-

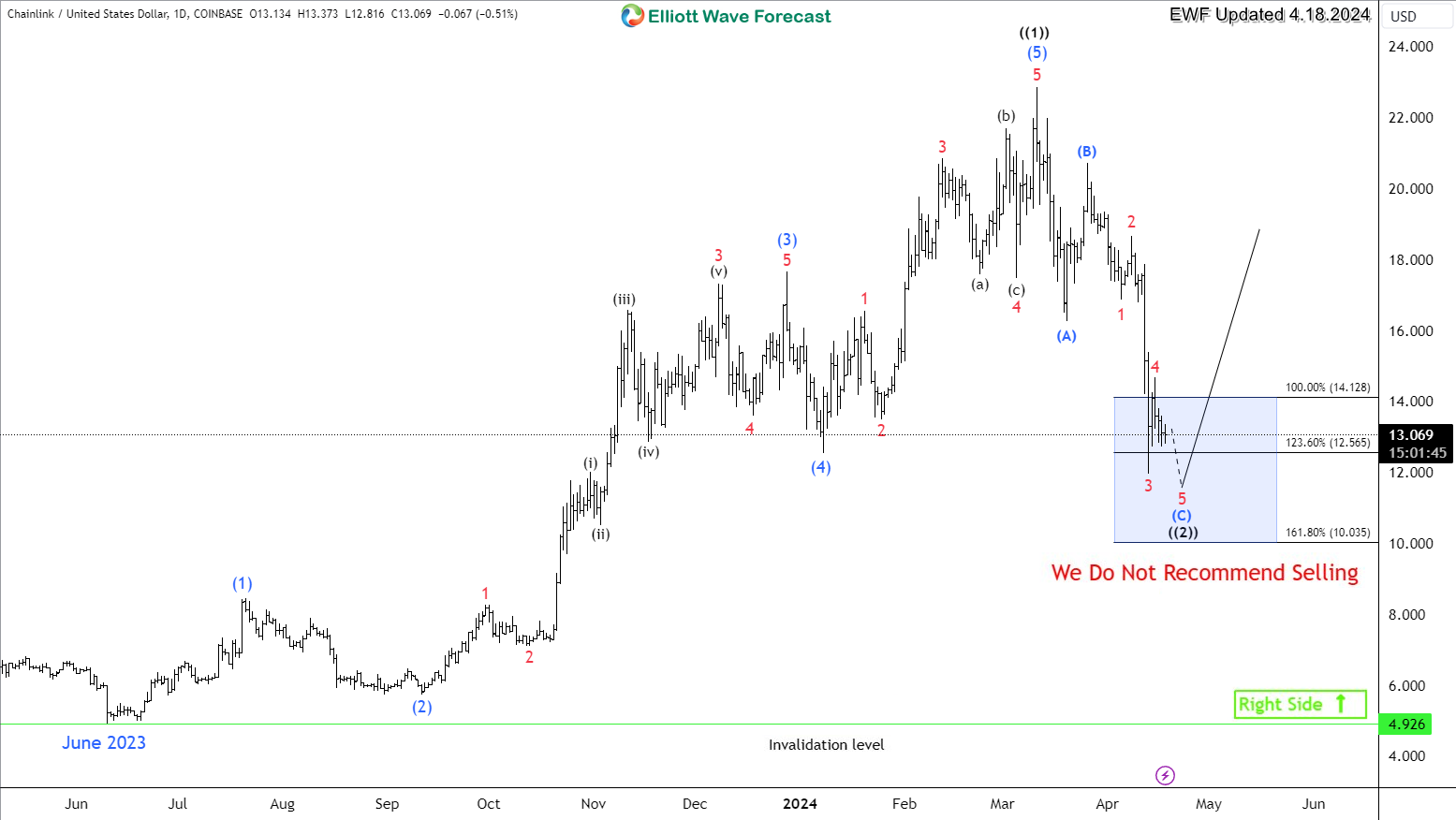

Chainlink $LINK Getting Ready For The Next Daily Move

Read MoreChainlink $LINK a cryptocurrency and technology platform that enables non-blockchain enterprises to securely connect with blockchain platforms. It’s acting as a bridge between the real world and the crypto universe to facilitate the connection between the two. In today’s article, we’ll dive into the daily cycle taking place and explore the potential path based on the Elliott […]

-

SuperVerse $SUPER New Investment Opportunity

Read MoreSuperVerse $SUPER is building and delivering Web3 products that empower crypto natives with next-generation NFT functionality, and onboard Web2 users through immersive blockchain gaming experiences. In today’s article, we’ll take a look at the recent daily bullish setup that took place and explore the potential path based on the Elliott Wave Theory. $SUPER rallied within an impulsive […]

-

Block, Inc. (NYSE: SQ) 50% Move On The Horizon

Read MoreBlock (NYSE: SQ) (formerly Square, Inc.), is a U.S. public company that provides financial services and mobile payments. In this article, we will be taking a look at the technical structure following the Elliott Wave Theory to define the path within current daily cycle. SQ started the initial rally from October 2023 low at $38.73 and it made 5 waves advance up to […]

-

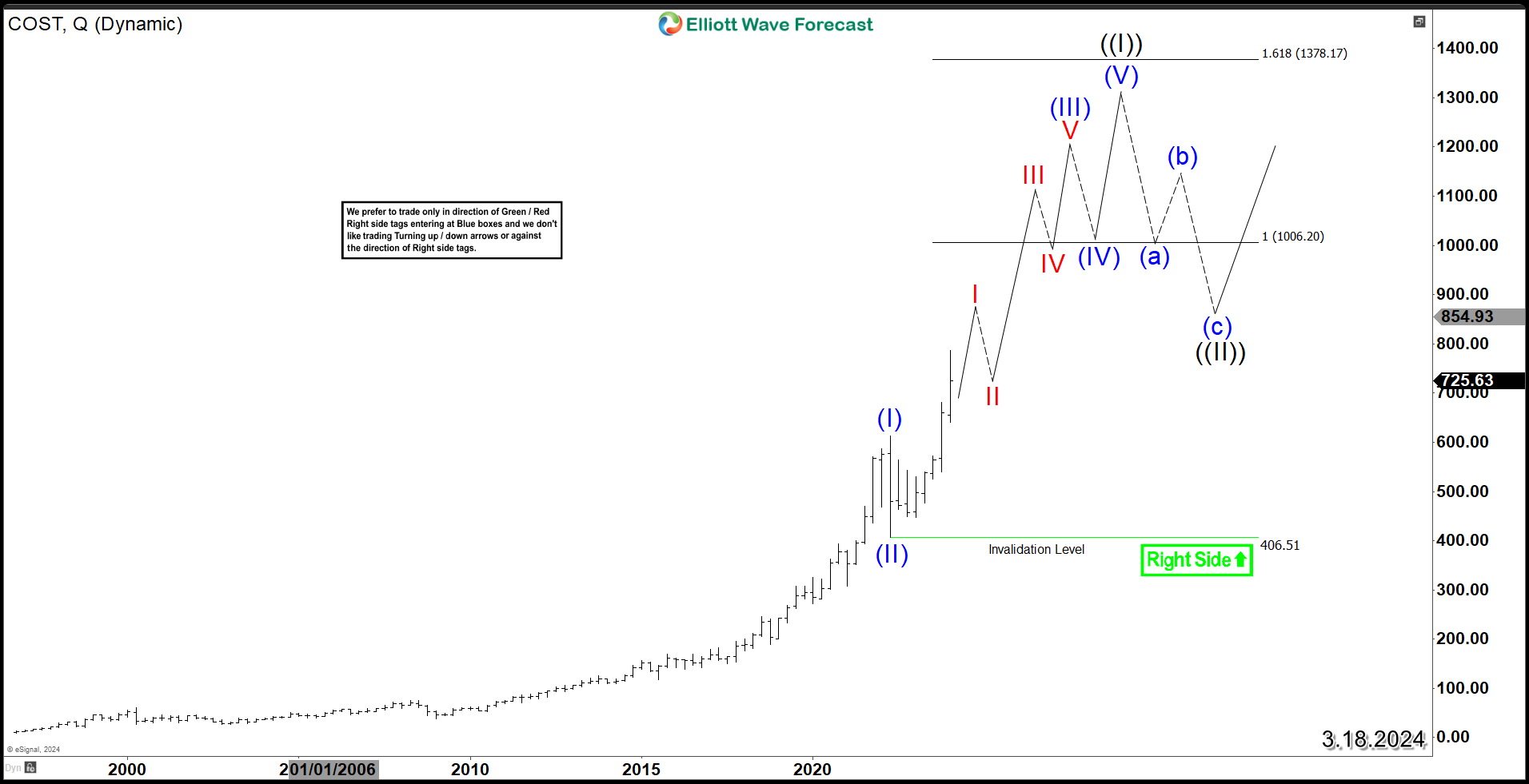

Costco Wholesale ( COST ) Super Cycle Upside Target

Read MoreCostco Wholesale Corporation (Nasdaq: COST) went public on December 5, 1985 at $10.00 per share (before stock splits). It’s considered as one of the good performing stocks with only 9 negative years out of 37. Last month, we discussed in our previous article the continuation to the upside within daily cycle as the stock is […]

-

MicroStrategy ( MSTR ) Breaks 2021 Peak with Bullish Momentum

Read MoreMicroStrategy Incorporated (NASDAQ: MSTR) is an American company that provides business intelligence, mobile software, and cloud-based services. Since 2020, MicroStrategy started investing in Bitcoin as a treasury reserve asset which impacted its stock price in the recent 4 years. In this article, we’ll take a look at the Elliott Wave Structure taking place and explore the potential path for the […]

-

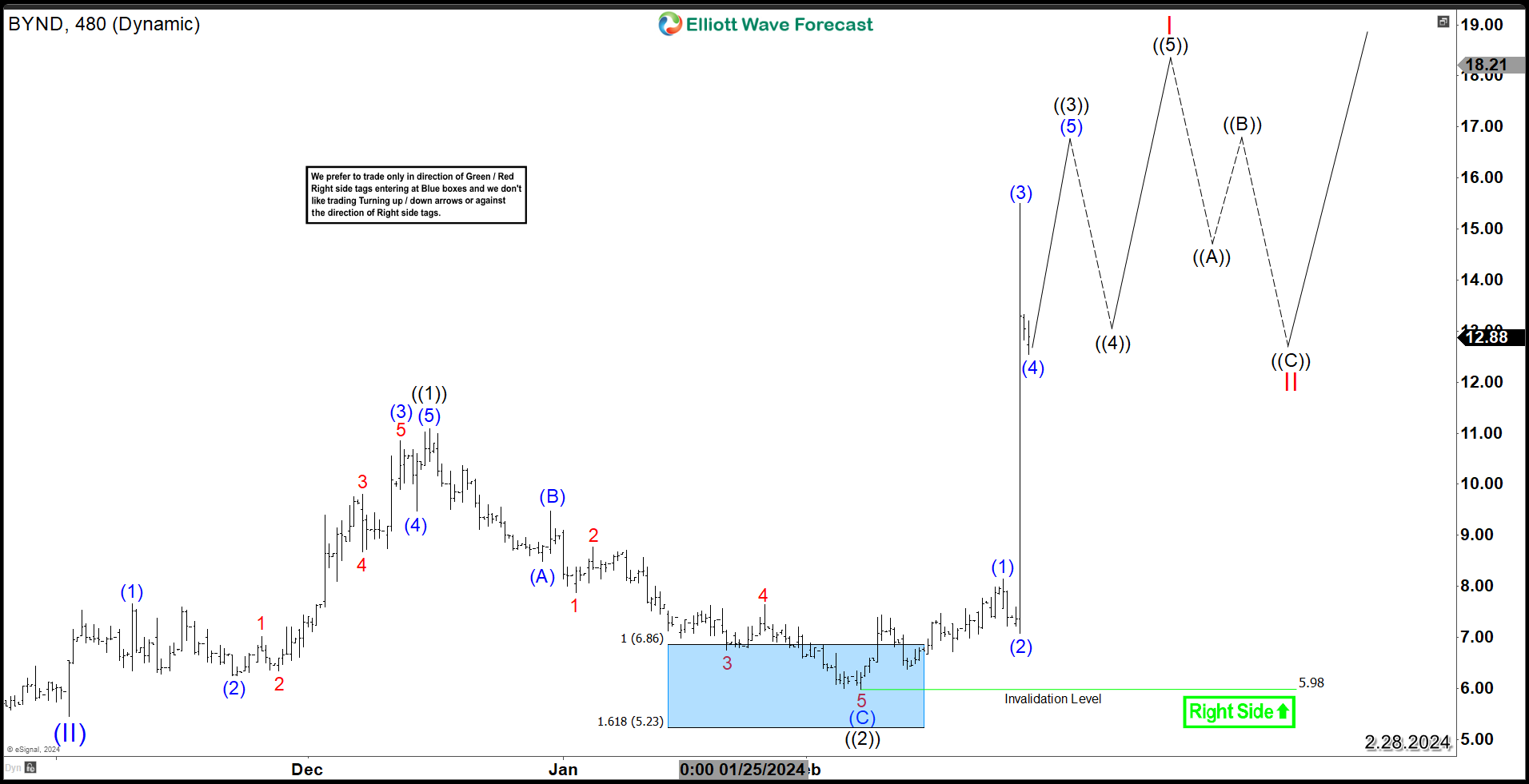

Beyond Meat (BYND) Impulsive Reversal Signals Further Upside

Read MoreBeyond Meat Inc (NASDAQ: BYND) is the first plant-based meat analogue company to go public. However, after an impressive 250% rally from the 2019 IPO, the stock suffered a 97% loss of it’s value within a span of 5 years in decline. The recent surge in price put the spotlight again on the stock so let’s dive into the […]