-

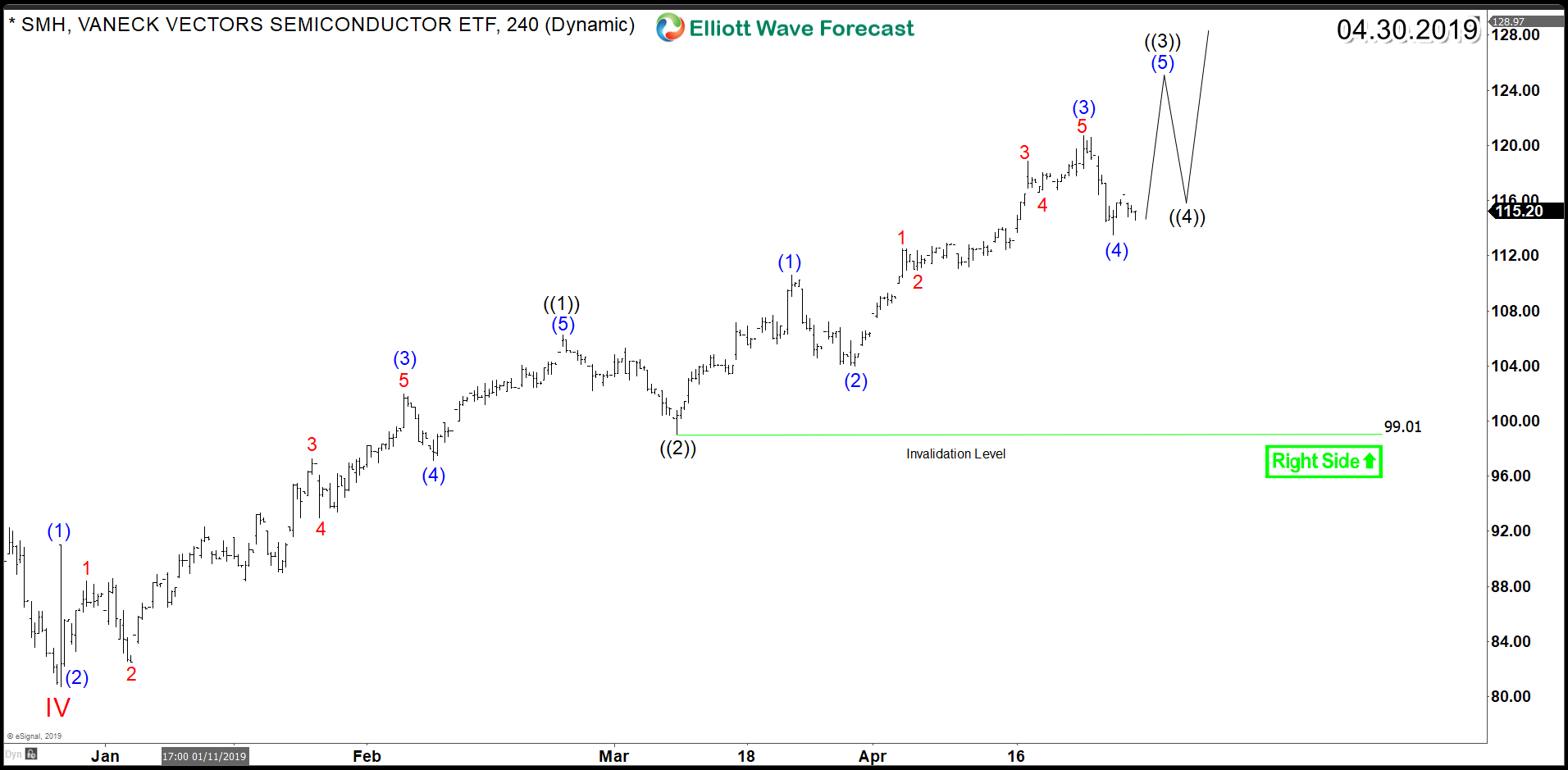

Further Rally Expected in Semiconductor ETF SMH

Read MoreVanEck Vectors Semiconductor ETF (SMH) tracks a market-cap-weighted index of US-listed semiconductors companies. Such companies include big technology names like Intel (INTC: NASDAQ) and Nvidia (NVDA: NASDAQ). The ETF is currently up +30% year-to-date making new all time highs and leading the move among few other instruments. For this article, we’ll be taking a look at the […]

-

JPMorgan Chase (NYSE: JPM) Aiming for New All Time Highs

Read MoreJPMorgan Chase (NYSE: JPM) is the largest bank in the United State. It is a multinational banking and financial service provider that was formed as a result of a merger of several banking companies in 1996. The Banking sector took its biggest hit during the financial crisis in 2008 as many banks announced bankruptcy and other […]

-

Intel Corporation (INTC) Bullish Structure Favors More Upside

Read MoreIntel Corporation (NASDAQ: INTC) is second largest and second highest valued chipmakers in the world. It designs and manufactures microprocessors and platform solutions for the global personal computer and data center markets. Looking at the company’s Fundamental situation, its return on Total Capital is 23.43 and its Return on Invested Capital has reached 20.60%. Its Return […]

-

Sony Corporation (NYSE: SNE) Impulsive Structure Since 2012

Read MoreSony Corporation (NYSE: SNE) is a Japanese multinational conglomerate corporation. The Company has a diversified business primarily focused on the Electronics, Games, Entertainment and Financial Services. In this article, we’ll be looking at the technical Elliott Wave structure of the stock since late 2012 after a significant drop in Yen value which helped the Japanese stock market […]

-

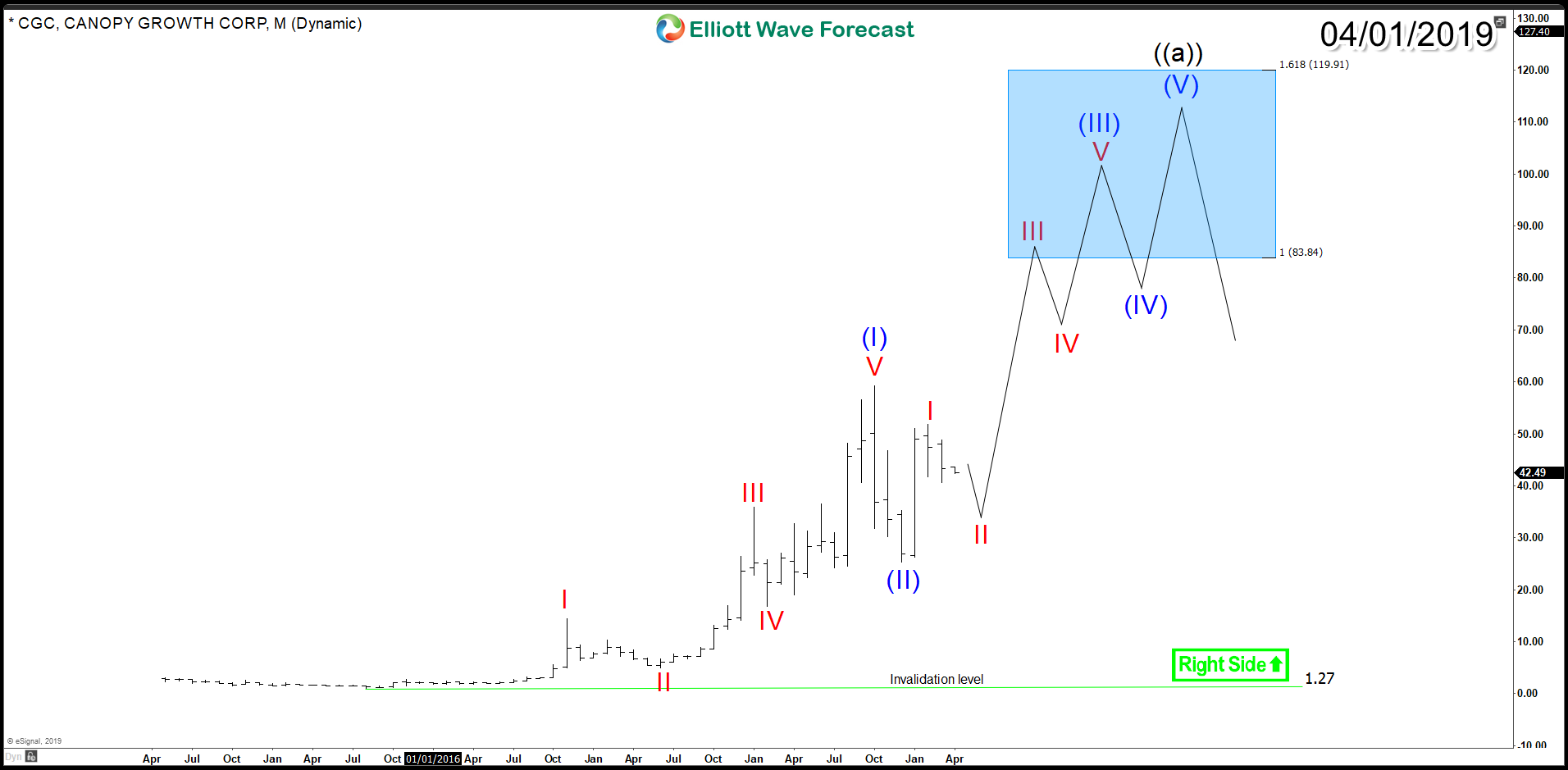

Canopy Growth Corporation (NYSE: CGC) Bullish Cycle in Progress

Read MoreCanopy Growth Corporation (NYSE : CGC) is a Canadian cannabis company which was known as Tweed Marijuana Inc. before it was renamed in 2015. As of late September 2018, Canopy became the world’s largest cannabis company, based on market capitalization. Since last December, CGC saw a strong rally achieving 90% gains in just 2 months […]

-

Cronos Group (NASDAQ: CRON) Bullish Side Remains Intact

Read MoreCronos Group (NASDAQ: CRON) is an innovative global cannabis company based in Canada. It’s one of the largest medical marijuana producer around the world and it was the first cannabis company to be listed on the Nasdaq stock market last year. Today, the company announced its fourth-quarter and full-year 2018 financial results before the market opens. It posted gross profit before […]