-

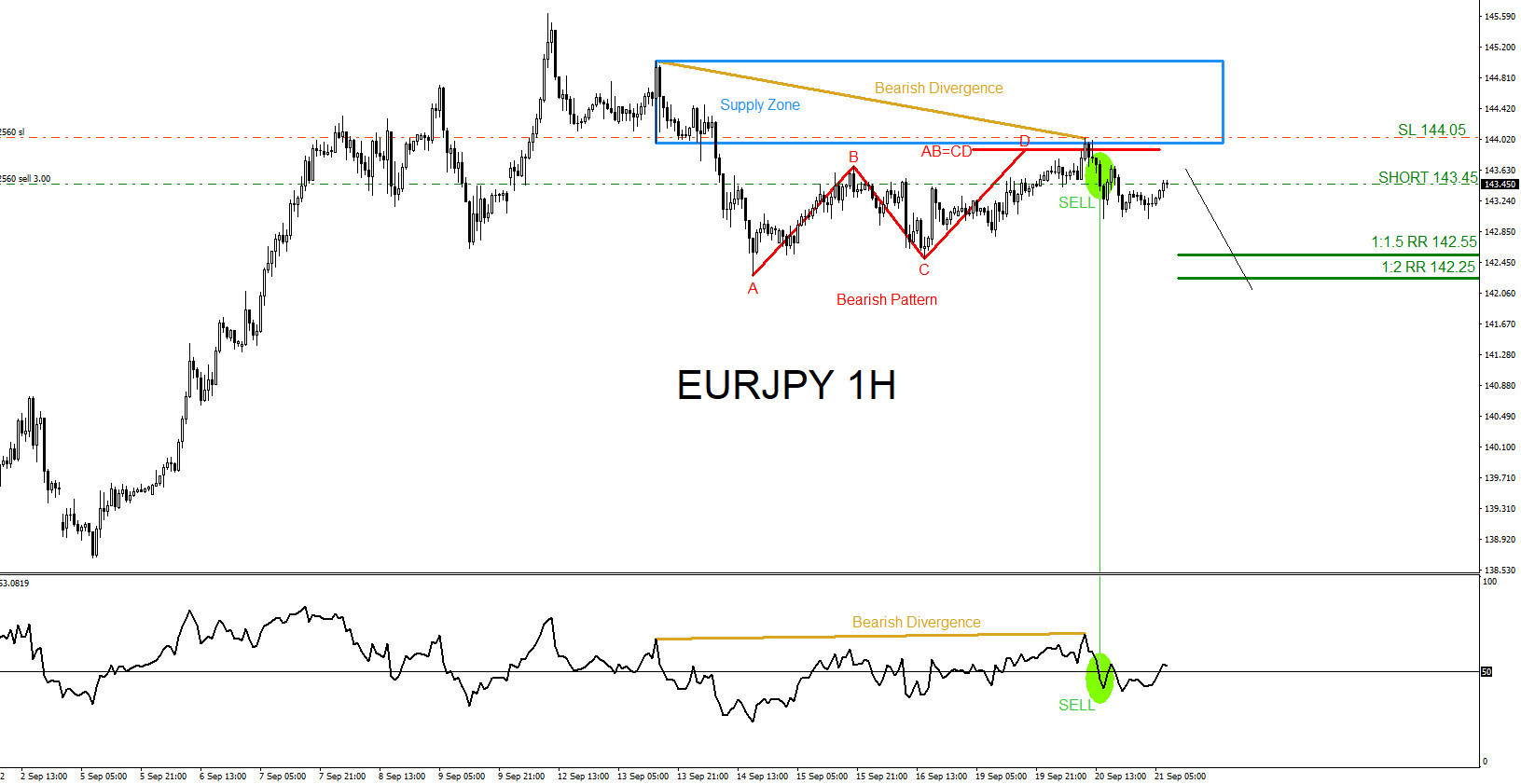

EURJPY : Moves Lower as Expected

Read MoreOn September 21 2022 I posted on social media @AidanFX “ SOLD EURJPY at 143.45 Stop Loss at 144.05 TP 142.55 (1:1.5 RR) 142.25 (1:2 RR)“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market […]

-

EURUSD : Sell Trade Hits Targets

Read MoreOn September 15 2022 I posted on social media @AidanFX “ SHORT/SELL EURUSD at 1.0005 Stop Loss at 1.0025 TP 0.9965 (1:2 RR) 0.9945 (1:3 RR)“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market […]

-

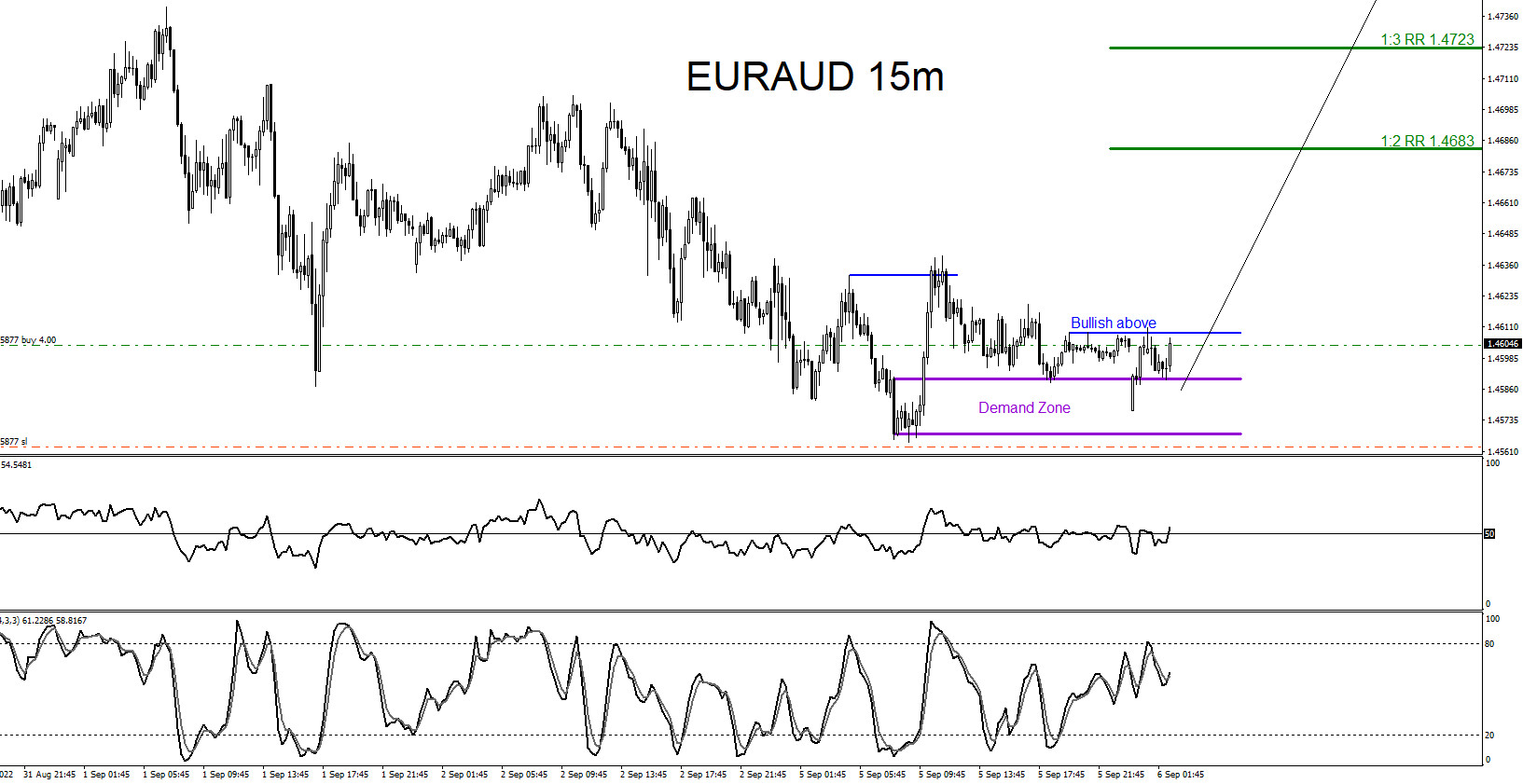

EURAUD : Moves Higher as Expected

Read MoreOn September 5 2022 I posted on social media @AidanFX “ EURAUD BUY at 1.4603 Stop Loss 1.4563 TP 1.4683 (1:2RR) 1.4723 (1:3RR)“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, […]

-

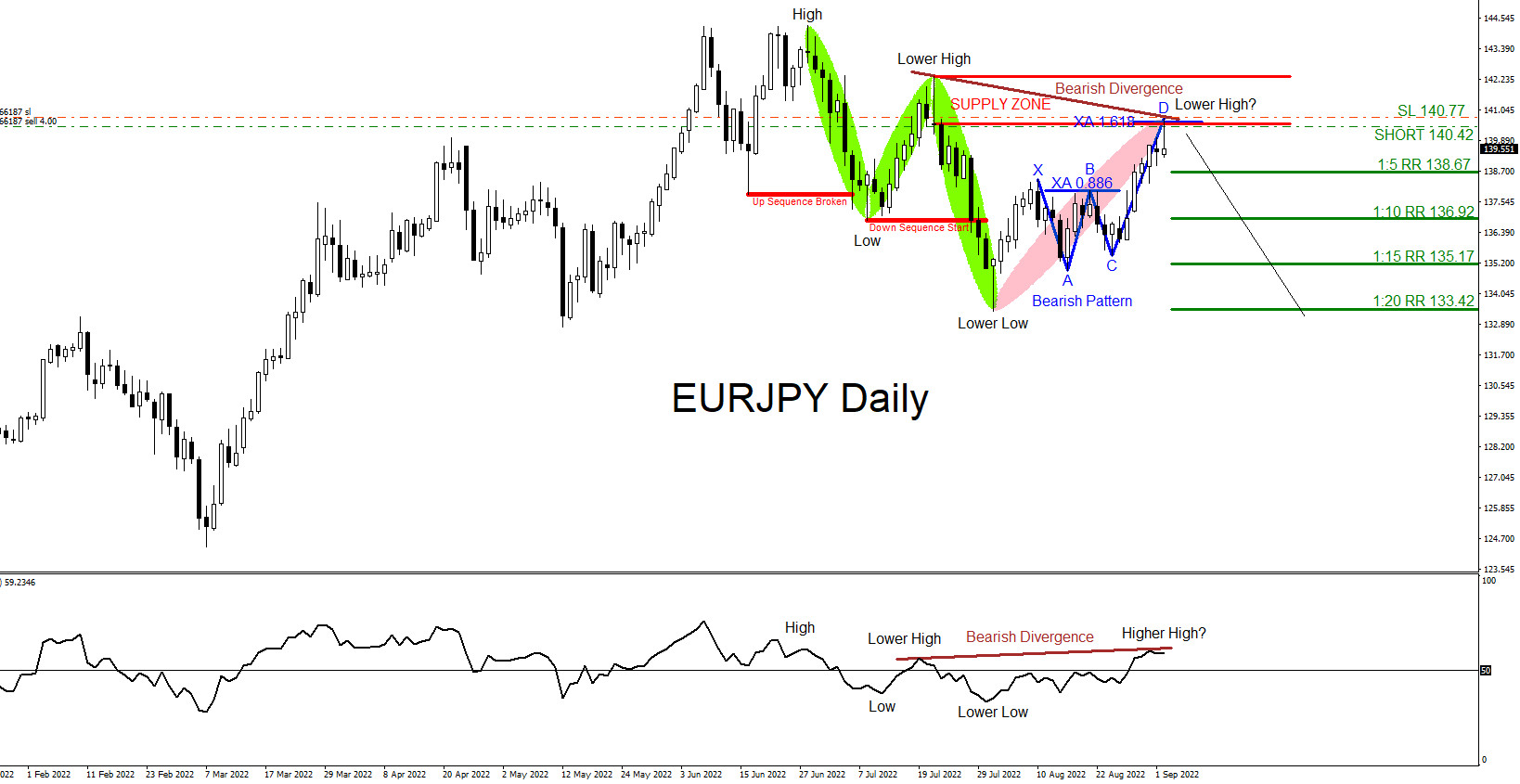

EURJPY : Higher Time Frame Analysis, Lower Time Frame Entry

Read MoreOn September 2 2022 the EURJPY pair entered a confluence zone and signalled a high probability SELL trade setup. Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders, […]

-

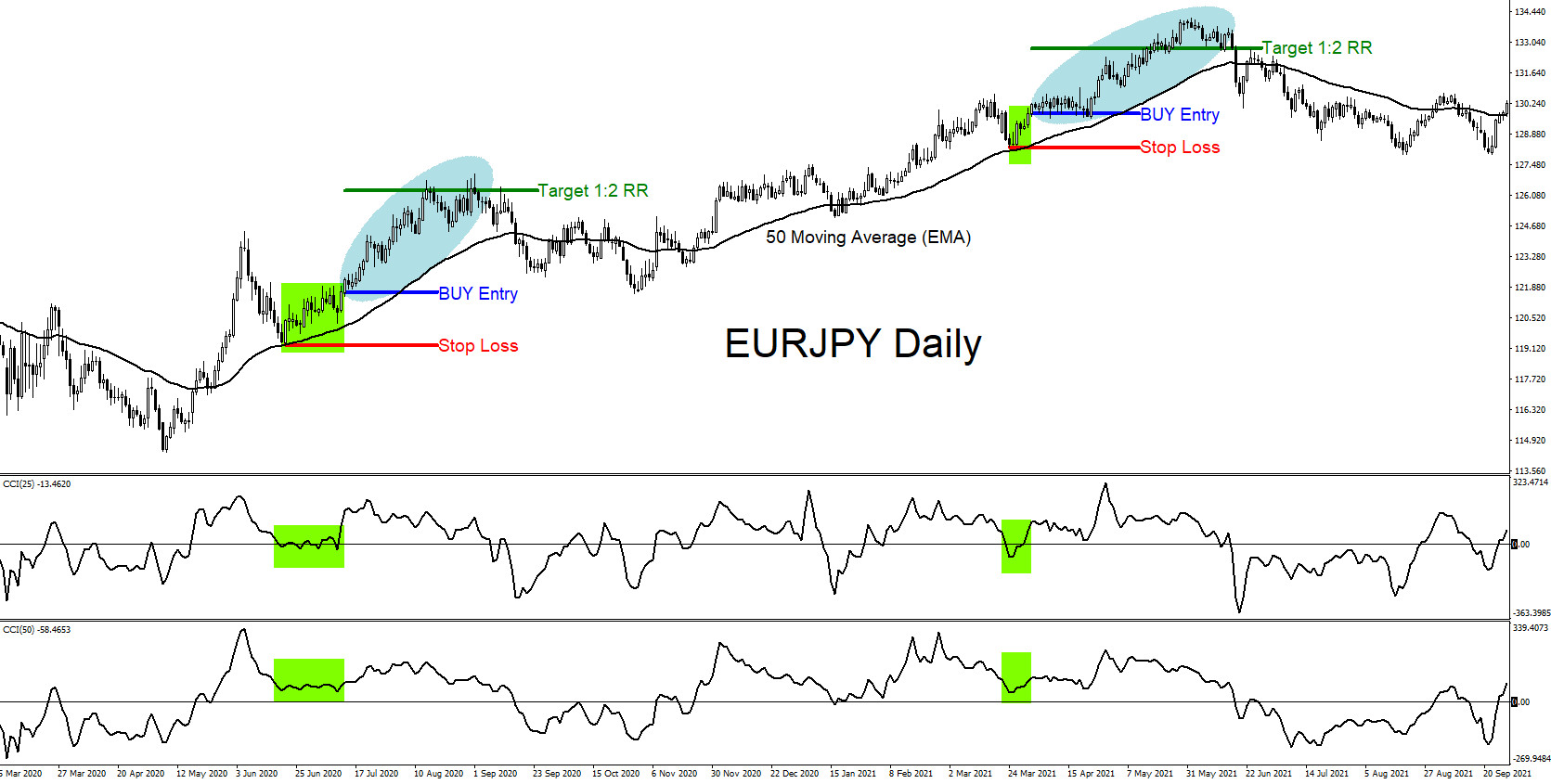

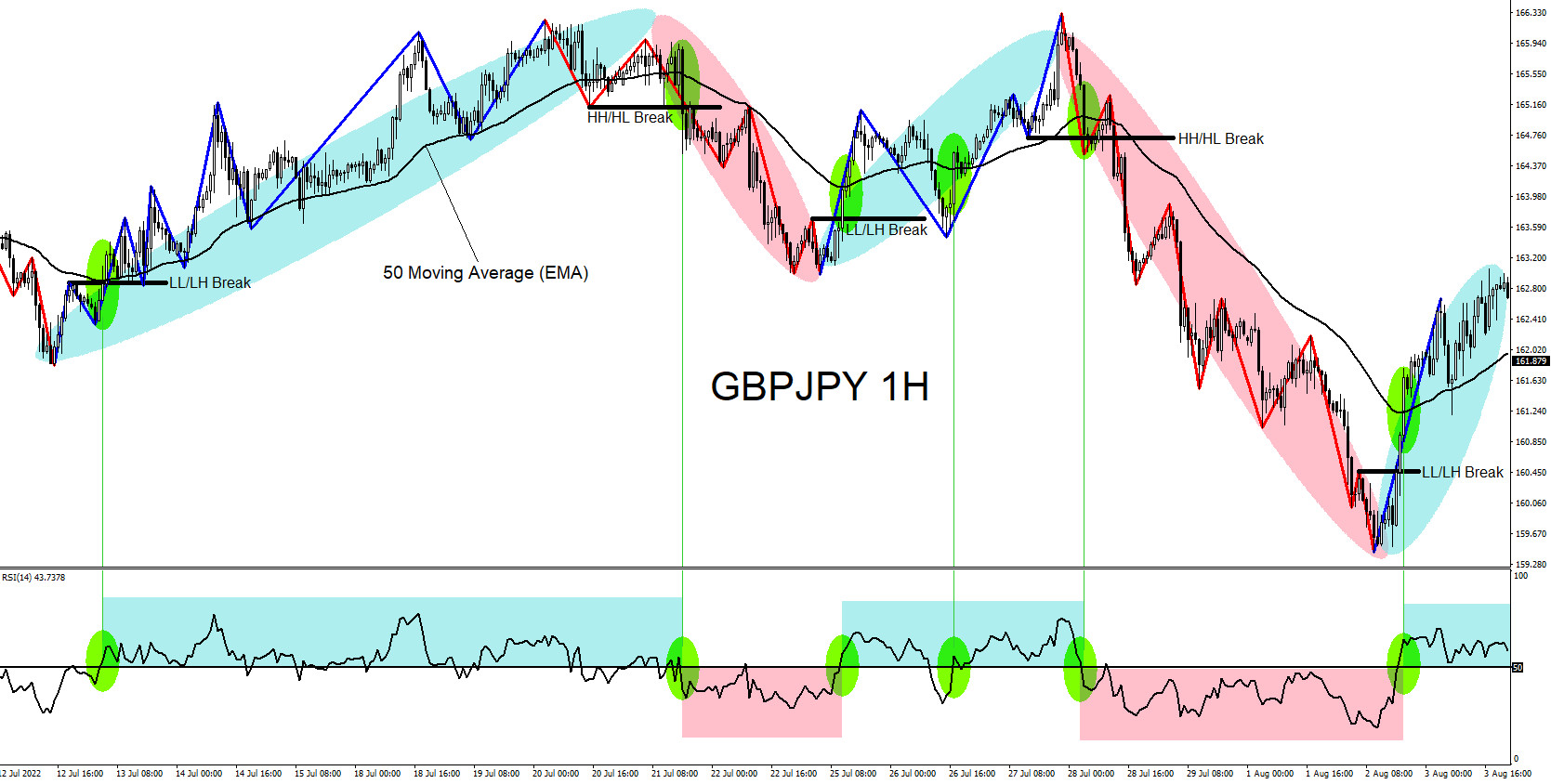

Trend Continuation Trading Strategy

Read MoreConfluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders, HH/HL and LL/LH sequences etc.), price action analysis (Support & Resistance, Supply & Demand Zones, Candlestick analysis etc.) and […]

-

Combining Technical Indicators to Form a Trading Strategy

Read MoreConfluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders, HH/HL and LL/LH sequences etc.), price action analysis (Support & Resistance, Supply & Demand Zones, Candlestick analysis etc.) and […]