-

Shopify (SHOP) Daily Bullish Structure Leading the Way

Read MoreShopify (NYSE: SHOP) is a cloud-based commerce platform that provides software for building and operating e-commerce businesses. In Q3 FY2023, Shopify’s revenue was up 25% YoY and gross profit was up 36% YoY. The company also reported positive free cash flow for the fourth consecutive quarter, which reached 16% of revenue. After the news, SHOP surged […]

-

A Closer Look at PepsiCo’s (PEP) Daily Correction

Read MorePepsiCo (NASDAQ: PEP), has been facing a challenging environment in the recent 2 years. With the continued uncertainty and volatility in the market, the stock’s long-term growth potential is under scrutiny by investors. In this article, we’ll analyze the various Elliott Wave patterns for PepsiCo in order to guide investors in navigating the mid-term movement of the […]

-

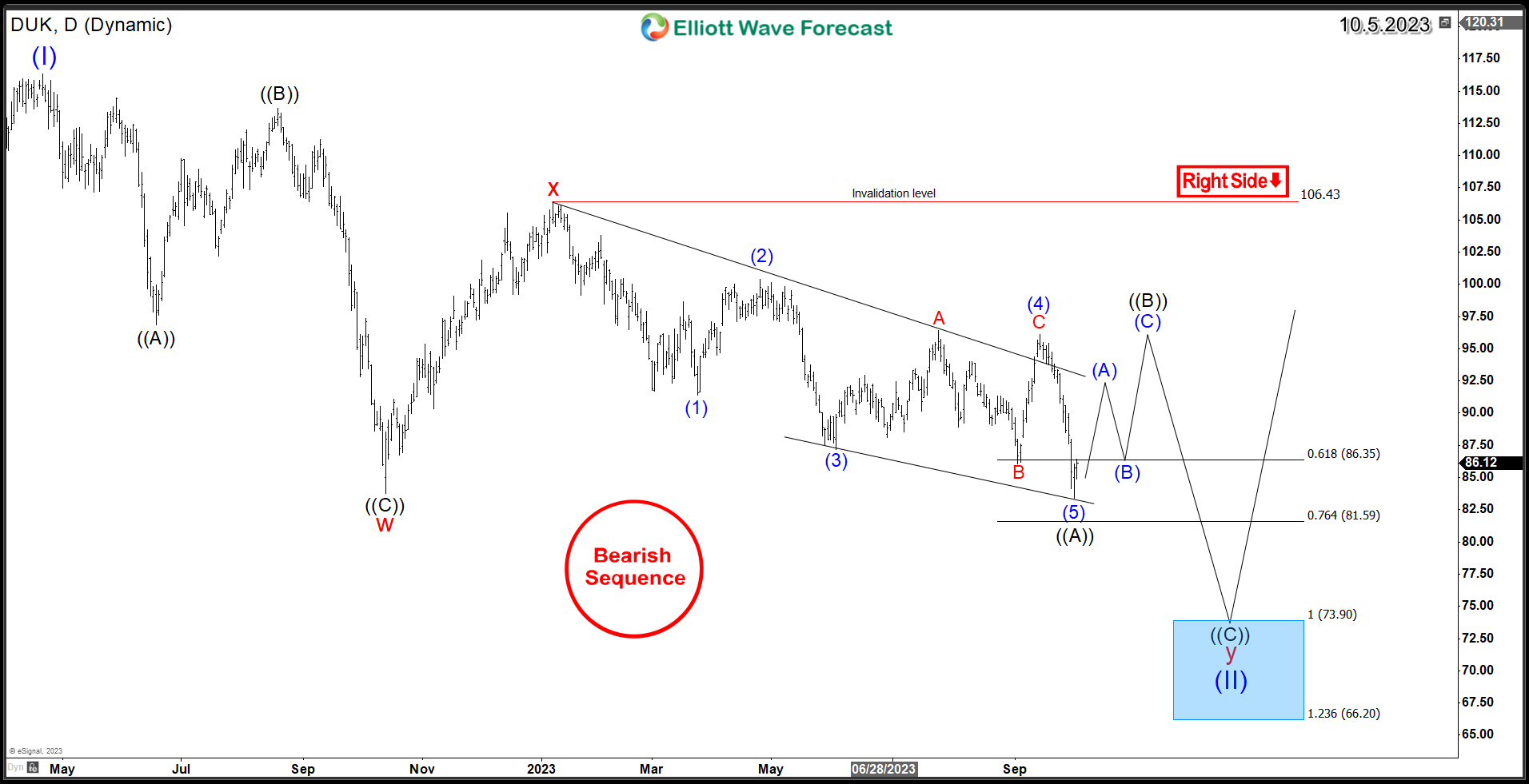

Duke Energy (NYSE: DUK) Navigating Rough Waters

Read MoreDuke Energy Corporation (NYSE: DUK), a prominent American electric power and natural gas holding company, has long been a stalwart in the utilities sector. However, recent market conditions have presented significant challenges for the company, and it finds itself navigating through turbulent times. As market volatility and industry headwinds persist, DUK faces short-term setbacks, but […]

-

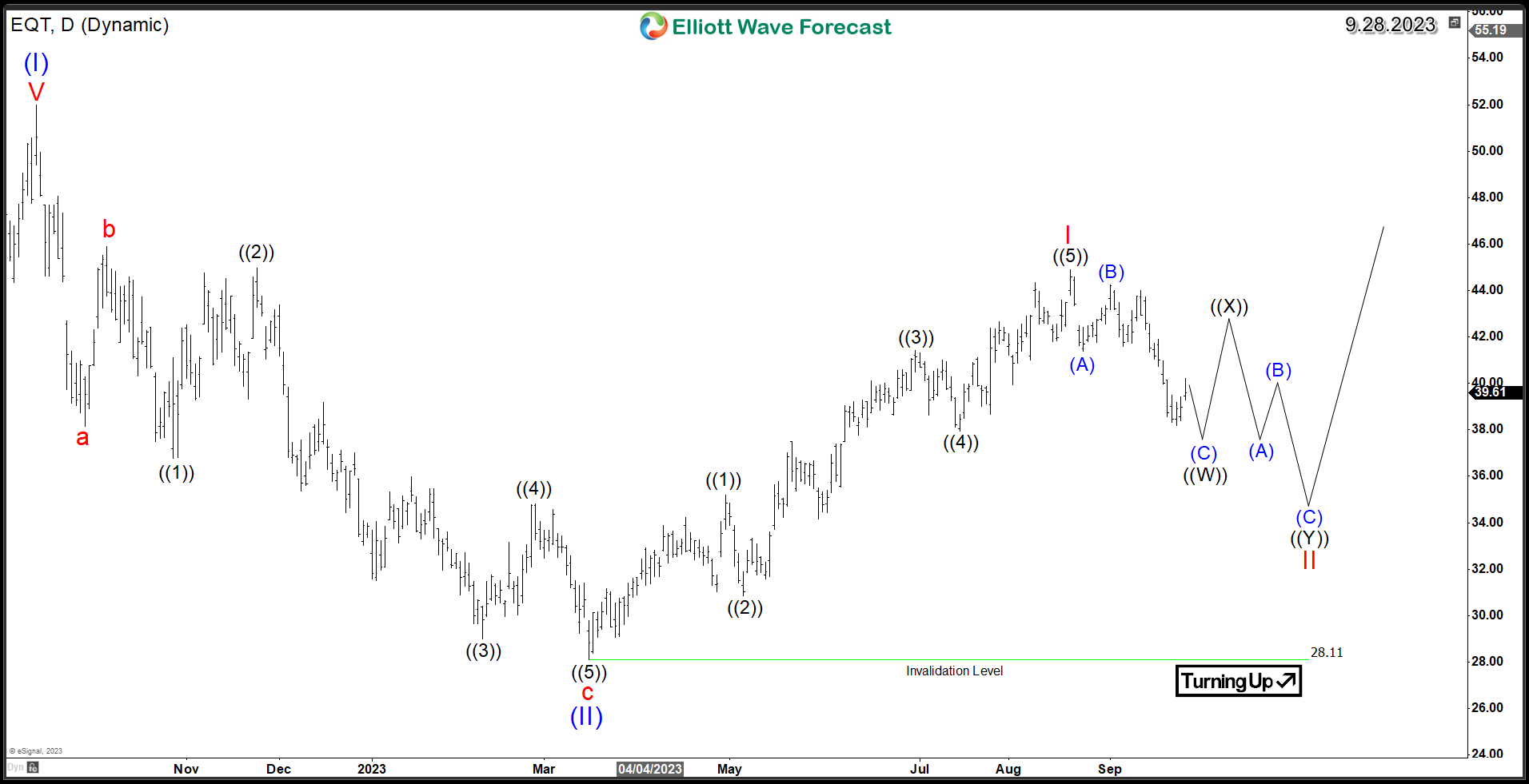

EQT Corporation : A Fresh Look at Energy Investment Opportunities

Read MoreAs the global energy landscape continues to evolve, EQT Corporation (NYSE: EQT) emerges as a key player in the realm of energy exploration and production. In our previous article, we explored the weekly path for the stock as it was presenting an investment opportunity for this year and we explained the potential path based on […]

-

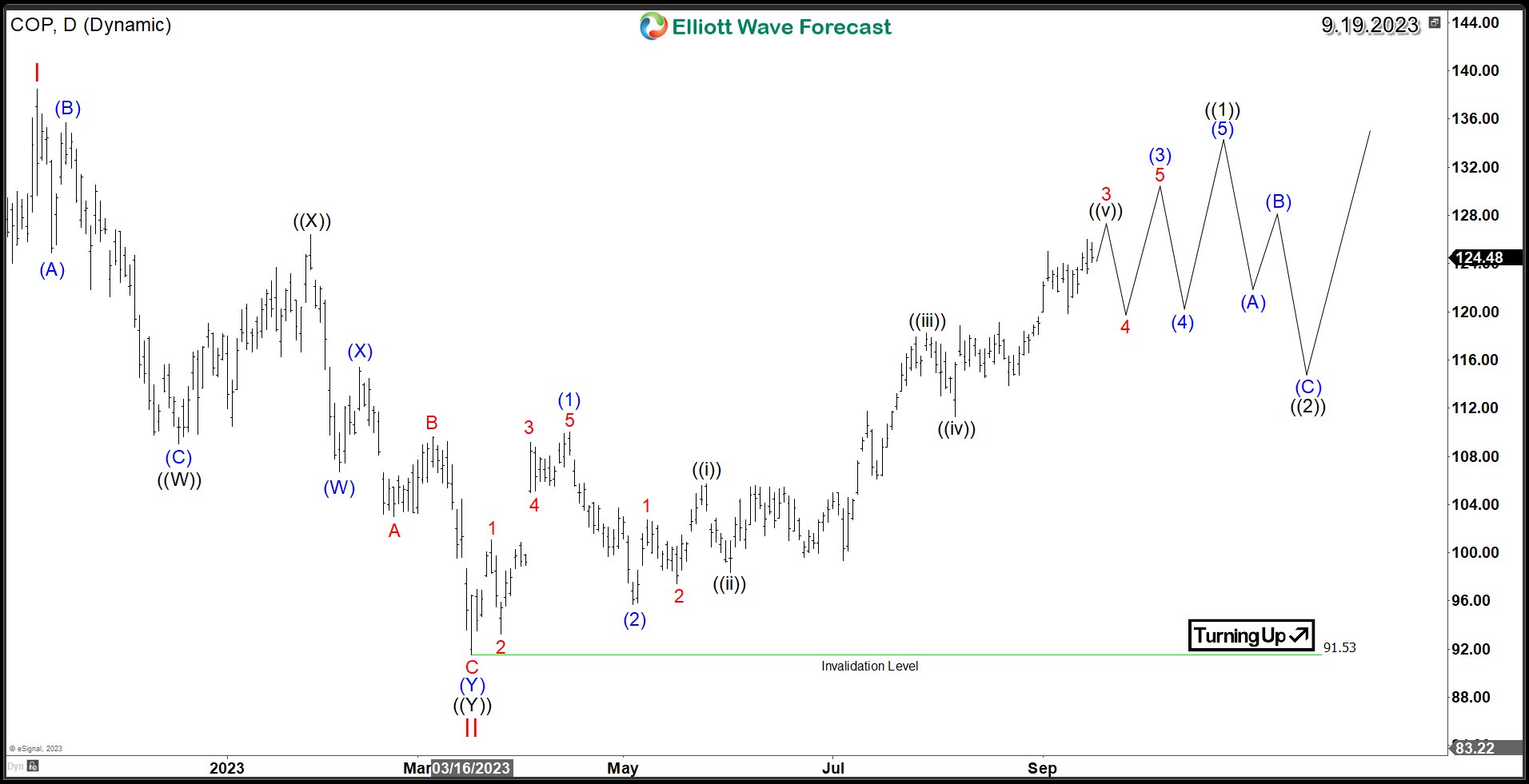

ConocoPhillips (COP) Paving the Path to Further Upside

Read MoreConocoPhillips (NYSE: COP), a prominent name in the realm of energy, has been demonstrating noteworthy strength in its recent market performance. This article delves into the company’s prevailing bullish trends and explores potential pathways for extending its upward trajectory based on the Elliott Wave Theory. The substantial 45% upswing in crude oil prices has significantly […]

-

Walmart (NYSE: WMT) Outperform Market Expectations

Read MoreIn the dynamic world of retail, few names stand as tall as Walmart Inc. (NYSE: WMT). With a legacy spanning decades, this retail giant has consistently delivered both value and convenience to millions of consumers around the world. In this video blog, we delve into the recent bullish performance of Walmart’s stock and explore various potential […]