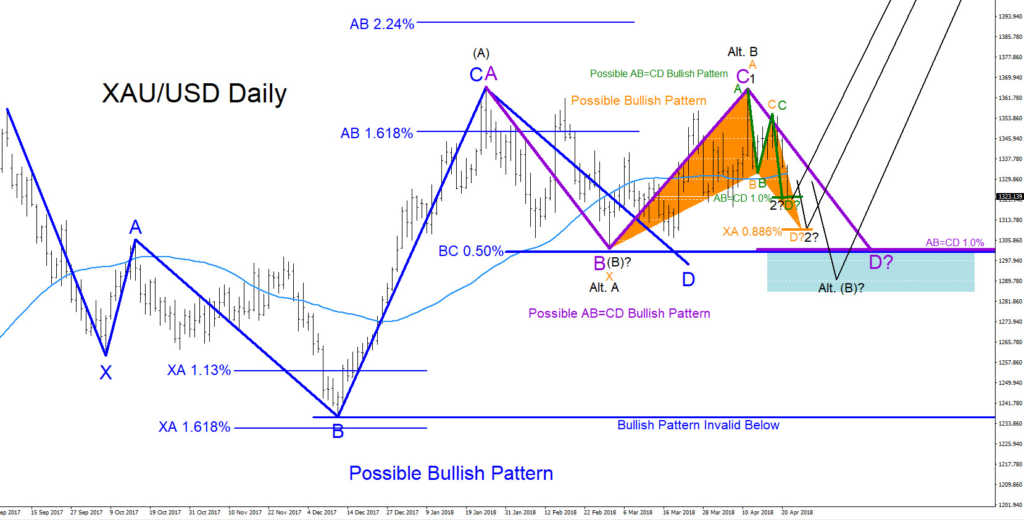

XAUUSD (Gold) Technical Analysis 4.25.2018

XAUUSD (Gold) remains bullish as long as the December 12/2017 low remains untouched. On the Daily chart there are clear visible bullish patterns that can be seen. Bullish Elliott Wave counts can also add more reasons that a possible rally higher can be seen in the near future. In the chart below, wave (B) can possibly have terminated at the March 1/2018 low and the rally higher, from this low, to the April 11/2018 high has possibly terminated the wave 1 of a possible impulse wave pattern higher. In the chart below, market patterns are used to determine where the wave 2 can possibly terminate. The first area where wave 2 can terminate is at the green bullish AB=CD pattern entry level which triggers at the Fib. extension 1.0% level (1322). If this level fails and price continues descending lower there will be another bullish pattern (orange) that triggers BUYS at the XA 0.886% Fib. retracement level (1309) where wave 2 can possibly terminate and bounce higher. Only a break below the March 1/2018 low will change the wave count to the Alternate count which will make the March 1/2018 low wave A, the April 11/2018 high wave B followed by a move lower to terminate wave (B). Alternate count is still a bullish view for the fact that there are two visible bullish patterns that trigger BUYS if Gold decides to extend even lower. Purple AB=CD bullish pattern triggers BUYS at the 1302 level and the blue bullish pattern triggers BUYS at the BC 0.50% Fib. retracement level 1301. If XAUUSD extends lower for the Alternate wave count the 1302 – 1280 area should surely find a bottom and GOLD should reverse and commence the rally higher. If looking to buy XAUUSD switch over to the smaller time frames and only look for bullish/buy signals.

XAUUSD Daily Chart April 23/2018

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 76 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back