-

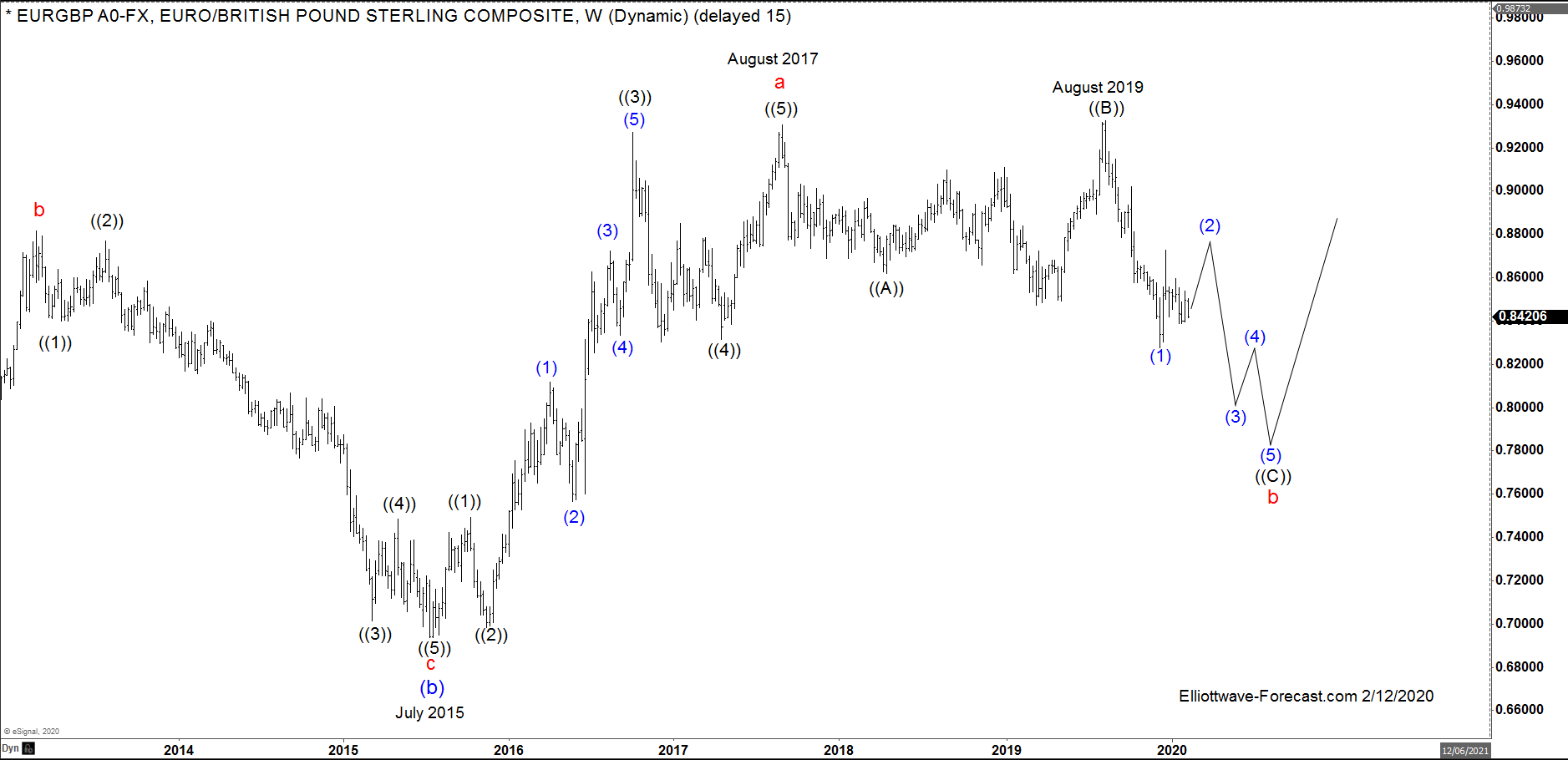

$EURGBP FX Pair Longer Term Cycles and Elliott Wave

Read More$EURGBP FX Pair Longer Term Cycles and Elliott Wave Firstly as seen on the monthly chart below there is data back to January 1975 in the pair. The EUR part being derived from the German Deutsche Mark up until the point EURUSD currency existed. Secondly as seen on the monthly chart below I will describe how I […]

-

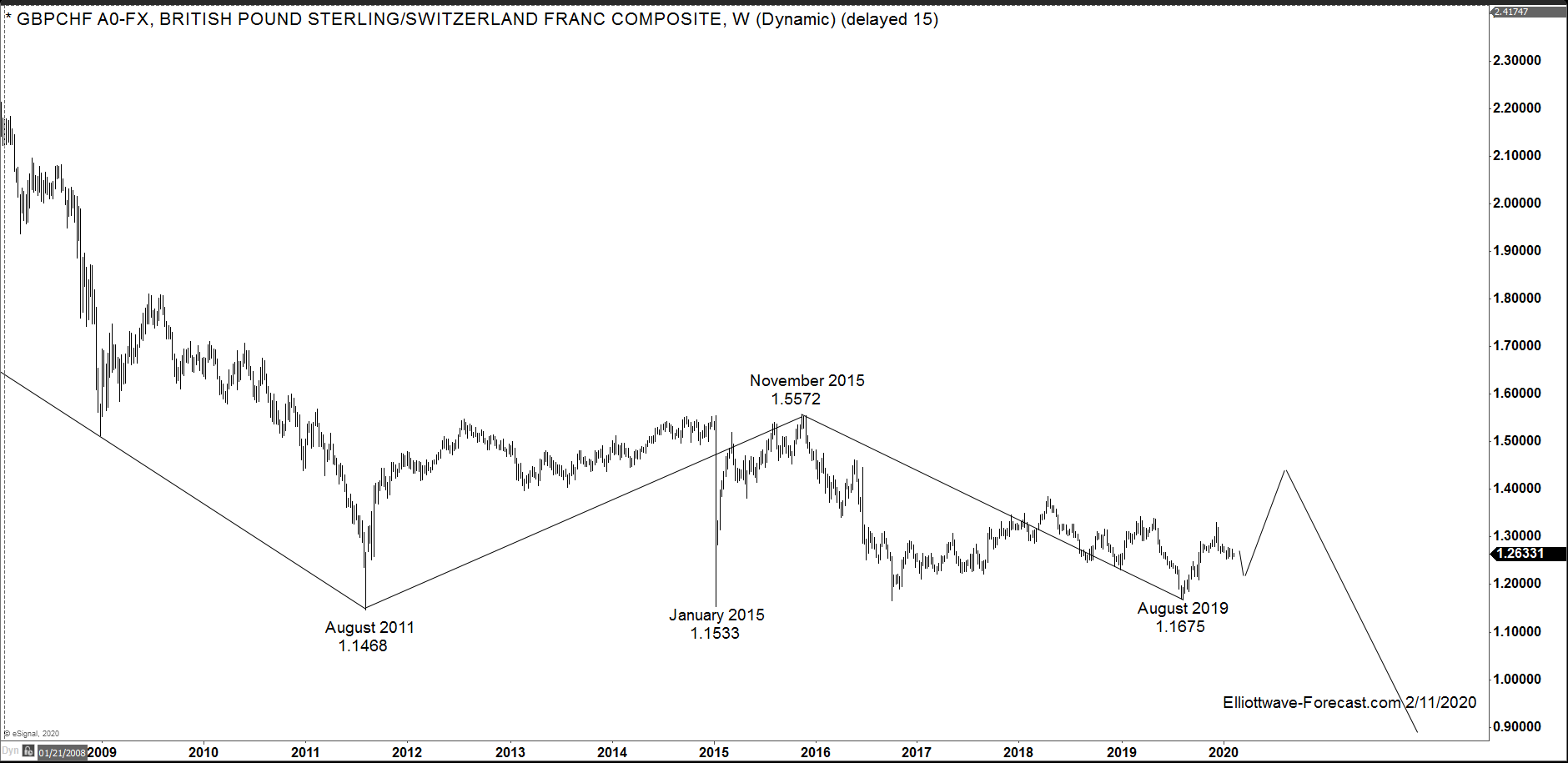

$GBPCHF FX Pair Long Term Cycles & Swings

Read More$GBPCHF FX Pair Long Term Cycles & Swings Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]

-

$SMH Elliott Wave and Longer Term Cycles

Read More$SMH Elliott Wave and Longer Term Cycles Firstly as seen on the monthly chart shown below. There is data back to May 2000 in the ETF fund. Data suggests the fund made a low in November 2008. This low has not been taken out in price. The cycles in this instrument tends to reflect the Nasdaq […]

-

FXE Longer Term Cycles and Elliott Wave

Read MoreFXE Longer Term Cycles and Elliott Wave Firstly as seen on the weekly chart shown below the instrument made a high in April 2008. There is data back to December 2005 in the ETF fund. Data correlated in the EURUSD foreign exchange pair suggests the high in April 2008 was the end of a cycle up […]

-

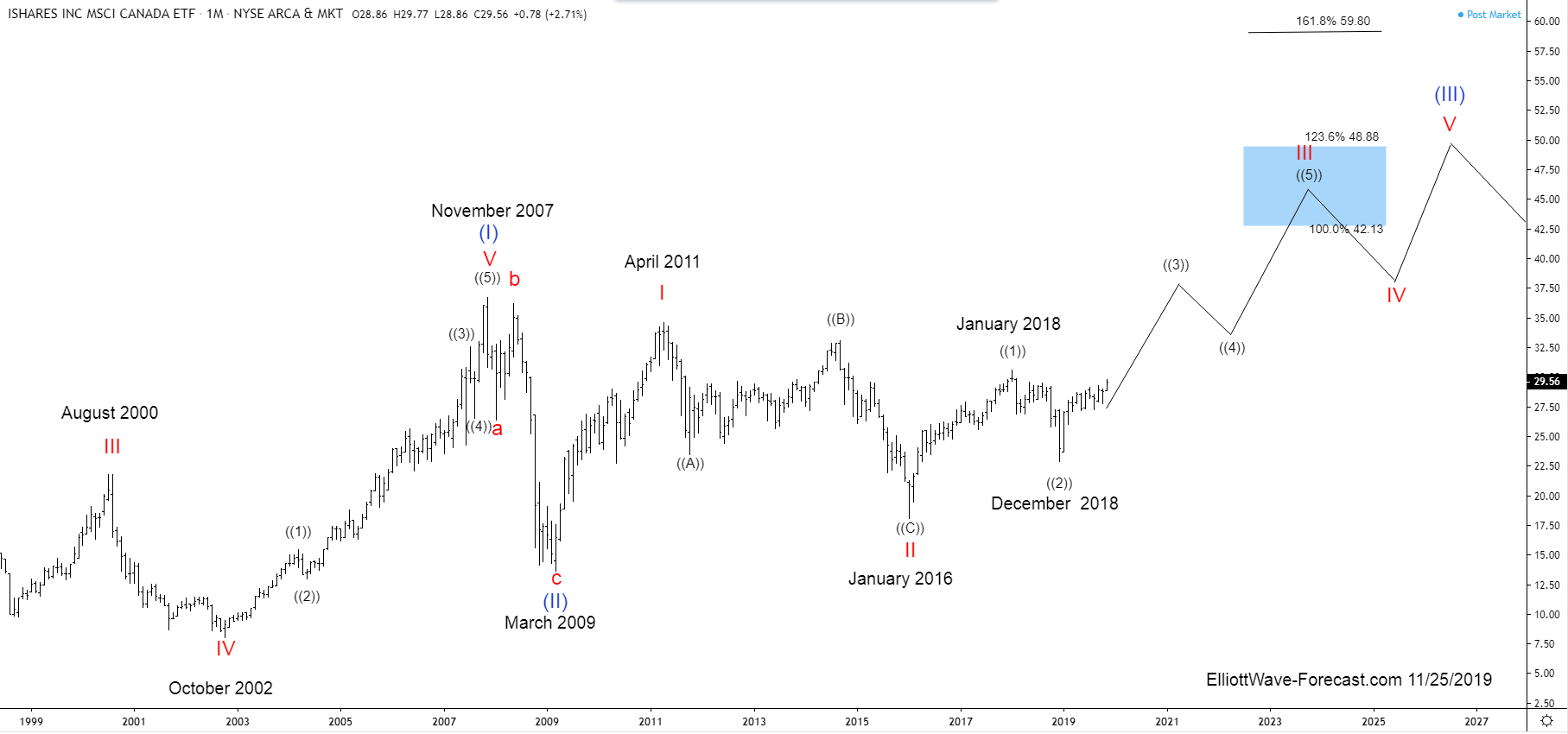

$EWC iShares MSCI Canada ETF Long Term Cycles & Elliott Wave

Read More$EWC iShares MSCI Canada ETF Long Term Cycles & Elliott Wave Firstly the EWC instrument inception date was 3/12/1996. The iShares MSCI Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the long […]

-

The Nasdaq Tracker QQQ Long Term Cycles & Elliott Wave

Read MoreThe Nasdaq Tracker QQQ Long Term Cycles & Elliott Wave Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq which did that. As shown below from the […]