-

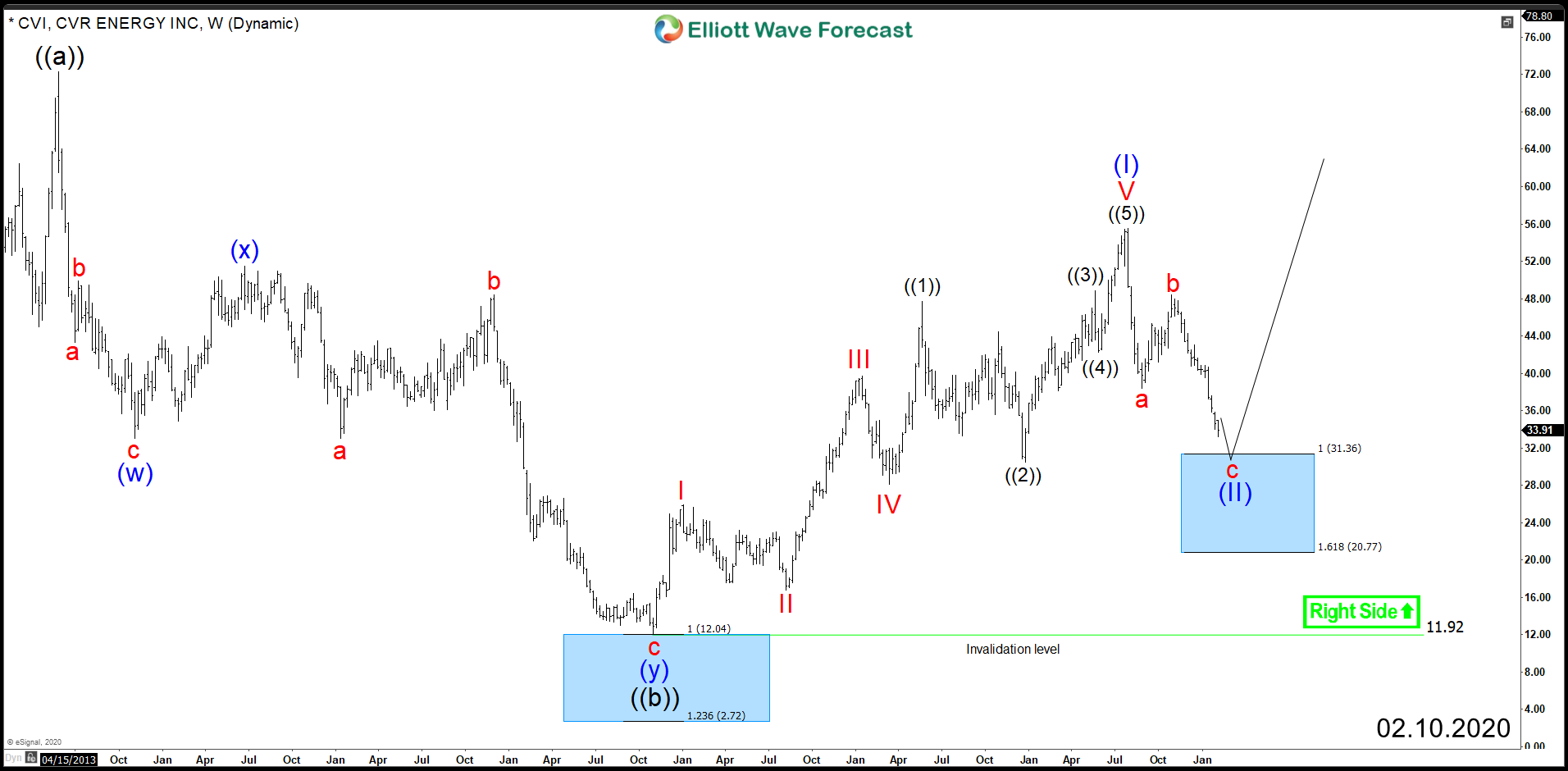

CVR Energy (NYSE:CVI) – Recovery on the Horizon

Read MoreCVR Energy (NYSE:CVI) lost almost 40% of it’s value since July of last year, as the stock started correcting the impulsive 5 waves advance from 2016 low. The correction taking place is unfolding as 3 waves Zigzag structure which can ideally find support at equal legs area $31.36 – $20.77 from where a reaction higher […]

-

Snap Inc. Bullish Sequence Supporting Further Upside

Read MoreSnap Inc. is an American camera and social media company which has three products: Snapchat, Spectacles, and Bitmoji. Last year, SNAP ended up with +195% gains as the stock saw an impressive 5 waves advance allowing it to establish a new bullish cycle which made the corrective pullbacks as another opportunity for buyers to join the […]

-

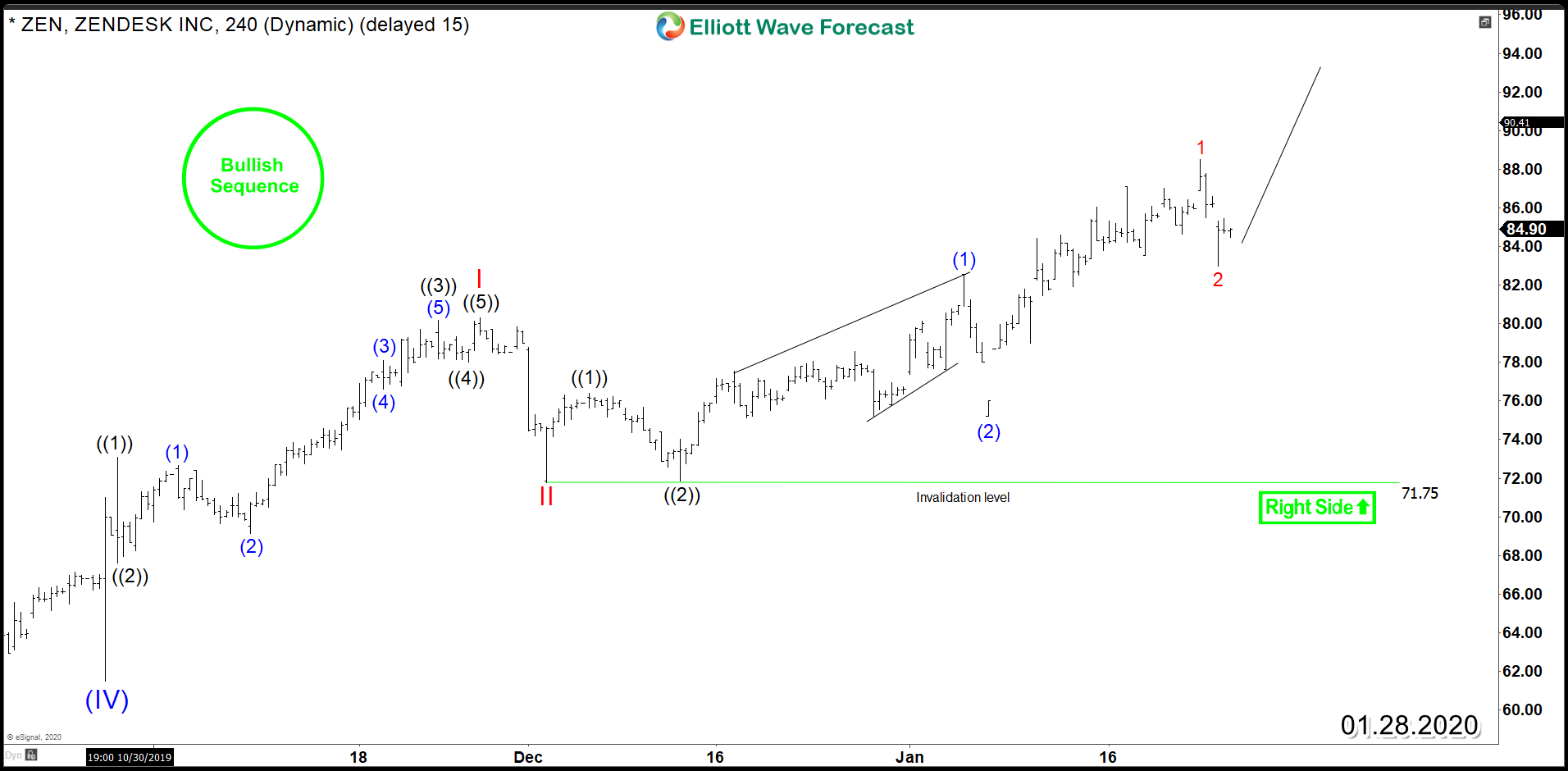

Zendesk (NYSE: ZEN) – Aiming for New All time Highs

Read MoreZendesk (NYSE: ZEN) bullish trend since IPO is still in progress despite the 30% correction which took place last year. The Bulls remained in Control as the stock ended a corrective 3 swing move lower then started a new rally since October 2019. Up from there, Zen is currently showing an incomplete bullish sequence suggesting further […]

-

ConocoPhillips (NYSE: COP) Getting Ready for Next Rally

Read MoreConocoPhillips (NYSE: COP) is an American multinational energy corporation that was created through the merger of American oil companies Conoco and Phillips Petroleum Company on August 30, 2002. Since February 2016, COP rallied higher within an impulsive 5 waves advance for almost 3 years before ending that cycle in October 2018. Then the stock turned lower into a […]

-

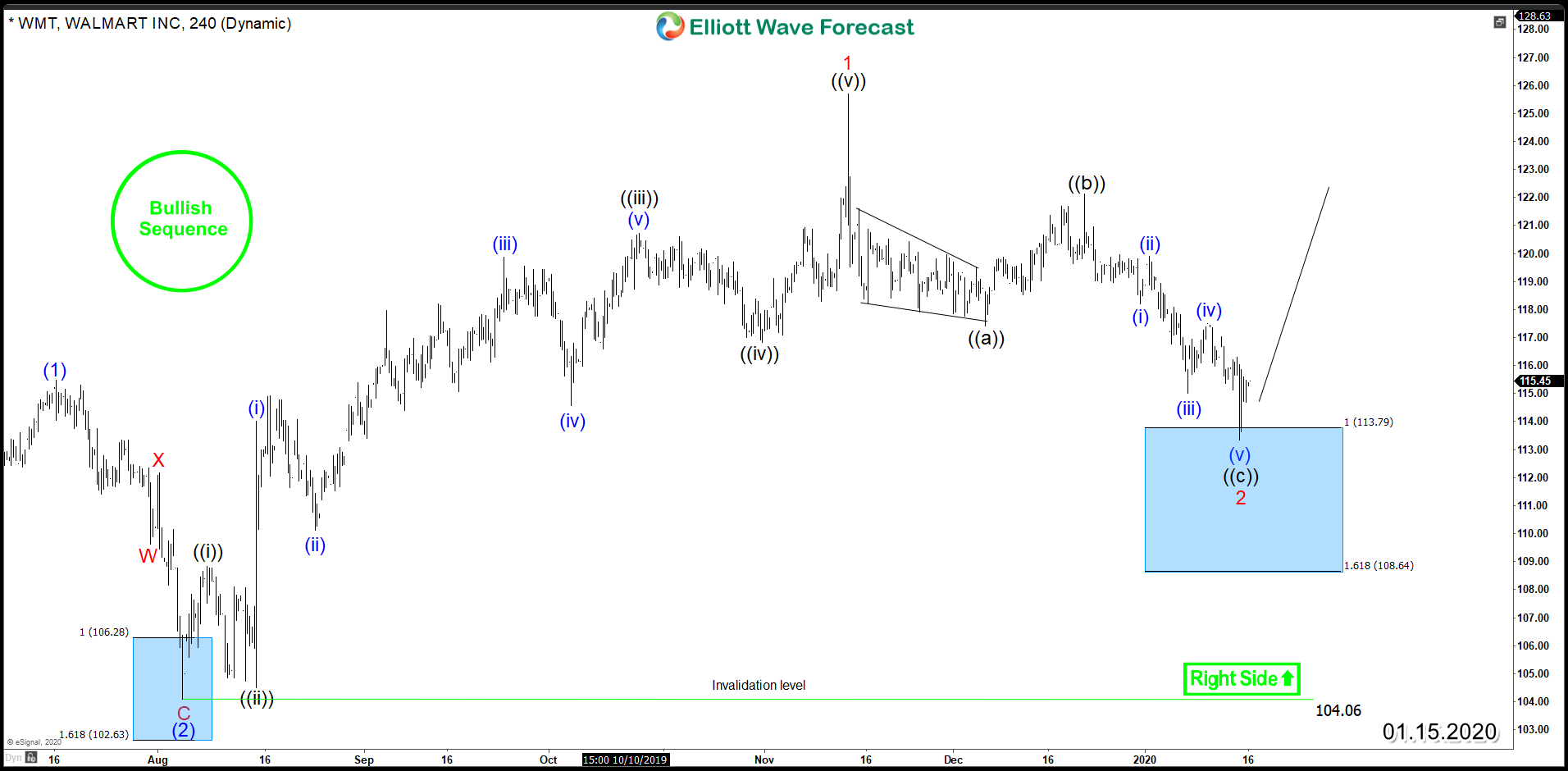

Walmart (NYSE: WMT) Looking to Find Buyers During Pullbacks

Read MoreIn today’s article, we’ll be taking a look at the current Elliott Wave Structure for the world’s largest retailer Walmart (NYSE: WMT). Since August 2019, WMT rallied within an impulsive 5 waves advance which took the stock to new all time highs before the cycle ends on November at $125.69. Down from there, it started a […]

-

Hecla Mining (NYSE: HL) Impulsive Rally in Progress

Read MoreHecla Mining (NYSE: HL) is a mining company engaged in the exploration and development of mineral properties also the mining and processing of silver, gold, lead and zinc. Since May 2019, HL established a strong reversal after it ended the decline since 2016 peak and started a new bullish cycle. the stock traded higher within an impulsive […]