-

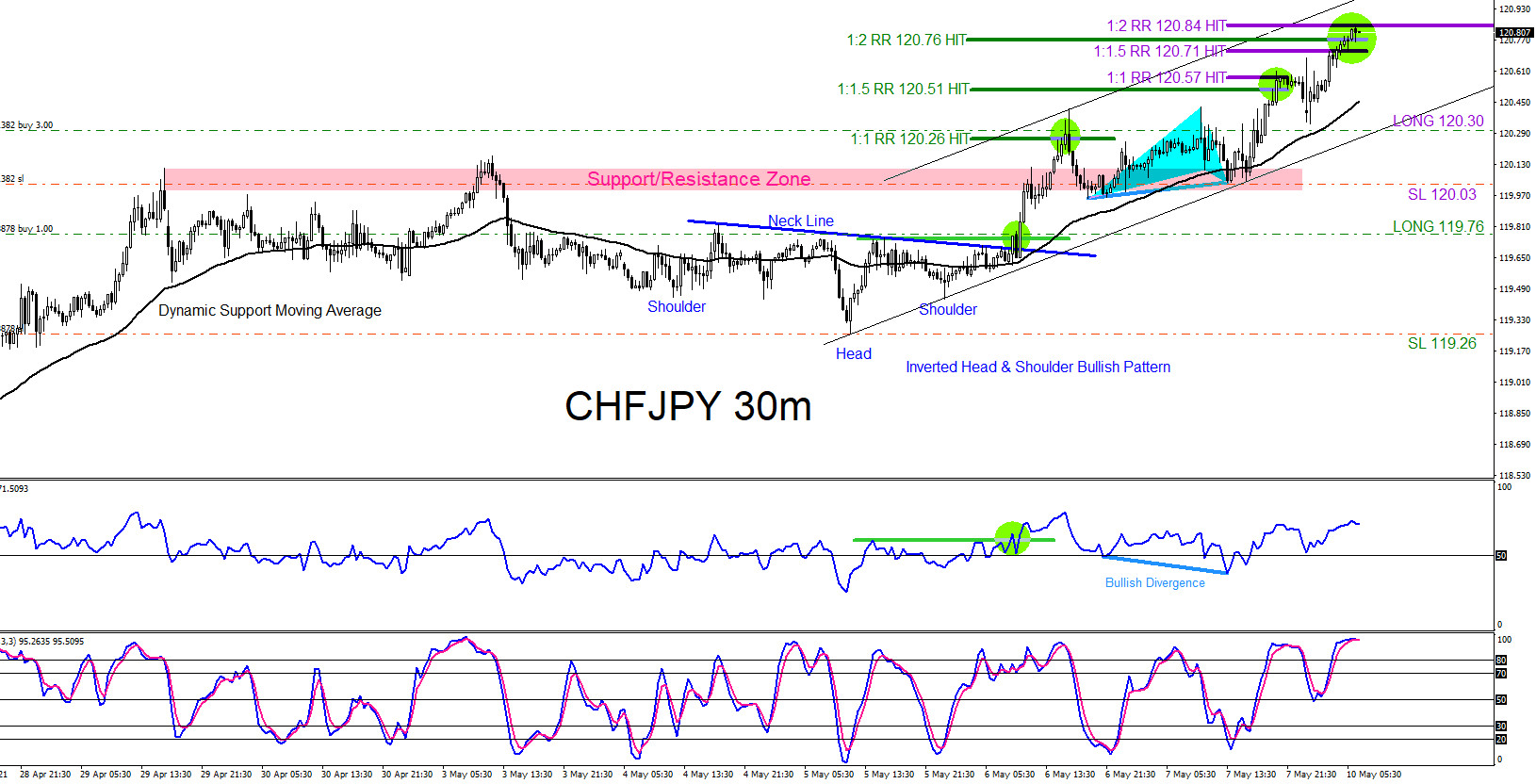

CHFJPY : Bullish Market Patterns Calling the Move Higher

Read MoreOn May 5 2021 I posted on social media @AidanFX “CHFJPY As long as price stays above 119.26 the pair will move higher towards the 120.50 area. Will be watching for buying opportunities” and “Watch for CHFJPY BUY on break above 119.76 with stops at 119.26 targeting the 120.26 – 120.50 area.” On May 7 2021 […]

-

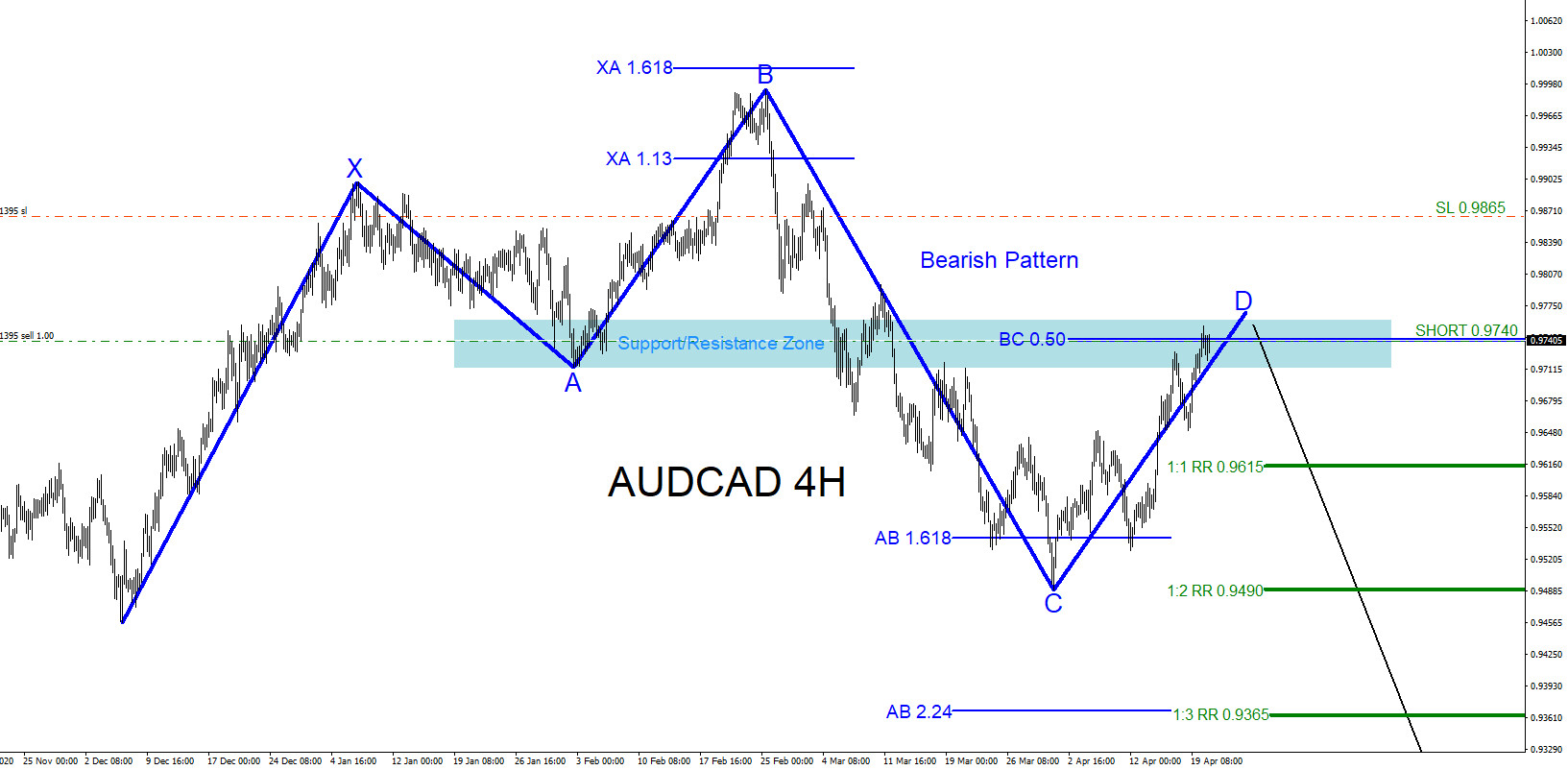

AUDCAD : Tracking and Trading the Move Lower

Read MoreOn April 19 2021 I published an article calling for AUDCAD to move lower -> AUDCAD : Possible Bearish Pattern? . In the article I explained where possible sellers would be waiting to enter and push the pair lower. The first chart below was posted on social media @AidanFX April 14 2021 and the second […]

-

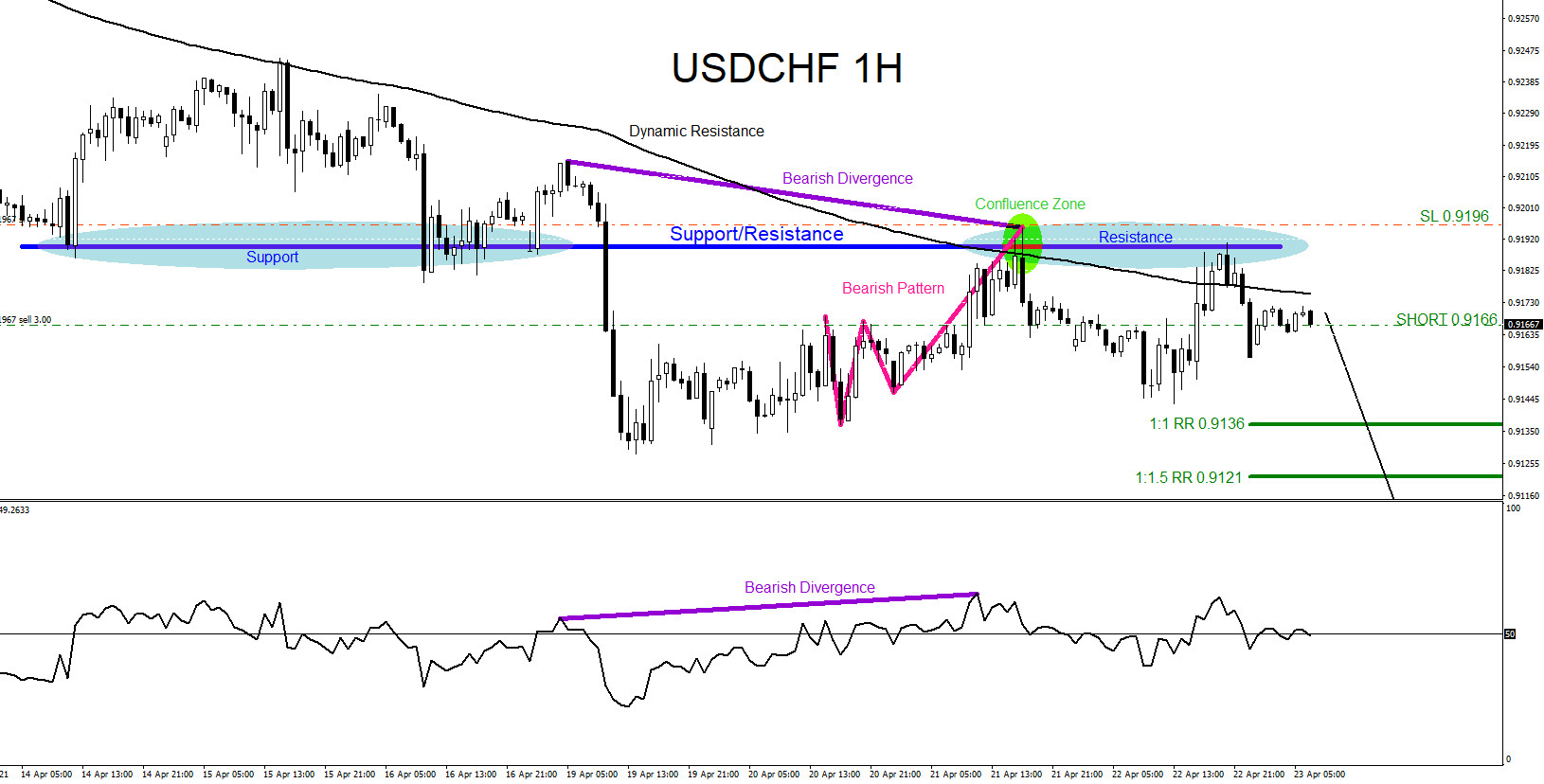

USDCHF : Moves Lower as Expected

Read MoreOn April 21 2021 I posted on social media @AidanFX “USDCHF as long as price stays below 0.9215 the pair can still make another move lower towards 0.91 handle.” The chart below was also posted on social media @AidanFX April 23 2021 showing the possible bearish patterns. Pink bearish pattern triggered SELLS perfectly in the […]

-

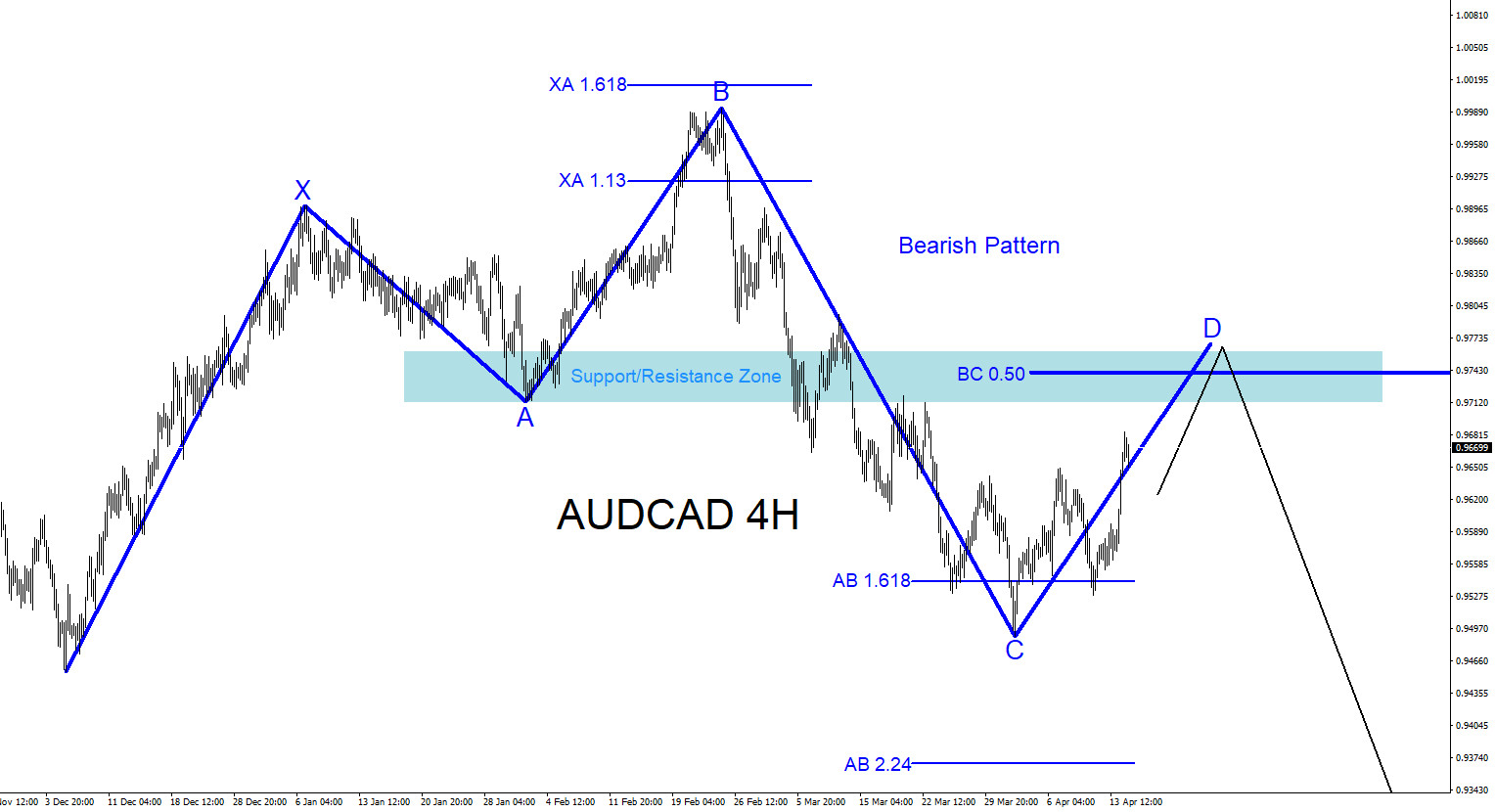

AUDCAD : Possible Bearish Pattern?

Read MoreA possible bearish pattern is visible on the AUDCAD 4 hour time frame. The blue bearish pattern still needs to make a push higher to complete point D at the BC 0.50% Fib. retracement level where AUDCAD can possibly find sellers to push the pair lower. The BC 0.50% Fib. level is also situated in […]

-

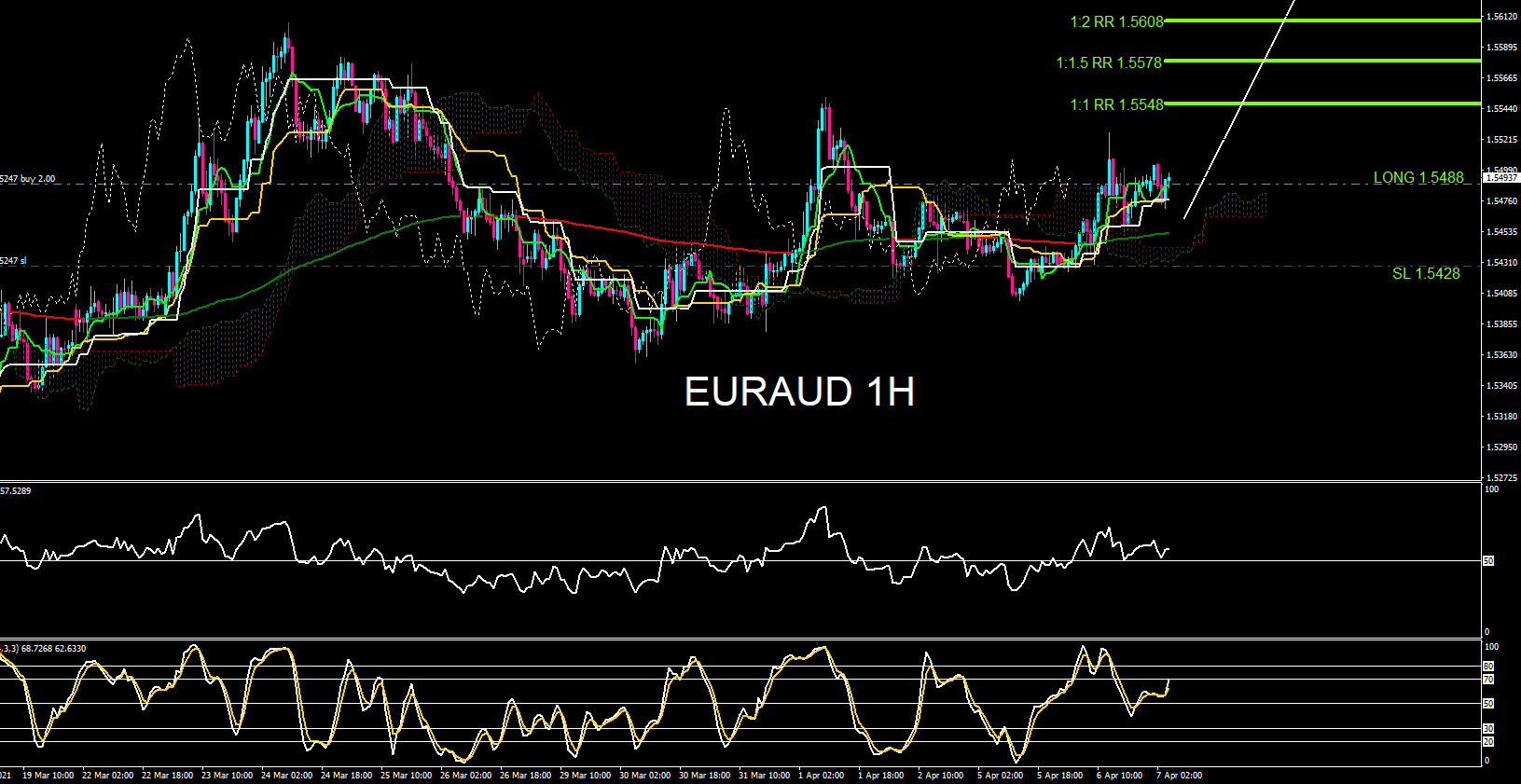

EURAUD : Rallied Higher as Expected

Read MoreTowards the end of February 2021 EURAUD seemed to have found a temporary bottom and has been trading sideways since. The pair still needs to make another move higher above the February 26 high to at least confirm a 3 wave move minimum to complete a corrective wave sequence. The overall trend on the higher […]

-

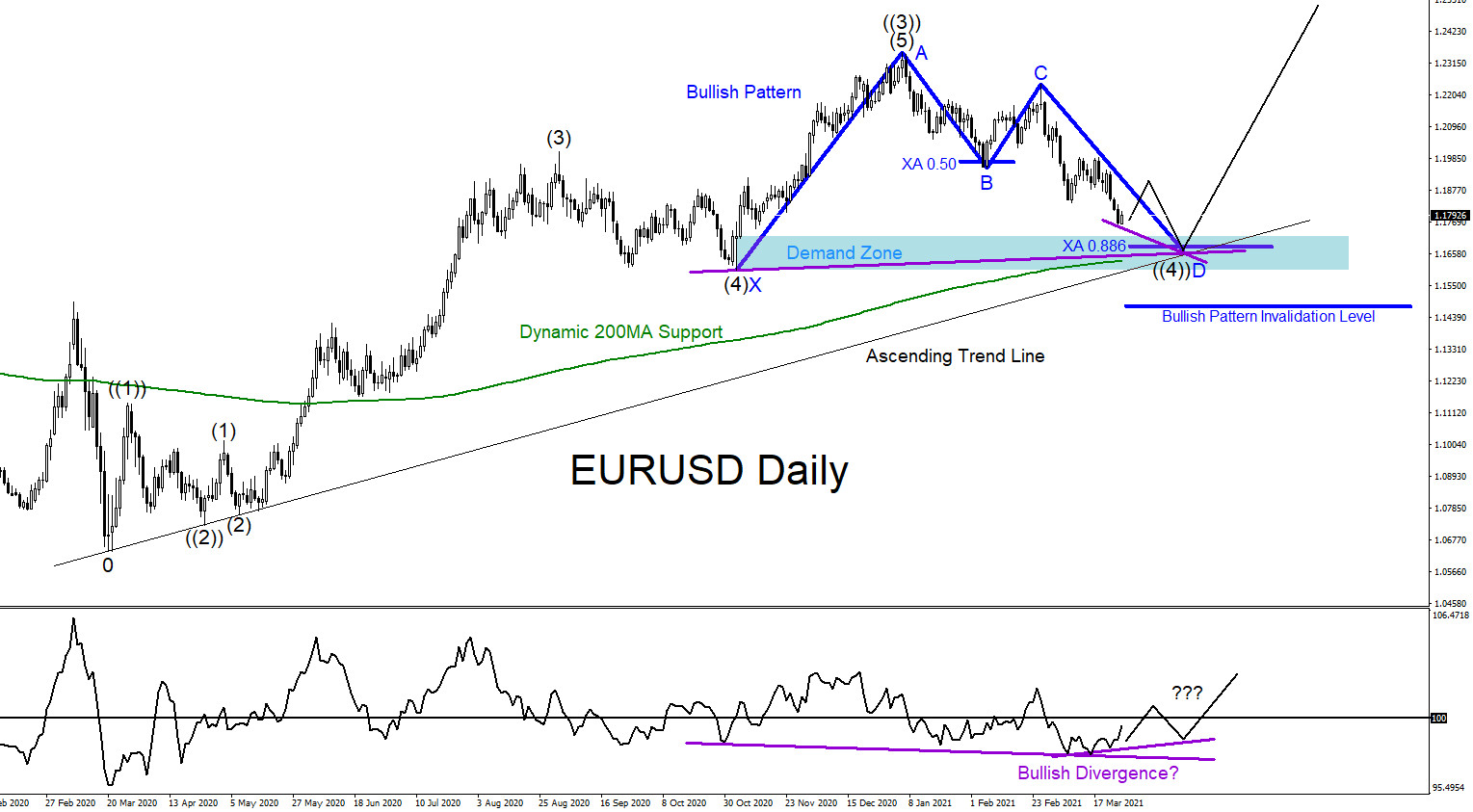

Will EURUSD Rally Higher?

Read MoreIn the chart below there are clear visible bullish market patterns that can signal for another possible move higher for the EURUSD pair. The pair still needs to do a push lower where bulls could be waiting to push the pair higher. Dark blue bullish market pattern triggers BUYS at the XA 0.886% Fib. retracement […]