-

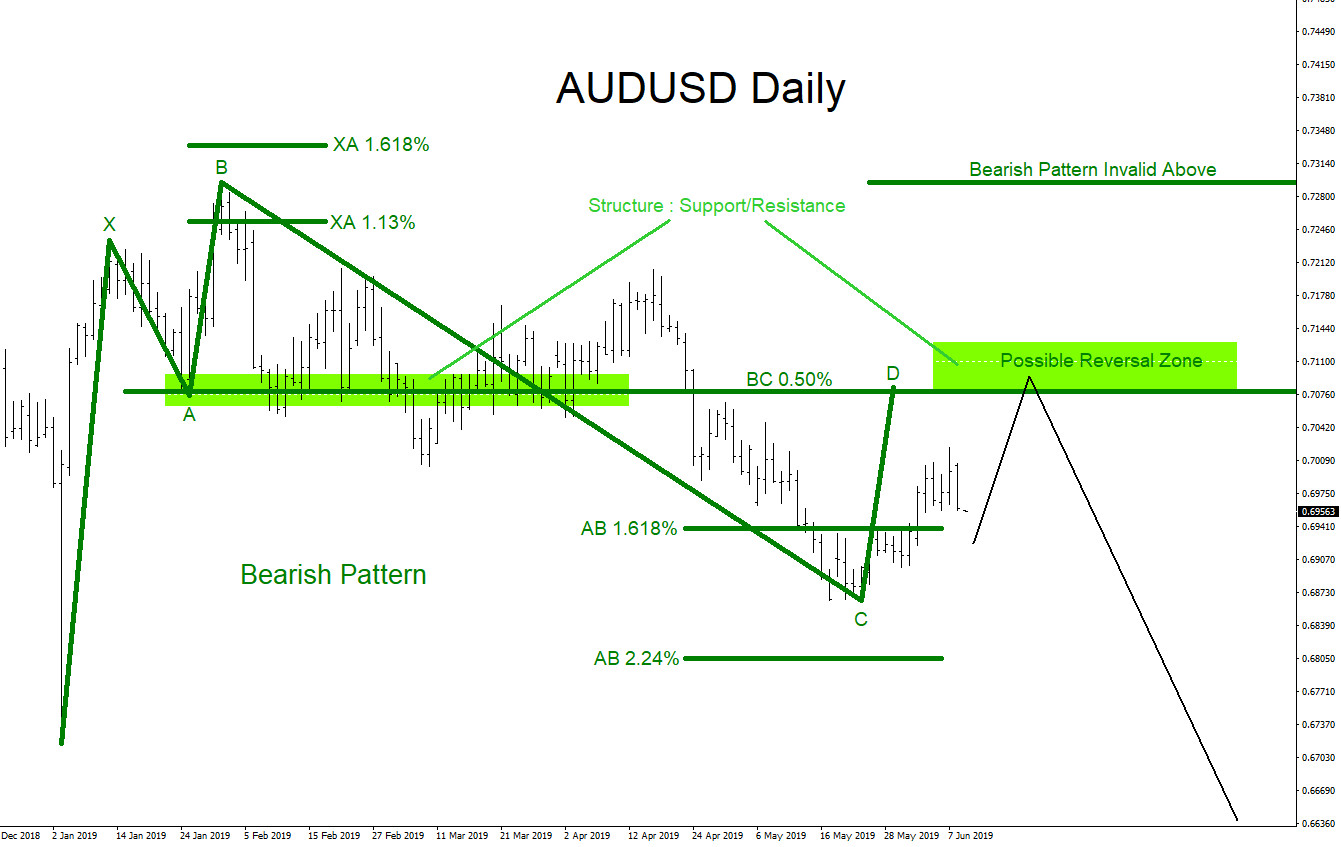

AUDUSD : Calling the Move Lower

Read MoreAUDUSD Technical Analysis AUDUSD: On June 10/2019 I posted on Twitter @AidanFX a possible bearish market pattern. On the Daily chart AUDUSD has been trending lower since 2018 so it would only make sense to follow the trend and continue to look for possible selling opportunities. The chart below shows the possible reversal zone where […]

-

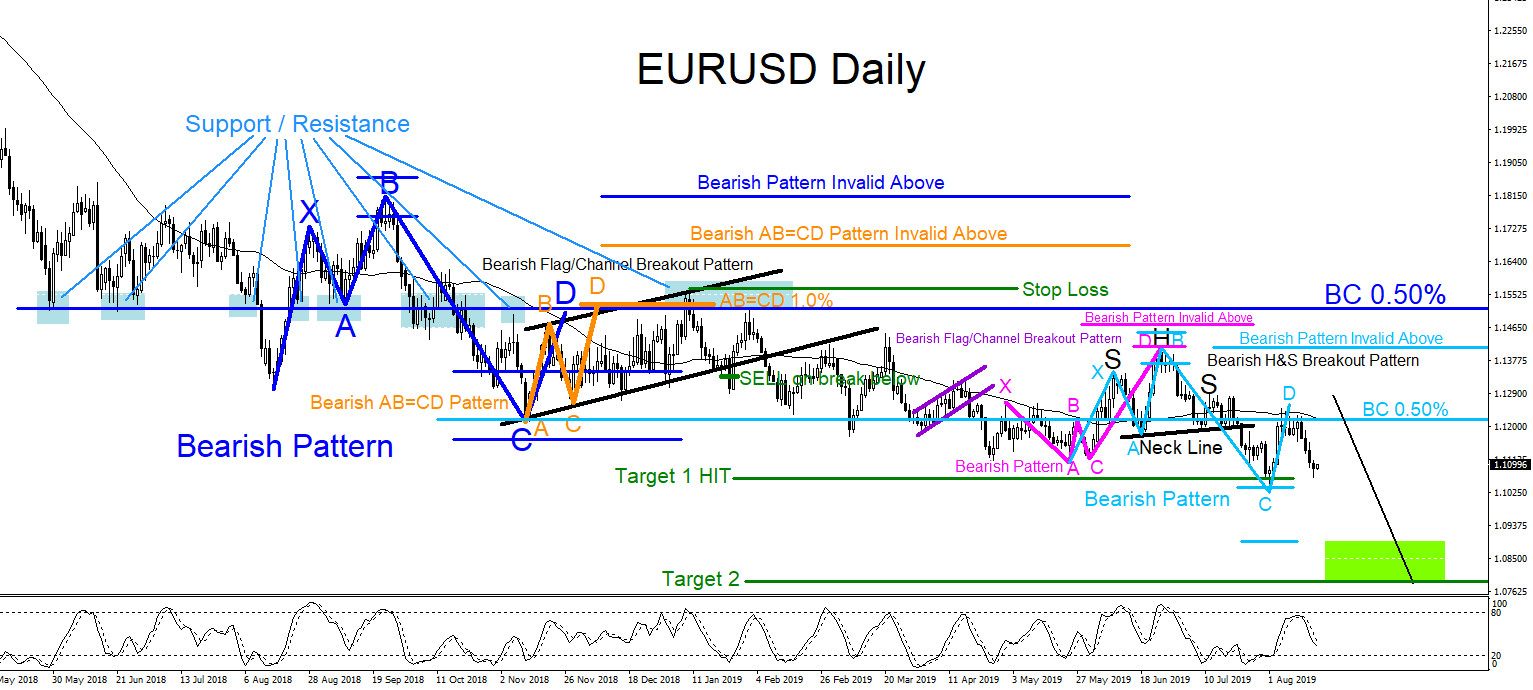

EURUSD : Bearish Market Patterns

Read MoreEURUSD Technical Analysis August 18/2019 In January of 2019 I published the EURUSD SELL breakout trade setup (EURUSD: Will Pair Break Lower) explaining that bearish market patterns were clearly visible and was calling for a move lower towards 1st Target at 1.1060. EURUSD Daily Chart 1.23.2019 Fast forward to August 2019. In the chart below […]

-

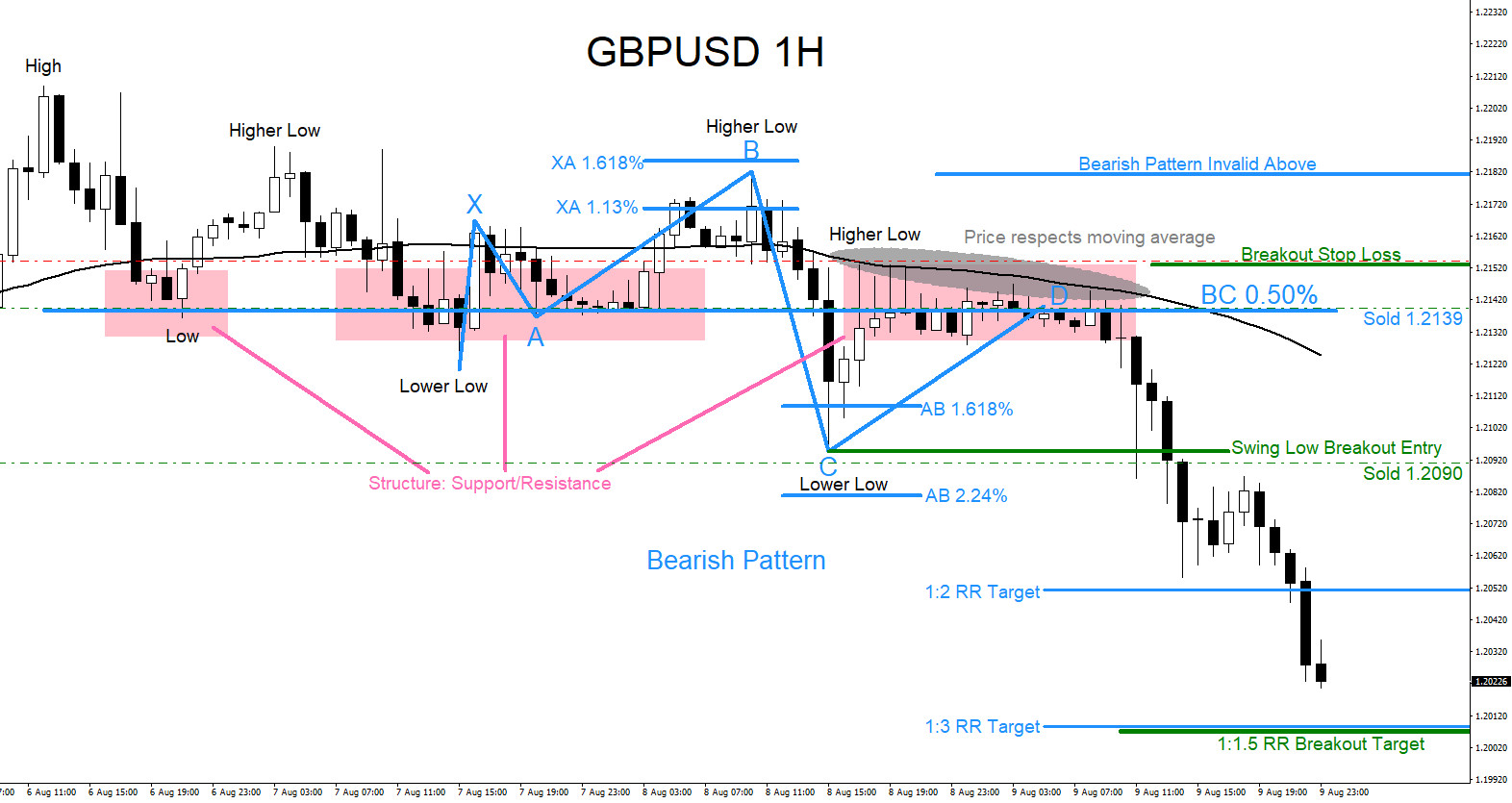

GBPUSD : Calling the Move Lower

Read MoreGBPUSD Technical Analysis Start of the trading week of August 4 – 9 / 2019 EWF members were already advised to watch for GBPUSD to make another move lower. The GBPUSD 1 Hour chart below, from our members area, clearly advises our members to watch for the termination of Wave ((iv)) in the blue box […]

-

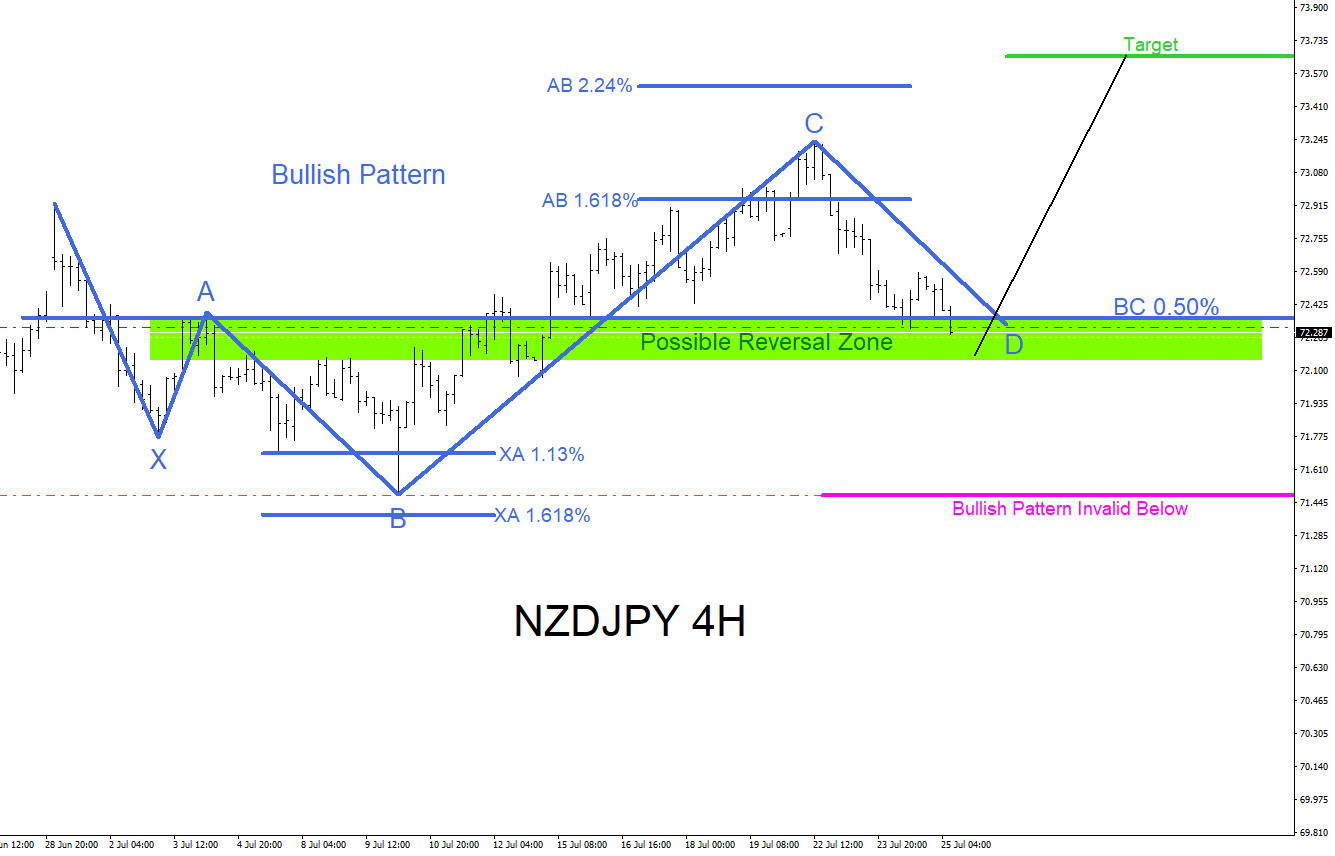

NZDJPY : Watch for Another Push Higher

Read MoreNZDJPY Technical Analysis July 25/2019 NZDJPY has a clear bullish market pattern that has already formed. In the 4 hour chart below the blue bullish market pattern has already triggered buyers to enter the market at the BC 0.50% Fib. retracement level. The BC 0.50% level also aligns with a support/resistance structure (possible reversal zone) […]

-

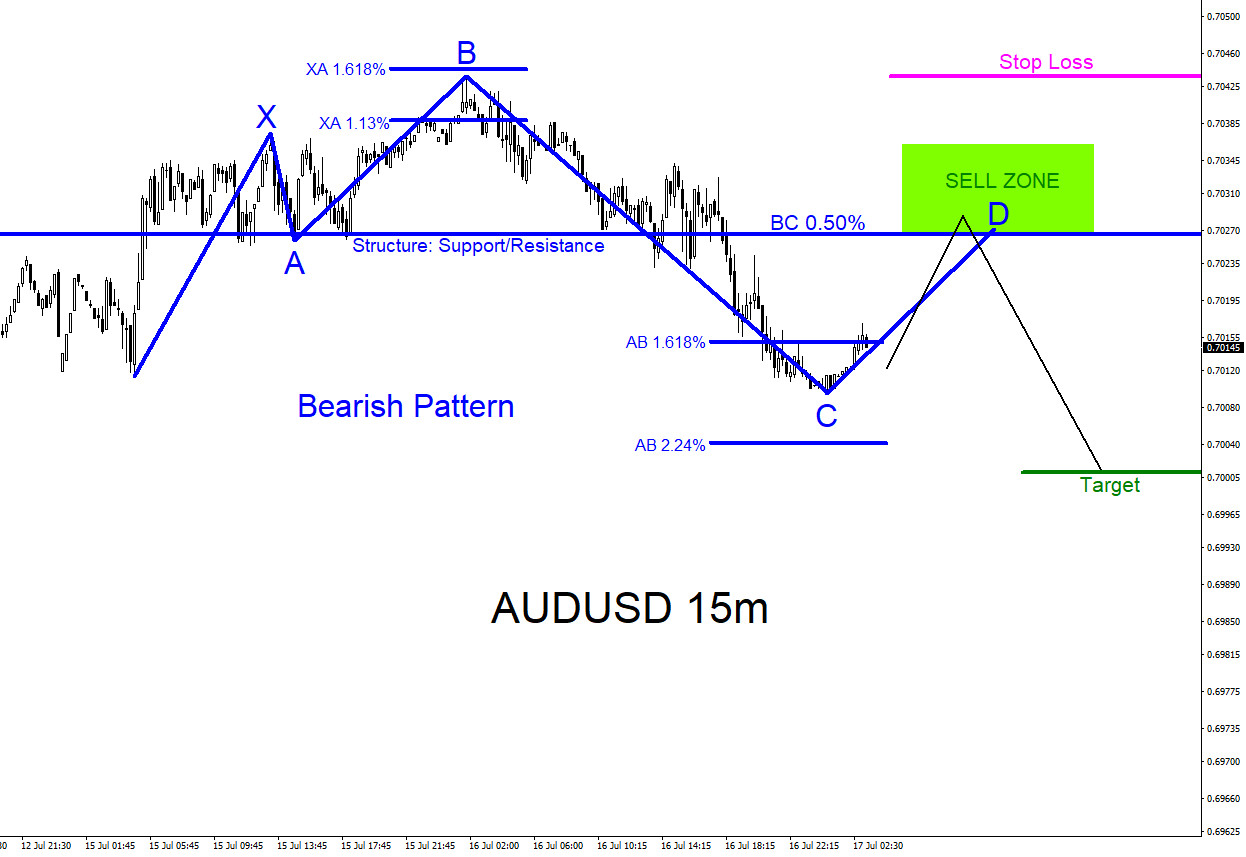

AUDUSD : Low Risk Trade Setup

Read MoreAUDUSD Technical Analysis July 17/2019 AUDUSD : A possible bearish pattern is clearly visible on the 15 minute chart. The blue bearish pattern still needs to make a small push higher to complete point D at the BC 0.50% Fib. retracement level where sellers will be possibly waiting to push the AUDUSD pair lower towards […]

-

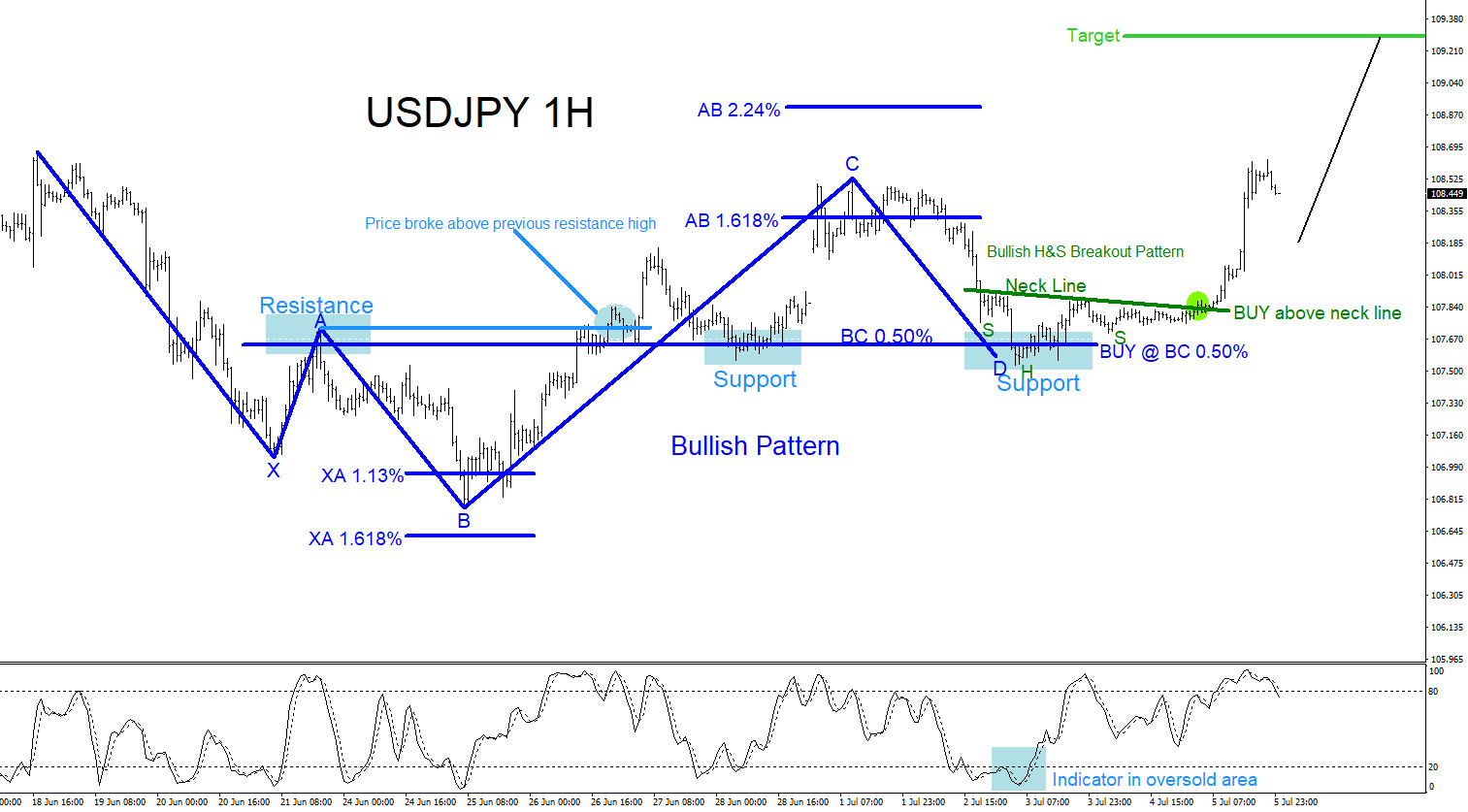

USDJPY : Trading Confluence Zones

Read MoreUSDJPY Technical Analysis USDJPY last week signalled bulls to enter the market. Why did traders decide to “BUY” the USDJPY pair towards the end of the week for a push higher? Some speculators will say because of fundamental analysis/news but technical traders will say because price hit a confluence zone. Trading confluence is when 2 […]