-

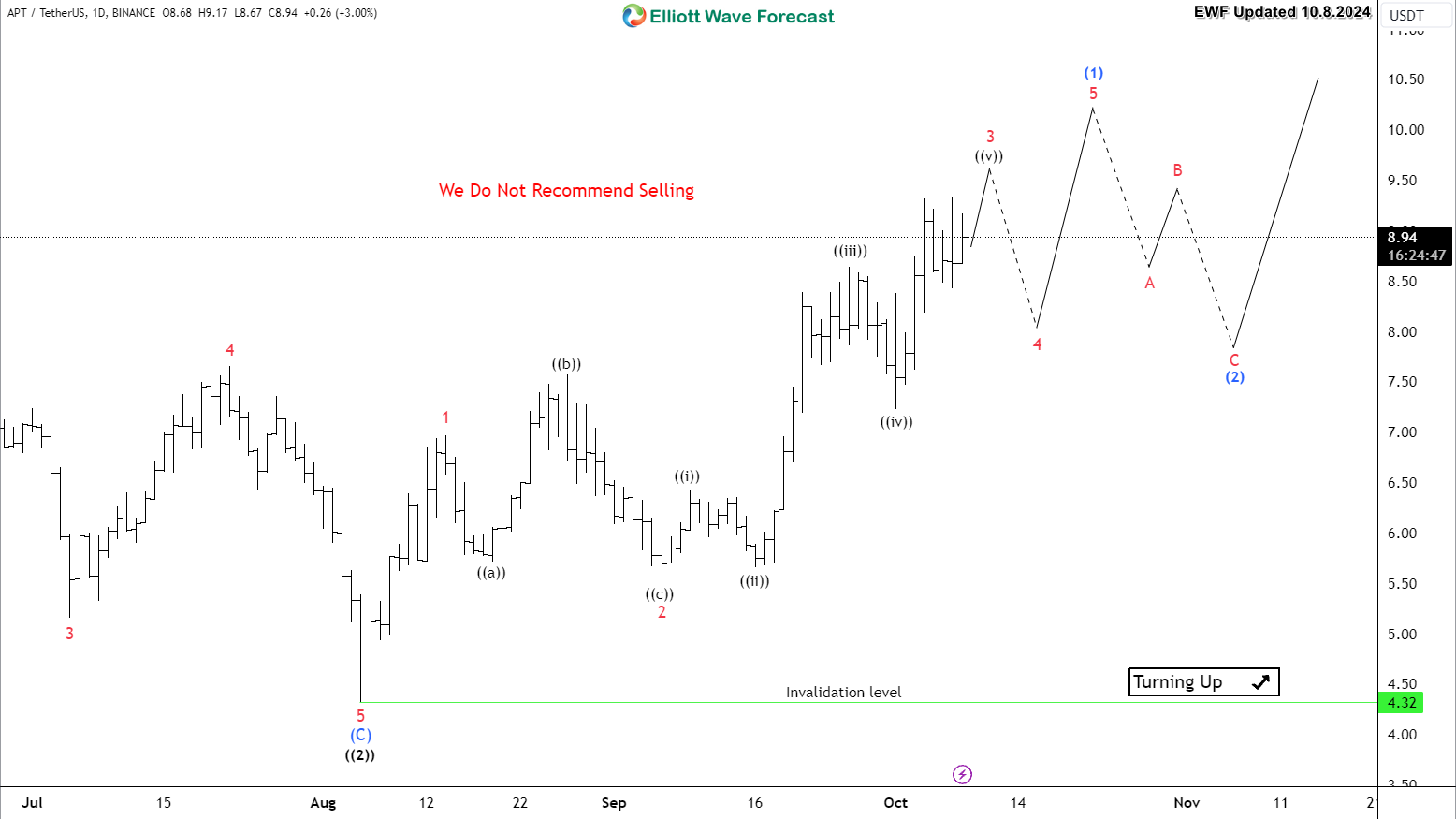

APTOS ( APT ) Bullish Structure Support More Upside

Read MoreAptos APT is an independent Layer 1 blockchain platform focused on safety and scalability driving growth within a decentralized network and developer ecosystem. In today’s blog, we’ll dive into the daily Elliott Wave structure taking place and show the potential outcome for the coin. On the 5th of August 2024, APT ended a corrective Zigzag structure at […]

-

MicroStrategy (NASDAQ: MSTR) Weekly Upside Target

Read MoreMicroStrategy (NASDAQ: MSTR) is one of the top performing stocks in recent two years. In our previous article, we explained the impulsive structure taking place since 2022 low. In this article, we’ll take a look at the potential targets to the upside based on the Elliott Wave Theory. MSTR started is major bullish cycle in 2002. Since then, the stock […]

-

Kaspa (KAS) Found Support at The Blue Box Area

Read MoreKaspa is a proof-of-work (PoW) blockchain that implements the GHOSTDAG protocol with rapid block processing and minimal confirmation durations. It’s ative cryptocurrency KAS is used for on-chain transactions and mining rewards. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the short term cycle and explain the potential path based on the theory. KAS […]

-

Coca-Cola Co (NYSE: KO) Weekly Bullish Sequence

Read MoreCoca-Cola Co (NYSE: KO) started a new bullish cycle on October 2023. As discussed in our previous article, the stock rallied from our blue box area after ending a corrective double three structure. The impulsive rally suggested the start of wave III to the upside and this year KO managed to break above 2022 into […]

-

Token PENDLE Looking for Reaction from Blue Box Area

Read MorePENDLE is a DeFi protocol focused on yield trading, allowing users to both fix or leverage their yield. In today’s blog, we’ll explain the daily Elliott Wave structure taking place and show the potential outcome for the token. Since April 2024, PENDLE started its correction to the downside and it lost 75% of its value. The move from the peak […]

-

MicroStrategy ( MSTR ) Potential Daily Buying Area

Read MoreMicroStrategy (NASDAQ: MSTR) is currently still one of the best performing stocks of 2024. In our previous article, we explained the bullish nature of the impulsive structure taking place and what we expect next. In this article, we’ll take a look at the current correction and highlight the potential buying area. MSTR ended the impulsive 5 waves advance at $200 […]