-

Microsoft ( NASDAQ: MSFT) Looking for buyers to remain in control

Read MoreMicrosoft ( NASDAQ: MSFT) established new all time highs back in April the 25th and since then it saw a 9% drop. MSFT follow the same code as the rest of the financial market so if we take a look at the technical chart of the stock we can recognize a clear impulsive pattern taking place […]

-

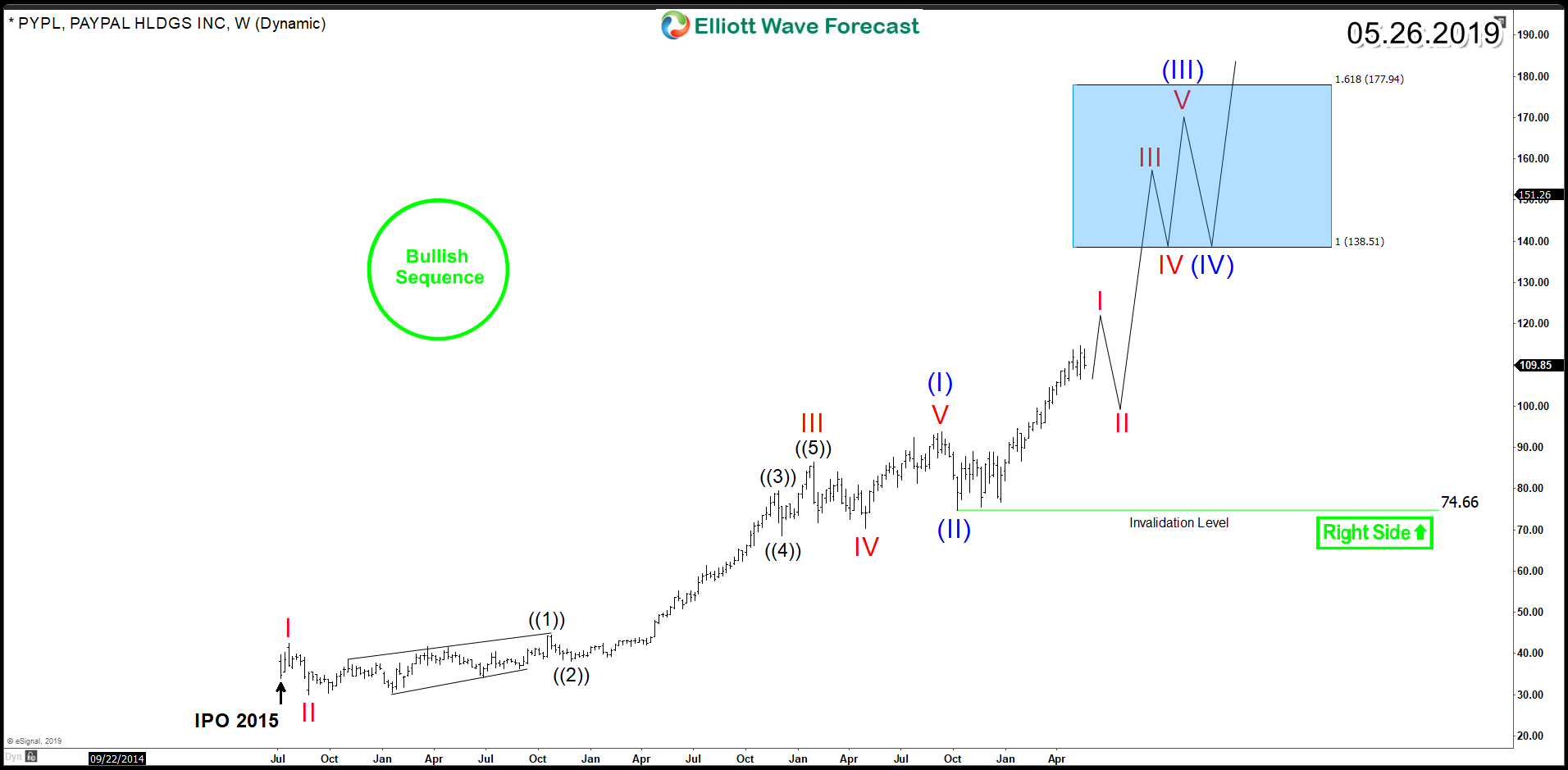

Paypal ( NASDAQ: PYPL) – Bulls are Looking for Further Profits

Read MorePaypal ( NASDAQ: PYPL) is a payment processor platform that enables digital and mobile payments on behalf of consumers and merchants worldwide providing an electronic alternative to traditional paper methods like checks and money. The company initial public offering was in 2002 then became a wholly owned subsidiary of eBay later that year before it spun off […]

-

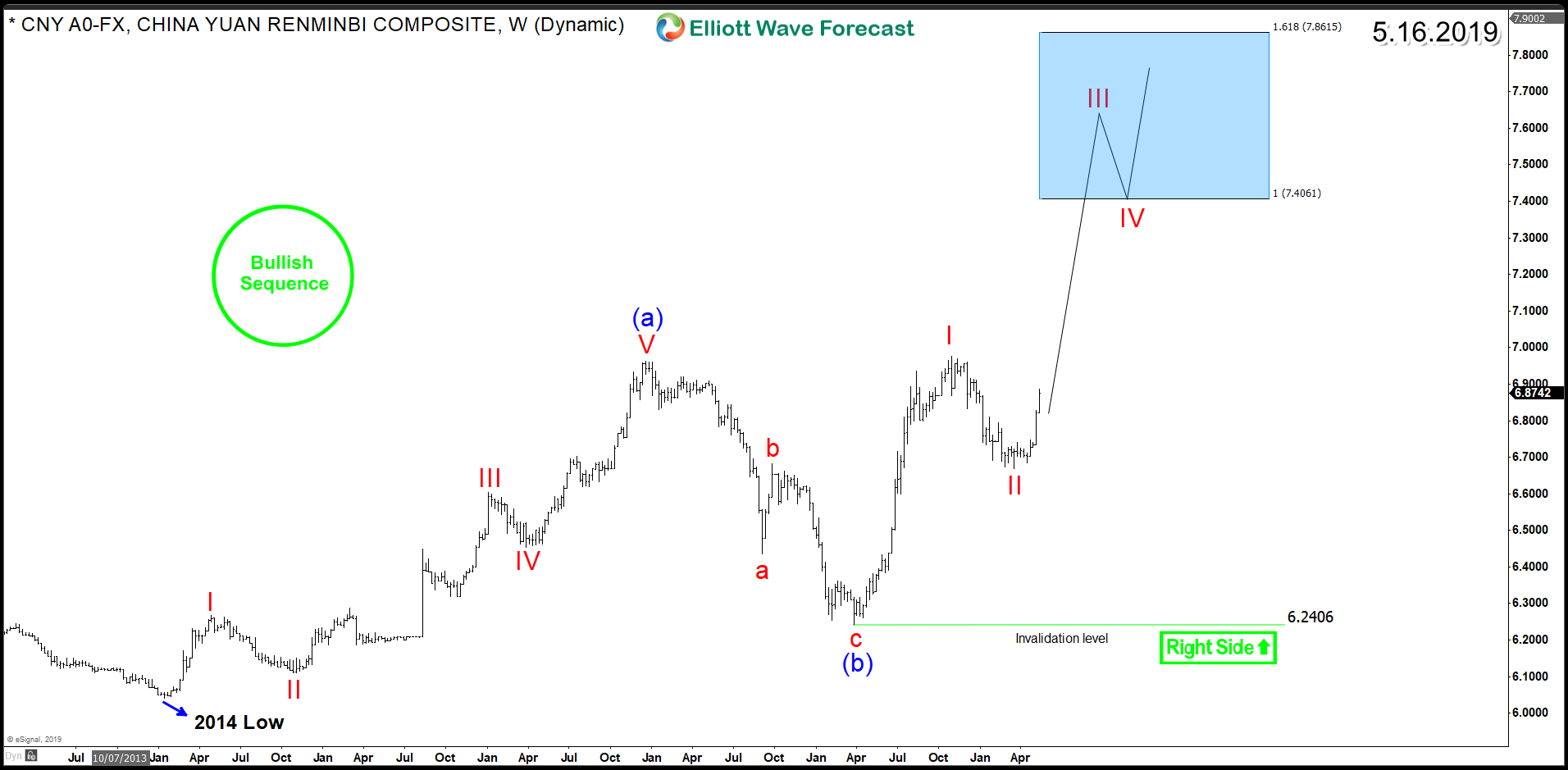

Chinese Yuan Looking For Further Weakness Against US Dollar

Read MoreThe Yuan (CNY) is the basic unit of the Renminbi which represents the official currency of the People’s Republic of China. The ongoing trade war between China and United States is affecting the economy for both country and the recent tension caused by U.S. Tariffs could be the trigger of more weakness in Yuan. China’s currency had appreciated 30% against the U.S. […]

-

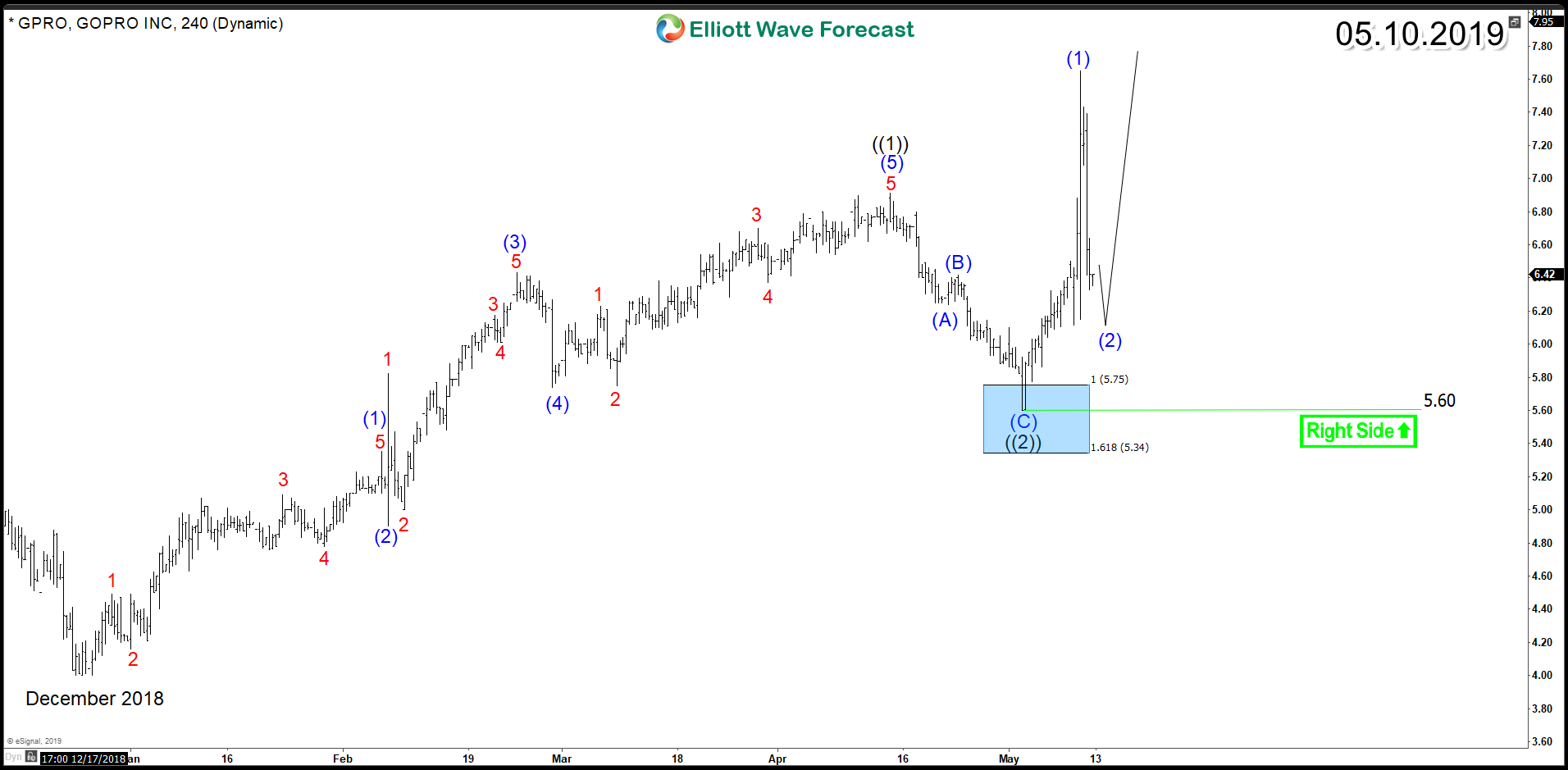

GoPro (NASDAQ: GPRO) Aiming for Technical Recovery

Read MoreGoPro (NASDAQ: GPRO) is an American technology company founded in 2002 and it was listed on the NASDAQ stock exchange on June 25, 2014. It manufactures action cameras and develops its own mobile apps and video-editing software. The company year on year earnings growth rate was negative over the past 5 years and its stock lost […]

-

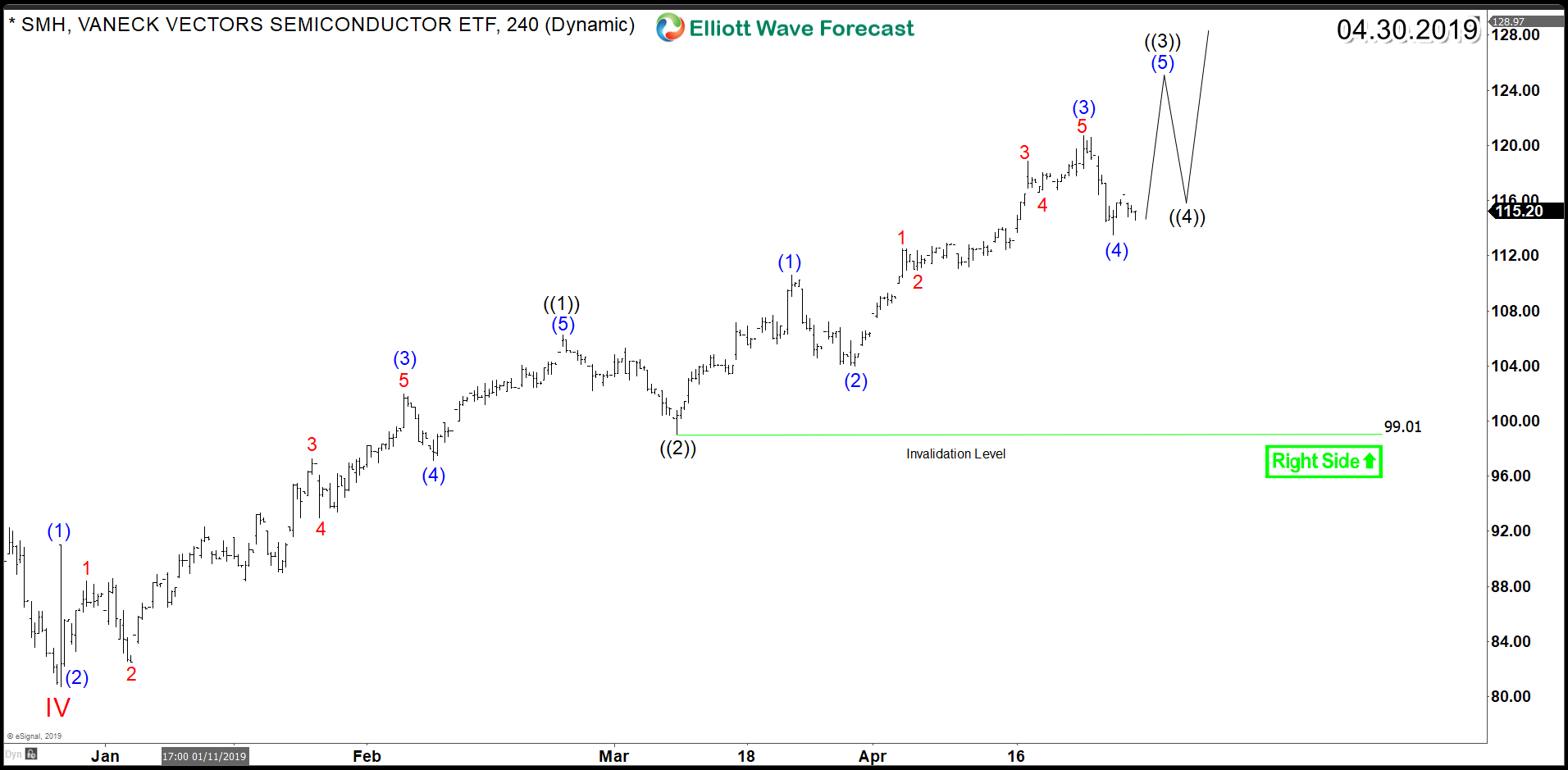

Further Rally Expected in Semiconductor ETF SMH

Read MoreVanEck Vectors Semiconductor ETF (SMH) tracks a market-cap-weighted index of US-listed semiconductors companies. Such companies include big technology names like Intel (INTC: NASDAQ) and Nvidia (NVDA: NASDAQ). The ETF is currently up +30% year-to-date making new all time highs and leading the move among few other instruments. For this article, we’ll be taking a look at the […]

-

JPMorgan Chase (NYSE: JPM) Aiming for New All Time Highs

Read MoreJPMorgan Chase (NYSE: JPM) is the largest bank in the United State. It is a multinational banking and financial service provider that was formed as a result of a merger of several banking companies in 1996. The Banking sector took its biggest hit during the financial crisis in 2008 as many banks announced bankruptcy and other […]