-

UnitedHealth Group (NYSE: UNH) Supported Pullback in Progress

Read MoreUnitedHealth Group Incorporated (NYSE: UNH) is the largest healthcare company in the world by revenue providing health care products and insurance services. UNH established an impulsive 5 waves advance from 3/25 low allowing the stock to rally to new all time highs last April followed by another move higher early this month. Based on the Elliott Wave Theory, […]

-

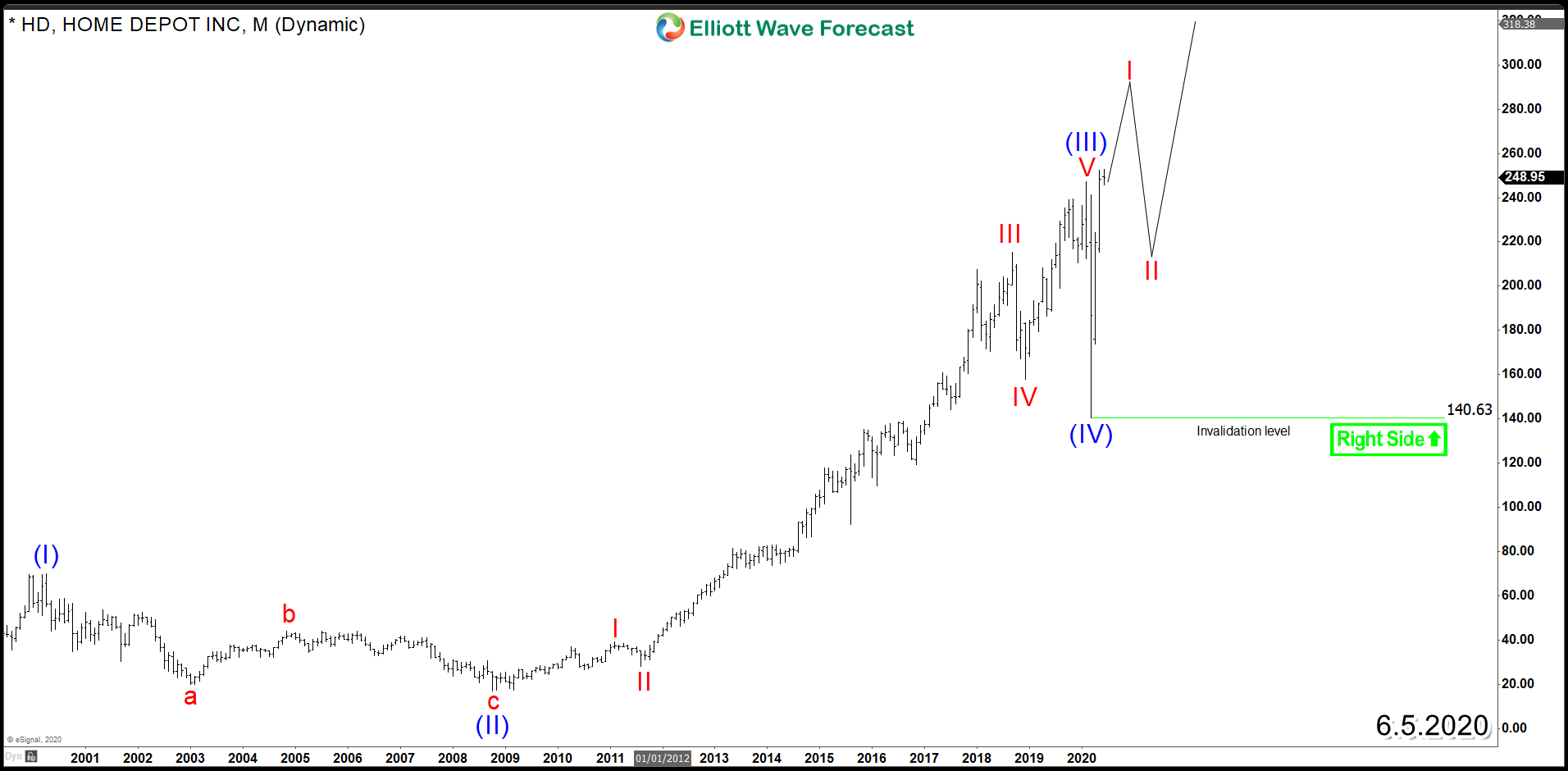

Home Depot (NYSE: HD) Next Investment Opportunity

Read MoreThe world largest home improvement retailer Home Depot (NYSE: HD) sales growth doubled its pace from the prior quarter despite reduced operating hours and cancelled promotions because of the COVID-19 pandemic which pressured most of the retail industry. Early this year, HD ended the cycle from 2008 low and did a sharp 40% drop along side the rest of the market. […]

-

Fortinet Inc (NASDAQ: FTNT) Bullish Sequence Supporting the Stock

Read MoreFortinet Inc (NASDAQ: FTNT) ended it’s initial bullish cycle from 2009 low after it rallied within an impulsive 5 waves advance which reached a pea at $121.8 peak on February of this year. The multinational corporation gained a total of %1330 during this 11 Years rally putting it on the list of one of the fastest growing stocks […]

-

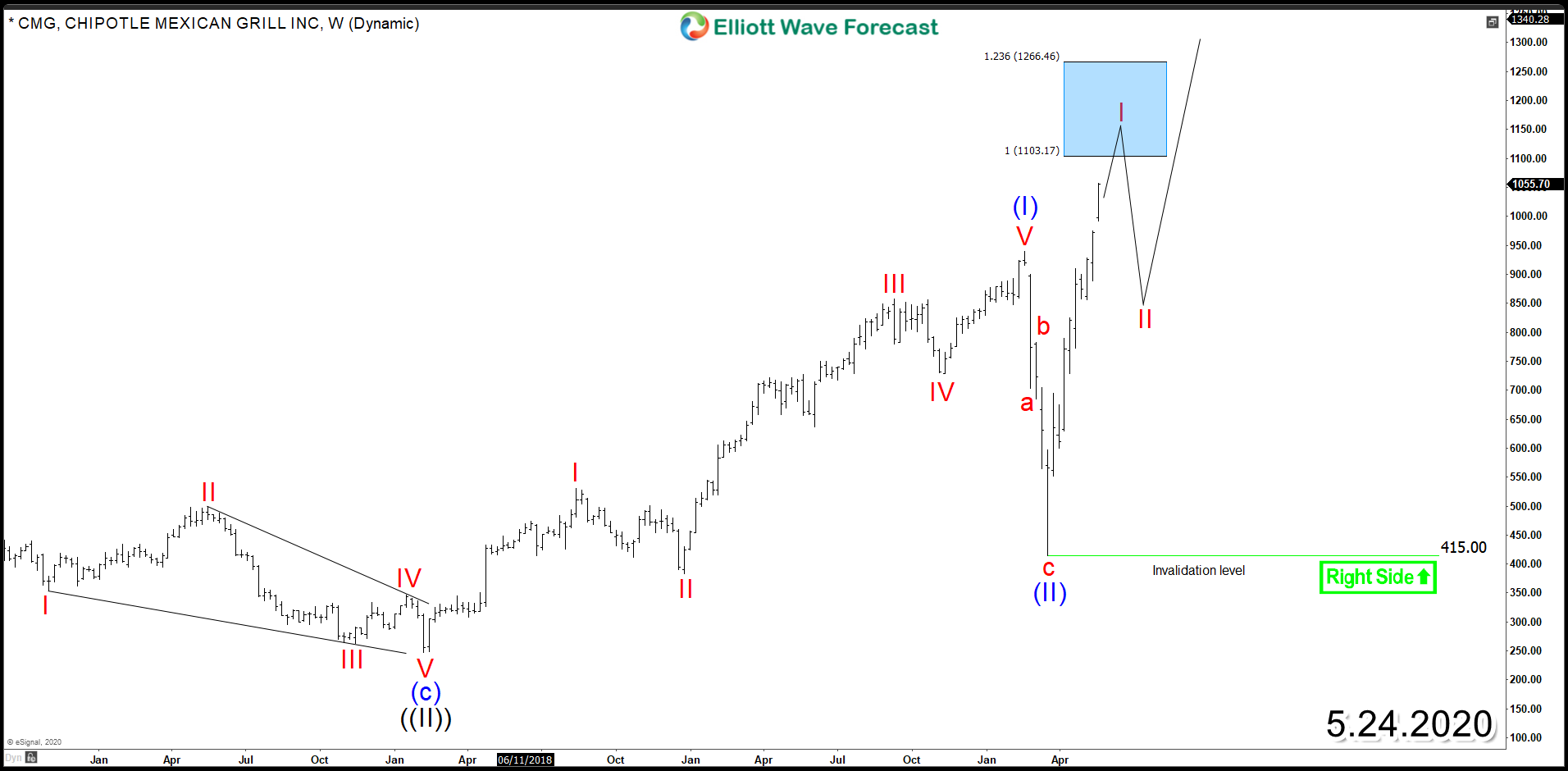

Chipotle Mexican Grill (NYSE: CMG) – Target Around the Corner

Read MoreChipotle Mexican Grill (NYSE: CMG) has been able to adapt within the current pandemic situation by adjusting its operations to handle digital orders and and made deliveries. Last week , the stock hit a record high, going over $1,000 per share for the first time and it’s currently up 125% since the March bottom. The technical outlook […]

-

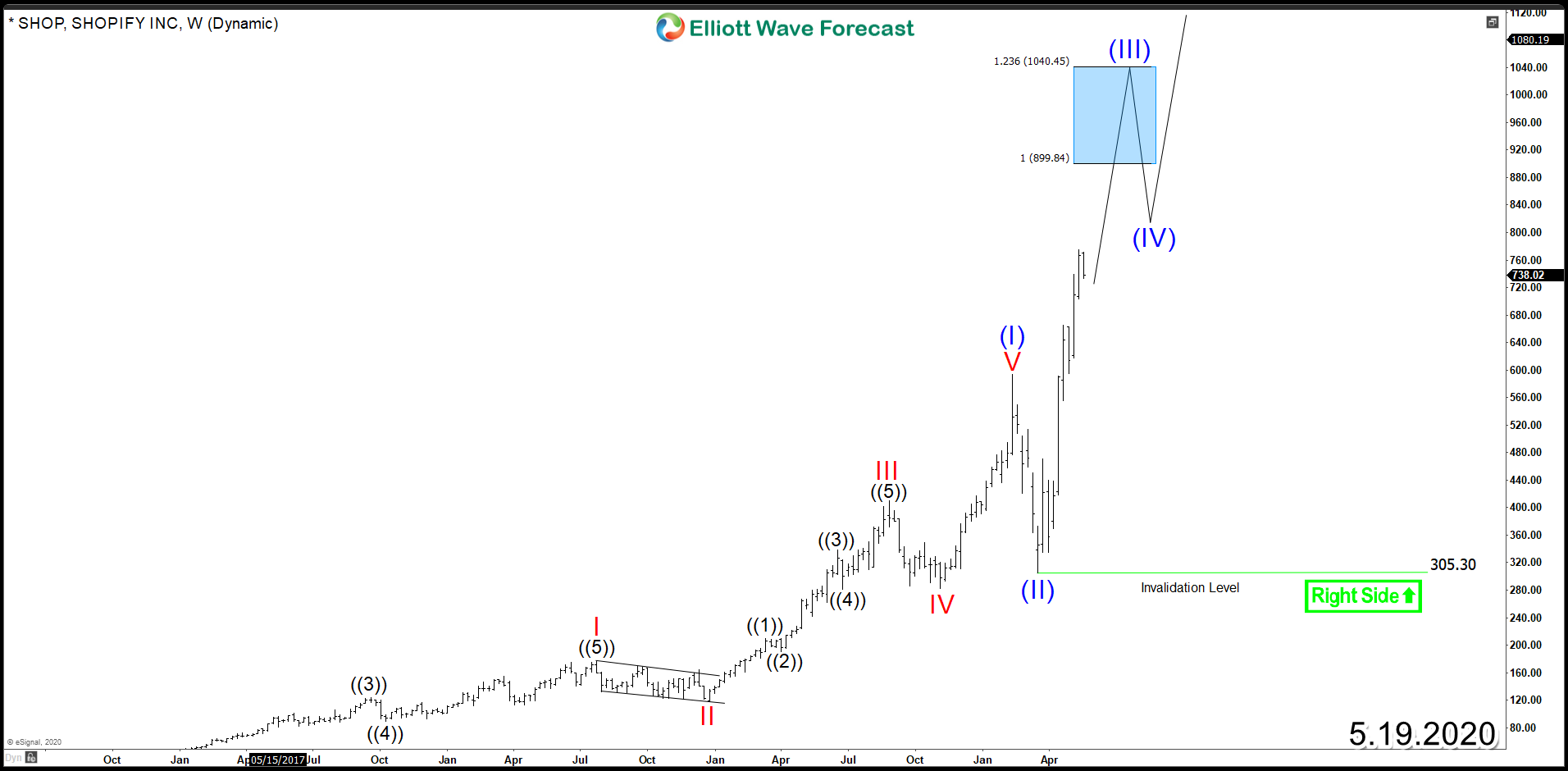

Shopify (NYSE:SHOP) – Bulls Looking To Remain In Control

Read MoreShopify (NYSE: SHOP) is one of the best performing technology stocks since its IPO back in 2015. As electronic commerce boomed in recent years, SHOP saw an enormous gain in value up to 2900% punting the stock as one of the fastest growing companies. Despite the majority of stock market being down in 2020%, SHOP was able to […]

-

Paypal (NASDAQ: PYPL) – Bullish Sequence Calling Higher

Read MorePaypal (NASDAQ: PYPL) is an American online payments company that enables digital and mobile payments on behalf of consumers and merchants worldwide. Last week, PYPL broke above February 2020 peak to hit an all-time high few days before its first-quarter results then after the earnings came out it soared again. It’s currently up 30% year-to-date […]