-

Zendesk (NYSE: ZEN) – Elliott Wave Bulls remain in Control

Read MoreZendesk (NYSE: ZEN) is a customer service software company based in United States. Its cloud-based help desk solution is used by more than 200000 organizations worldwide. the company’s earnings over the next few years are expected to increase by 34%, indicating a highly optimistic future ahead which would attract more investors. In this article, we’ll be taking a […]

-

Union Pacific Railroad (NYSE:UNP) – Bullish Sequence Calling Higher

Read MoreUnion Pacific Railroad (NYSE:UNP) is a publicly-traded railroad holding company that was established in 1969. Last year, revenues grew to $22.8 billion, while earnings was up in mid-single-digits to $10.8 billion. Revenue growth was led by strong gains in Intermodal, amid capacity constraints in the trucking industry and a higher industrial production for commodities shipments. Union Pacific’s […]

-

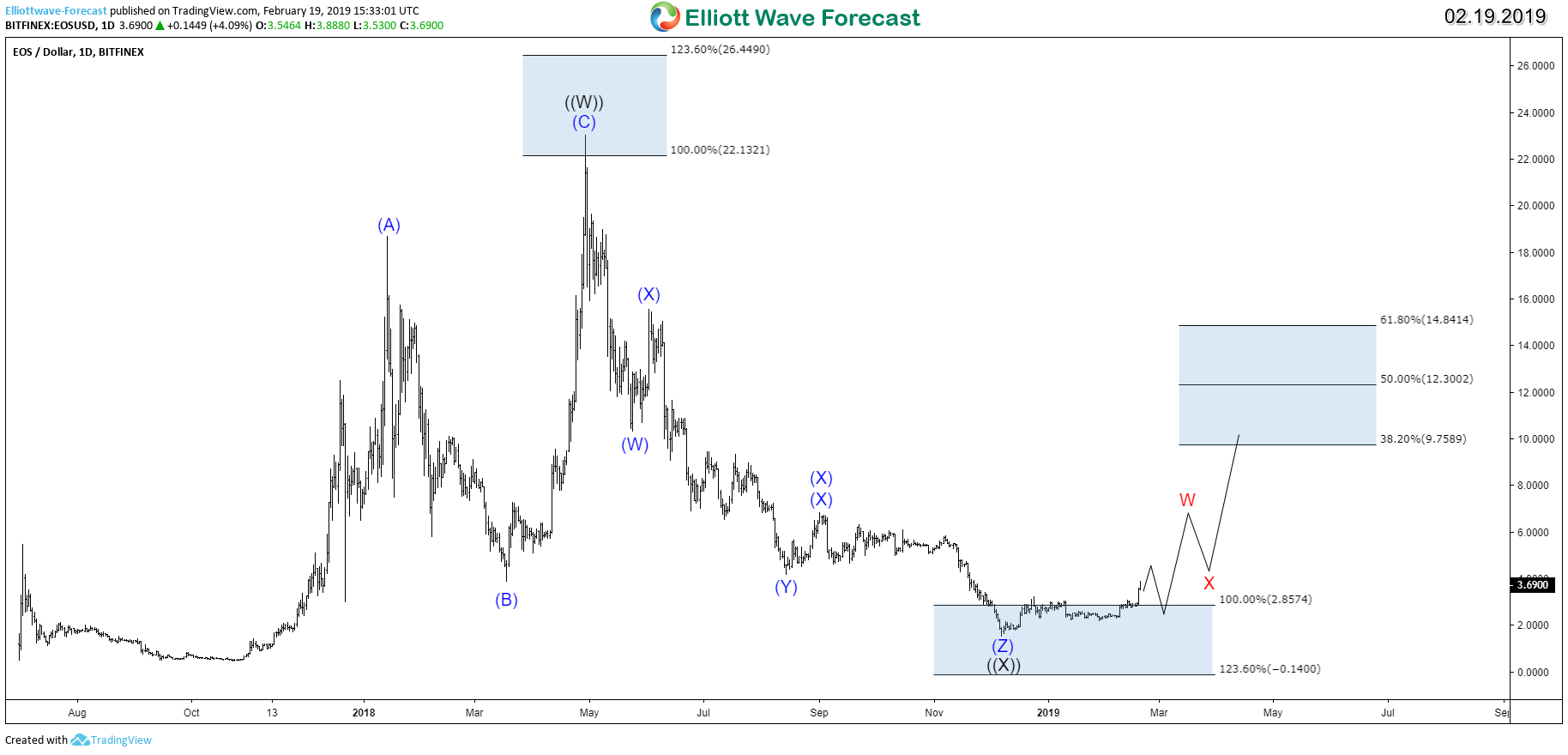

EOS Token Price Looking for A Technical Recovery

Read MoreThe EOS token is the cryptocurrency of the EOS network which is using the blockchain technology architecture to enable vertical and horizontal scaling of decentralized applications. 2018 was the worst year for cryptocurrency investors as the market saw a significant price drop but despite that, ESO coin managed to make new all time highs during […]

-

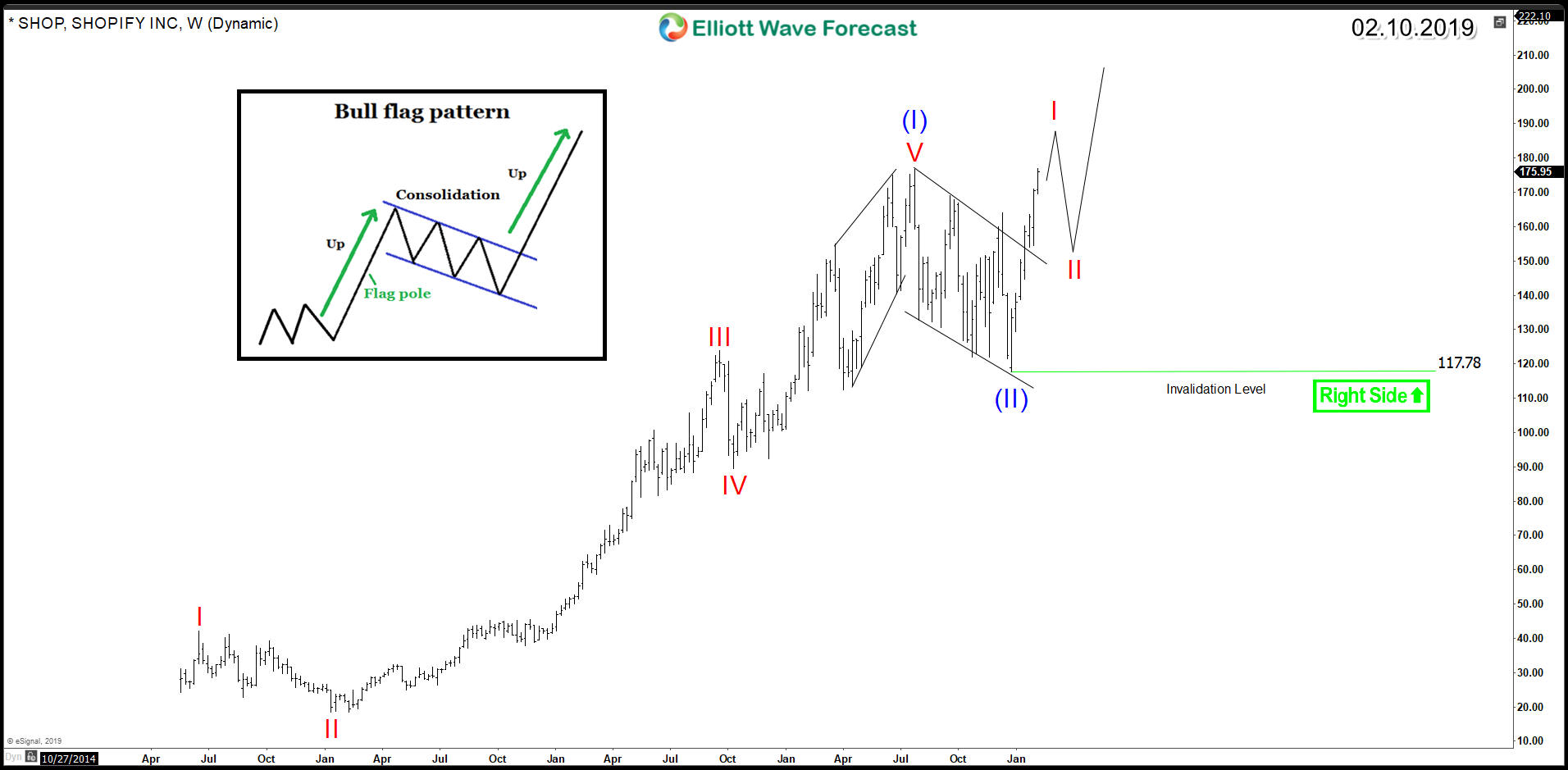

Shopify (NYSE:SHOP) – Bullish Flag Breakout Higher

Read MoreShopify (NYSE:SHOP) is an electronic commerce company offering online stores and retail point of sale platform designed for small and medium-sized businesses. Merchants can design, set up and manage their shops using a single interface which make is an easy and attractive way to start up a business in few clicks. E-commerce industry been around for almost […]

-

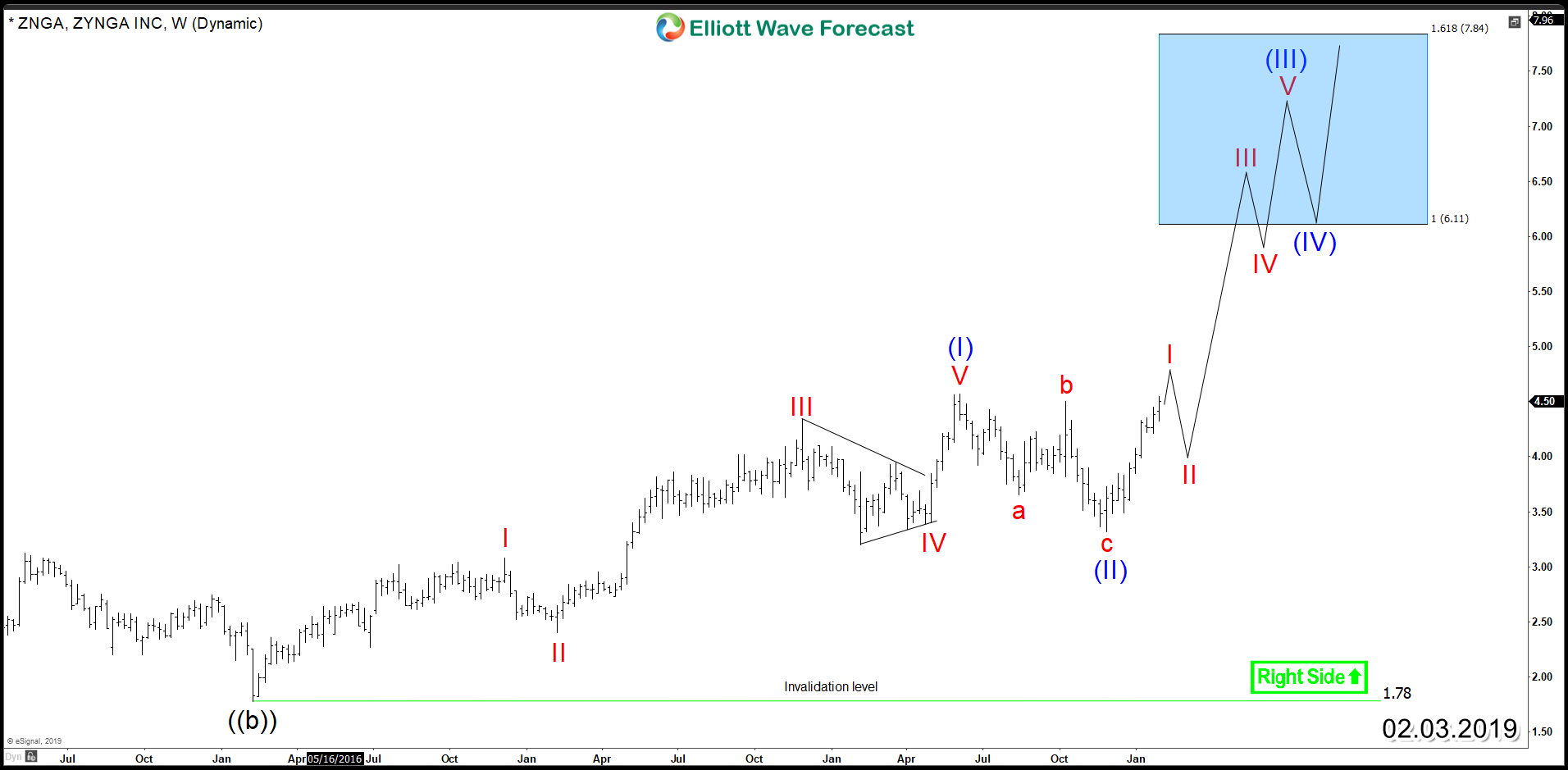

Zynga (NASDAQ: ZNGA) – Starting New Bullish Sequence

Read MoreZynga (NASDAQ: ZNGA) is a video game developer company focused on social mobile gaming. With popular games like FarmVille and Zynga Poker, the American publisher managed to stand out in a crowded market. In the recent decade, the number of gamers grow in a fast pace and leading companies like Activision Blizzard (NASDAQ: ATVI) & Electronic Arts (NASDAQ: […]

-

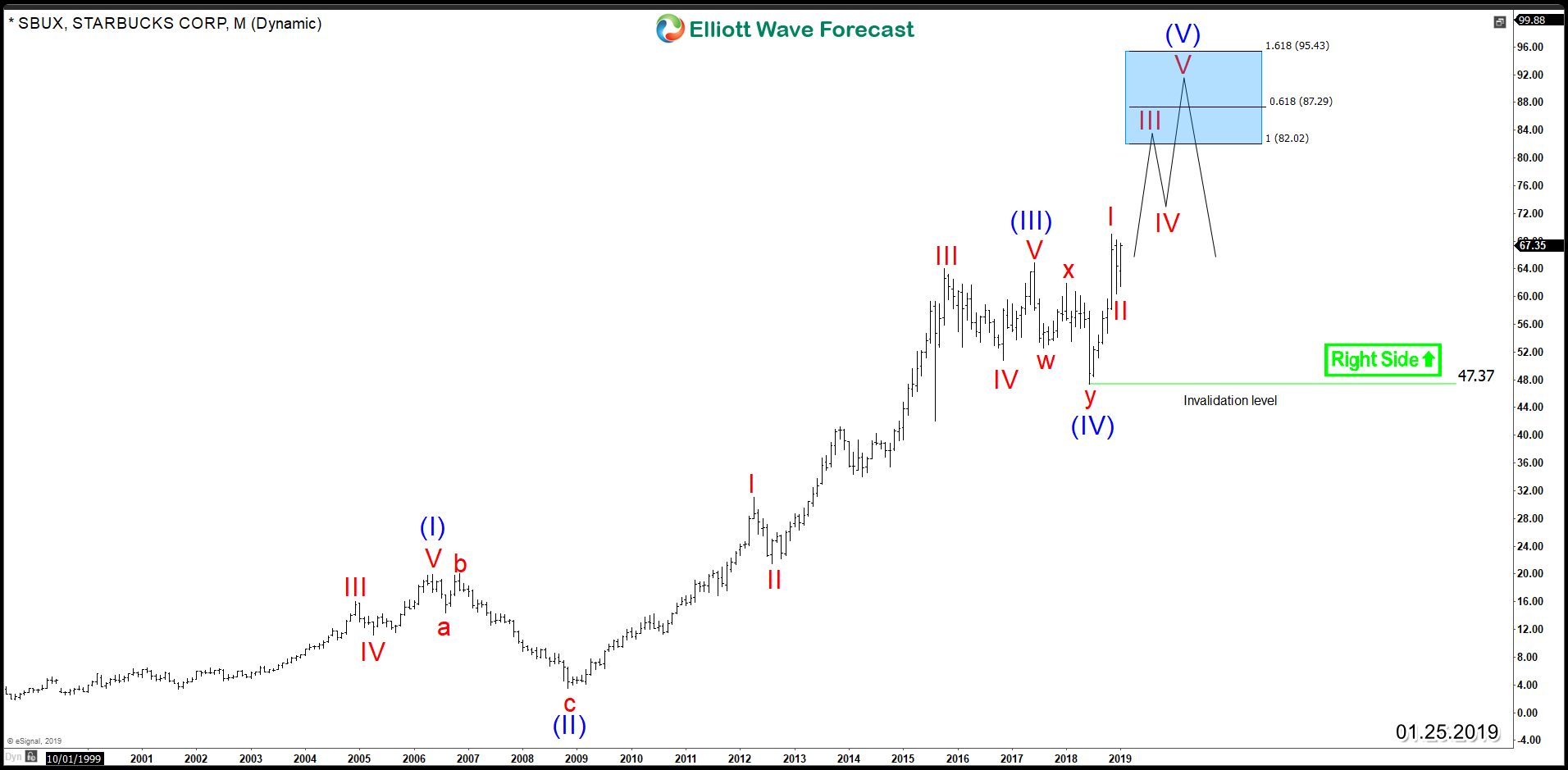

Starbucks (NASDAQ: SBUX) – Leading The Bull Market

Read MoreStarbucks (NASDAQ: SBUX) is American coffeehouse chain and it’s also the 3rd largest fast food restaurant chain by number of locations around the world. The coffee giant boosted sales by the end of the 2018 and its revenue and earnings beat expectations for the second consecutive quarter. 2018 was a red year for the stock market, […]