-

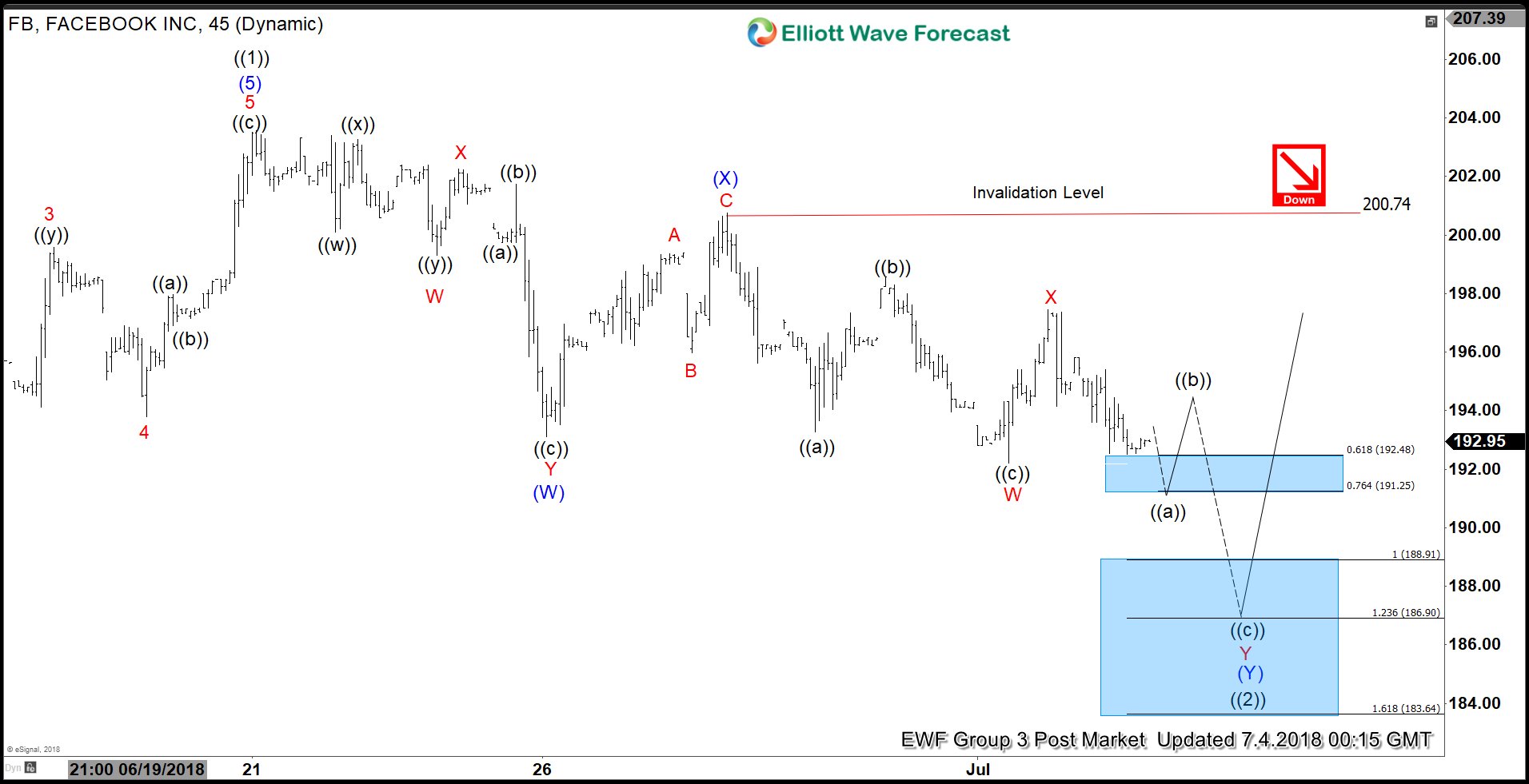

Facebook ($FB) Elliott Wave Analysis: Pullback Remains In-progress

Read MoreFacebook ticker symbol: $FB short-term Elliott wave analysis suggests that the rally to $203.55 ended primary wave ((1)). Down from there, the pullback in primary wave ((2)) remains in progress in 3, 7 or 11 swings to correct cycle from 3/26/2018 low. The internals of that pullback shows an overlapping structure thus suggesting that the […]

-

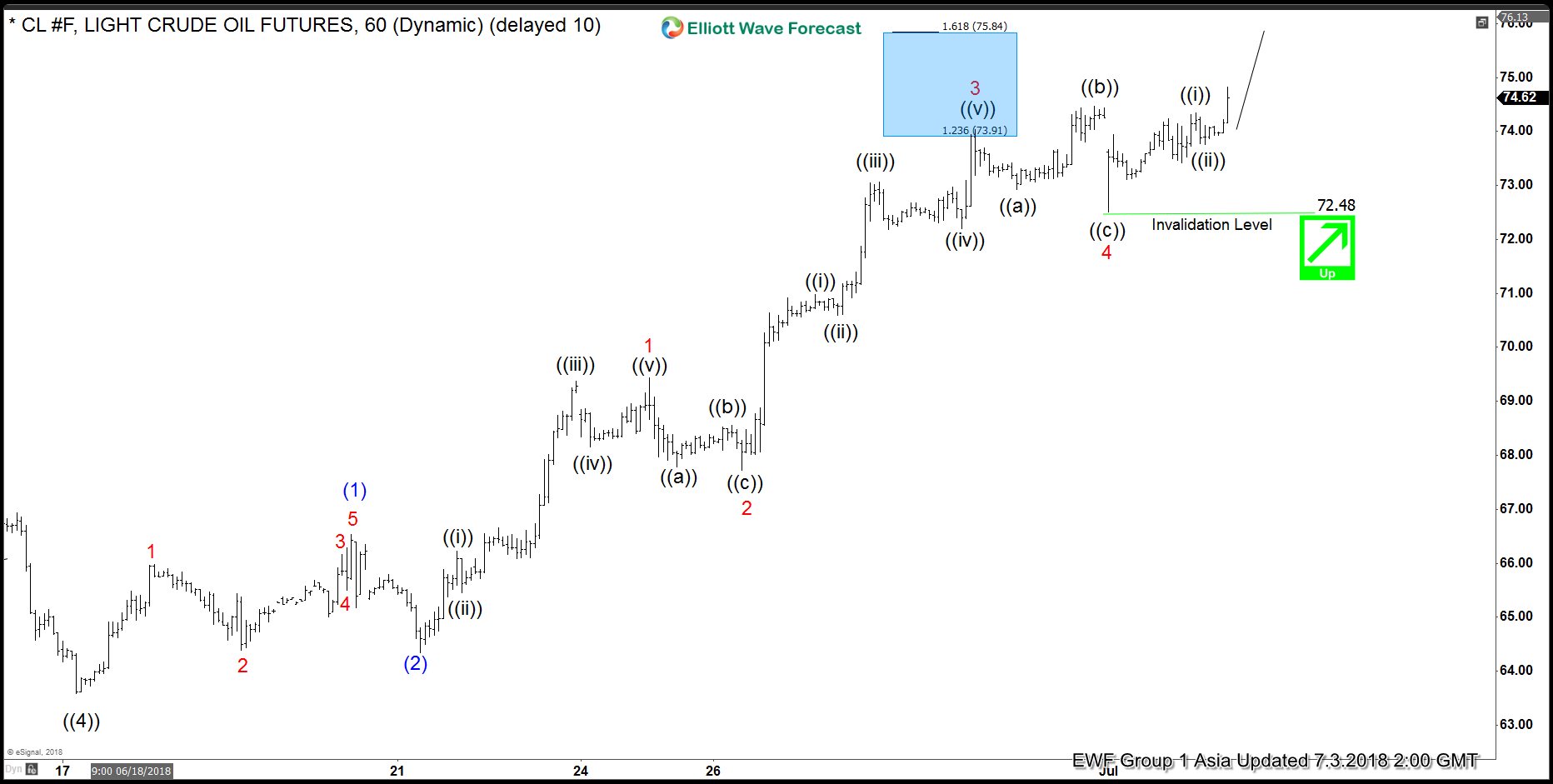

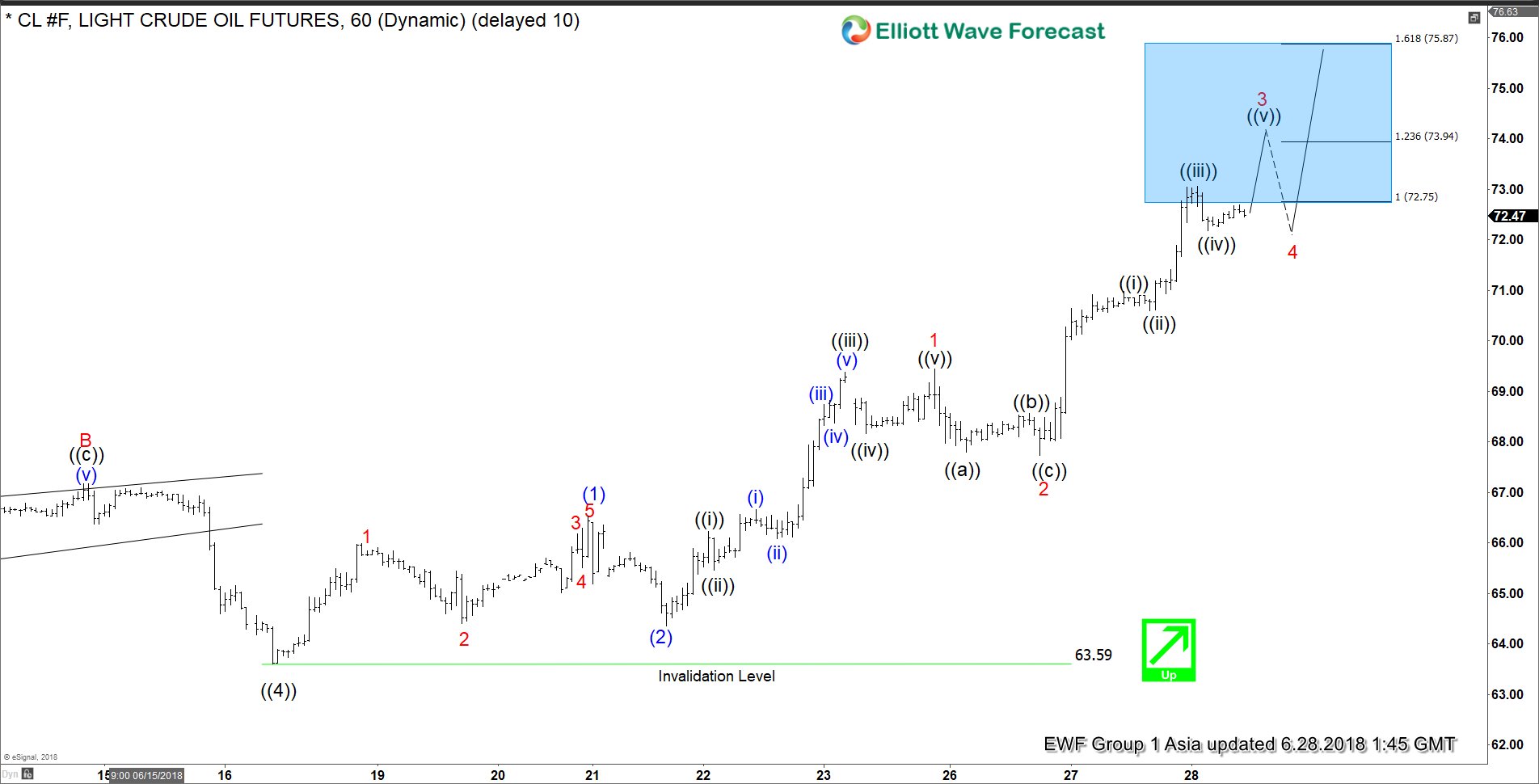

OIL Elliott Wave Analysis: Rallying Higher In An Impulse Structure

Read MoreOIL short-term Elliott Wave view suggests that the pullback to $63.59 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument reacting strongly to the upside and internals of that rally higher suggests that it’s taking place in an Impulse Elliott wave structure with extension with lesser degree oscillation showing the sub-division of 5 waves […]

-

USDX Elliott Wave Analysis: Bullish Sequence Calling Higher

Read MoreUSDX short-term Elliott Wave view suggests that the decline to 94.18 on 6/25 low has ended correction to the cycle from 6/7/2018 low as Intermediate wave (X). The internals of that pullback unfolded as a Flat correction where Minor wave A ended in 3 swings at 94.53, Minor wave B ended in 3 swings at […]

-

OIL Elliott Wave Impulse Structure Calling For More Upside

Read MoreOIL short-term Elliott Wave view suggests that the decline to $63.59 on 6/18/2018 low ended primary wave ((4)) pullback. Above from there, the instrument has rallied to new highs already. And confirming the next extension higher taking place in primary wave ((5)). The rally higher from $63.59 low is taking the form of Elliott wave […]

-

Nikkei How Far Elliott Wave Correction Can Take Place?

Read MoreNikkei short-term Elliott Wave view suggests that the index is correcting the cycle from 3/23/2018 low (20190) in 3, 7 or 11 swings. Rally to 23005 high ended Minor wave X of a possible double correction lower. Down from there, Minor wave Y remains in progress with lesser degree cycle showing another double correction structure. Below […]

-

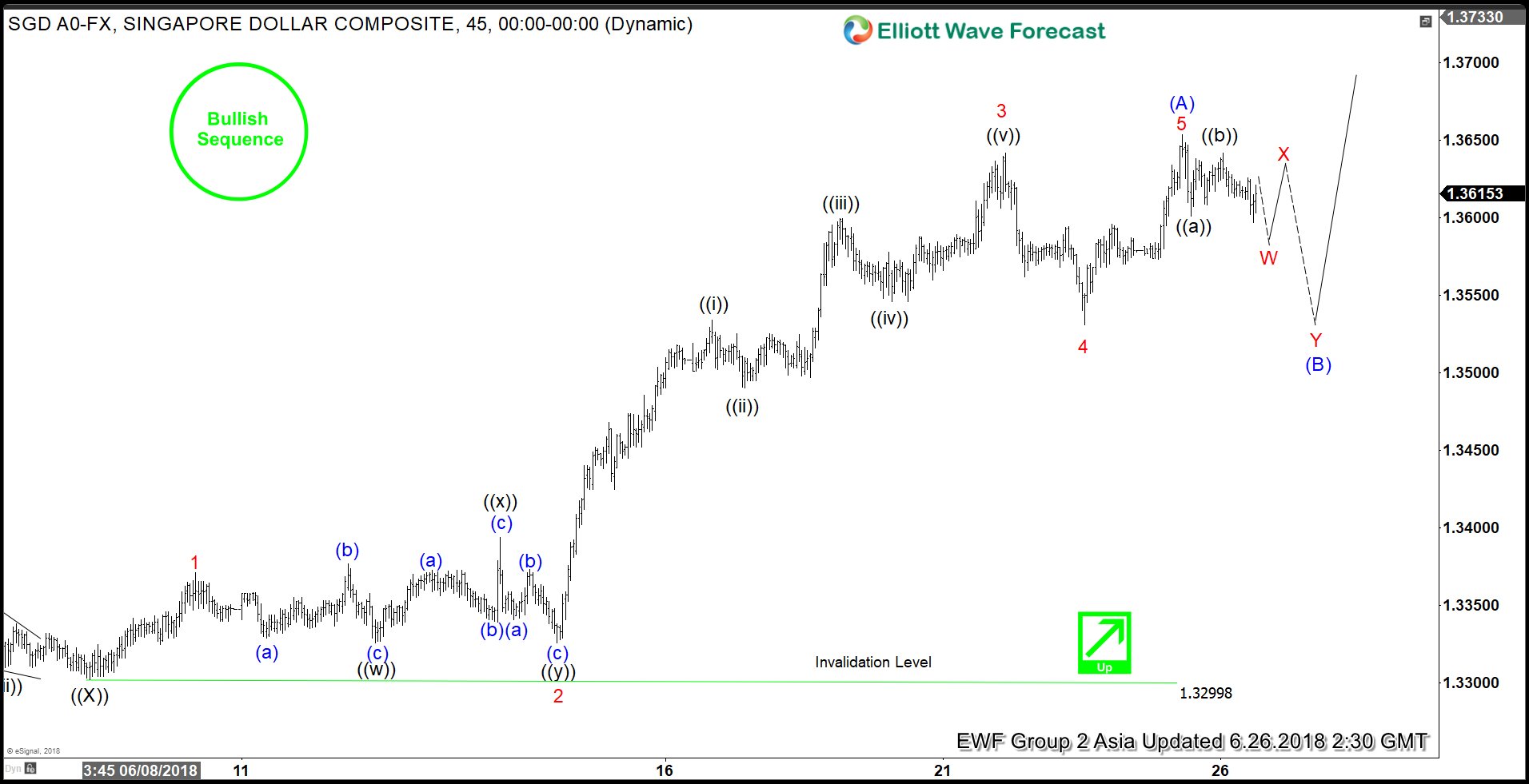

USDSGD Showing Incomplete Elliott Wave Structure To The Upside

Read MoreUSDSGD short-term Elliott wave view suggests that the decline to 1.3299 on 6/07 low ended primary wave ((X)) pullback. Above from there, the pair rallied higher and went on to make a new high for this year creating 5 swing incomplete sequence to the upside from 1/25/2018 low. This sequence is represented by the bullish […]