-

SPDR S&P Bank ETF (KBE) Bouncing from Daily Blue Box Area

Read MoreSPDR S&P Bank ETF (KBE) is a widely-tracked exchange-traded fund that provides exposure to the banking sector within the S&P 500 index. As an essential component of the financial markets, KBE offers investors an opportunity to participate in the performance of leading banks and financial institutions. This article will explore the current outlook for KBE, based […]

-

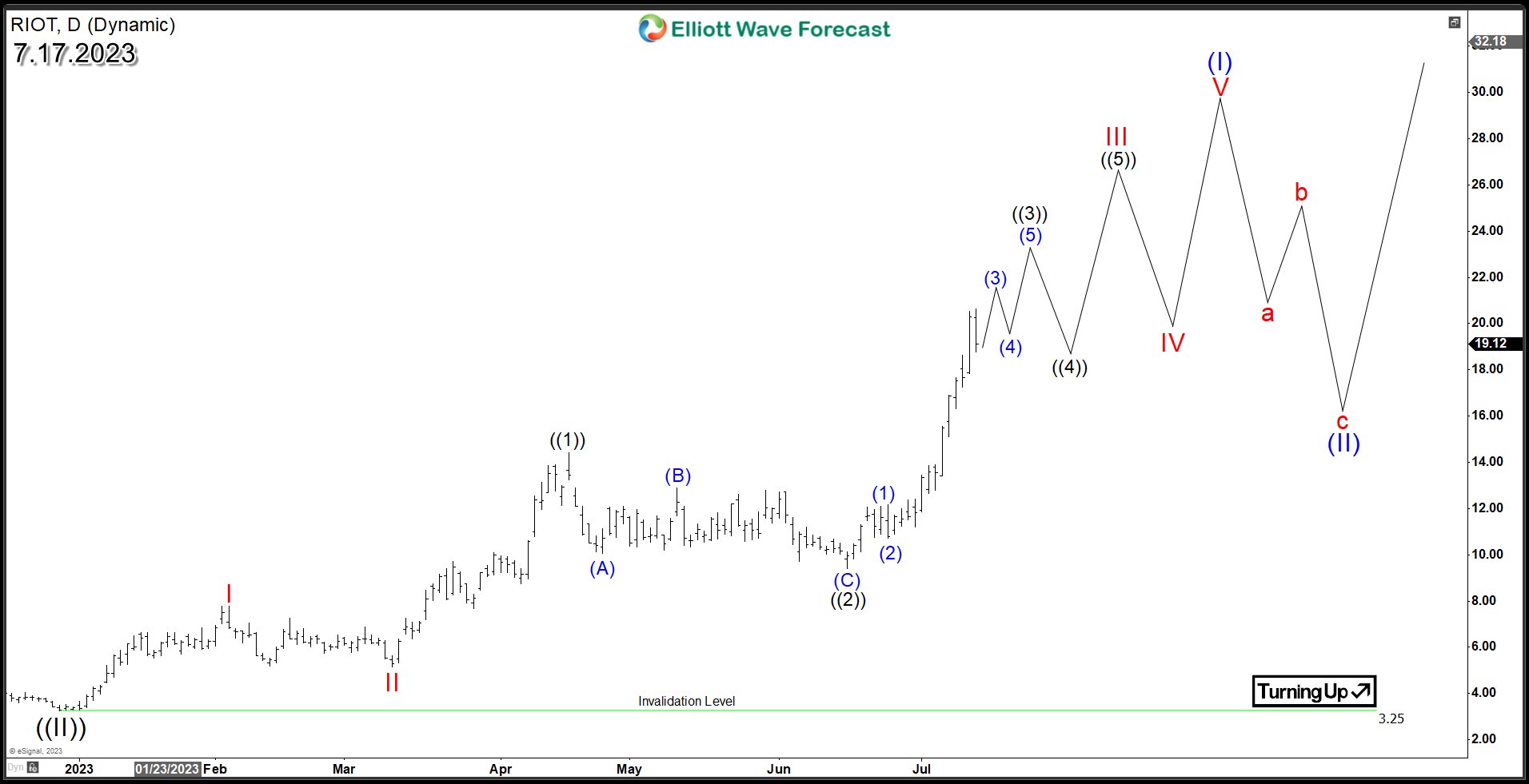

RIOT Sets the Stage for Further Advances with Strong Bullish Structure

Read MoreIn the fast-paced world of cryptocurrency, Riot Blockchain Inc (NASDAQ: RIOT) has emerged as a key player, fueled by its innovative blockchain technology and successful venture into mining Bitcoin. As the demand for digital currencies continues to rise, RIOT has positioned itself for further growth and success. In this article, we will delve into the […]

-

Navigating 3M’s (MMM) Downside Pressure and Long-Term Prospects

Read More3M Company (NYSE: MMM) is a globally recognized leader in innovation, manufacturing, and technology solutions. With a rich history spanning over a century, 3M has established itself as a trusted name in various industries. In this article, we will explore the Elliott Wave technical chart to provide an overview for long-term Prospects and potential opportunities that […]

-

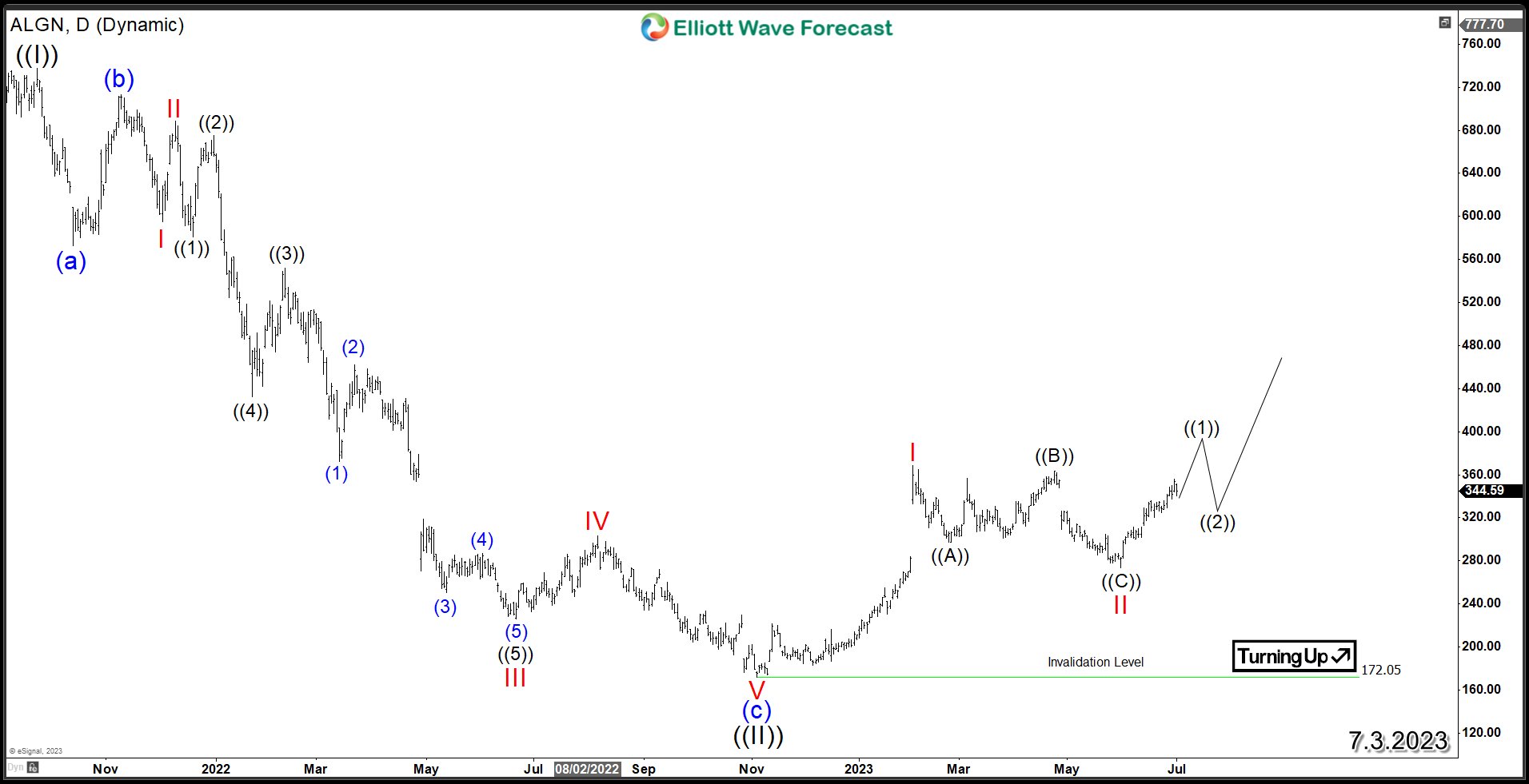

ALGN Stock Shows Promising Signs of Extended Growth Potential

Read MoreIn the ever-evolving landscape of dental technology, Align Technology, Inc. (NASDAQ: ALGN) stands out as a pioneering force. With its groundbreaking solutions and customer-focused approach, ALGN has garnered significant attention and market momentum. This article delves into the bullish prospects for Align Technology, examining the unfolding Elliott Wave pattern within its daily cycle. Since reaching […]

-

E.L.F Beauty ELF Rides the Strong Wave of Bullish Sentiment

Read MoreIn the dynamic world of beauty and cosmetics, e.l.f. Beauty Inc (NYSE : ELF ) has been making waves with its innovative products and customer-centric approach. The company has been riding a strong wave of bullish sentiment, driven by its ability to capture the hearts of consumers and deliver impressive financial results. In this article, we will […]

-

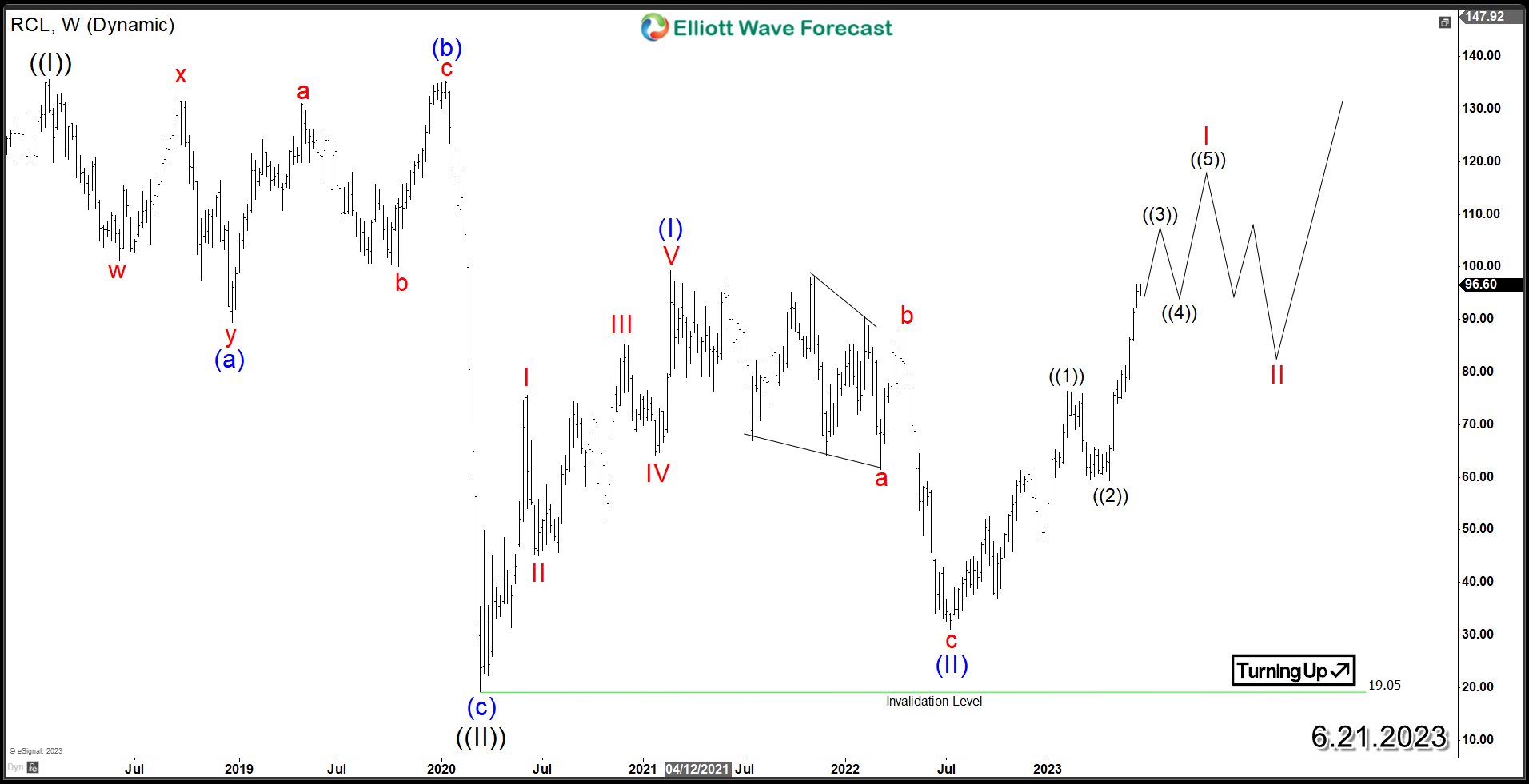

Royal Caribbean Cruises (NYSE: RCL) Sets Sail For Profitable Growth

Read MoreRoyal Caribbean Cruises Ltd (NYSE: RCL), a leading player in the global cruise industry, has weathered the challenges of the past year and is now poised for continued growth and success. As the world emerges from the pandemic and travel restrictions gradually ease, Royal Caribbean Cruises is well-positioned to capitalize on the pent-up demand for […]