-

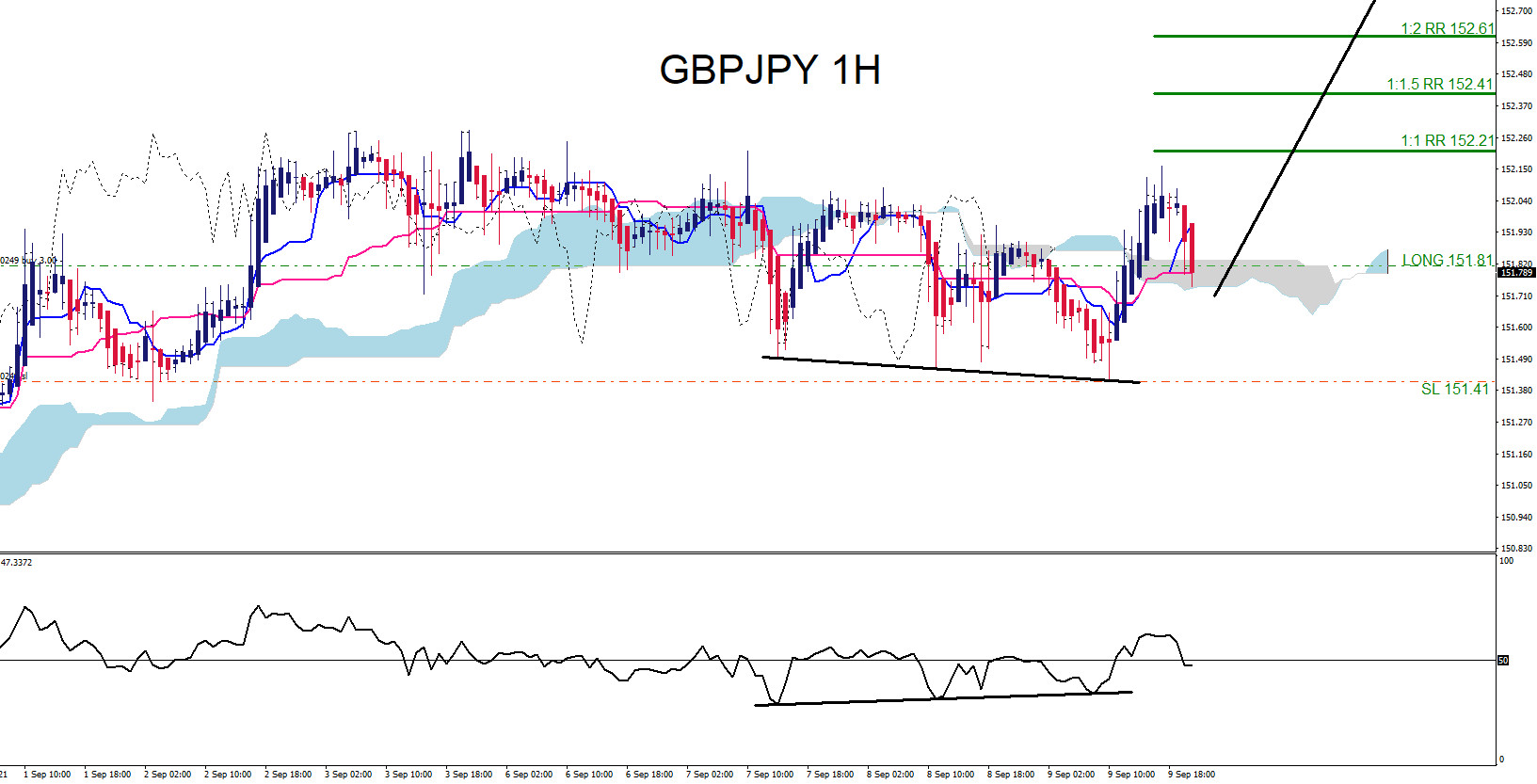

GBPJPY Moves Higher as Expected

Read MoreOn September 9 2021 I posted on social media @AidanFX “GBPJPY will be watching for buying opportunities for a move higher towards the 152.20 – 152.60 area.“ The chart below was also posted on social media @AidanFX September 9 2021 showing the possible GBPJPY bullish scenario. Price formed a bullish divergence pattern (black) on indicator and […]

-

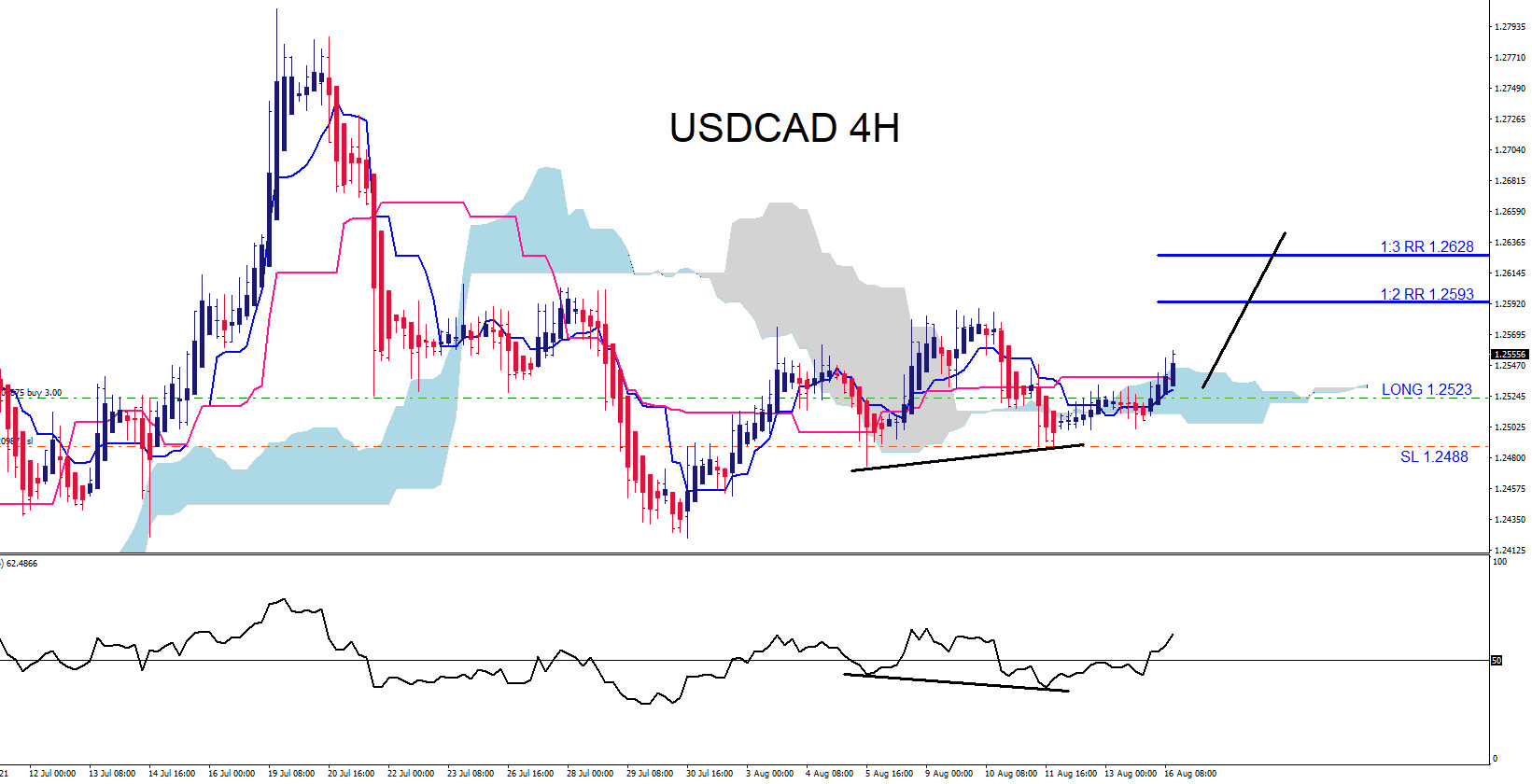

USDCAD Rallies Higher as Expected

Read MoreThe USDCAD 4 Hour chart below was posted on social media @AidanFX August 16 2021 showing the possible bullish scenario. Both price and indicator formed a bullish divergence pattern signalling a trend continuation. Since the July 30 2021 low the pair has moved higher in a higher high/higher low sequence confirming an upside trend was in […]

-

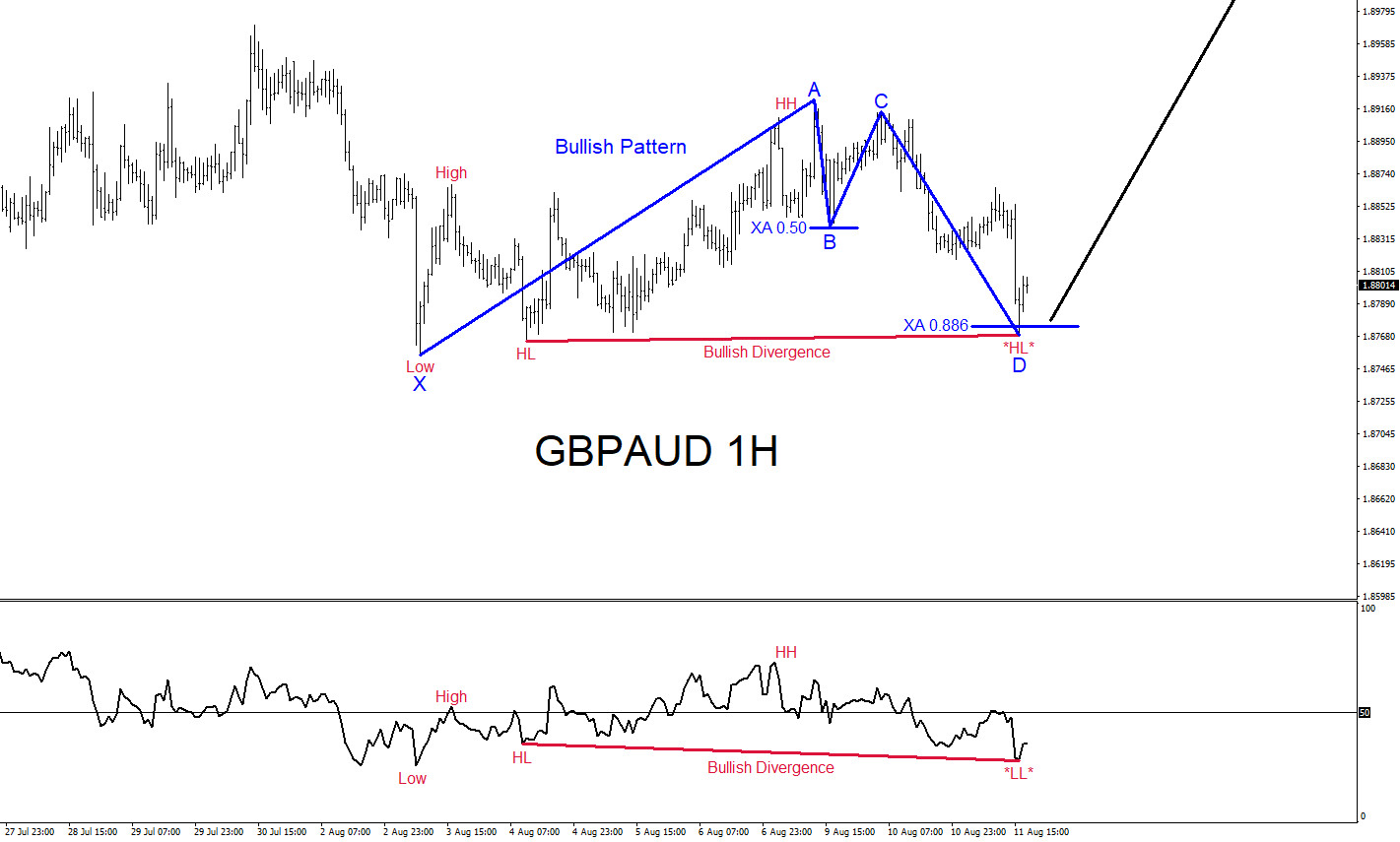

GBPAUD : Bullish Patterns Calling for Move Higher

Read MoreThe GBPAUD chart below was posted on social media @AidanFX August 11 2021 showing the possible bullish patterns. Blue bullish pattern triggered BUYS at the XA 0.886% Fib. retracement level. More evidence the pair could push higher was a bullish divergence pattern (red) also formed in the same area where the XA 0.886% level triggered […]

-

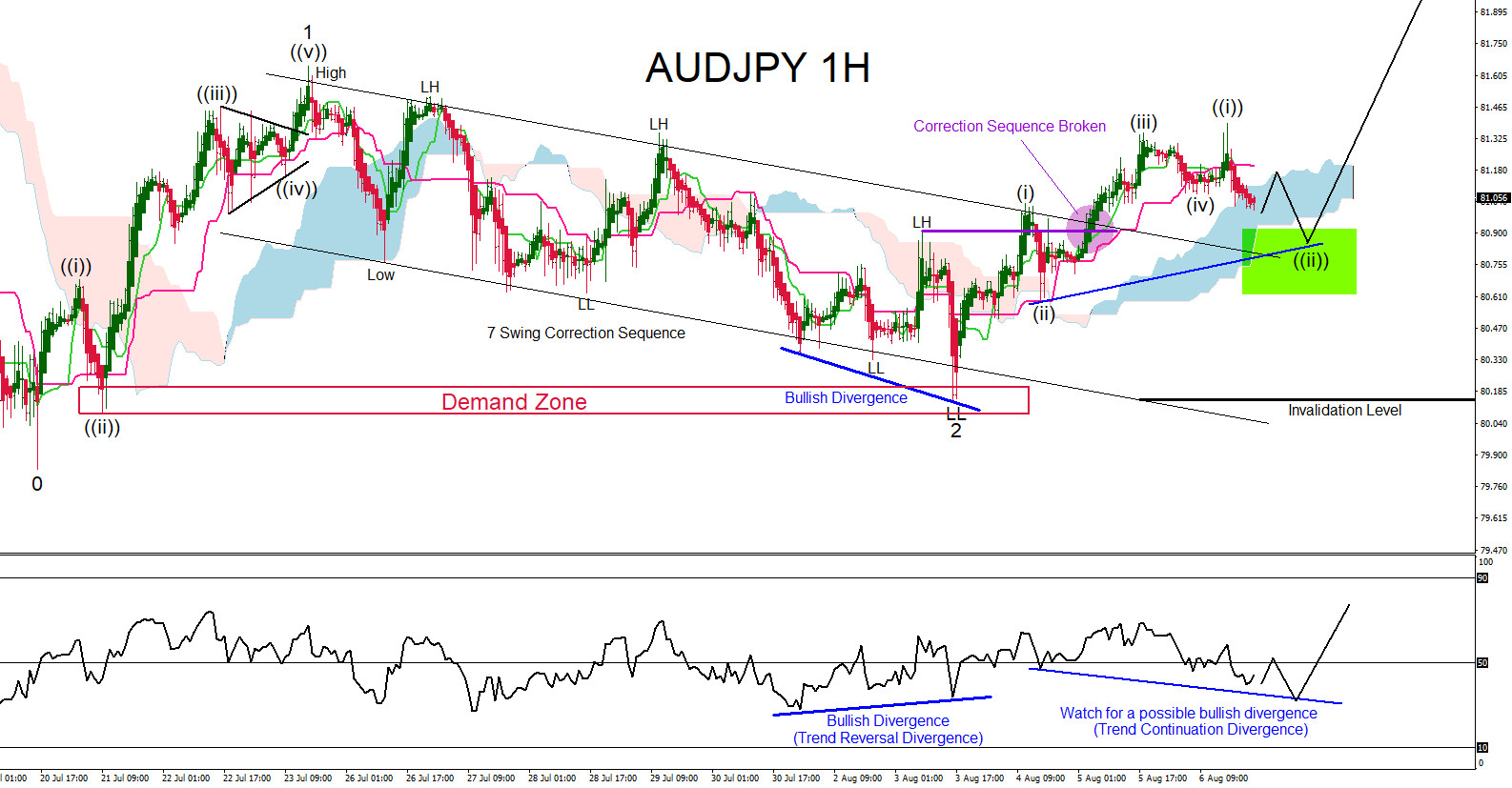

AUDJPY : Will the Pair Rally Higher?

Read MoreAUDJPY can be getting ready for a possible rally higher. In the 1 hour chart below, it is visible that the pair found a bottom/support at the Demand Zone signalling the proposed wave 2 has terminated. The pair was in correction lower from the July 23 2021 impulse wave 1. The correction lower was in […]

-

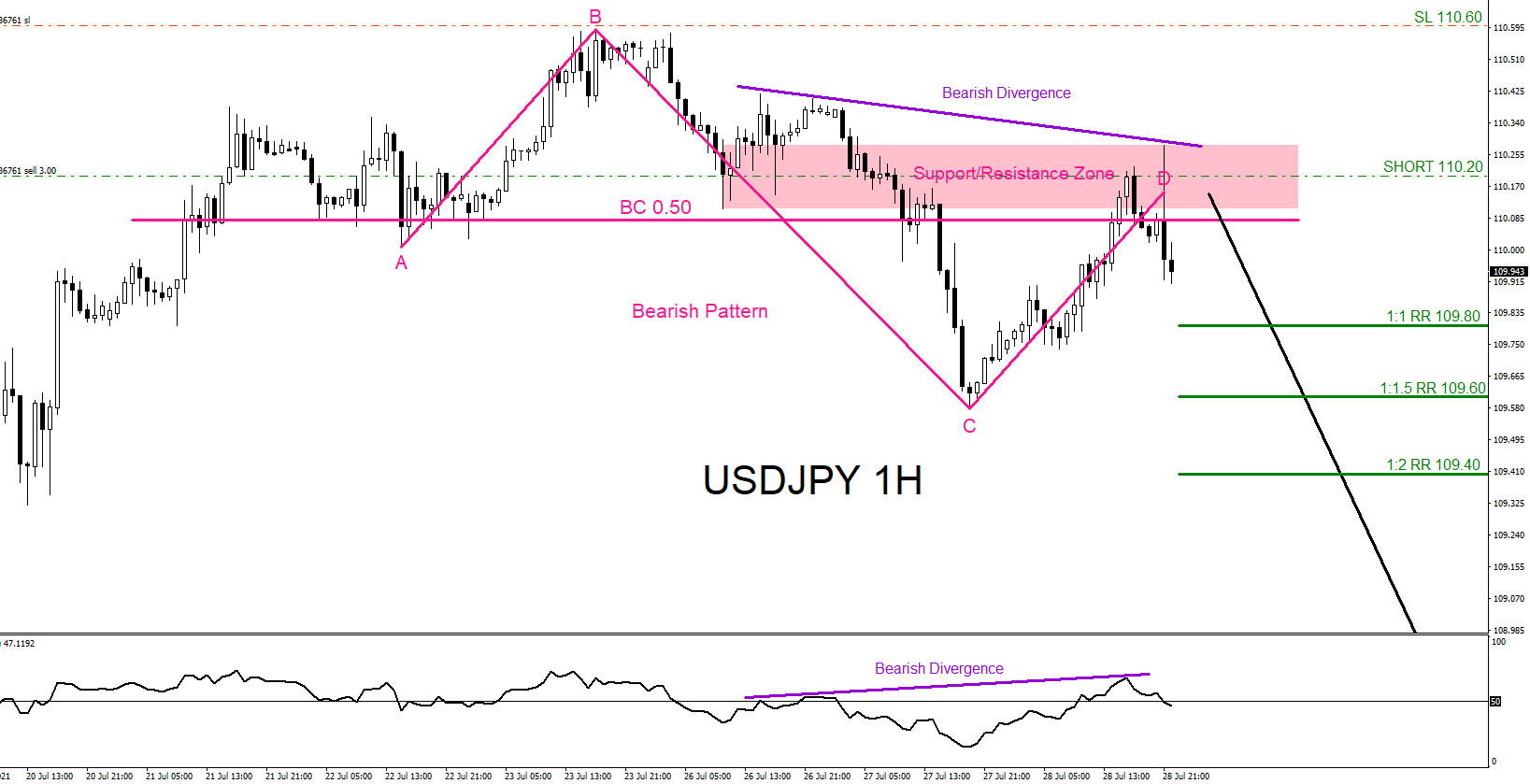

USDJPY : Bearish Market Patterns Calling the Move lower

Read MoreThe USDJPY chart below was posted on social media @AidanFX July 28 2021 showing a possible bearish market pattern where bears/sellers could be waiting to get in the market. The pink bearish pattern triggers SELLS at the BC 0.50% Fib. retracement level. Traders would need to be patient and wait for the pair to pullback […]

-

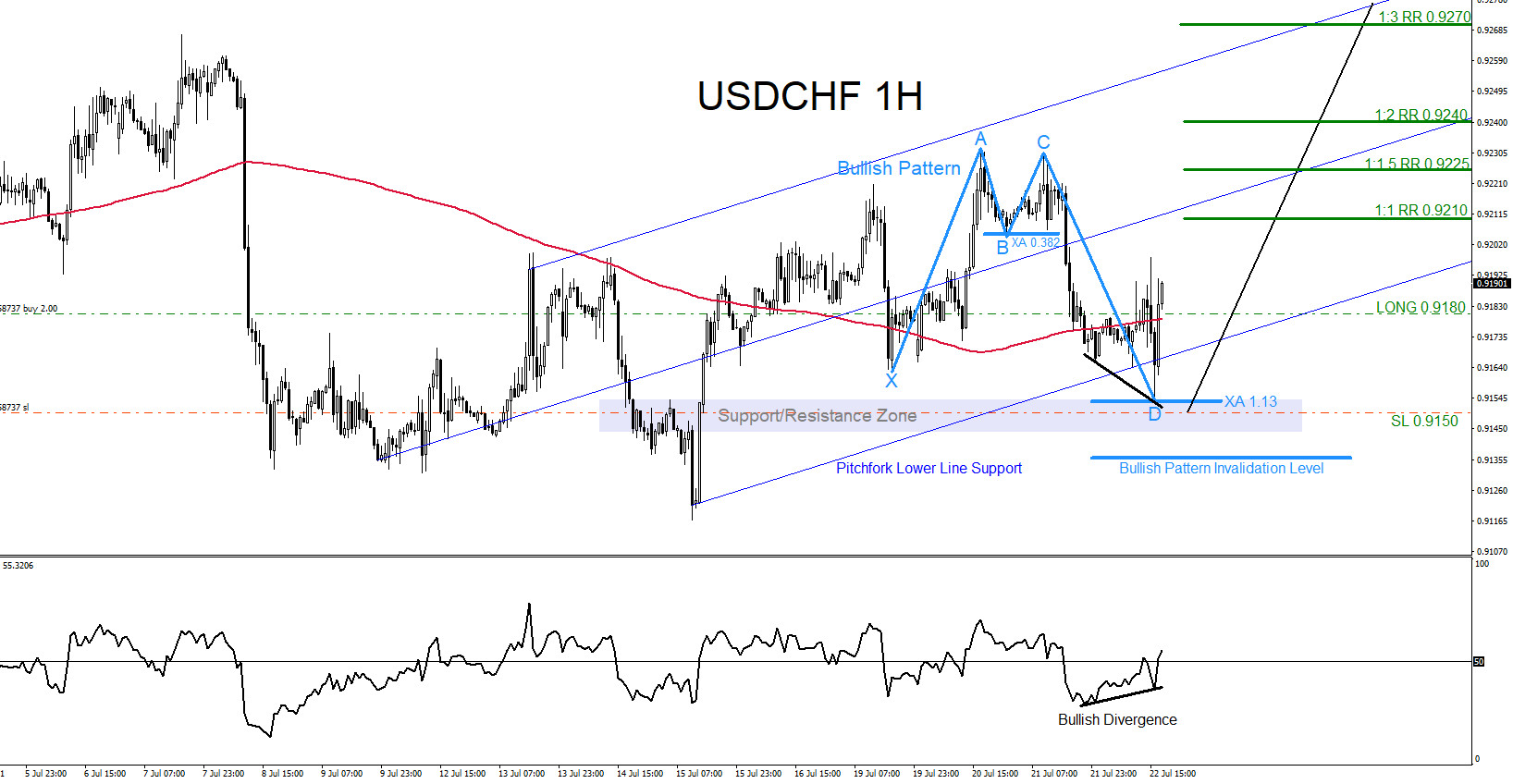

USDCHF : Will the Pair Continue Higher?

Read MoreThere are visible bullish patterns on the USDCHF 1 Hour time frame that can be signalling traders of a move higher. The light blue bullish market pattern already triggered buyers at the XA 1.13% Fib. retracement level and the pair has reacted with a push higher from this level. Price also found support from the […]