-

UUP Bullish Cycles from May 2011 lows

Read MoreUUP Bullish Cycles from May 2011 lows Firstly the dollar tracking ETF fund UUP inception date was 2/20/2007. Interestingly the dollar index has a low in March 2008. The UUP ETF fund shows a low in May 2011. The dollar index did make a pullback cycle low in May 2011 however it was well above […]

-

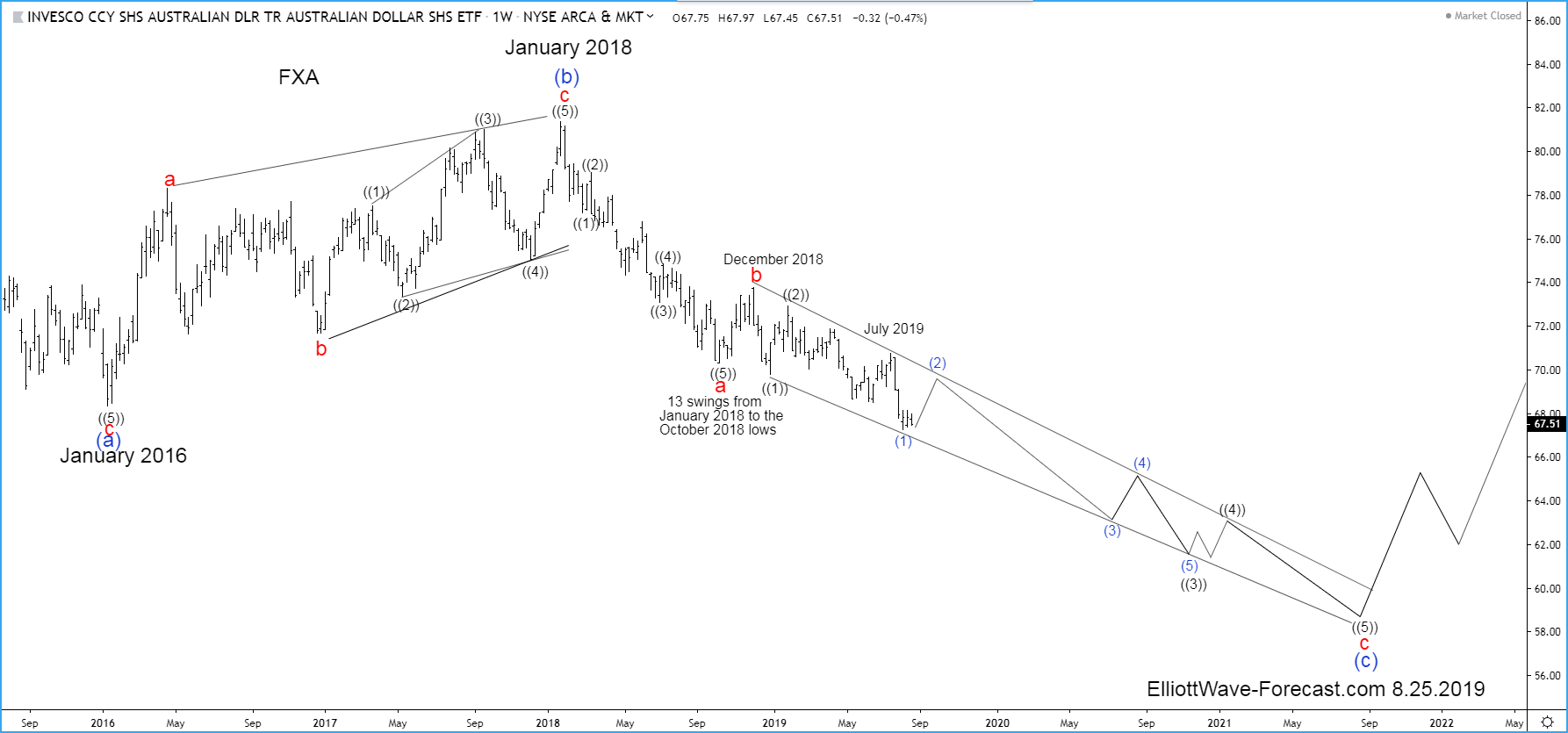

FXA Bearish Cycle From The July 2011 Highs

Read MoreFXA Bearish Cycle From The July 2011 Highs Firstly the FXA ETF fund is the Australian dollar tracking fund that has an Inception Date of 06/21/2006. With that said the fund mainly reflects the currency spot price of the AUDUSD forex pair. The data available from the Reserve Bank of Australia at their website suggests the spot price […]

-

GLD Longer Term Cycles and Elliott Wave Analysis

Read MoreGLD Longer Term Cycles and Elliott Wave Analysis Firstly the GLD ETF fund is one of the largest as well as one of the oldest Gold tracking funds out there since it’s inception date of November 18, 2004. From there on up into the September 2011 highs it ended a larger bullish cycle as did […]

-

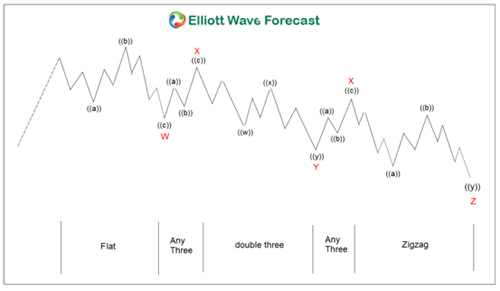

Mastering Triple Three Corrections in Elliott Wave Theory

Read MoreFirstly, triple three corrections are a sideways combination of three corrective patterns in Elliott Wave Theory. These corrections are one of the five types of corrective patterns that correct the completed cycle of the prevailing trend. Zigzags (5-3-5), Flats (3-3-5), Triangles (3-3-3-3-3), Double threes which are a combination of two corrective patterns previously mentioned. Then lastly […]

-

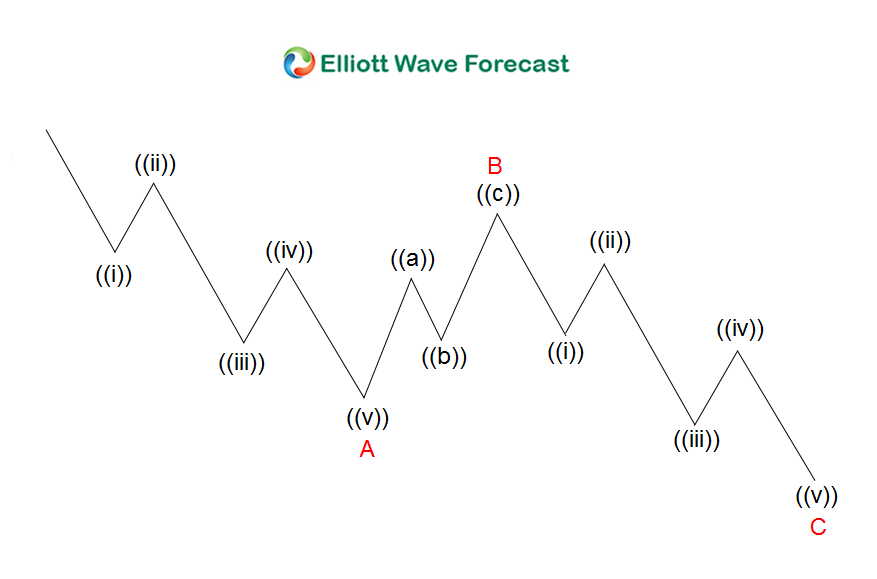

Importance of an Elliott Wave ZigZag Fibonacci Extension

Read MoreImportance of an Elliott Wave ZigZag Fibonacci Extension Firstly the point of measuring a Fibonacci extension is to get the area pinpointed that an Elliott Wave correction will move against the trend so an entry position into the market can be taken. The conventional thought is that the market will trend in impulses of 5, […]

-

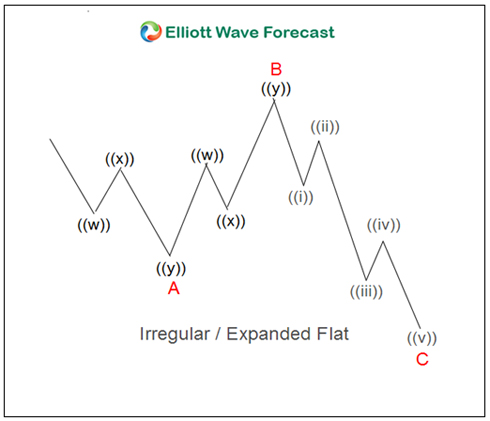

How to Measure Fibonacci Extensions in Elliott Wave Flat Corrections

Read MoreHow to Measure Fibonacci Extensions in Elliott Wave Flat Corrections In the first place the point of measuring a Fibonacci extension is to get the area pinpointed that an Elliott Wave correction will move against the trend. The conventional thought is that the market will trend in impulses of 5, 9, & 13 swings. The […]