-

Oil and SPX simple correlation using Elliott wave cycles.

Read MoreIn today’s video we are going to take a look at relation ship between Oil (blue) and SPX (black). Followers of fundamentals often argue that lower Oil means higher Indices. Looking at charts, we can see huge correlation between the 2 instruments. We use another dimension correlation in which 2 instruments could be moving in […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 1.8.2015

Read MoreLooking at Elliott wave swing sequence, Copper (HG_F) metal is showing 5 swings down from 12/9 high (2.95) which is an incomplete swing sequence so our preferred Elliott wave view is that wave B high at 2.866 would hold for another swing lower toward 2.67 (100% ext) followed by 2.61 which is 100% ext of […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 1.7.2015

Read MoreLooking at Elliott wave swing sequence, Copper (HG_F) metal is showing 5 swings down from 12/9 high (2.95) which is an incomplete swing sequence so our preferred Elliott wave view is that wave B high at 2.866 would hold for another swing lower toward 2.67 (100% ext) followed by 2.61 which is 100% ext of […]

-

USDCAD Short-term Elliott Wave Analysis 1.5.2015

Read MorePreferred Elliott wave view suggests pair completed wave “W” at 1.1673 and wave “X” is also proposed to be over at 1.1595. Cycle from 1.1594 is proposed to be over at 1.1843 which we think completed wave (( w )). Wave (( x )) pull back is in progress and is taking the form of a […]

-

USDCAD Elliott Wave Setup Video

Read MoreUSDCAD preferred Elliott Wave view shows decline from 1.1843 high is taking the form of a 7 swing structure and expected to test 1.1729 – 1.1710 area before pair turns higher and resumes the rally. Worst case scenario would be a 3 wave bounce from 1.1729 – 1.1710 area but ideally we would expect the […]

-

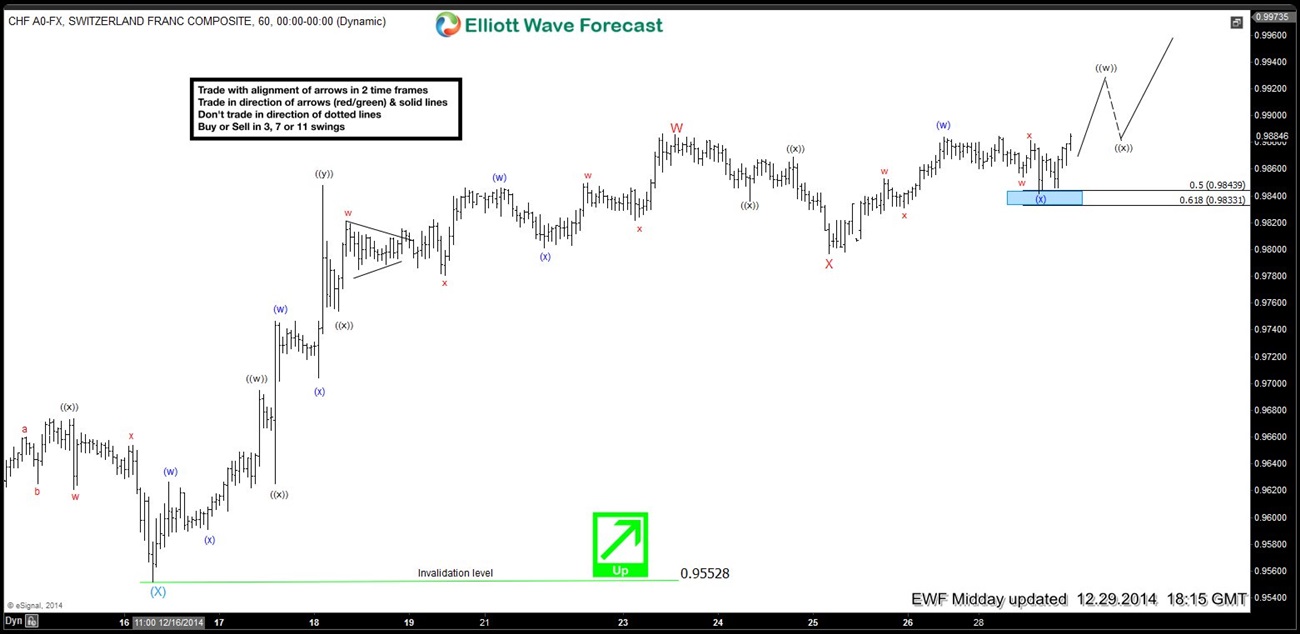

USDCHF Short-term Elliott Wave Analysis 12.29.2014

Read MoreUSDCHF preferred Elliott Wave view remains bullish and suggests wave “W” ended at 0.9887 and wave “X” is also proposed to be over at 0.9796. Pair has made a new high above 0.9887 adding more conviction to this view and near-term focus is on 0.9928 – 0.9949 area to complete wave (( w )) before […]