-

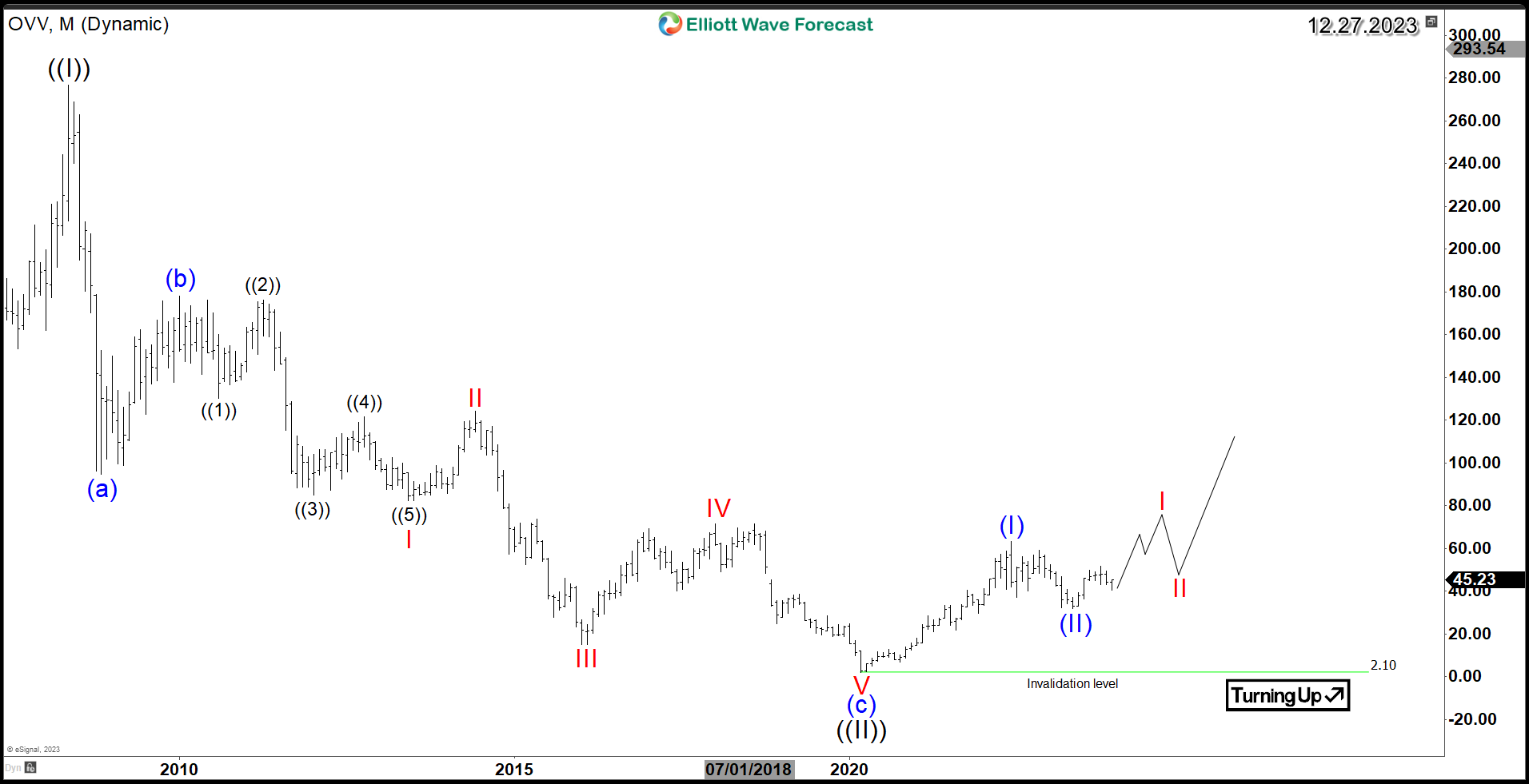

Ovintiv Inc (NYSE: OVV) Long Term Bullish Reversal

Read MoreOvintiv Inc. (NYSE: OVV) is a leading North American exploration and production company. It is an oil and gas producer that explores, develops, produces, and markets natural gas, oil, and natural gas liquids. In this article, we delve into OVV’s technical structure based on Elliott Wave Theory and highlight its potential for further growth. Since It’s […]

-

West Pharmaceutical Services WST Bullish Daily Cycle

Read MoreWest Pharmaceutical Services, Inc. (NYSE:WST) is a designer and manufacturer of injectable pharmaceutical packaging and delivery systems. The Elliott Wave structure based on the 2023 daily cycle will be explored in this article. Since the 55% decline from its 2021 peak, WST found a major low in October 2022 before reversing to the upside. Since then, […]

-

Coinbase Global (NASDAQ: COIN) Bullish Cycle In Progress

Read MoreCoinbase Global (NASDAQ: COIN) went public on April 14, 2021 with its Initial Public Offering (IPO) and the stock reached its peak on the same day. Subsequently, the cryptocurrency sector was hit hard by the bear market, causing COIN to lose 90% of its value over the following 21 months . Since the beginning of this year, Coinbase has shown an […]

-

Coca-Cola (KO) Impulsive Reaction Support The Rally

Read MoreIn the past two years, Coca-Cola (NYSE: KO) has grappled with a challenging business landscape. Amid ongoing market uncertainty and volatility, investors closely examine the stock’s long-term growth prospects. In this article, we delve into analysing the current Elliott Wave Pattern for Coca-Cola, providing insights to guide investors through the stock’s mid-term movements. Since April 2022, KO has experienced a corrective […]

-

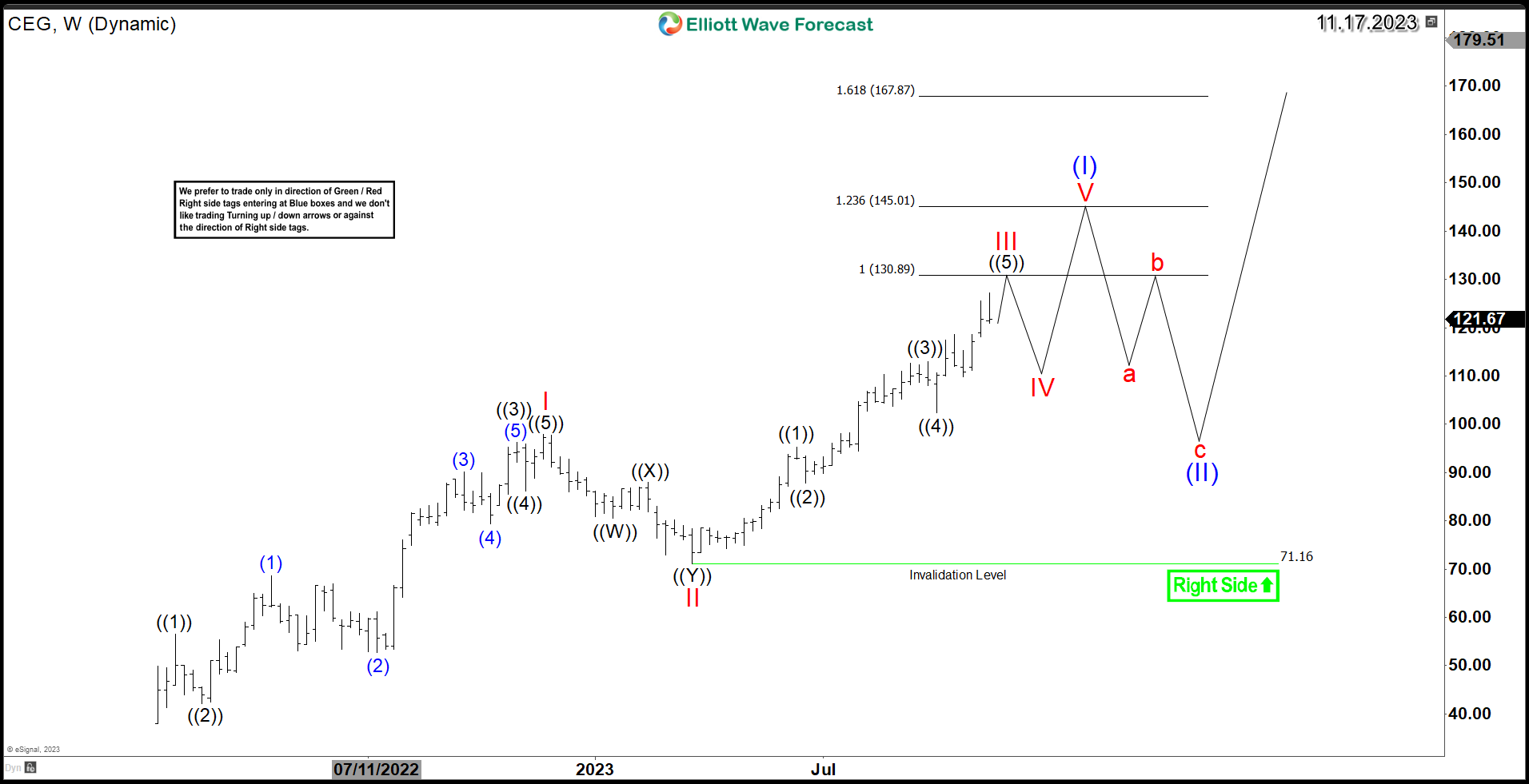

Constellation Energy (CEG) Riding the Renewable Energy Bullish Wave

Read MoreAmid the global momentum toward sustainable energy, Constellation Energy (CEG) stands out as a dynamic player in the renewable sector. In this article, we explore CEG’s recent performance, analyze its technical structure, and highlight its promising potential for further growth. Following its spinoff from Exelon Corporation (EXC) on February 1, 2022, Constellation Energy Corporation (CEG) […]

-

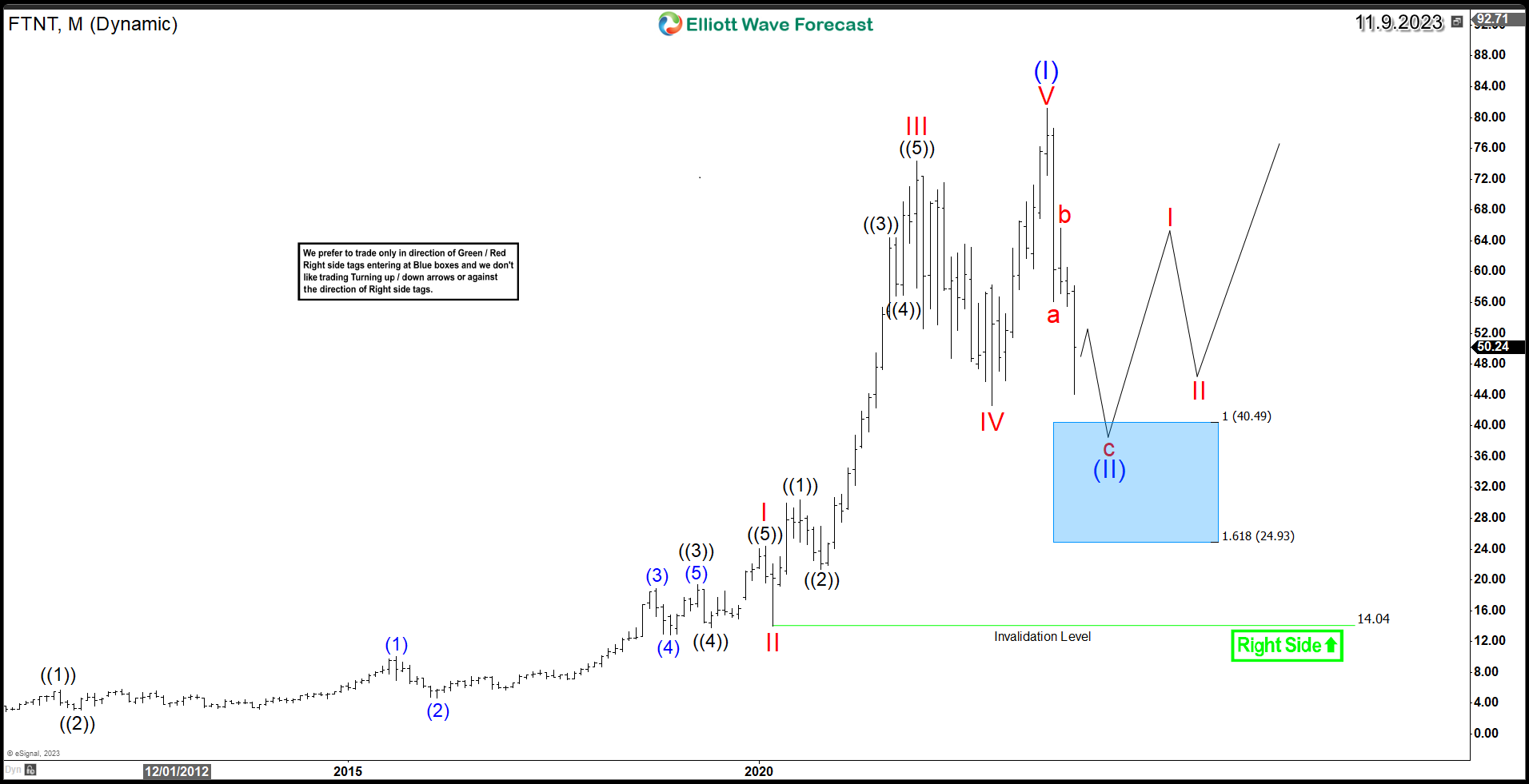

Fortinet (NASDAQ: FTNT) New Opportunity on The Horizon

Read MoreFortinet Inc (NASDAQ: FTNT) the global leader in cybersecurity is facing some turbulence as it will likely miss Wall Street’s estimate of $5.4 billion for the year. Despite the good start of year with a +68% rally making new all time highs, the stock erased all those gains in the second half of this year. […]