-

Nifty Elliott wave view 7.14.2017

Read MoreShort term NIFTY Elliott Wave view suggests the rally to 9709.3 ended Intermediate wave (1), and the pullback to 9449.06 low ended Intermediate wave (2). Rally from there could be unfolding as an Elliott wave Zigzag structure where Minor wave A is in progress as a Leading diagonal structure. Minute wave ((i)) ended as a double three Elliottwave structure at 9649.80 […]

-

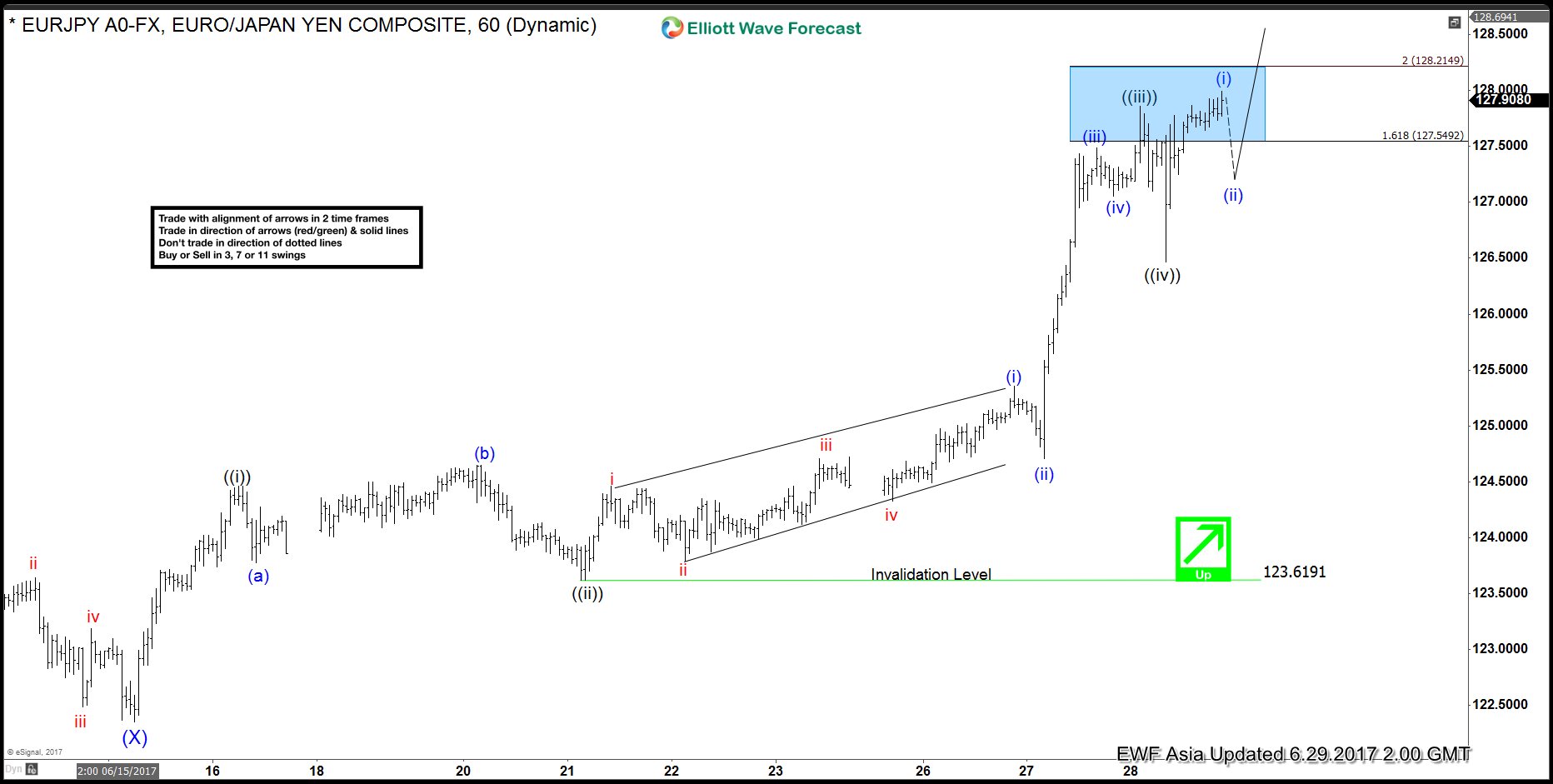

EURJPY Elliott Wave View: Pullback Started

Read MoreShort term EURJPY Elliott Wave view suggests the decline to 122.35 on 6/15 low ended Intermediate wave (X). Rally from there is unfolding as an impulse Elliott Wave structure with extension. This 5 wave move could be a wave A of an Elliott wave zigzag structure structure, where Minute wave ((i)) ended at 124.46 and Minute wave ((ii)) ended at 123.62. Minute […]

-

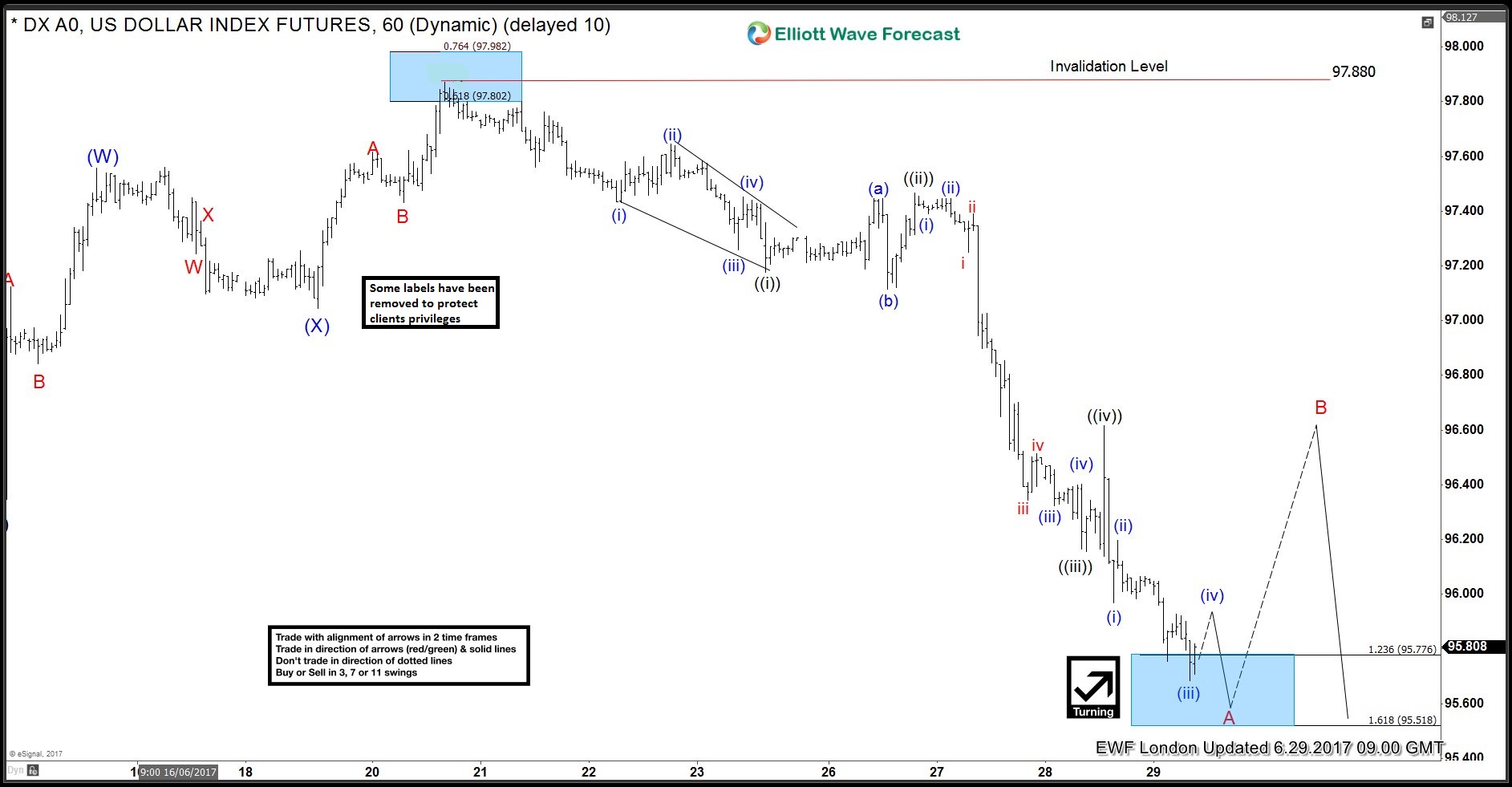

USDX Elliott Wave View: Showing impulse

Read MoreShort term Elliott wave view in USDX suggest that the cycle from 6/20 peak (97.88) is unfolding as an impulsive Elliott wave structure . This 5 wave move could be a wave A of an Elliott wave zigzag structure structure or a wave C of a FLAT correction. In either case, after 5 wave move ends, pair should pull back in […]

-

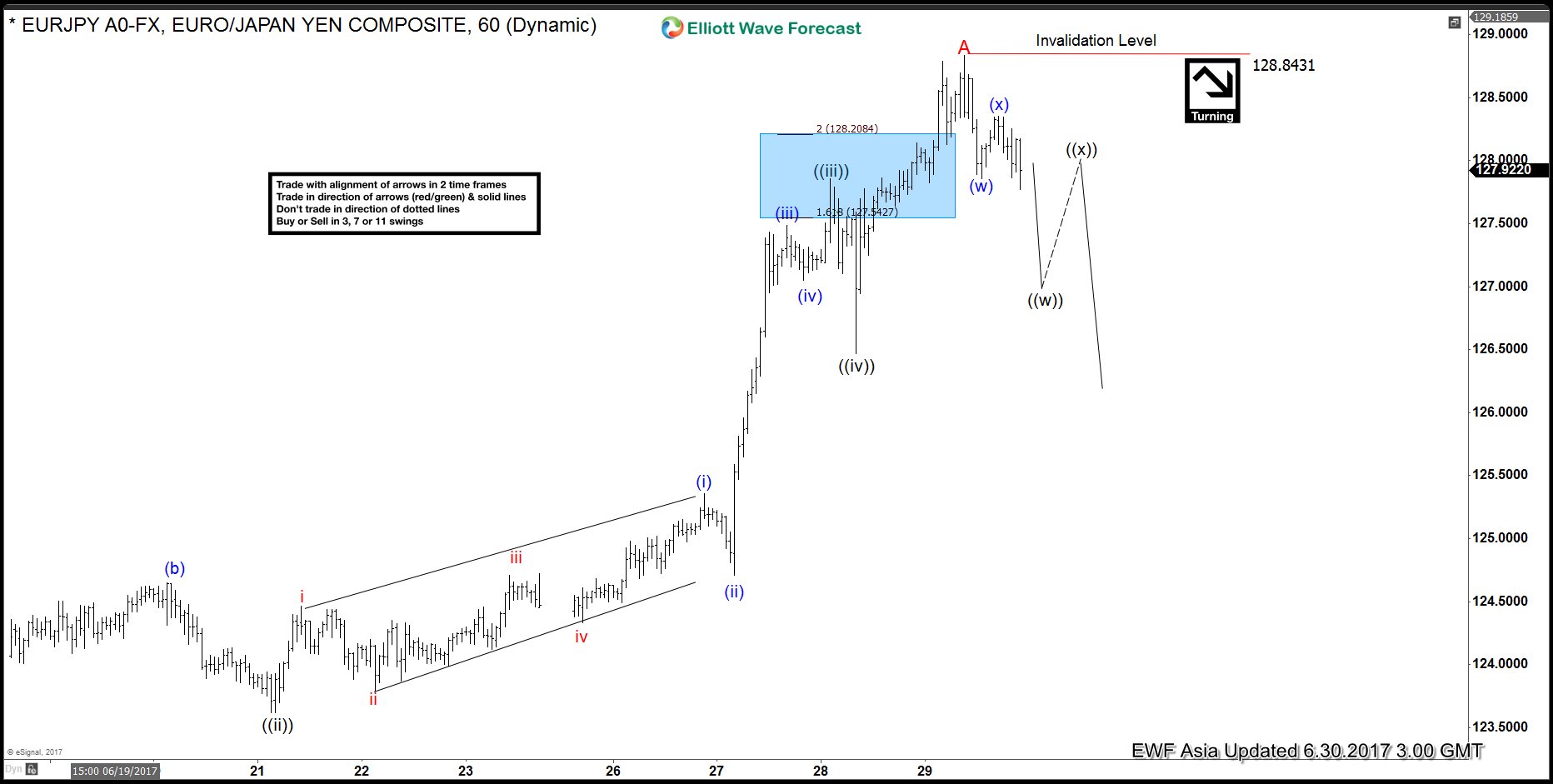

EURJPY Elliott Wave Analysis Update 6.29.2017

Read MoreShort term EURJPY Elliott Wave view suggests the decline to 122.35 on 6/15 low ended Intermediate wave (X). Rally from there is unfolding as an impulse Elliott Wave structure with extension where Minute wave ((i)) ended at 124.46 and Minute wave ((ii)) ended at 123.62. Minute wave ((iii)) ended at 127.84 and Minute wave ((iv)) at […]

-

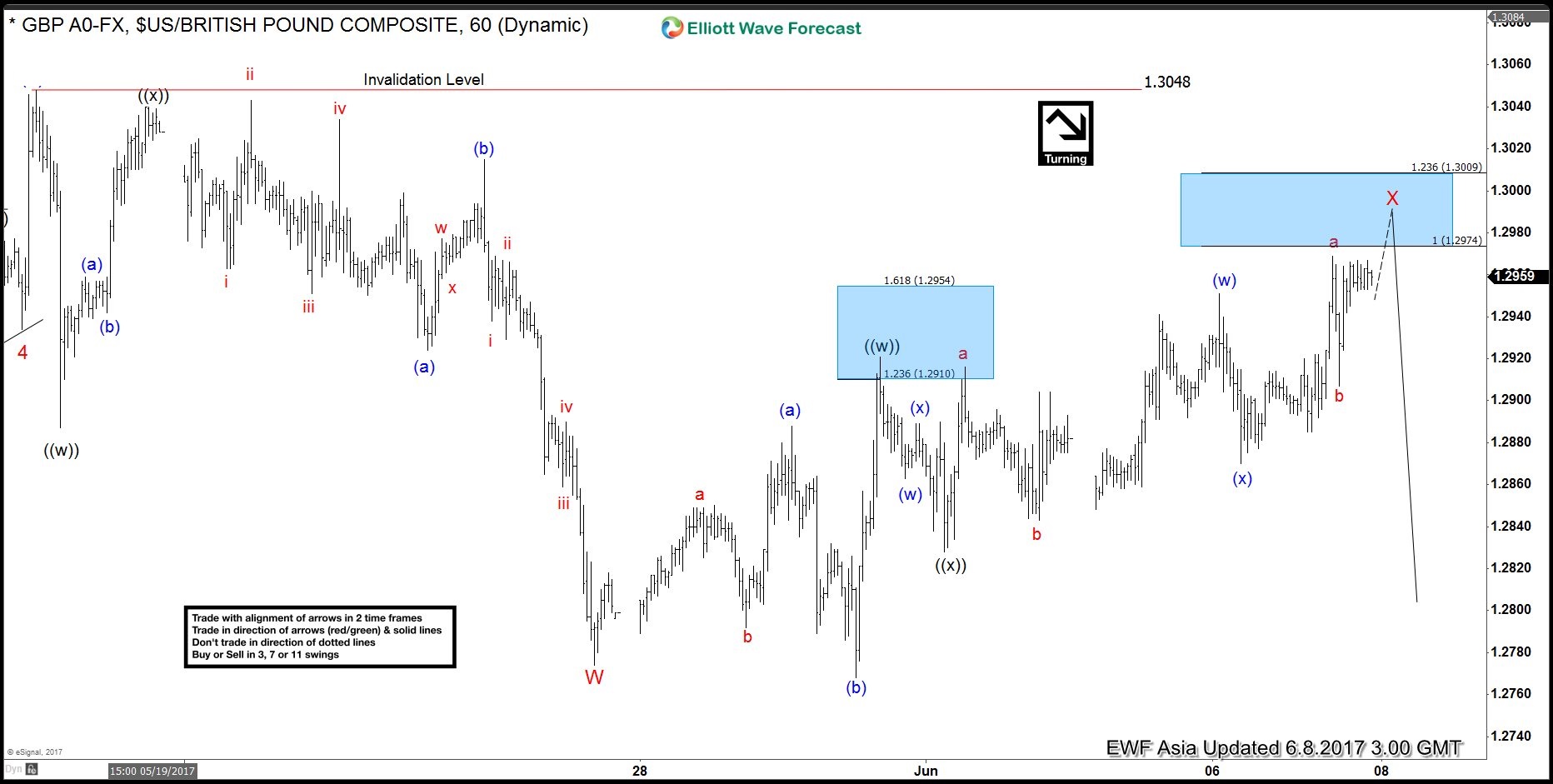

GBP reaction after UK Election (GE2017)

Read MoreThe pound sterling was headed for the biggest drop in a year after it emerged that the ruling Conservative Party has fallen short of a general majority after UK Election (GE 2017), just 10 days before the Brexit talks are scheduled to begin. The currency collapsed in front of all its main counterparts, since the supporters […]

-

NZDUSD Elliott Wave View: Showing impulse

Read MoreShort term Elliott wave view in NZDUSD suggest that the cycle from 5/11 low (0.6816) is unfolding as an impulsive Elliott wave structure . This 5 wave move could be a wave C of a FLAT correction or wave A of an Elliott wave zigzag structure structure. In either case, after 5 wave move ends, pair should pull back in 3 waves at […]