-

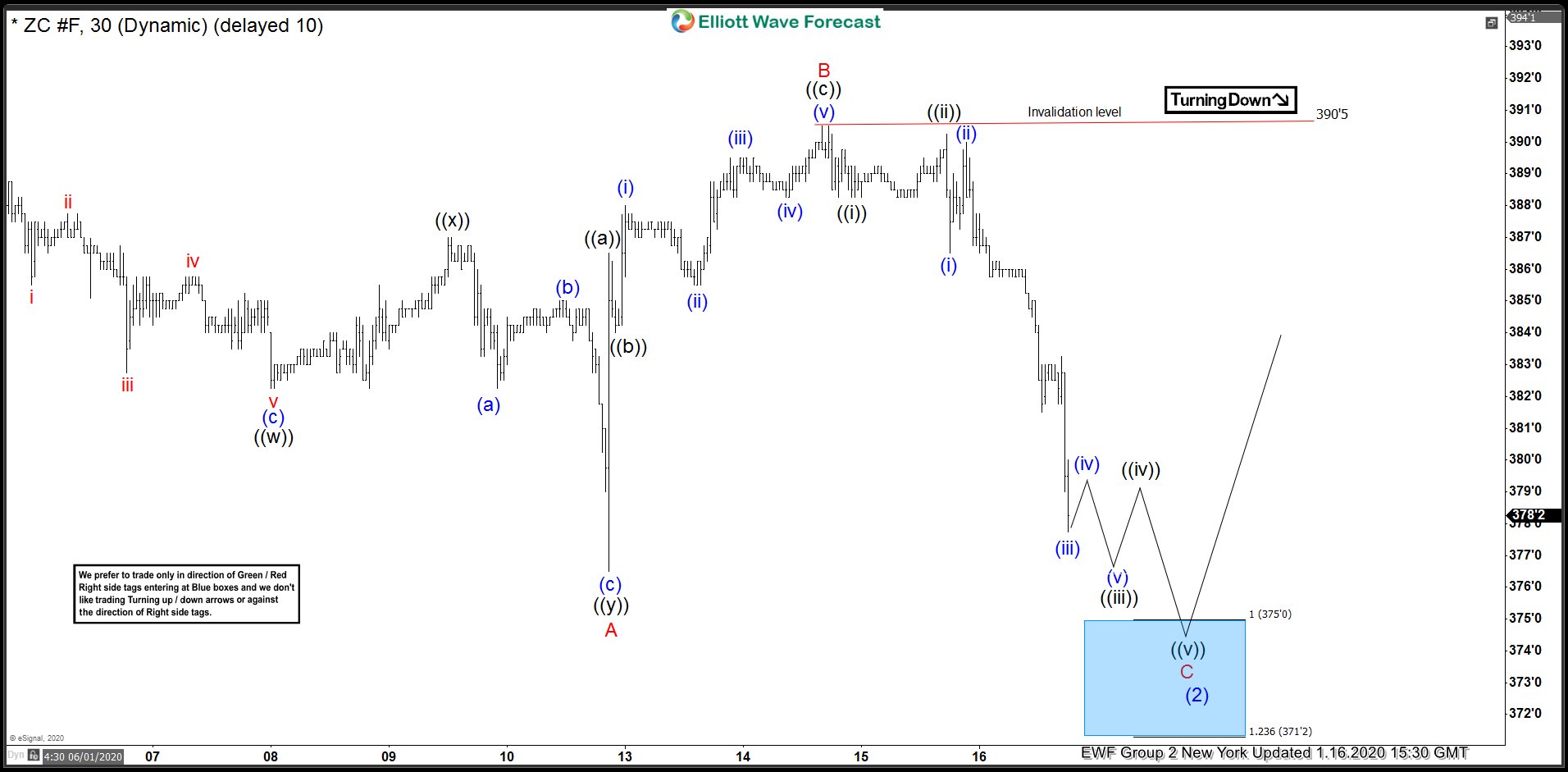

Corn (ZC_F) Forecasting The Bounce From The Blue Box Area

Read MoreIn this blog, we are going to take a quick look at the Elliottwave chart of Corn (ZC_F). The chart from 1.16.2020 New York update showed that Corn was doing a pullback in wave (2). Wave A of (2) ended at 376’4 low. Wave B of (2) ended at 390’5 high. From there, we expect […]

-

NZDJPY Forecasting The Bounce From Blue Box Area

Read MoreIn this blog, we are going to take a quick look at the Elliottwave chart of NZDJPY. The chart from 1.22.2020 New York update showed that NZDJPY ended wave 4 at 71.234 low. The pair then extended higher in wave ((i)) of 5. Wave ((i)) ended at 73.343 high. From there the pair is proposed […]

-

Swiss Franc Strengthens After Being Added Back to US Watch List

Read MoreSwiss Franc strengthens on Tuesday, January 14 2020, after the US Treasury Department added Switzerland to its watch list for countries labelled as “currency manipulator” alongside other countries such as Germany, Ireland, Italy, Japan, Malaysia, Singapore, South Korea and Vietnam. This is not the first time Switzerland has been added to the watch list. In […]

-

Copper (HG_F) Buying The Dip From The Blue Box Area

Read MoreIn this blog, we’re going to take a quick look at the Elliott Wave chart of copper. The chart from 1.3.2020 update showed that copper ended the cycle up from 11.15.2019 low at 2.6130 to 12.26.2019 high at 2.8565 as 5 waves impulse structure. Copper then did a pullback from the high, which unfolded as […]

-

EURJPY Forecasting The Rally From The Blue Box Area

Read MoreIn this blog, we’re going to take a quick look at the Elliott Wave charts of EURJPY pair. EURJPY ended short term cycle in wave ((iii)) as 5 waves rally from 11.14.2019 low at 117.05 to 12.13.2019 high at 122.66. Then, the pair pulled back to correct the cycle up from 11.14.2019 low in 3 […]

-

Pound Sterling After the Tories’ Landslide Victory in UK Election

Read MoreThe UK election result pushed GBP higher after the Conservatives, led by Prime Minister Boris Johnson, won the majority in parliament with a landslide victory. This is the Tories’ biggest victory since Margaret Thatcher days. Johnson can finally get his Withdrawal Agreement Bill passed now that the Parliamentary blockage out of the way. However, getting […]