-

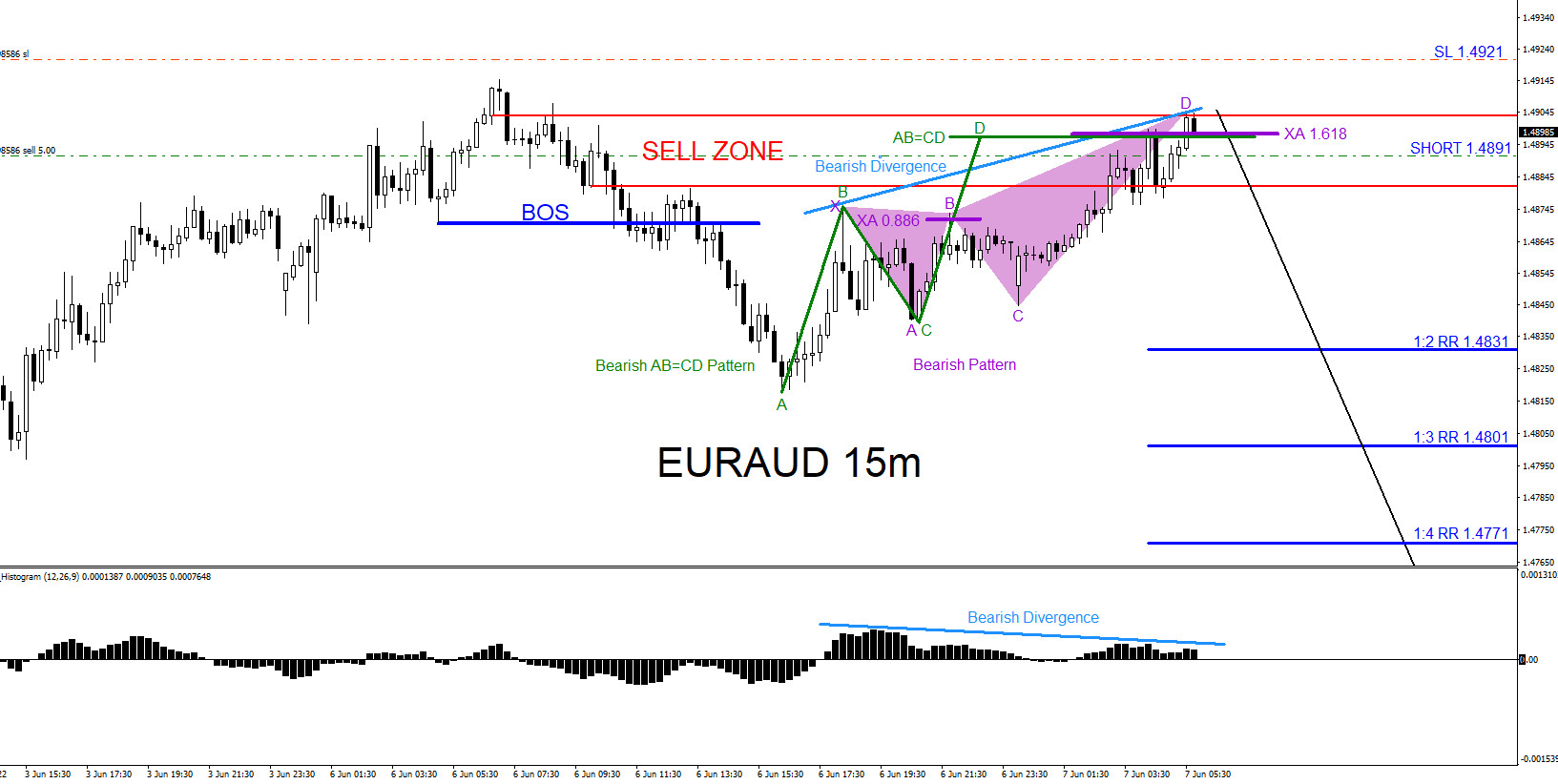

EURAUD : Catching the Sell Setup for a Move Lower

Read MoreOn June 6 2022 I posted on social media @AidanFX “ EURAUD : I will be watching the 1.4890 area for possible selling opportunities against 1.4920 stop loss and targeting the 1.4790-1.4760 area.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in […]

-

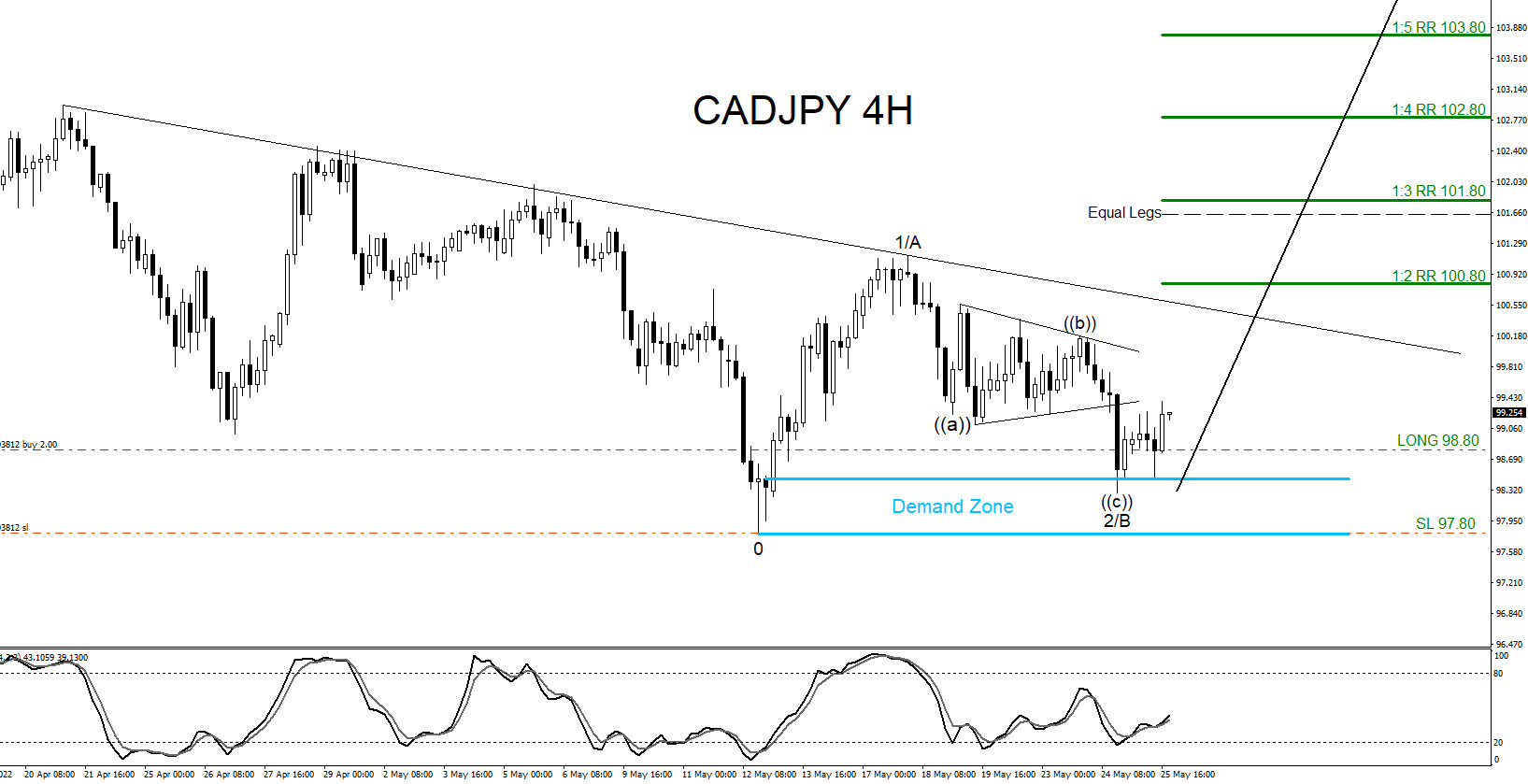

CADJPY : Remains Bullish Pushing for New Highs

Read MoreThe CADJPY chart below was posted on social media @AidanFX on May 25 2022 showing price terminating wave 2 (B alternate) in Demand Zone (Light Blue) and looking to see a reaction higher from the zone. Stochastic indicator showing divergence from wave ((a)) low to wave ((c)) low and hit oversold levels confirming a possible […]

-

AUDJPY : Will the Pair Move Higher?

Read MoreOn May 18 2022 I posted on social media the AUDJPY 4 hour chart bullish scenario. In the chart below there are clear visible bullish market patterns that are calling for a move higher. Blue bullish market pattern already triggered BUYS at the pattern entry line where point 5 terminated. Red bullish pattern also triggered BUYS […]

-

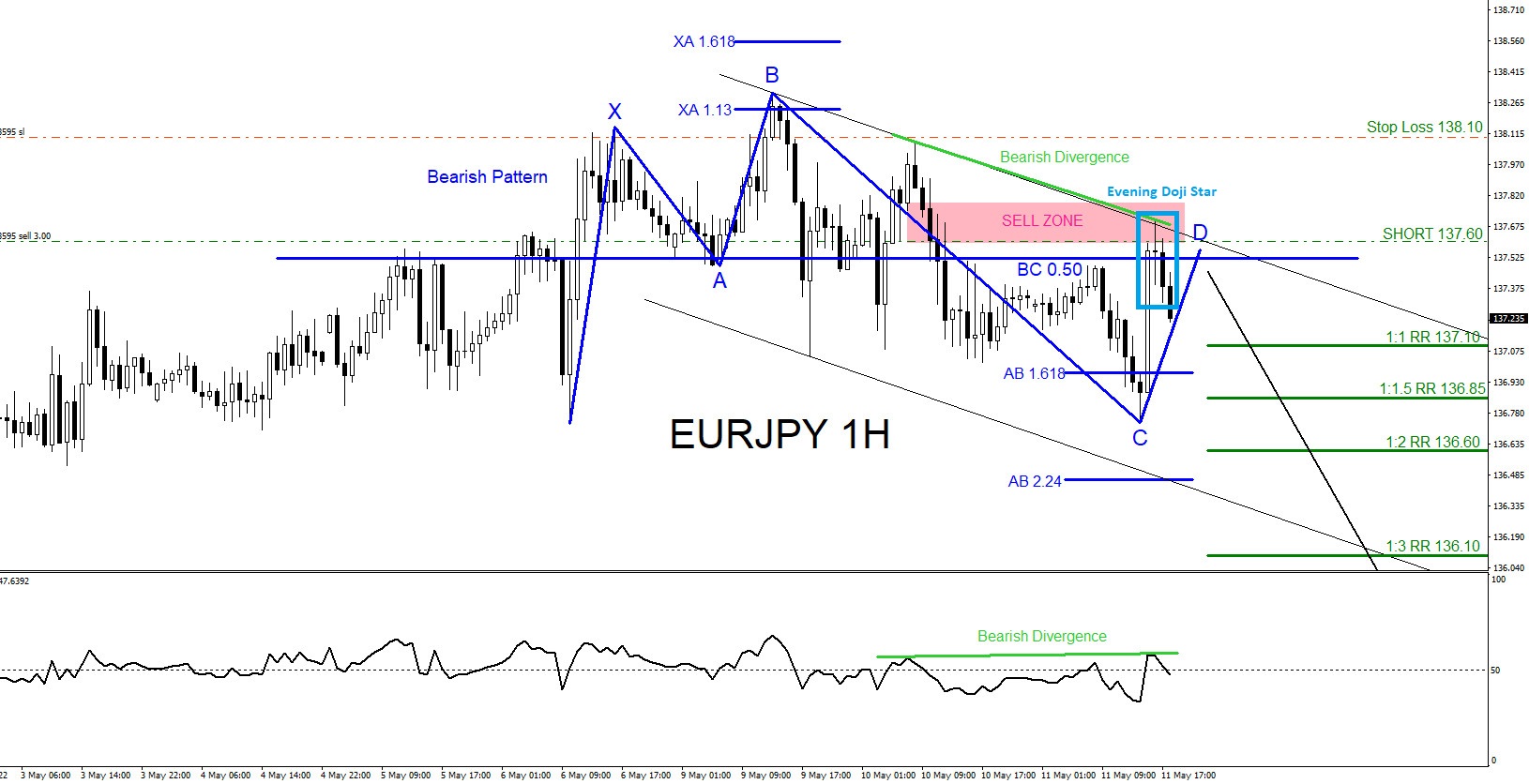

EURJPY : Bearish Market Patterns Signalling the Move Lower

Read MoreOn May 11 2022 I posted on social media “ EURJPY If price makes a bounce higher towards the 137.60-137.80 area will take a SELL against 138.10 Stop Loss.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in […]

-

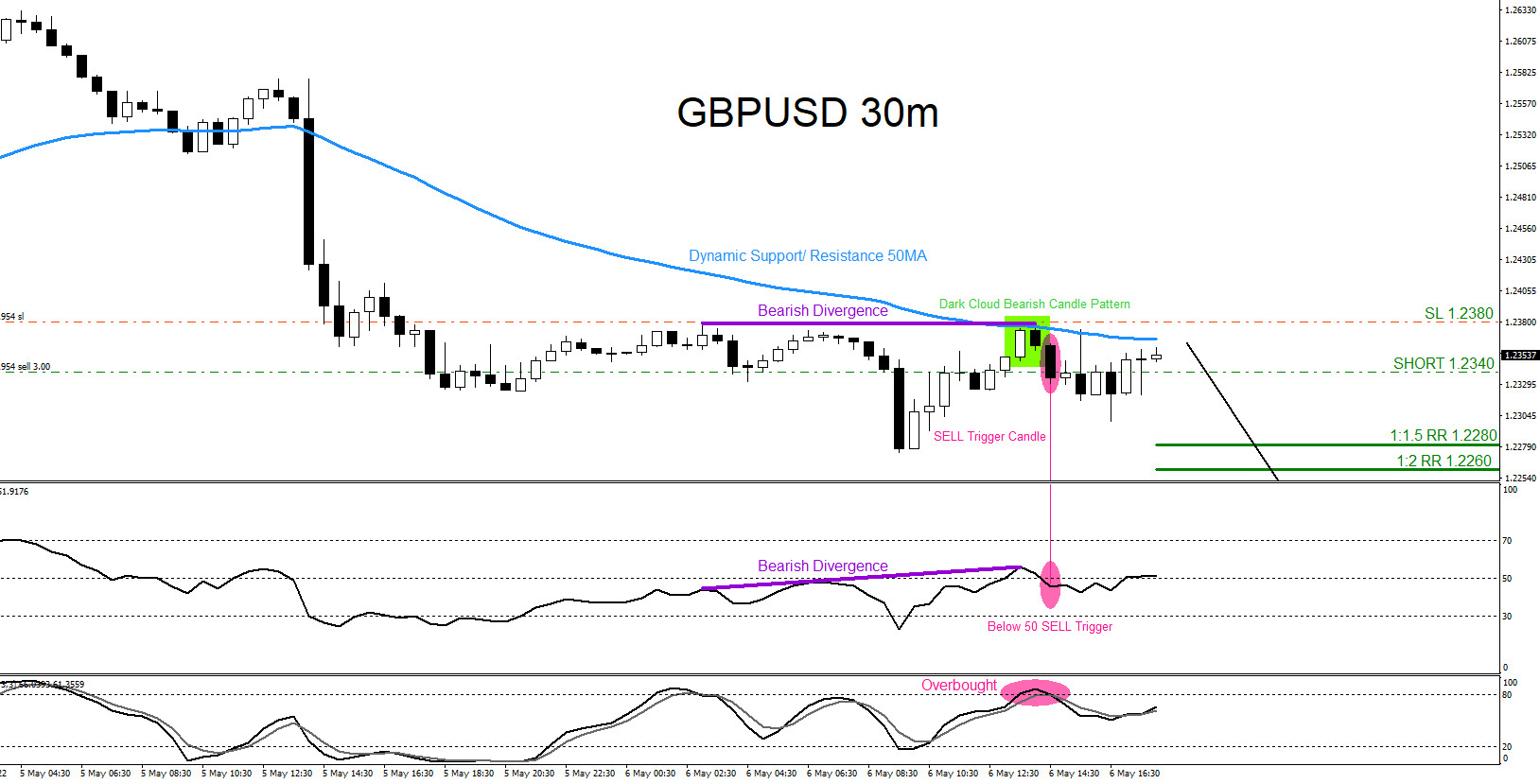

GBPUSD : Trading the Move Lower

Read MoreOn May 6 2022 I posted on social media “GBPUSD SOLD @ 1.2340 Stop Loss 1.2380 Target 1.2280 – 1.2260 area.“ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head […]

-

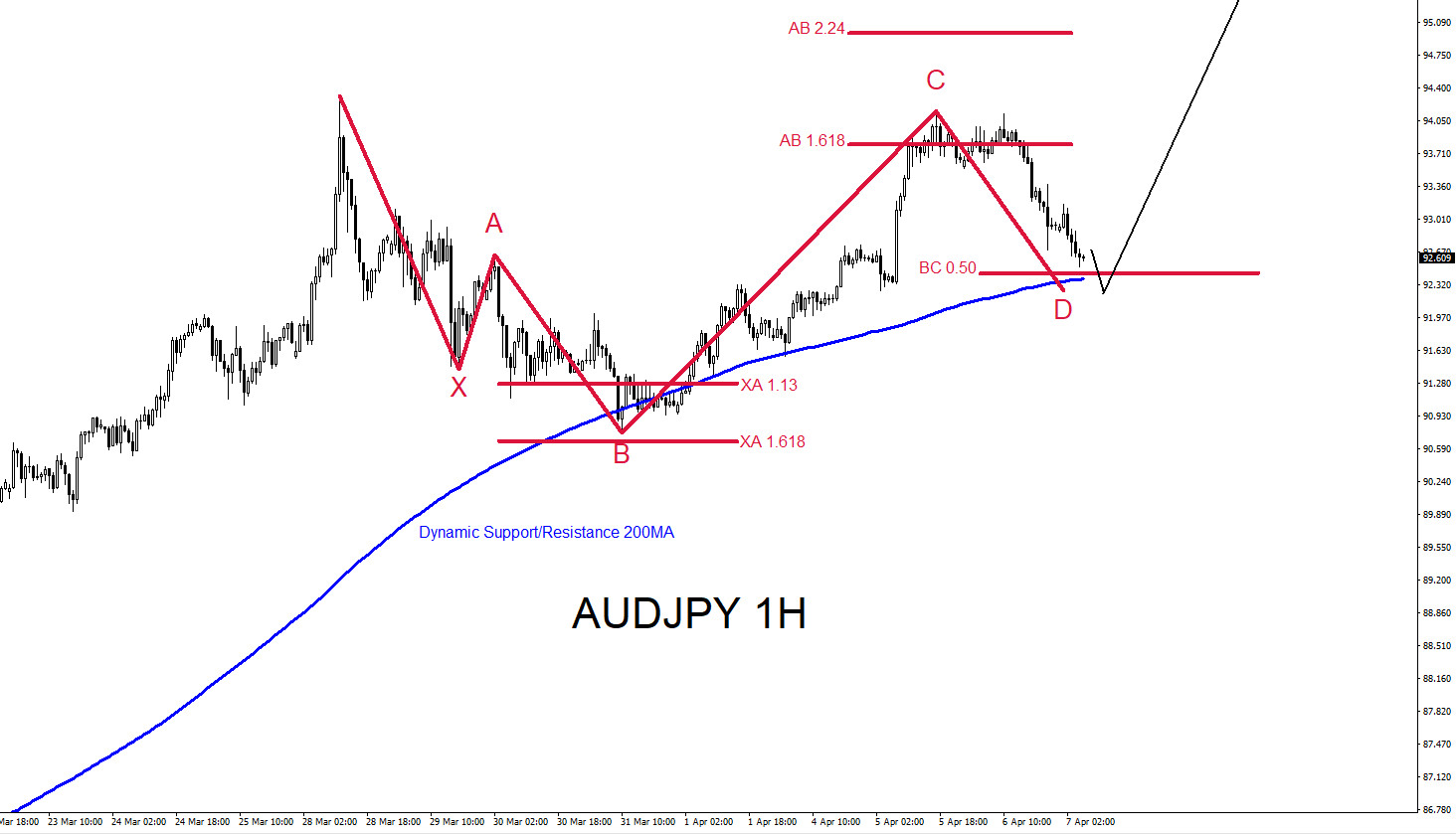

AUDJPY : Market Patterns Signalled the Move Higher

Read MoreOn April 6 2022 there were several market patterns that signalled the AUDJPY pair would move higher. Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders etc.), price action […]