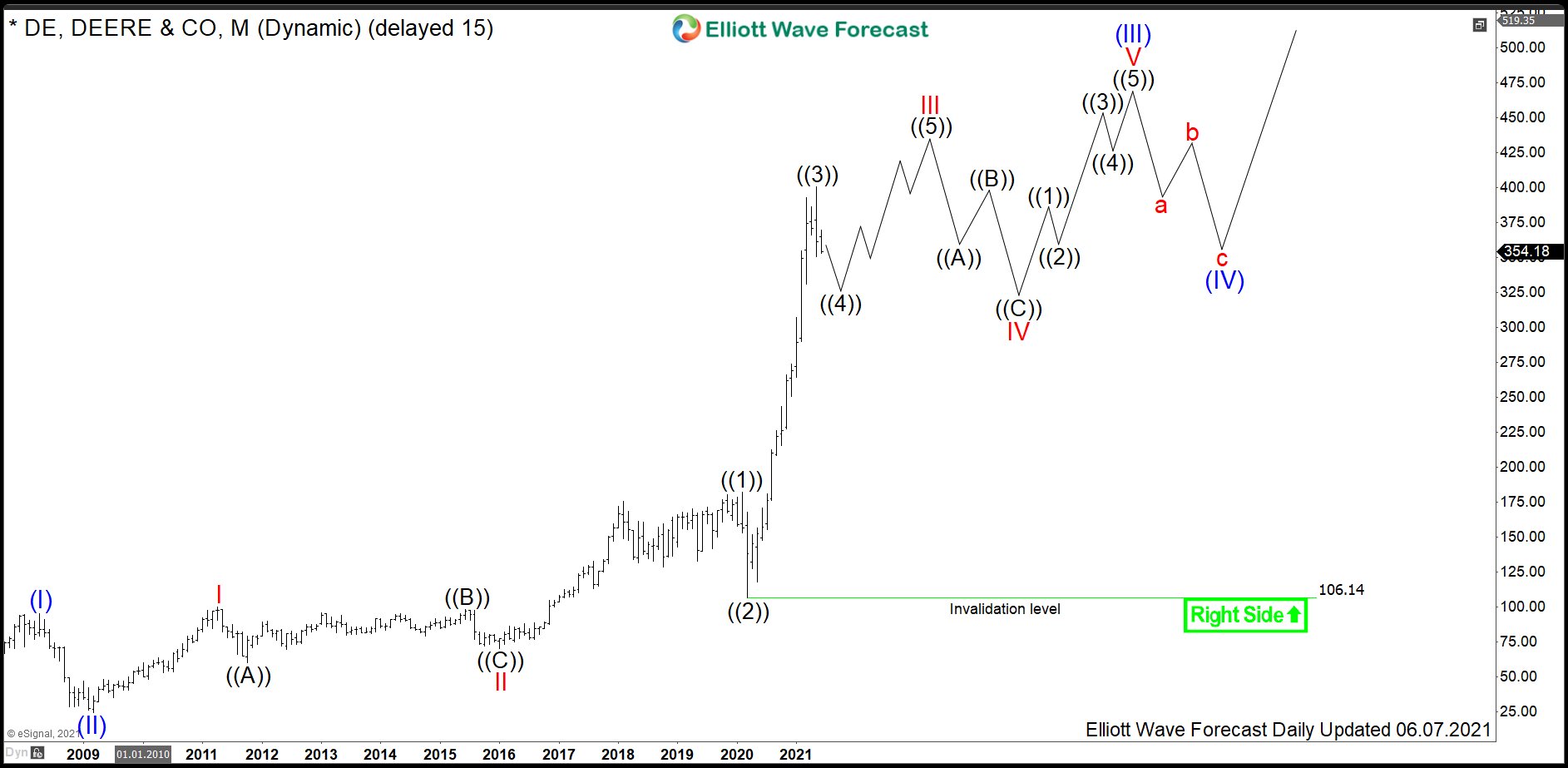

$DE: John Deere Should Continue Showing Strength

Read MoreJohn Deere is an American corporation that manufactures acricultural, construction and forestry machinery, diesel engines and drivertrains. Founded in 1837 and based in Moline, Illinois, USA, the stock being a component of the S&P500 index can be traded under ticker $DE at NYSE. Currently, we can see agriculture commodities like wheat and corn on the […]

-

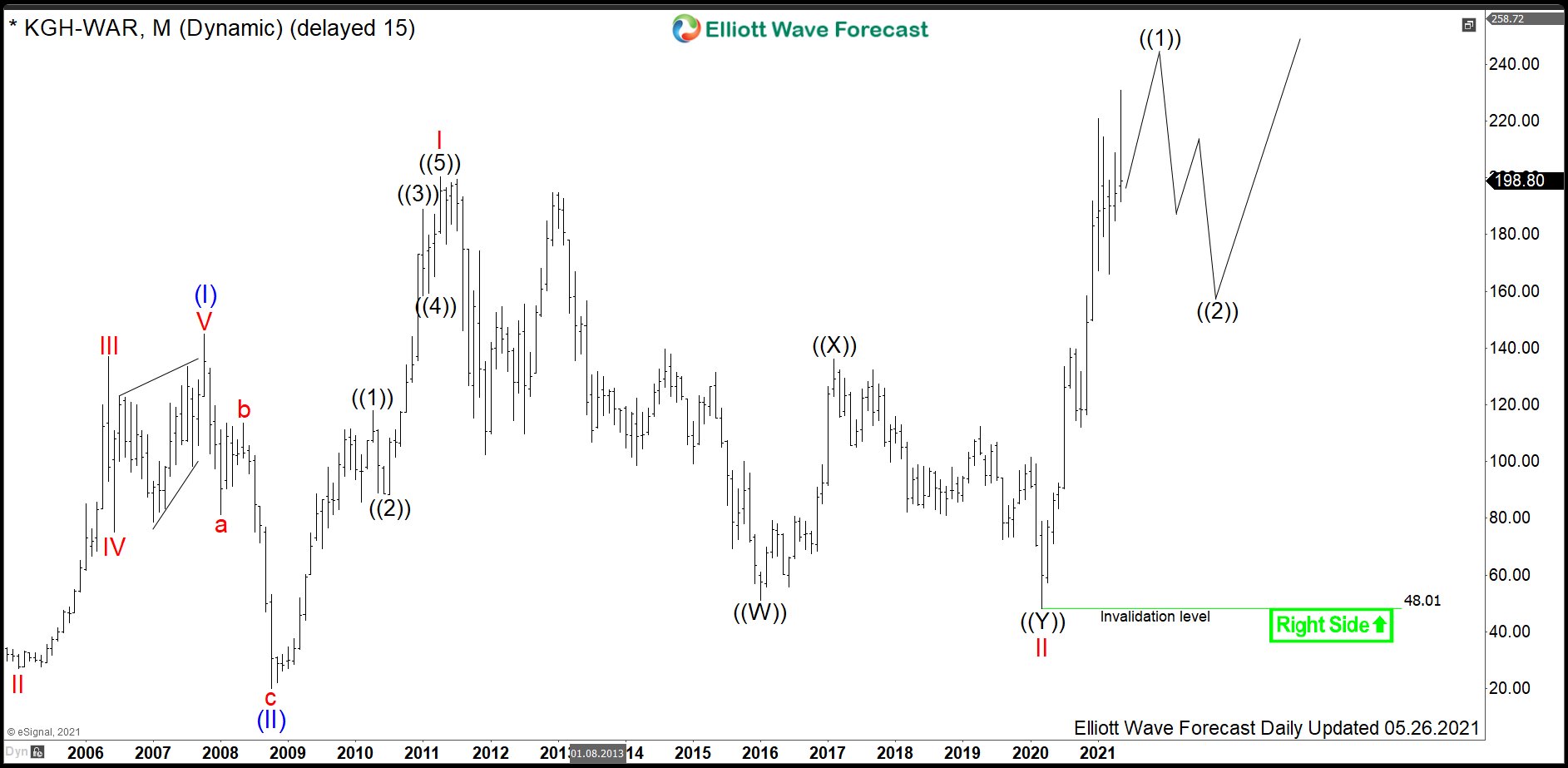

$KGH: Metals Producer KGHM Should Continue Higher

Read MoreThe stock of KGHM Polska Miedź S.A. is attracting a high attention of investors and traders. It has demonstrated an impressive rally since our initial article from August 2020. As a matter of fact, advance of indices on the one hand and powerful acceleration in commodities like copper and silver on the other have provided a double […]