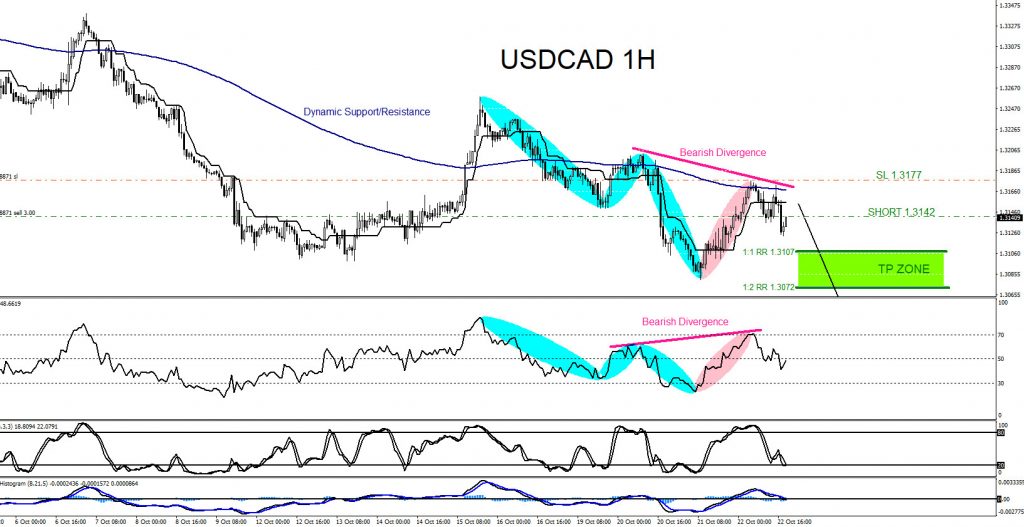

On October 22 2020 I posted on social media Stocktwits/Twitter @AidanFX “USDCAD Sold/Short at 1.3142 Stop Loss 1.3177 Target 1.3107-1.3072 area.” The chart below of the USDCAD pair shows a bearish Lower Low/Lower High sequence (light blue) signalling the pair is in a down trend. A bearish divergence pattern (pink) formed when price chart registered a Lower High but oscillator indicator was registering a Higher High. This was a signal to traders that USDCAD found a possible resistance area and the pair could reverse lower. Combining the bearish divergence market pattern together with price hitting and reacting lower off the Dynamic Support/Resistance moving average (dark blue) was enough for me to call the SELL/SHORT trade looking to hit the minimum 1:1 RR – 1:2 RR target zone below. Stop loss was set at the previous Lower High where the bearish divergence pattern formed. At the moment USDCAD has still not hit the proposed minimum target zone and we will continue to expect for price to move lower this coming trading week as long as price does not reverse higher and hit the stop loss. The pair has a high probability to extend lower towards the 1.3040-1.3020 area.

USDCAD 1 Hour Chart October 22 2020

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back