-

The Elliott Wave Theory and High Frequency Trading

Read MoreFinancial markets have evolved dramatically over time, moving from human-dominated trading floors to highly automated, algorithm-driven systems. Two concepts that represent these different eras are the Elliott Wave Theory and high-frequency trading (HFT), Elliott Wave Theory focuses on market psychology and recurring price patterns. HFT on the other hand relies on advanced algorithms and ultra-fast execution. […]

-

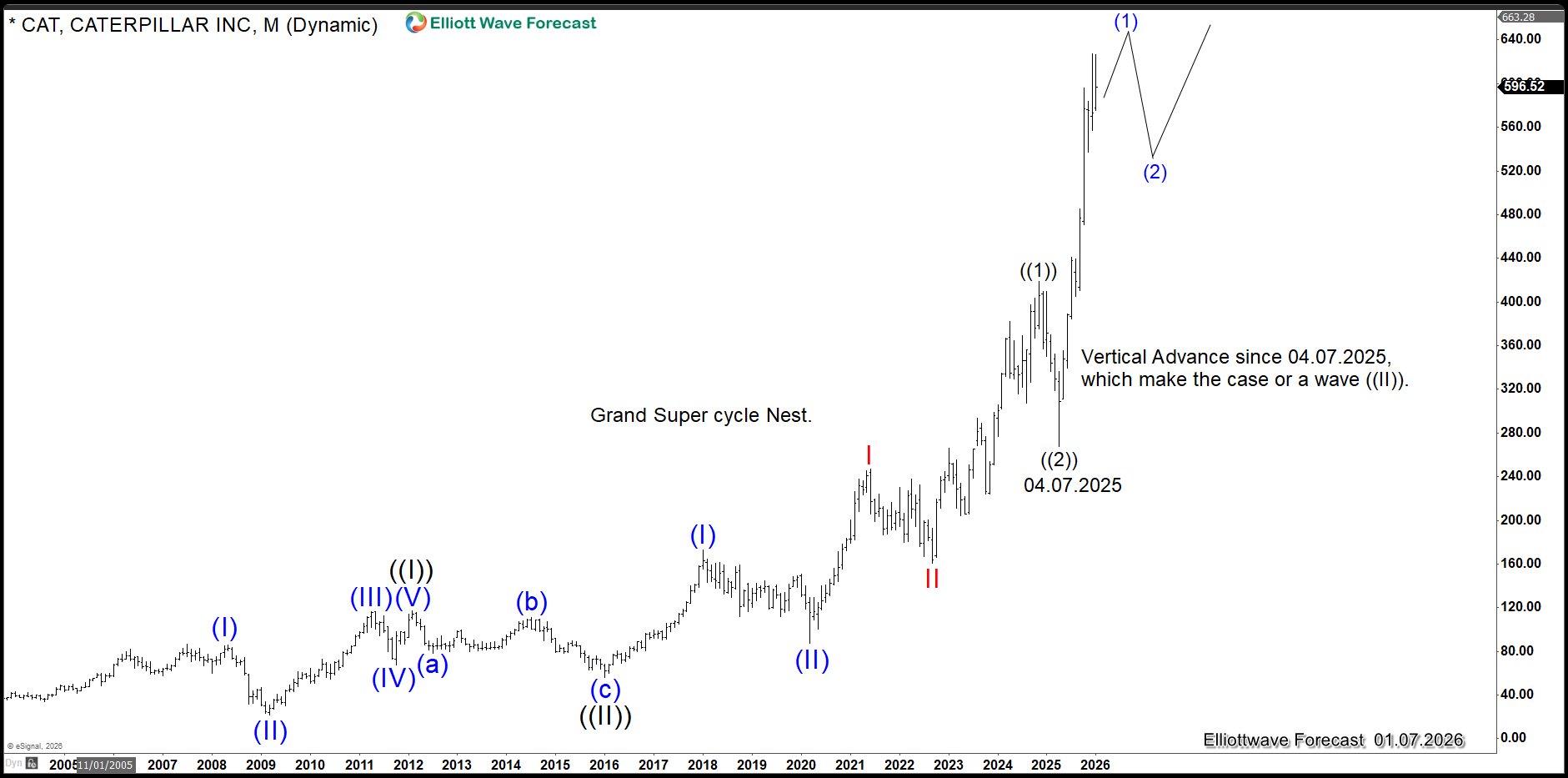

Caterpillar (CAT) Confirms Structural Nesting in the S&P 500 (SPX) With Targets at 10,000

Read MoreCaterpillar (CAT) outlook confirms the nesting thesis in S&P 500 (SPX) with a target towards 10,000. This article looks at the Elliott Wave path.

-

Hecla Mining (HL) and the $150 Silver Thesis

Read MoreStrong correlation between HL and XAG/USD suggest both should have tremendous gains in years ahead. This article talks about potential targets for both.

-

World Indices: 2025–2026 Will Be a Defining Period

Read MoreThe Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

2025 & The Elliott Wave Theory: Welcome to the Era of the Machines

Read MoreRalph Nelson Elliot developed the Elliott Wave Theory in the 1930s by. Influenced by Dow Theory and his extensive observation of market behavior, Elliott concluded that stock market movements follow repetitive and identifiable wave patterns. According to the theory, price action broke down in to two parts. First is in the motive wave that moves in […]

-

Jet Blue: A Buying Opportunity and Definition Soon

Read MoreJet Blue Airways Corporation (JBLU), is a major U.S. airline headquartered in Long Island City, Queens, New York. Operating over 1,000 daily flights, it serves around 100 destinations across the Americas and Europe, with a focus on point-to-point travel and key hubs like New York’s JFK Airport. Known for its low-cost model paired with premium […]