-

European Indices Forecast (8.15.2013)

Read MoreIt’s time to revisit $FTSE chart as we last looked at it on 8.1.2013 and establish that bulls had regain control as Index showed a 5 wave move up following a 5 wave decline which is a bullish setup. We expected Index to find resistance around 6743 and turn lower in 3 waves to complete […]

-

$USDJPY 10.4.2013

Read MorePair is bouncing from 76.4 fib of wave ( D ) @ 96.92. Marginal new lows to 96.78 could still be seen before pair turns higher. Cycle is very close to ending and bounce can happen at any moment. We don’t like chasing weakness in the pair as hourly cycles remain positive and like the […]

-

$CL_F (US Oil) 10.3.2013

Read MoreExpect marginal new highs to 105.00 to complete wave A as a FLAT. This should result in a wave B pull back and further strength toward 106.67 – 107.99 to complete wave ( B ). Hourly cycles are negative but we don’t recommend selling in wave B as more upside would be expected after that. […]

-

$USDJPY (10.2.2013)

Read MoreBreak of 97.44 suggests wave ( 4 ) is not over yet. Expect a test of 96.92 as the next level to look for longs in the pair. We don’t like chasing weakness in the pair as strategy remains to buy the dips in 3, 7 and 11 swings. If you would like to receive […]

-

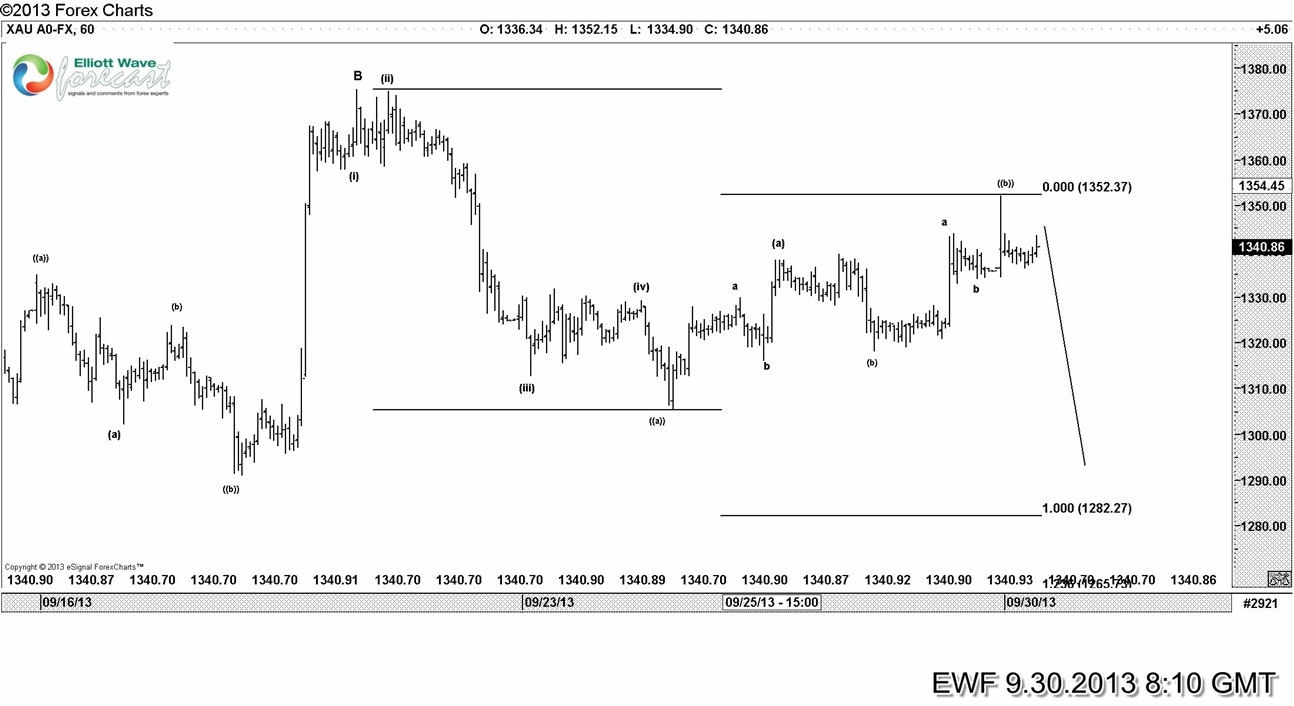

$Gold breaks lower

Read MoreGold faces a perfect rejection at 1351 (equal legs) as forecased in this 1 hour Elliott wave analysis presented to members on September 28 2013. Let’s take a look at some charts 9.28.2013 9.30.2013 10.1.2013 If you would like to receive frequent , timely updates, stay on top of changes in […]

-

$GC_F (Gold) Short-term forecast (10.1.2013)

Read MoreBreak below 1306 confirms wave (( b )) has completed @ 1351. While below 1312 – 1322 expect 2 more lows to complete a 5 wave decline from 1351 peak. Focus is at 1265 and if exceeded , we could even reach 1246 If you would like to receive frequent , timely updates, stay on […]