-

HFC HollyFrontier Corporation Impulsive Elliott Wave Rally

Read MoreHolly Corporation and Frontier Oil merged in July 2011 to form HollyFrontier Corporation (NYSE: HFC). The company is a petroleum refiner and distributor of petroleum products, from gasoline to petroleum-based lubricants and waxes. Over the past 2 years, Hollyfrontier Corp performed better than majority of its peers in the Oil & Gas Refining and Basic Materials sector. Its […]

-

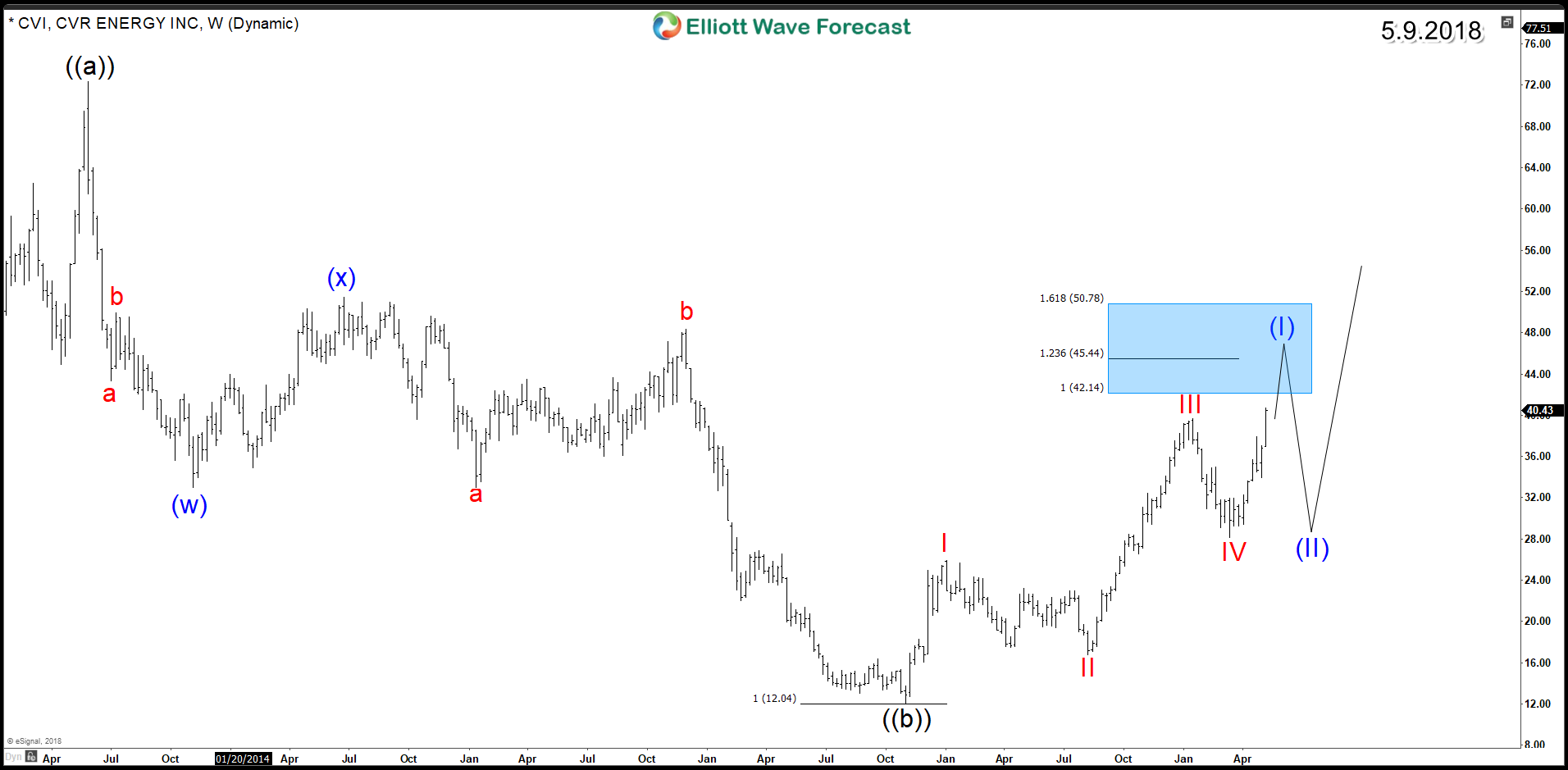

CVR Energy CVI Showing Bullish Structure

Read MoreCVR Energy (NYSE: CVI) is one of the best performing Energy stocks in the recent 2 years yielding +220% since November 2016 low. Despite the correction taking place in the stock market, CVI did manage to retrace the whole decline since January peak and it’s currently already up +7.9% year-to-date. To understand further the technical […]

-

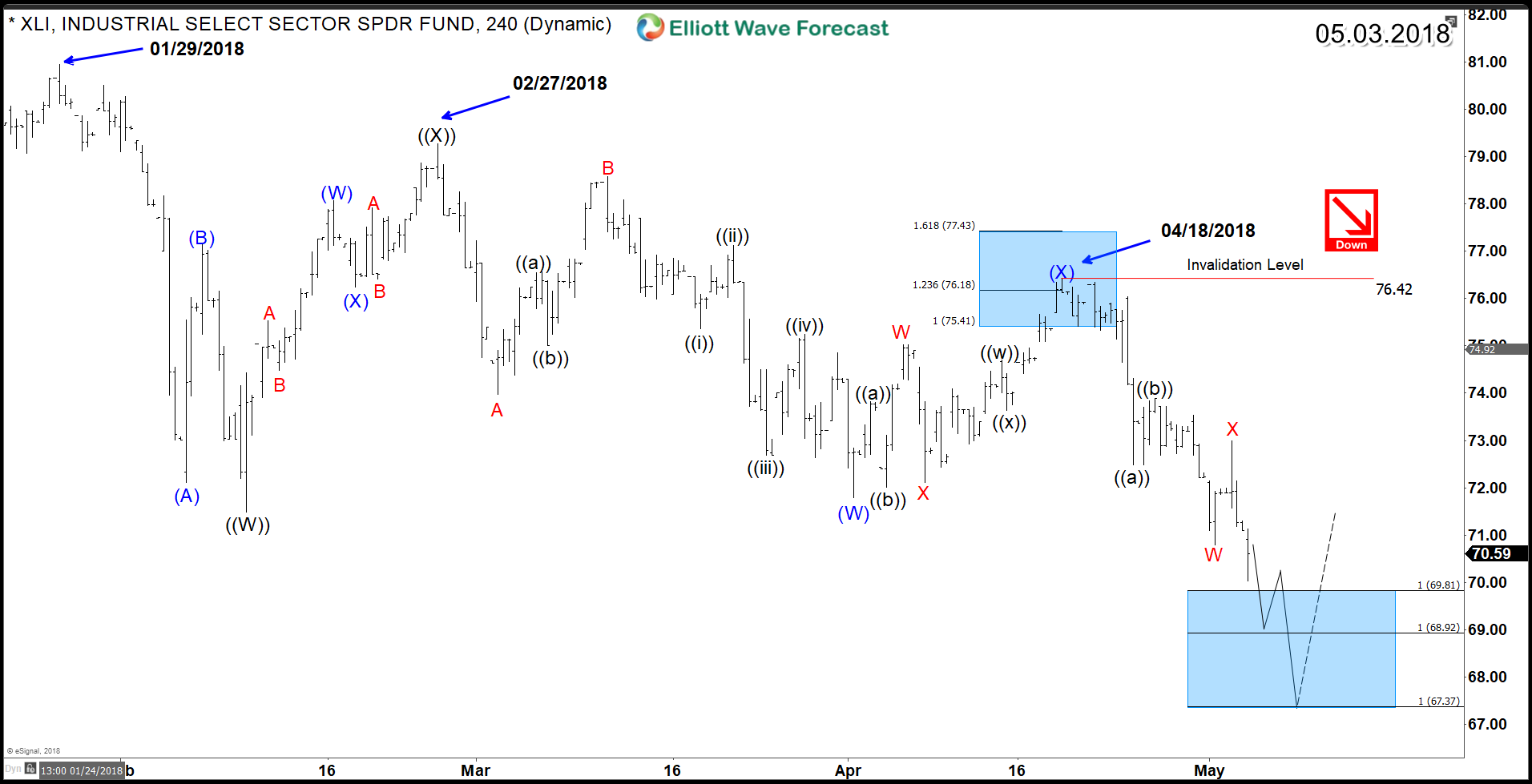

Industrial Select Sector XLI Corrective Structure Still calling Lower

Read MoreThe Industrial Select Sector SPDR Fund XLI tracks a market-cap-weighted index of industrial-sector stocks drawn from the S&P 500. Industries in the Index include aerospace and defense, building products, construction and engineering, electrical equipment, commercial services and supplies, airlines, marine, etc. It provides investors with broad US industrial exposure that’s cheap to hold and extremely […]

-

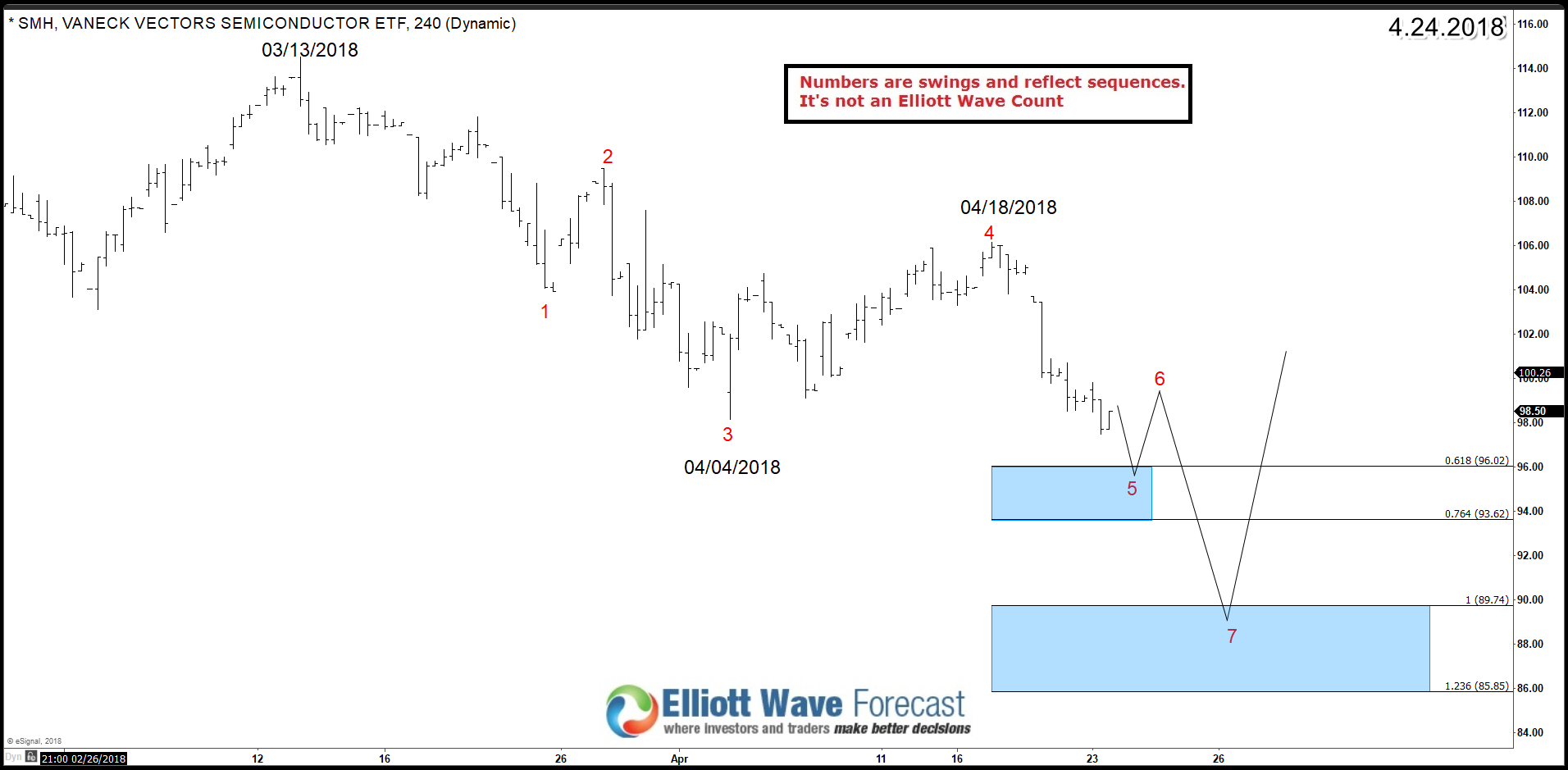

SMH Semiconductor ETF Leading the short term correction

Read MoreThe VanEck Vectors Semiconductor ETF (SMH) tracks a market-cap-weighted index of 25 of the largest US-listed semiconductors companies. Such companies include foreign companies that are listed on a U.S. exchange like Taiwan Semiconductor Manufacturing (TSM: NYSE) and also big technology companies like Intel (INTC: NASDAQ) or Nvidia (NVDA: NASDAQ). During this year, the Index made new all […]

-

Straits Times Index STI Supporting Stock Market Bulls

Read MoreStraits Times Index (STI) is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies listed on the Singapore Exchange. It is jointly calculated by Singapore Exchange (SGX), Singapore Press Holdings (SPH) and FTSE Group (FTSE). Applying the One Market concept , we know that major world […]

-

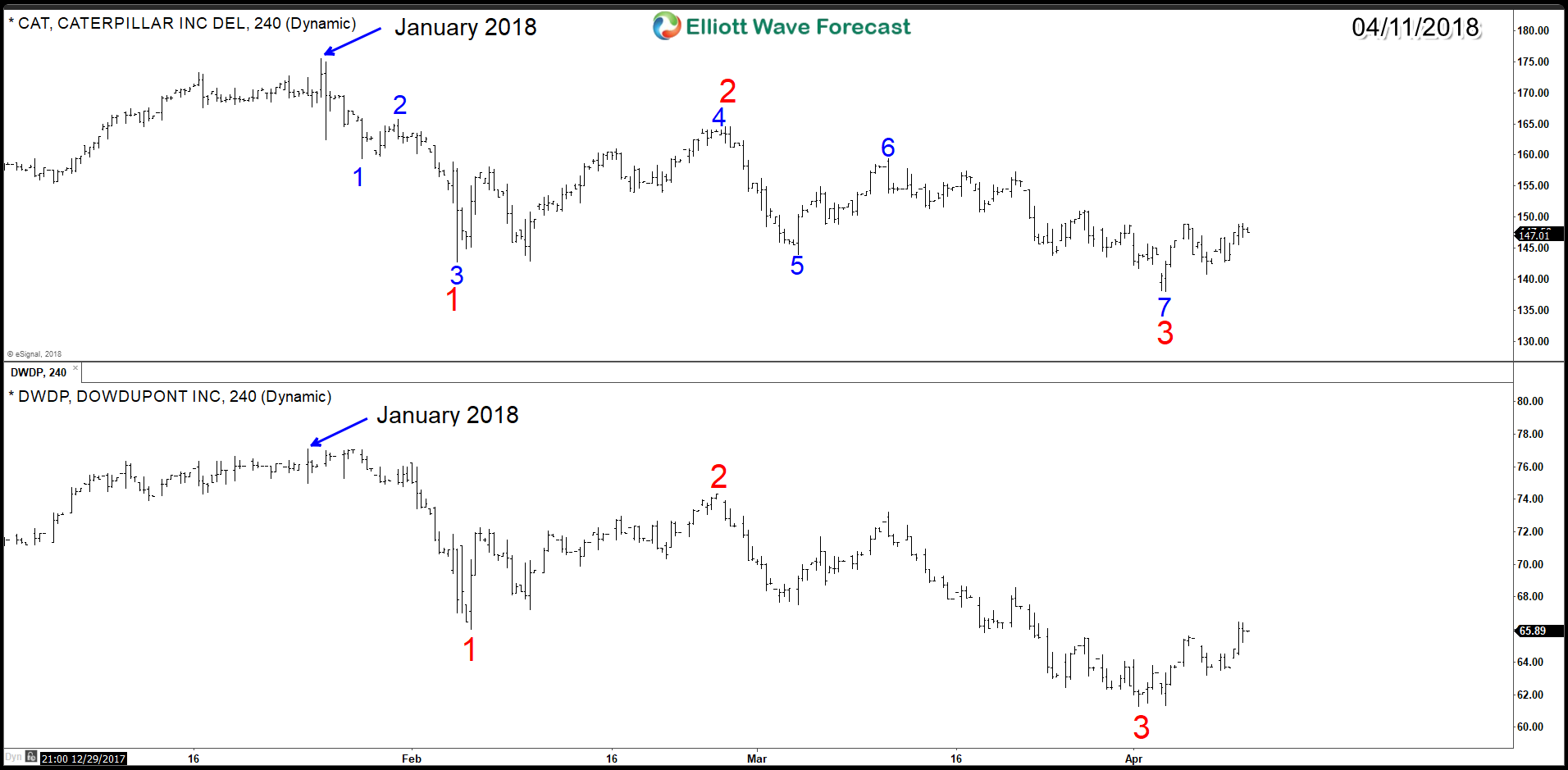

Stocks Short Term Elliott Wave Bounce is Purely Technical

Read MoreStocks and ETFs follow the same code in the market same as the rest of financial instruments like Forex. Every 5 waves impulsive structure is followed by a technical corrective sequences which come in 3-7-11. At the end of the corrective sequence, usually the instrument will resume the move within the main trend or at least correct […]