-

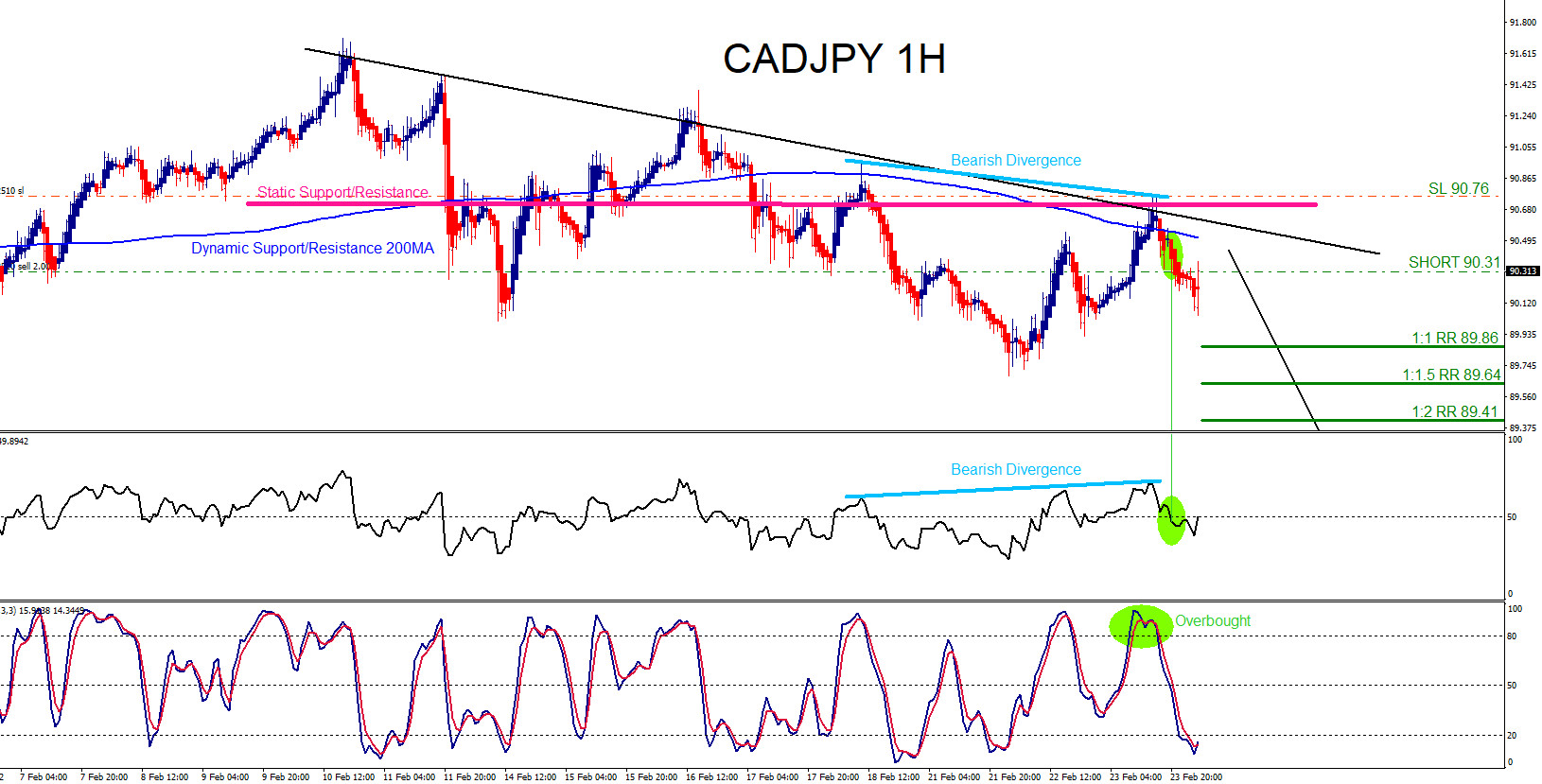

CADJPY : Catching the Move Lower

Read MoreOn February 23 2022 I posted on social media @AidanFX “SHORT/SELL CADJPY“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders etc.), price action analysis (Support & Resistance, […]

-

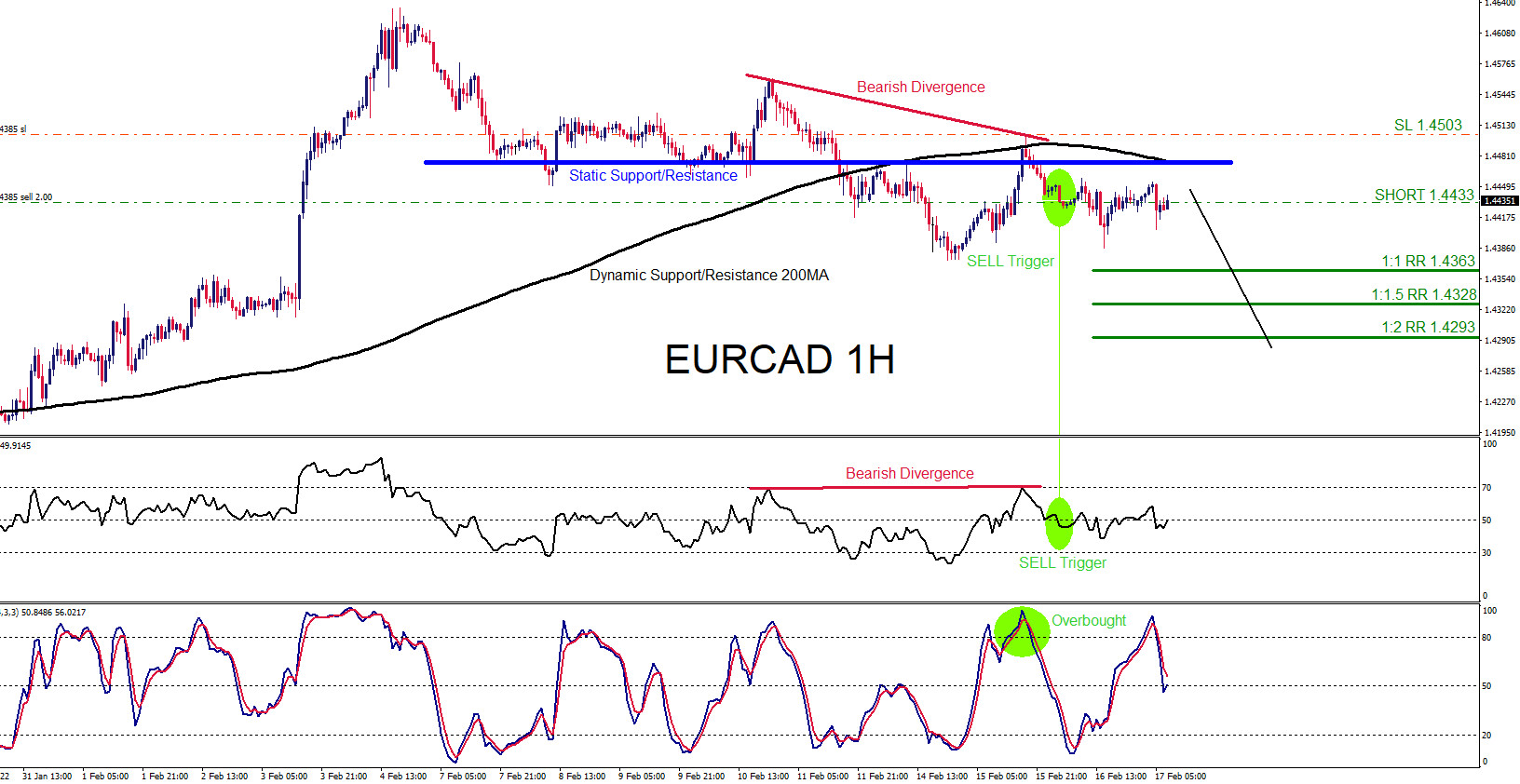

EURCAD : Catching the Sell Setup

Read MoreOn February 17 2022 I posted on social media @AidanFX “ SHORT EURCAD at 1.4433 Stop Loss at 1.4503 Target 1.4363 – 1.4328 area.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott […]

-

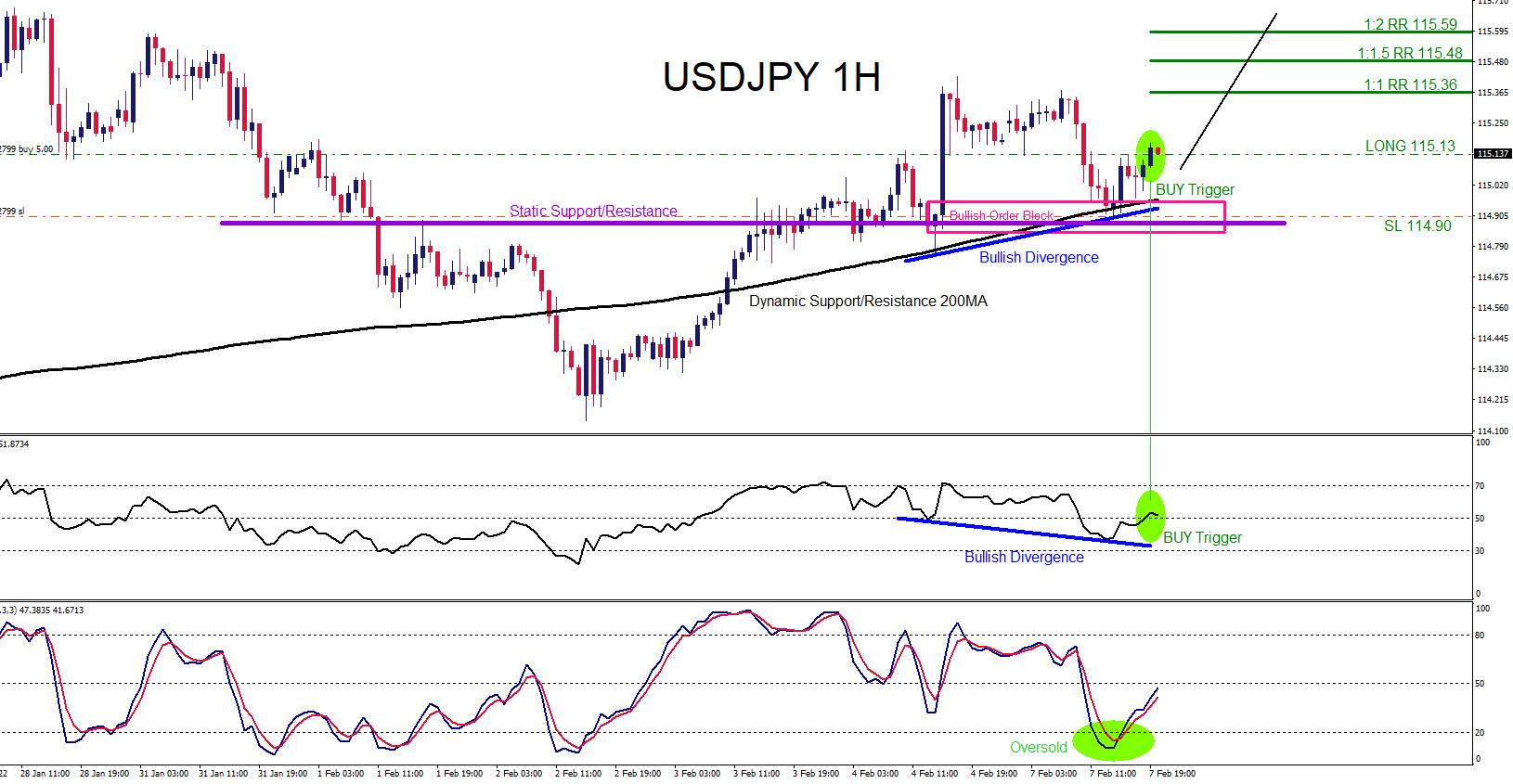

USDJPY : Trading the Move Higher

Read MoreOn February 7 2022 I posted on social media @AidanFX “ USDJPY Will be watching for BUYING opportunities for a move higher towards 115.36 – 115.59 area. Price needs to stay above 114.90 so any buying stop loss will be this level.“ Confluence trading is a combination of two or more trading strategies/techniques that come […]

-

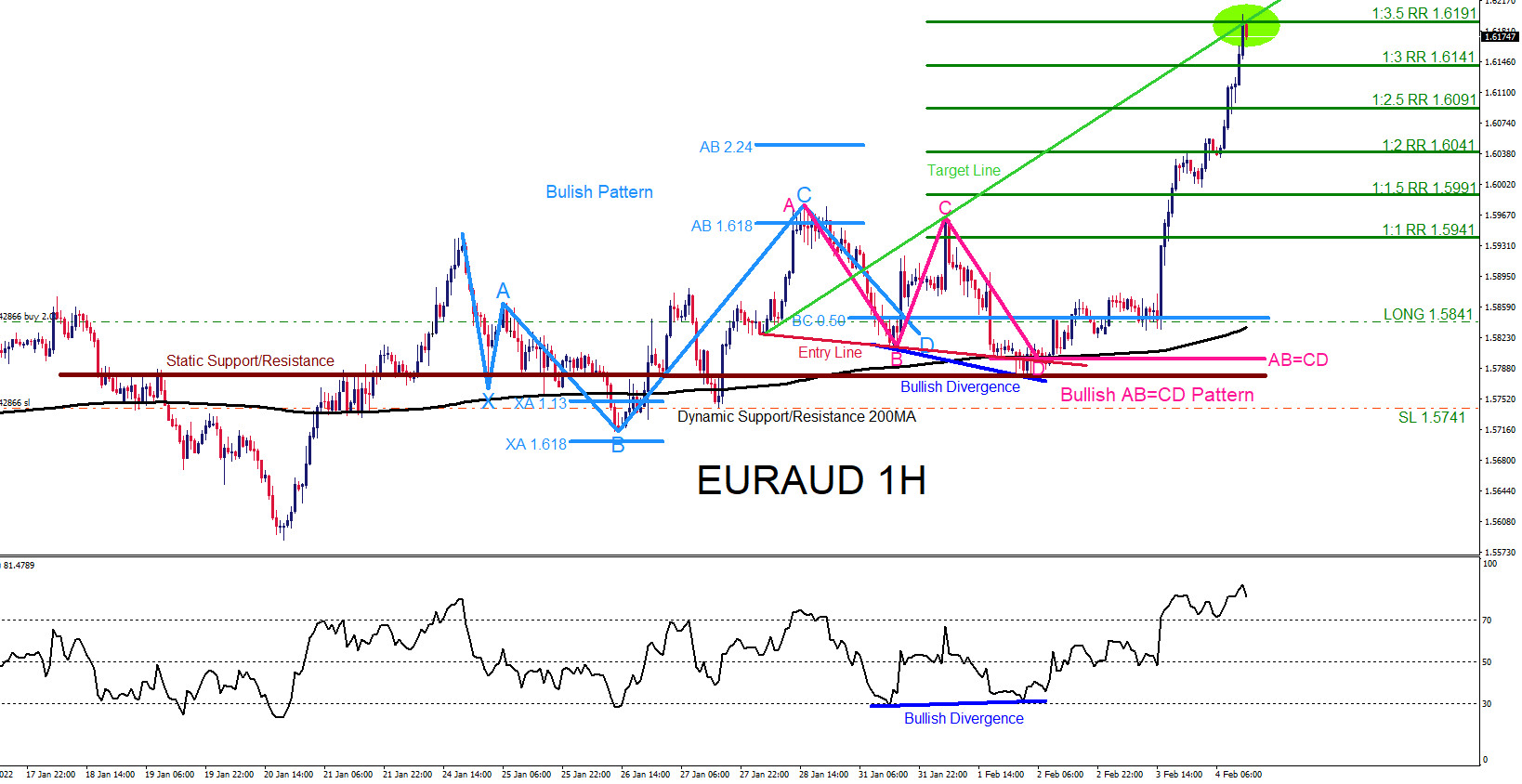

EURAUD : Trading the Move Higher

Read MoreOn January 31 2022 I posted on social media @AidanFX “ EURAUD Watch for buying opportunities as long as price stays above 1.5741.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, […]

-

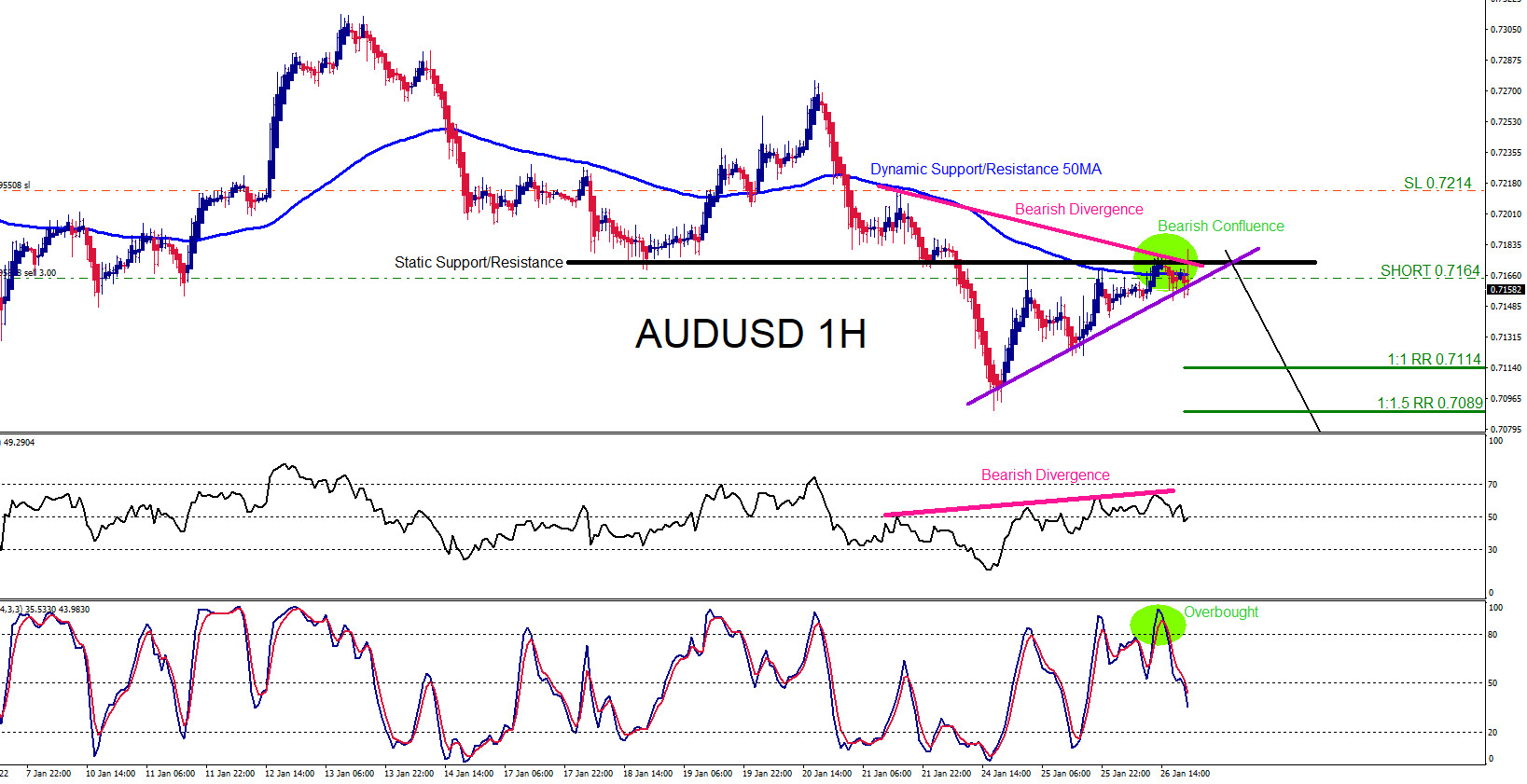

AUDUSD : Trading the Move Lower

Read MoreOn January 26 2022 I posted on social media @AidanFX the AUDUSD SELL/SHORT Trade Setup. Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders etc.), price action analysis […]

-

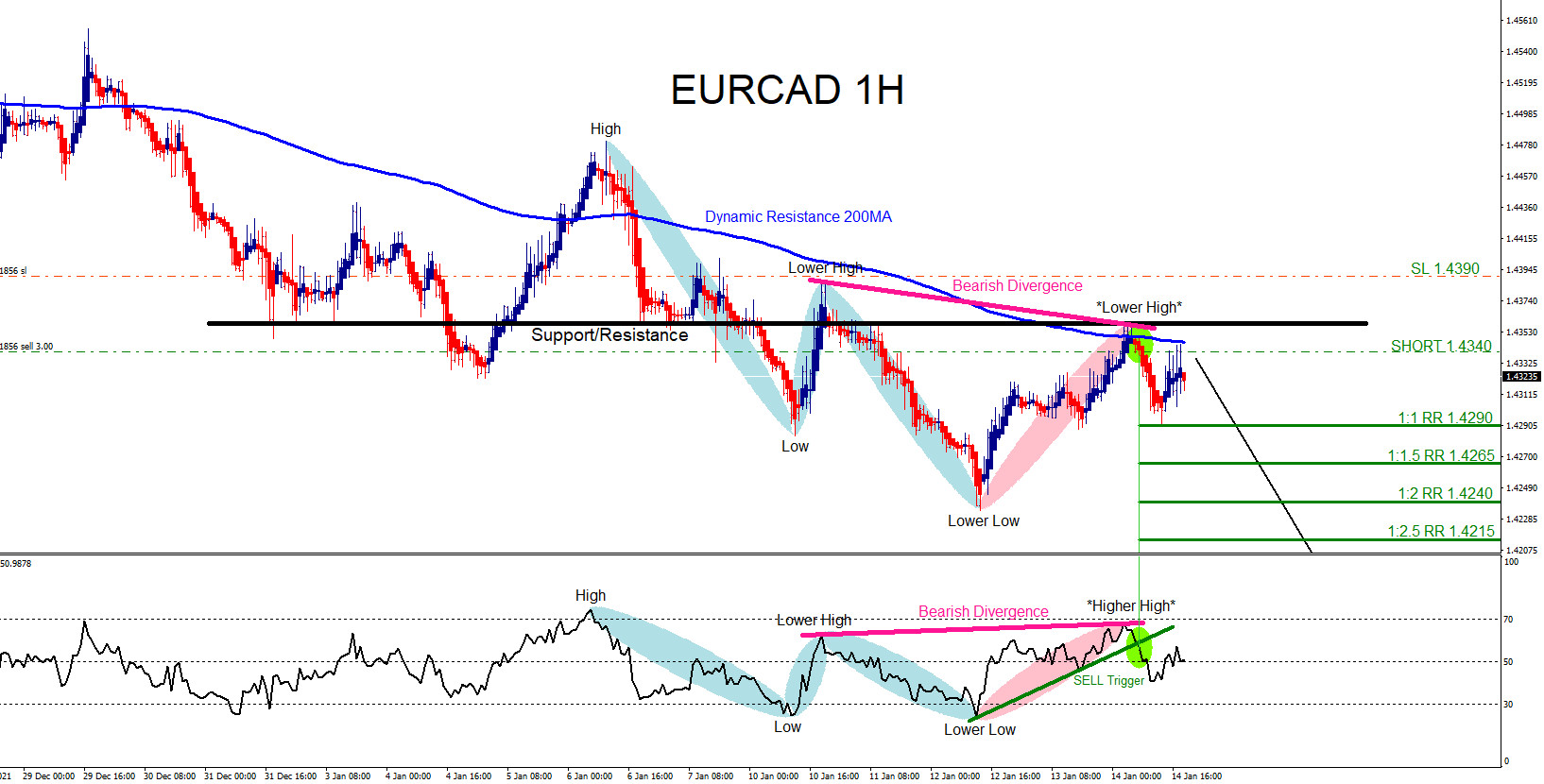

EURCAD : Trading the Move Lower

Read MoreOn January 13 2022 I posted on social media @AidanFX “ EURCAD Watch for a move lower. Watch for selling opportunities. As long as price stays below 1.4387 the pair will move lower towards the 1.4230 area.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high […]