-

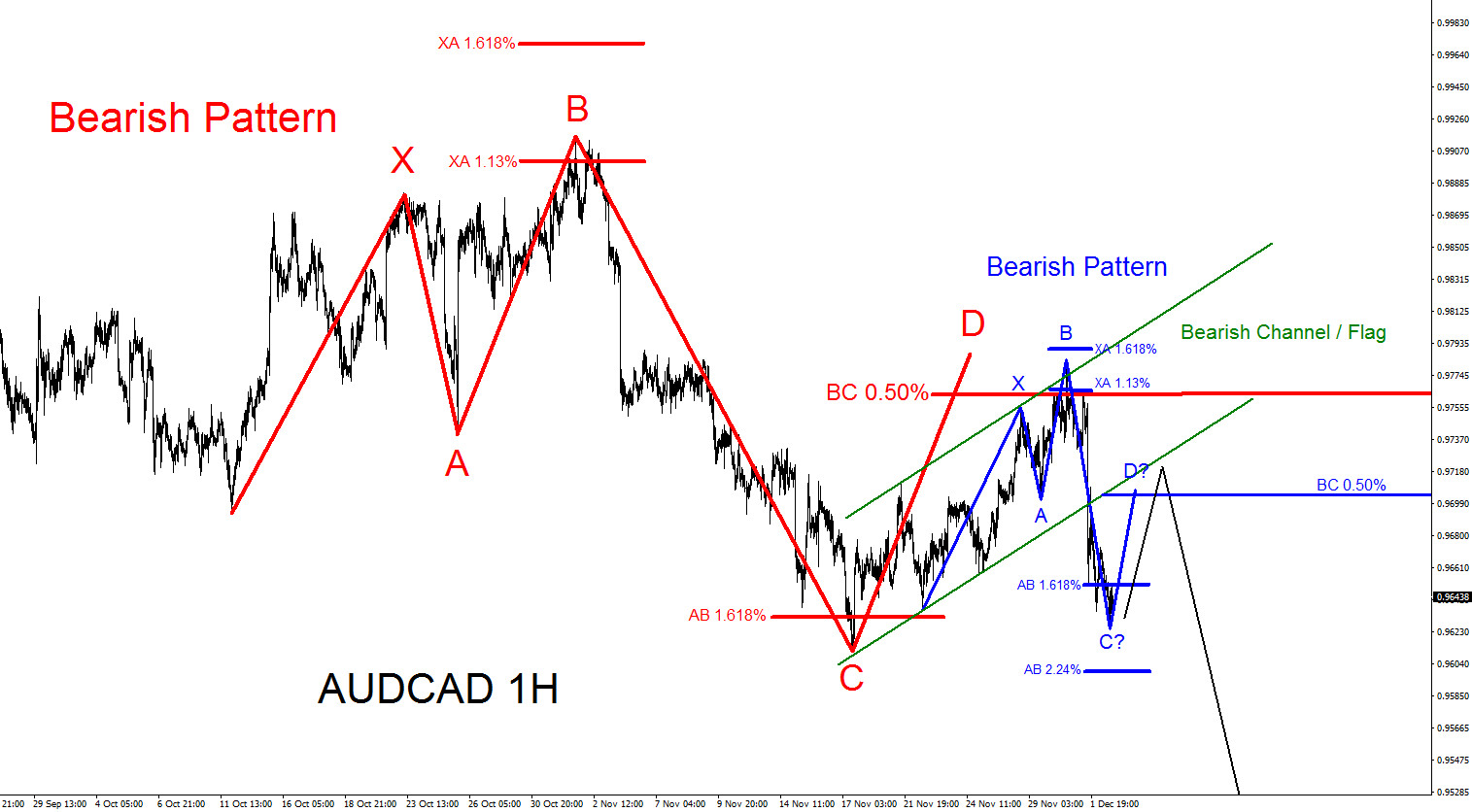

AUDCAD : Selling Opportunity

Read MoreAUDCAD Technical Analysis 12.4.2017 AUDCAD has already pushed lower since it formed a top last week on November 30 2017. The pair is showing bearish patterns which has already sold off from. Red bearish pattern triggered sells at the red BC 0.50% Fib. retracement level where the pair reversed lower from that area. To add […]

-

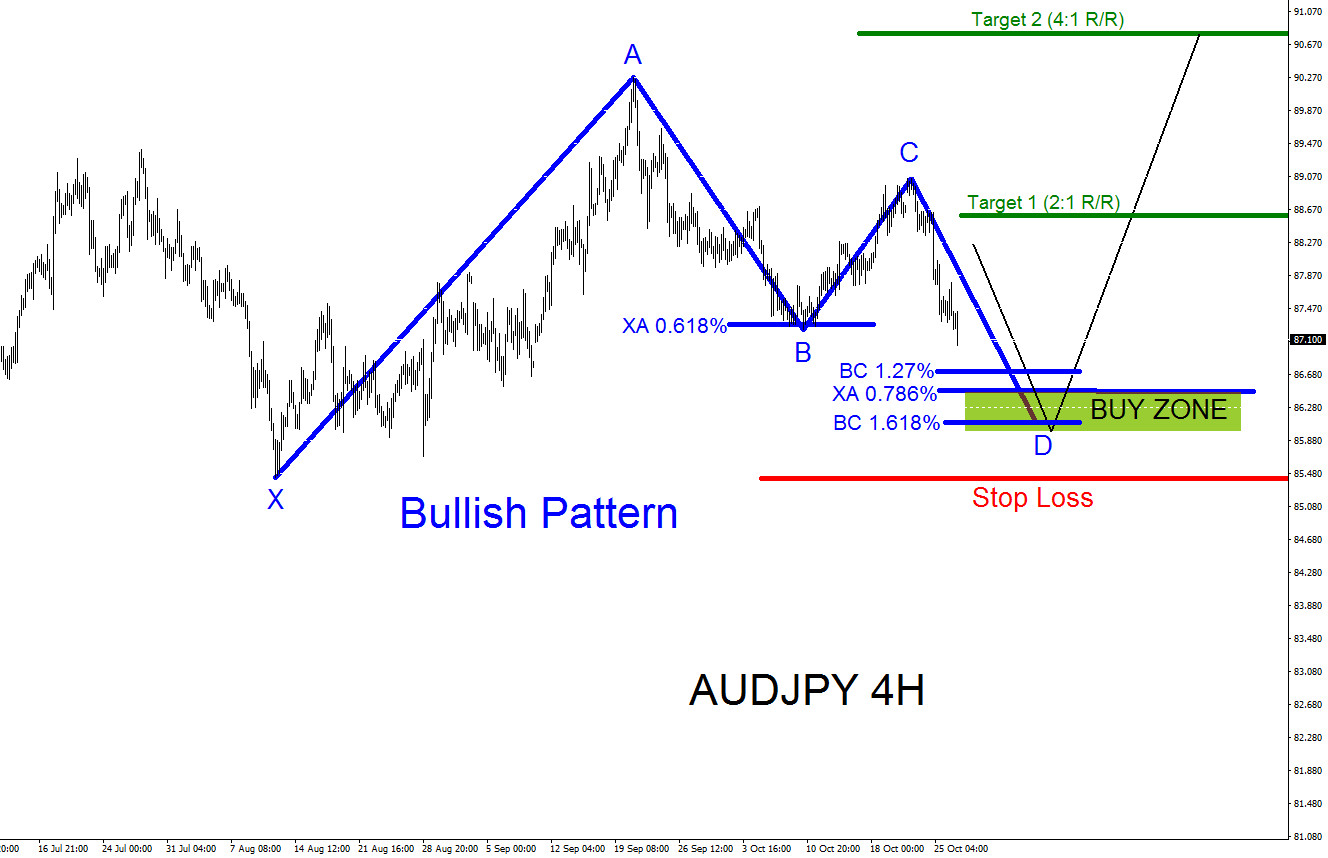

AUDJPY : Possible Bounce Higher (Part 2)

Read MoreAUDJPY Technical Analysis 11.9.2017 Just to add on to the article published on October 27 2017 “AUDJPY : Possible Bounce Higher” we can now see more bullish patterns that can push AUDJPY higher if it reaches levels lower. In the original article we had and still have a bullish pattern that triggers buys at the purple […]

-

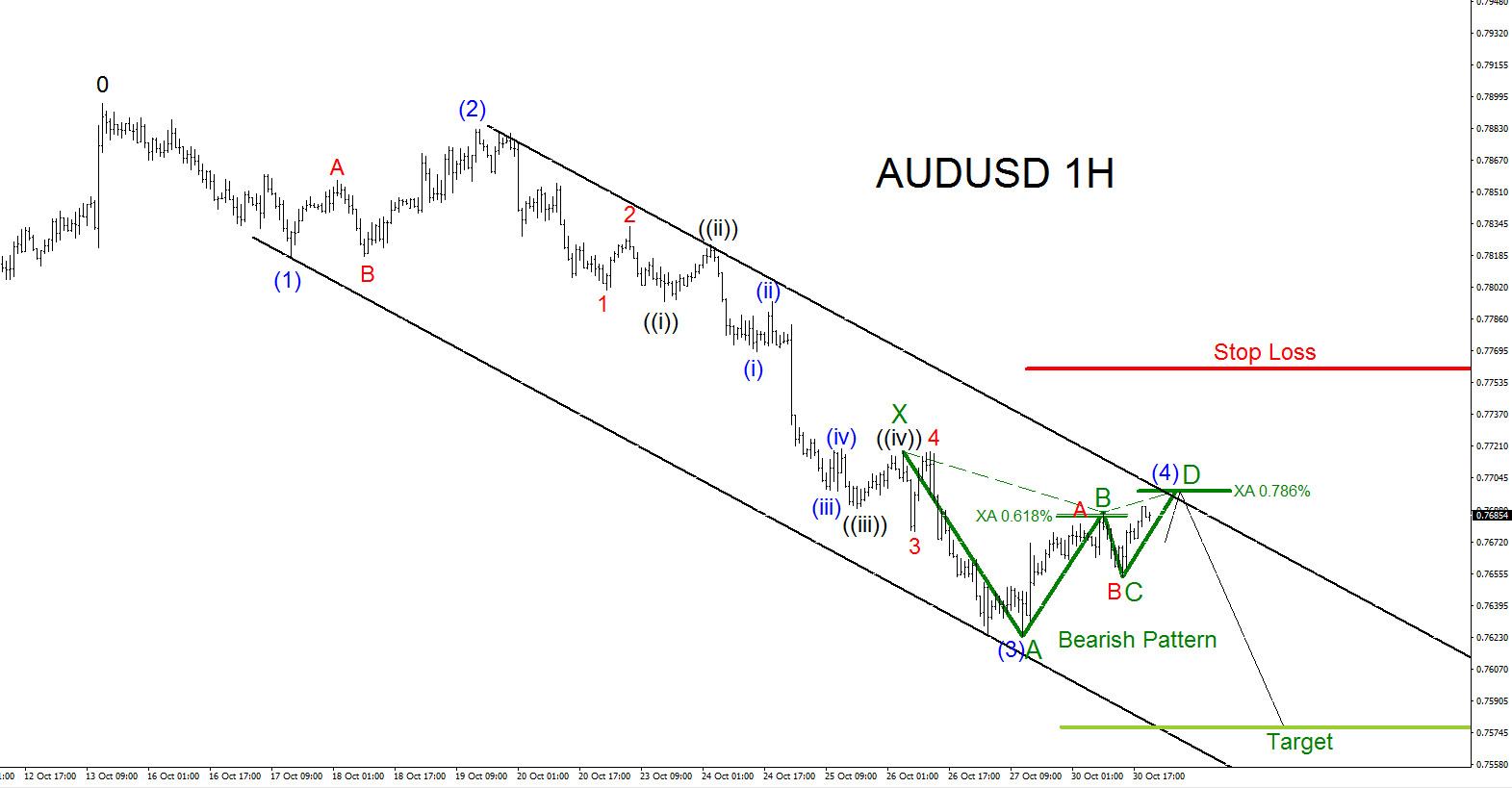

AUDUSD Needs Another Move Lower

Read MoreAUDUSD Technical Analysis 10.30.2017 AUDUSD is currently in a Elliott Wave impulse five wave move lower from the October 13 high. The pair is currently in the blue wave (4) correction higher and traders should watch for the termination of this wave for another push lower towards the possible fifth wave target at 0.7580 area. […]

-

AUDJPY : Possible Bounce Higher

Read MoreAUDJPY Technical Analysis 10.27.2017 AUDJPY has been trending to the upside making higher highs and higher lows since June 24/2016 on the Daily chart. On the 4 hour (Chart below) we can see a possible bullish pattern that can extend the trend higher and push AUDJPY to new highs. The chart below we can see […]

-

EURUSD Possible Bounce Higher

Read MoreEURUSD Technical Analysis 10.17.2017 EURUSD on the 4 hour chart is showing two possible bullish patterns. Below you can see a blue bullish pattern which triggers buys at the BC 0.50% Fib. retracement level and a possible red bullish falling wedge pattern where price has still yet to break above the top trend line of […]

-

EURCAD Selling Opportunity

Read MoreEURCAD Technical Analysis 8.1.2017 On June 13/2017 I published an article EURCAD : Sell the Bounce Bearish Pattern where I called for the pair to make another move lower after a bounce/retracement higher. EURCAD since then bounced and continued lower as expected but did not fully close the April 13/2017 market gap as I would have […]