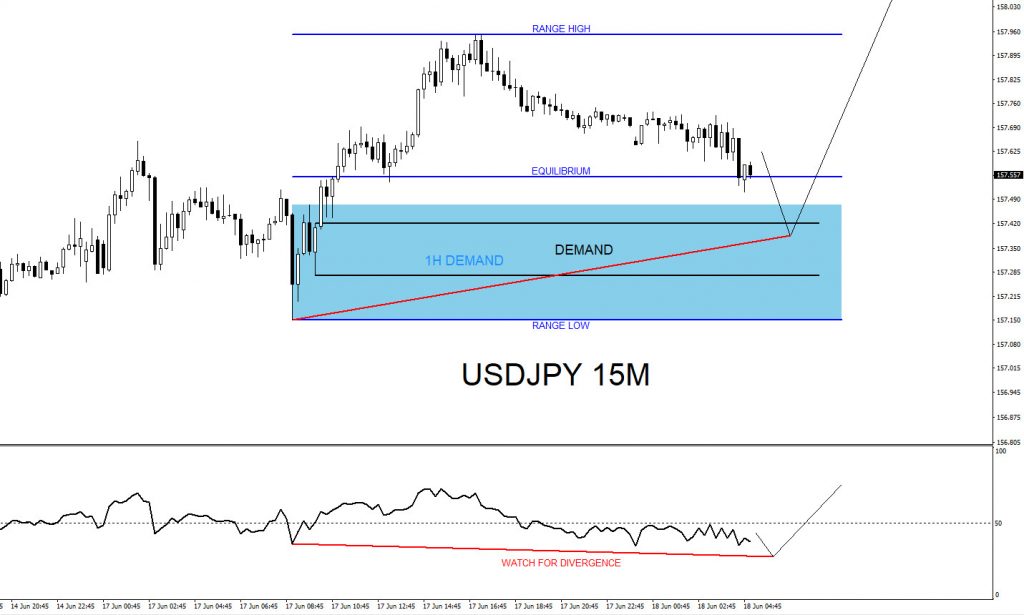

The USDJPY pair is currently in an uptrend. Looking at the 15 minute chart below, we could expect for USDJPY to dip lower below the equilibrium level and tap into either the 1 hour demand zone (Blue) or the 15 minute demand zone (Black) where price can get a reaction bounce higher. The pair can get a reaction from any of these zones so we advise switching to a smaller time frame (5M or 1M) for signs that the pair will want to reverse higher. On the smaller time frames watch for a MSS/Market Structure Shift pattern to form. Switching down to the smaller time frames can also give the trade a better risk to reward ratio with tighter stops. If price continues below the range low without providing an entry pattern then we will remain on the sidelines and continue to search for the next trading opportunity.

USDJPY 15 Minute Chart June 17 2024

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup.

We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

Back