-

$DWAC: Digital World Acquisition Corporation Stock Turning Higher

Read MoreDigital World Acquisition Corporation is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. While the company may pursue an initial business combination target in any business or industry, it intends to focus on combining with […]

-

$DBK: Deutsche Bank Stock Nesting before Acceleration

Read MoreDeutsche Bank is a German multinational investment bank and financial services provider. It is one of the nine bulge bracket banks. Deutsche Bank is the largest German banking institution and is a part of the DAX-40 index. Founded 1869 and headquartered in Frankfurt, Germany, it can be traded under tickers $DBK at Frankfurt and $DB […]

-

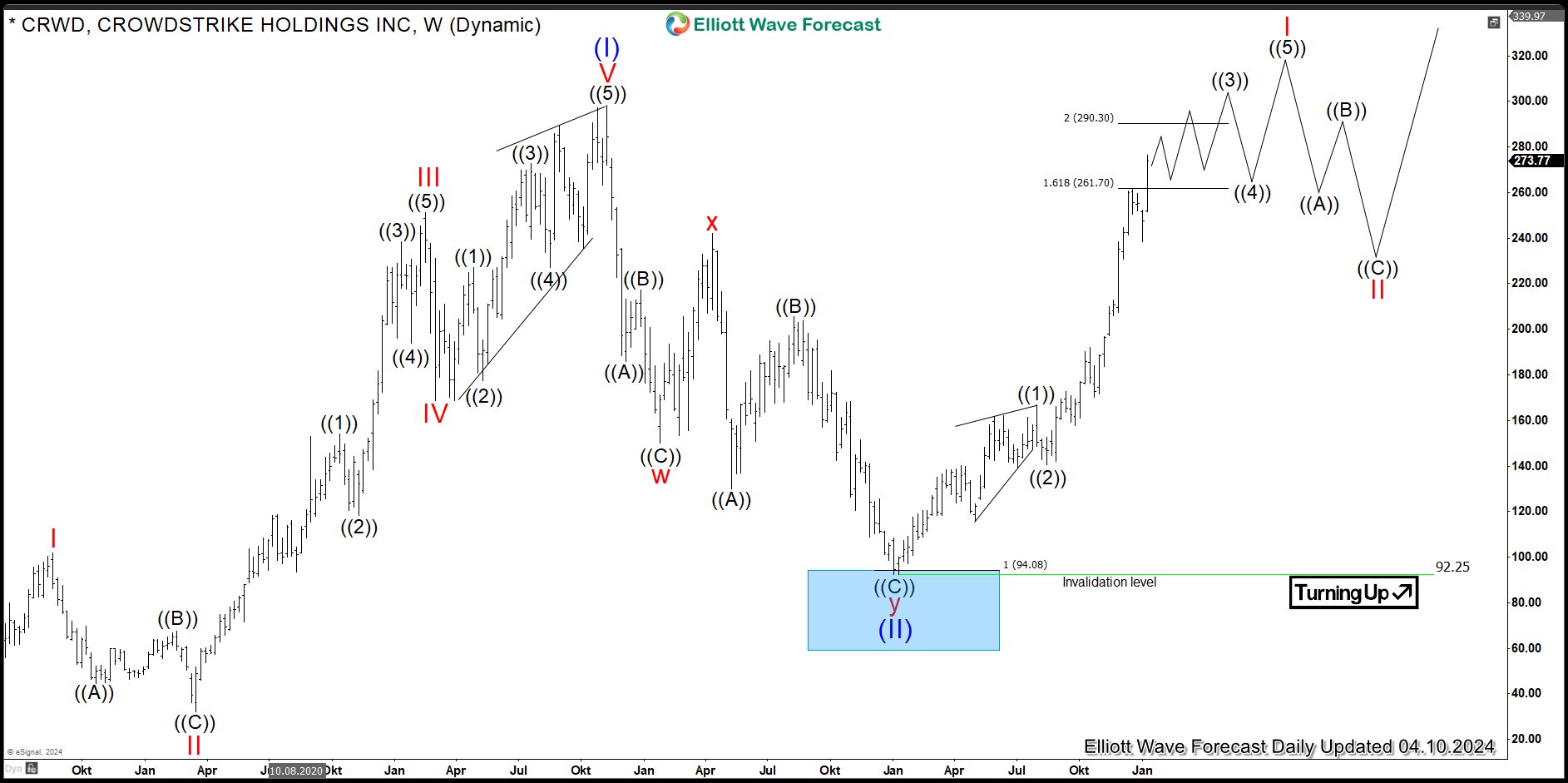

$CRWD: Crowdstrike Reacting from Weekly Bluebox Area

Read MoreCrowdstrike Holdings, Inc. is an US American cybersecurity technology company. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. Founded 2011 and headquartered in Austin, Texas, U.S., it is a part of the NASDAQ-100 index. One can trade Crowdstrike under the ticker $CRWD at NASDAQ. Crowdstrike Weekly Elliott Wave Analysis 1.10.2024 The weekly chart below shows the […]

-

$FSR : Weekly Buying Opportunity in EV Stock Fisker

Read MoreFisker Inc. is an US American automotive company. It is producing electric sport utility vehicles (SUVs) like Fisker Ocean, Pear, Ronin and Alaska. Founded 2016, headquartered in Los Angeles, California, US, it is a component of the Russel3000 index. Investors and traders can trade it under the ticker $FSR at NYSE, Fisker Weekly Elliott Wave Analysis […]

-

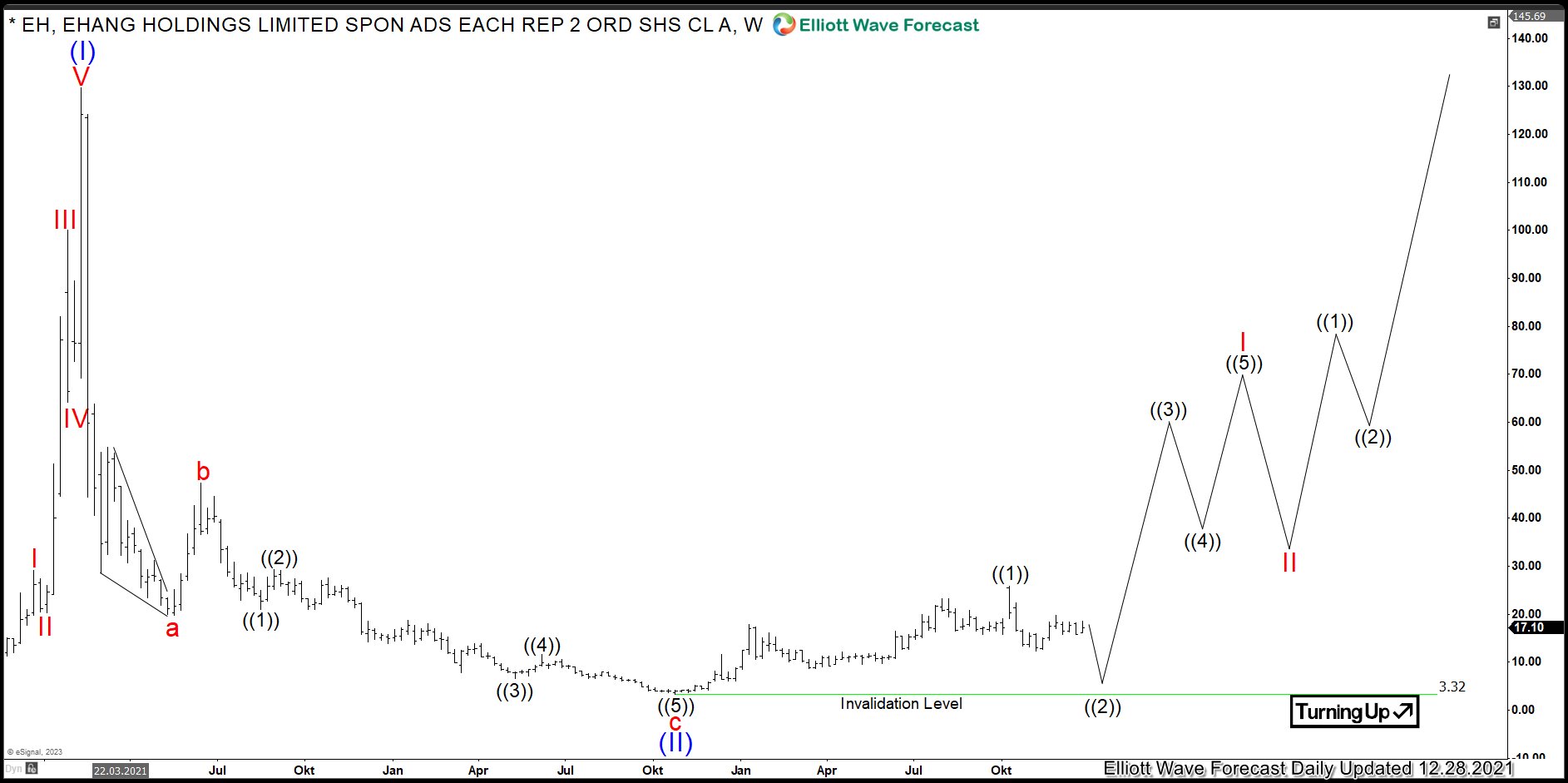

$EH: Buying Guangzhou EHang Stock in a Zigzag Pullback

Read MoreGuangzhou EHang Intelligent Technology Co. Ltd. is a Chinese designer and manufacturer of autonomous aerial vehicles (AAVs) and passenger AAVs. These products have entered service in China for aerial cinematography, photography, emergency response and survey missions. Founded 2014, EHang is headquartered in Guangzhou, China. One can trade it under the ticker $EH at NASDAQ. EHang […]

-

$MRNA: Moderna Entering Weekly Bluebox Support Area

Read MoreModerna, Inc. is an US American pharmaceutical and biotechnology company. Founded in 2010 and headquartered in Cambridge, Massachusetts, USA, it is a part of NASDAQ100 and S&P500 indices. Investors can trade it under the ticker $MRNA at NASDAQ. The company’s only commercial product is the COVID-19 vaccin. Moreover, it has a portfolio of vaccine candidates […]