-

PepsiCo (NASDAQ: PEP) Gains Momentum as market volatility subsides

Read MoreWith a market capitalization of over $200 billion, PepsiCo (NASDAQ: PEP) is a global leader in the food and beverage industry. It has recently broken into new all-time highs, indicating a potentially bullish outlook for the stock. Despite ongoing market volatility and changing consumer preferences, the company’s strong revenue and profits suggest a solid business […]

-

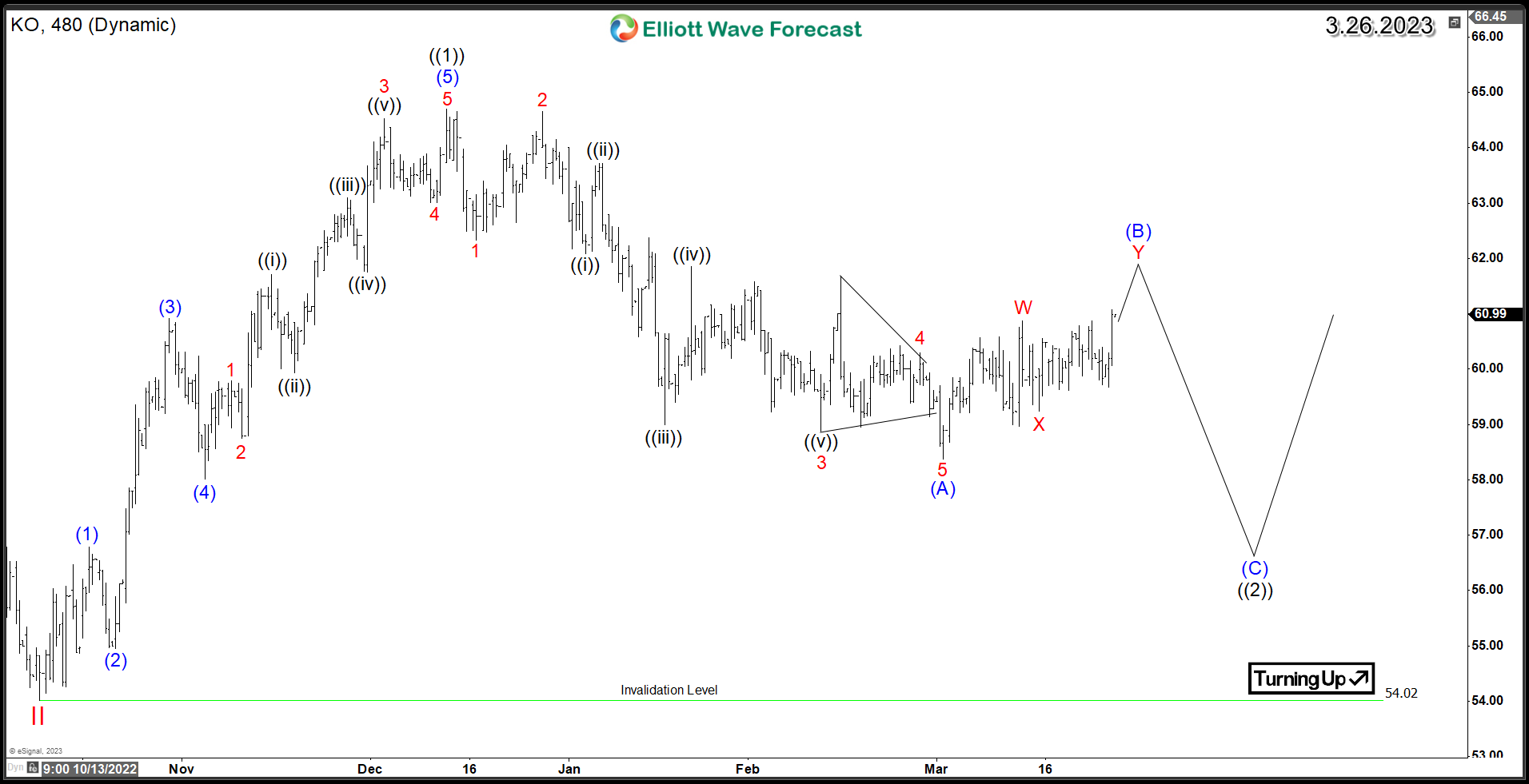

Coca-Cola Stock KO Price Surge Creates Bullish Sequence

Read MoreCoca-Cola (NYSE: KO), a leading beverage company, recently reported better-than-expected earnings and revenue for the quarter. The strong financial results, demonstrate the company’s resilience in the face of challenging economic conditions and highlight its ability to adapt to changing market dynamics. It leads to increased investor confidence and a surge in the company’s stock price. As […]

-

Raytheon Technologies RTX Set for Bullish Rally into New All-Time Highs

Read MoreRaytheon Technologies Corp (NYSE: RTX) is a leading provider of advanced technologies and services for aerospace and defense industries. The company has a long history of innovation and has been a key player in the defense industry for decades. In this article, we will examine the current Elliott Wave technical structure of RTX. We’ll discuss […]

-

CMG Continues to Impress Investors with Bullish Outlook

Read MoreChipotle Mexican Grill (NYSE: CMG) is a fast-casual restaurant chain that has caught the eye of investors due to its strong performance in recent years. Since the market bottomed out in February 2018, the stock has displayed an impressive bullish trend. This article will analyze CMG’s stock using Elliott Wave technical analysis and explore potential […]

-

Starbucks SBUX Continue to Defy Market Pressure

Read MoreStarbucks (NASDAQ: SBUX) has shown resilience in the face of market volatility, with technical price action suggesting continued support for the stock. As investors continue to navigate the current financial landscape, many are looking to technical analysis to identify the potential trend for the stock. In this article, we will examine the Elliott Wave structure of […]

-

Technical Analysis Suggests Short-Term Ceiling for Coca-Cola Stock KO

Read MoreAs one of the most recognizable beverage companies globally, Coca-Cola (NYSE: KO) is a well-known name in the stock market. Over the last two months, the stock has been range-bound, prompting investors to question whether it will break out of its sideways pattern. The lack of directional momentum has led to uncertainty regarding the stock’s future […]