-

Elliott Wave Analysis Offers Insight into LVS’s Potential Trajectory

Read MoreLas Vegas Sands Corp. (NYSE: LVS), a prominent player in the global integrated resort industry, has seen its fortunes shift amidst changing landscapes in the world of entertainment and hospitality. This article delves into the present Elliott Wave analysis for the stock, exploring two potential pathways based on Elliott Wave Theory and future prospects. Examining LVS’s […]

-

Mastercard (MA) Sets New All-Time High and Open Daily Upside

Read MoreMastercard Incorporated (NYSE: MA), a global leader in payment technology, continues to navigate the ever-evolving landscape of financial transactions. As digital payments become increasingly integral to modern economies, Mastercard remains at the forefront of innovation. This article dives into the recent technical developments and potential trajectories within its daily cycle using Elliott Wave Theory. Last […]

-

Procter & Gamble (NYSE: PG) Next Investment Opportunity

Read MoreProcter & Gamble (NYSE: PG) continues to capture investor attention following our previous video blog that illuminated a promising bullish trajectory for the company. Building upon those insights, this article delves deeper into PG’s mid-term prospects. By examining two Elliott Wave potential scenarios that could shape its near future, we aim to offer readers a […]

-

Berkshire Hathaway (BRK.B) Signals Strong Upside

Read MoreWarren Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) stands as a beacon of enduring success in the investment world. With a reputation built on prudent financial decisions and a long history of market acumen, Berkshire Hathaway has become synonymous with stability and prosperity. In this article, we dive into the latest developments and signals that suggest […]

-

Starbucks (NASDAQ: SBUX) Signals Next Investment Move

Read MoreAmid the ever-evolving landscape of global markets, Starbucks Corporation (NASDAQ: SBUX) stands as a recognizable and influential player. In this article, we dive into the current status of SBUX, exploring its recent market movement and projecting its future growth potential based on the Elliott Wave Theory. The daily chart reveals SBUX’s impulsive 5-wave rally from […]

-

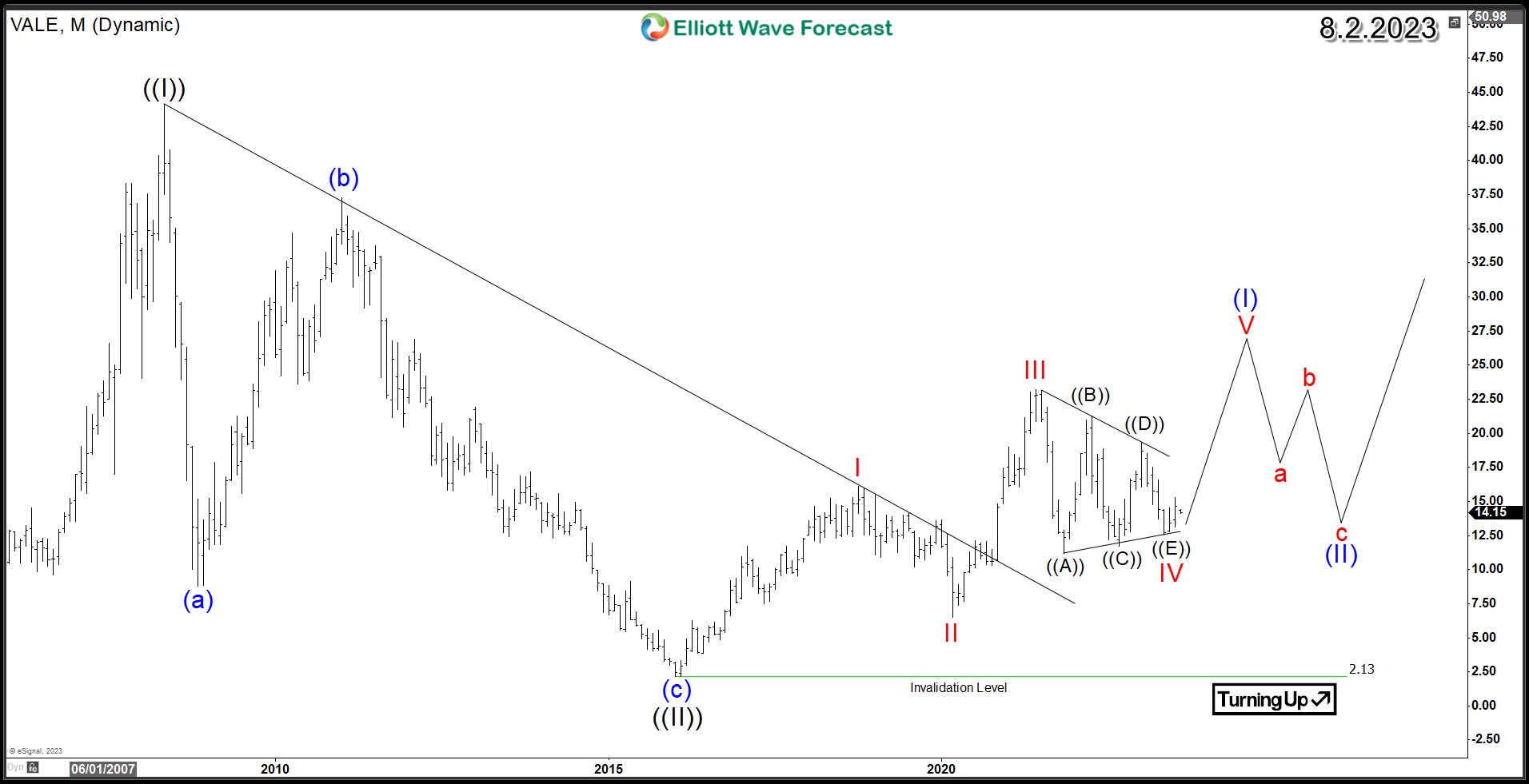

Vale SA (NYSE: VALE) Price Action Signals Further Upside

Read MoreAs a major player in the mining sector, Vale SA (NYSE: VALE) has been making significant strides with its robust performance and strategic position in the industry. This article will delve into Vale’s Monthly chart analysis, focusing on the bullish continuation pattern that has been unfolding. In a prior 2019 article, we examined the prospect […]