-

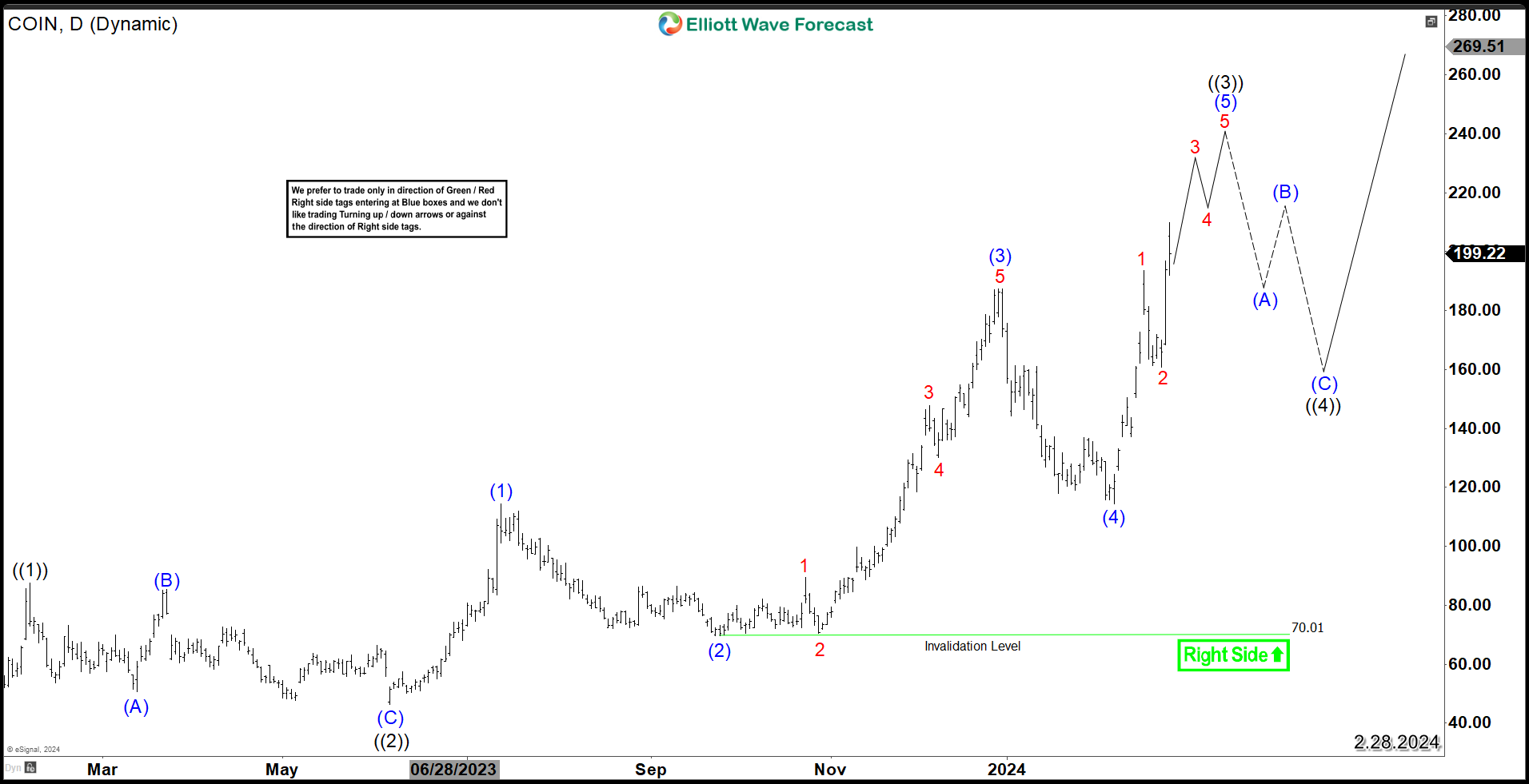

Coinbase (NASDAQ: COIN) Bullish Sequence Support More Upside

Read MoreCoinbase Global (NASDAQ: COIN) is one of the top performing stock in the recent 2 years, up +550% since January 2023 low. In our previous article, we explained the structure of the new weekly bullish cycle taking place from the lows. In this article, we dive into the daily cycle as market structure is providing more insights […]

-

BlackRock (NYSE: BLK) New Bullish Sequence To the Upside

Read MoreBlackRock (NYSE: BLK) is the world’s largest asset manager, with $9.42 trillion in assets as of June 30, 2023. Headquartered in New York City, Blackrock has 70 offices in 30 countries, and clients in 100 countries. In this article, we will be taking a look at the technical structure for the stock based on the Elliott Wave Theory and we’ll […]

-

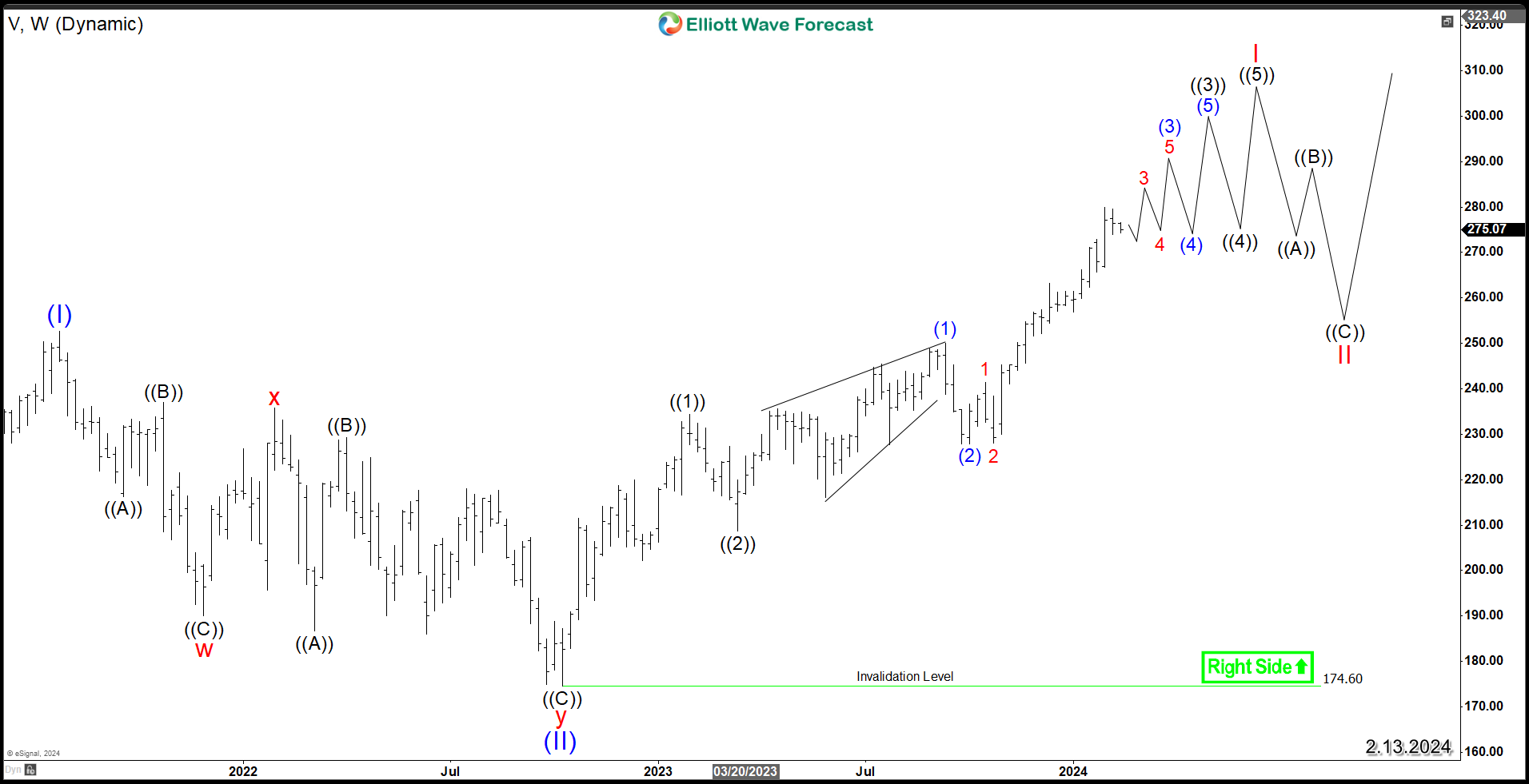

Visa Inc (NYSE: V) Nest structure Signals Further Upside

Read MoreVisa Inc (NYSE: V) is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. This article dives into the potential technical trajectories within its weekly cycle using Elliott Wave Theory. In November 2023, Visa stock surged […]

-

Crowdstrike Holdings (NASDAQ: CRWD) Surging Into New All Time Highs

Read MoreCrowdstrike Holdings (NASDAQ: CRWD) is a global cybersecurity leader based in Austin, Texas. It has an advanced cloud-native platform for protecting endpoints, cloud workloads, identities and data. In this article, we will be delve into the Elliott Wave structure based on the weekly cycle. Last month, CRWD surged into new all time highs after breaking above 2021 peak […]

-

Twist Bioscience Corp (NASDAQ: TWST) Daily Investment Opportunity

Read MoreTwist Bioscience (NASDAQ: TWST) is a public biotechnology company founded in 2013 and it’s based in South San Francisco. It manufactures synthetic DNA and DNA products for customers in a wide range of industries. In this article, we will be explored the Elliott Wave structure based on the daily cycle . From the low on 5/2/2023, TWST rallied an […]

-

ServiceNow (NYSE: NOW) Riding the Wave of Cloud Computing

Read MoreServiceNow (NYSE: NOW) is an American software company based in Santa Clara, California that develops a cloud computing platform to help companies manage digital workflows for enterprise operations. The stock doubled in price in recent year and with a strong performance investors are piling up to buy it as Cloud computing industry is booming and attracting […]