-

$SPX: The Expanded Flat, Which Tricked Buyers Last Month

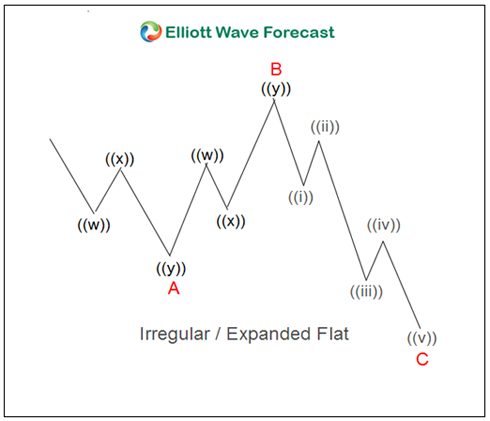

Read MoreThe Expanded Flat is one of trickiest structures in the Elliott Wave Theory. The structure comes with a strong reaction after new highs are made. But the idea is that the reaction comes in five waves, which confuse wavers. As a result, wavers often get trapped by the structure. When Mr. Elliott developed the theory […]

-

Delta (DAL): A Nest Into Higher Levels Might Be Happening

Read MoreBack in 2020, during the big pullback in Delta (DAL), we were able to tell members and followers to buy the pullback. We suspect that a nest is taking place A nest is a series of 1 and 2 with extension within the extended portion of an impulse structure. Below is a graph showing how […]

-

BITO (Proshares Bitcoin Strategy ETF ) Gives Opportunity To Invest Into Bitcoin

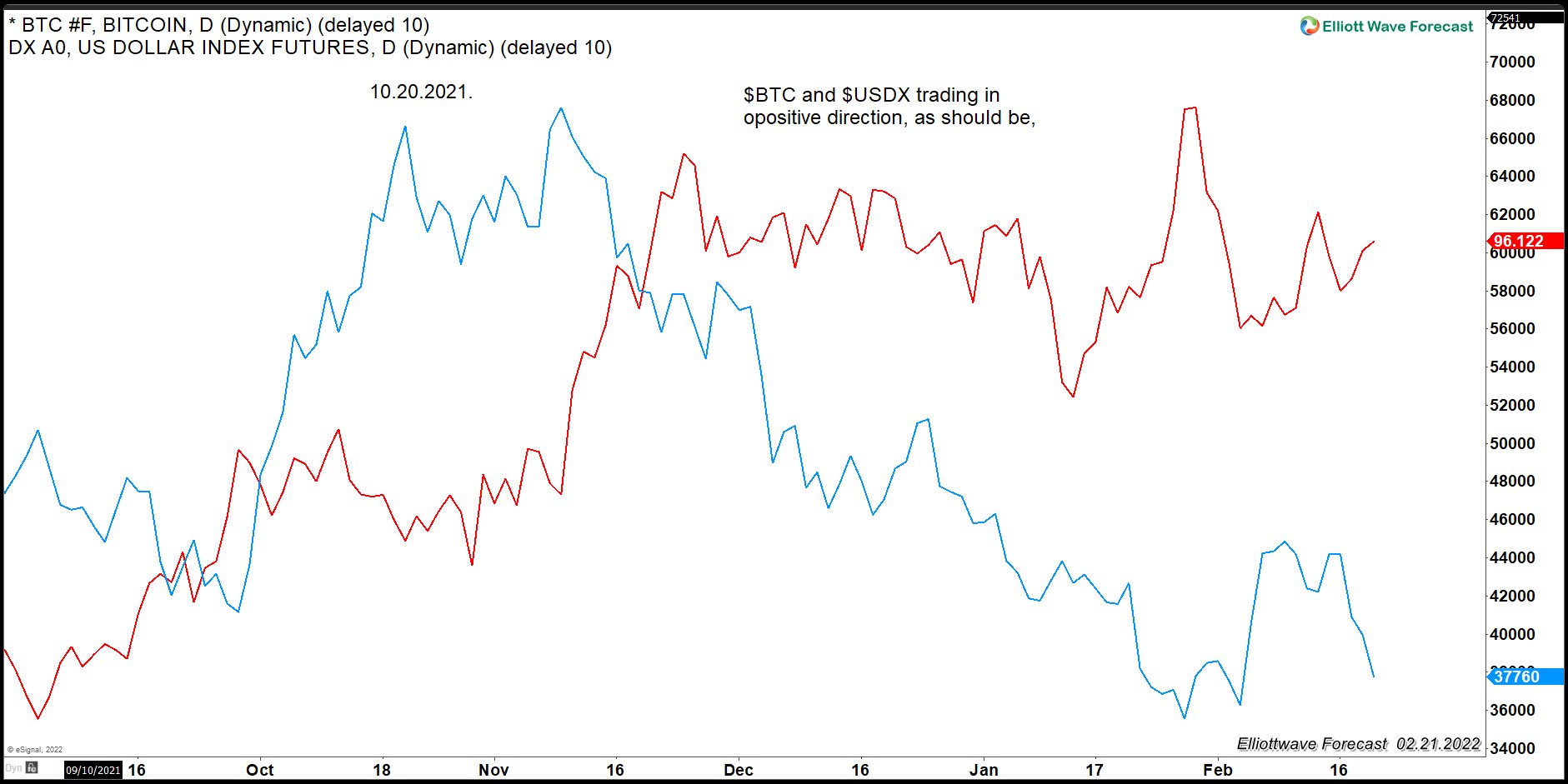

Read MoreCryptocurrencies have become very popular worldwide. Many young investors want to chase every move the instrument does daily. The reality is that many traders tend to trade without looking at the higher time frames. Traders also don’t relate instruments that trade within the same group. $BTC (Bitcoin) might have ended the all-time cycle when it […]

-

USDMXN (Mexican Peso): Might Be Showing The Path For US Dollar

Read MoreUSDMXN looks to have ended the cycle from all-time lows in an impulse sequence & started the pullback. This Article & Video look at Elliott wave path.

-

FTSE: Giving Warning About A Possible Acceleration Among Indices

Read MoreFTSE is providing a warning about a possible acceleration among indices with a possible nest. This article and video look at the Elliott Wave path.

-

GCC: Reacting From Blue Box Supporting Higher Commodities Prices

Read MoreGCC is WisdomTree Enhanced Commodity Strategy Fund, it an actively managed exchange-traded fund and intends to provide broad-based exposure to the following four commodity sectors: Energy, Agriculture, Industrial Metals, and Precious Metals primarily through investments in futures contracts. The Fund may also invest up to 5% of its net assets in bitcoin futures contracts. The […]