-

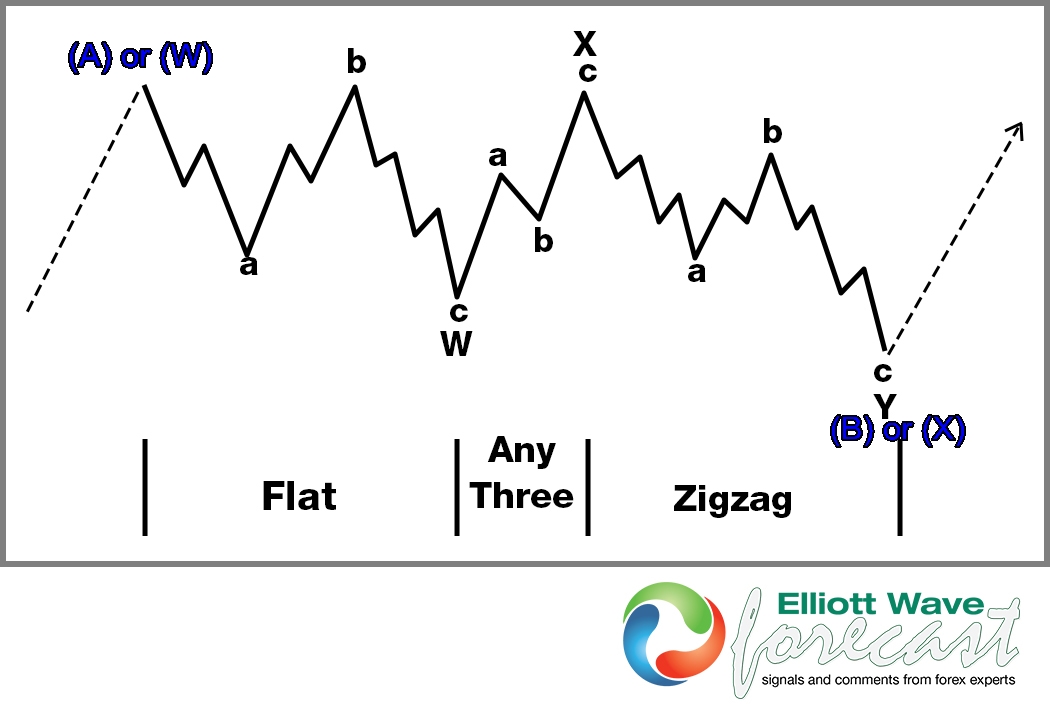

Elliott Wave Theory Structure : A Double Three Combination

Read MoreDouble three structures are common occurrences in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending within the larger degrees and time frames. As pointed out here before, it is simply impossible in some markets to get a legitimate […]

-

Trend Trading with Elliott Wave

Read MoreThe first thing needed to be accepted in a traders mind is by itself, Elliott Wave as a trading or trend trading method is not enough. There are always several “valid” Elliott Wave counts. As known, some markets shown here at our site for quite a while have been proven to “trend” in 3, 7 […]

-

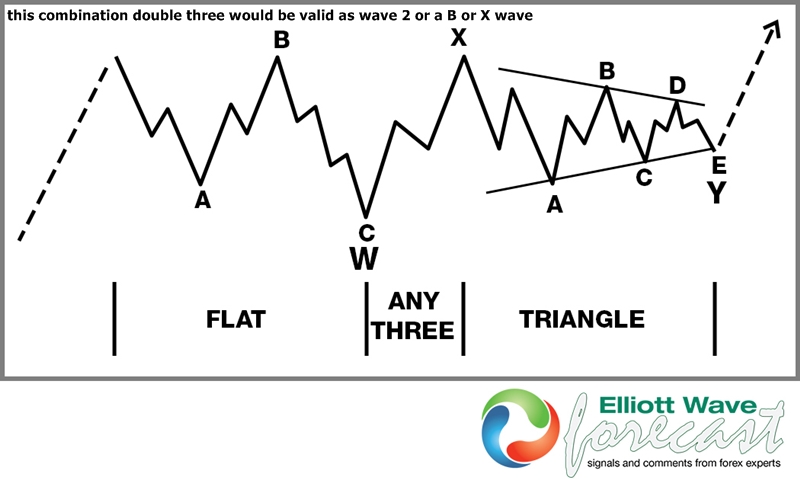

Elliott Wave Theory Structure : Double Three with a Triangle Y

Read MoreDouble three structures in general are common occurrences in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending in the larger degrees and time frames as it is simply impossible in some markets to get a legitimate impulsive […]

-

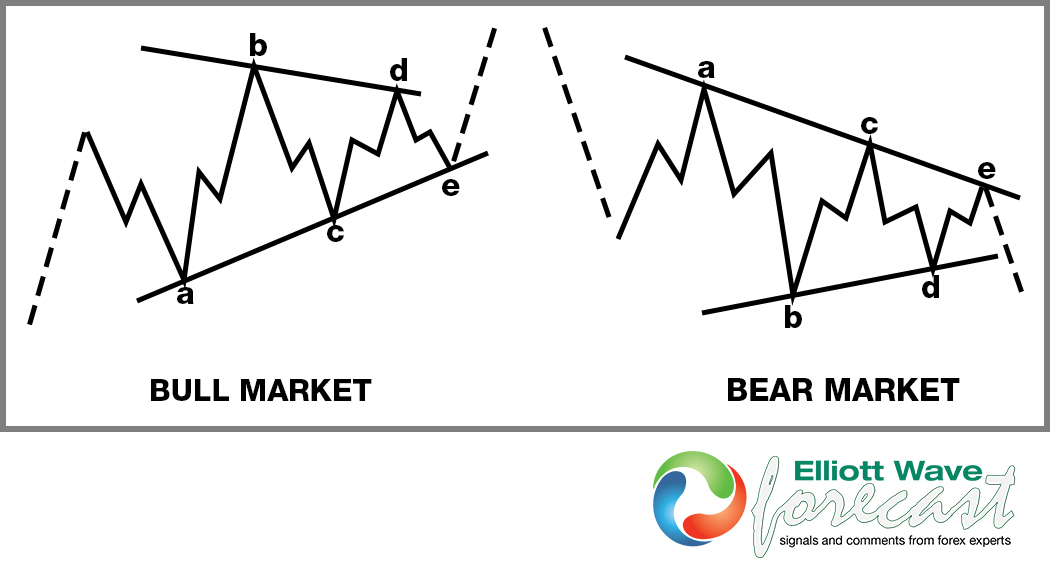

Elliott Wave Theory Structure : A Running Triangle

Read MoreElliott Wave Theory Structure : A Running Triangle Triangles are overlapping five wave structures. They subdivide into five, three swing moves as 3-3-3-3-3 that give pause to a trend. This consolidates the progress made during a trending move that can be either bullish or bearish. These will only show up in the fourth waves of […]

-

$TLT iShares Barclays 20+ Year Treasury Bond from June, 2015

Read MoreSince the 26th of June, 2015 the TLT has rallied & continues to appear it will go higher once again while yields go lower. That said and knowing the correlation with yields as well as the maturity of that cycle lower from the 1980’s highs this market is in dangerous territory. It is not clear yet […]

-

$IWM Russell 2000 tracking ETF 9.30.2015

Read MoreIn our previous post on the $IWM Russell 2000 tracking ETF instrument from September 14th that can be seen here , we were looking for a swing higher into the 50%-.618 Fibonacci retracement zone at 118.69-121.15 in wave ((Y)) of x & did see a new high on the 17th. Since the wave x completion at 118.89 on […]