-

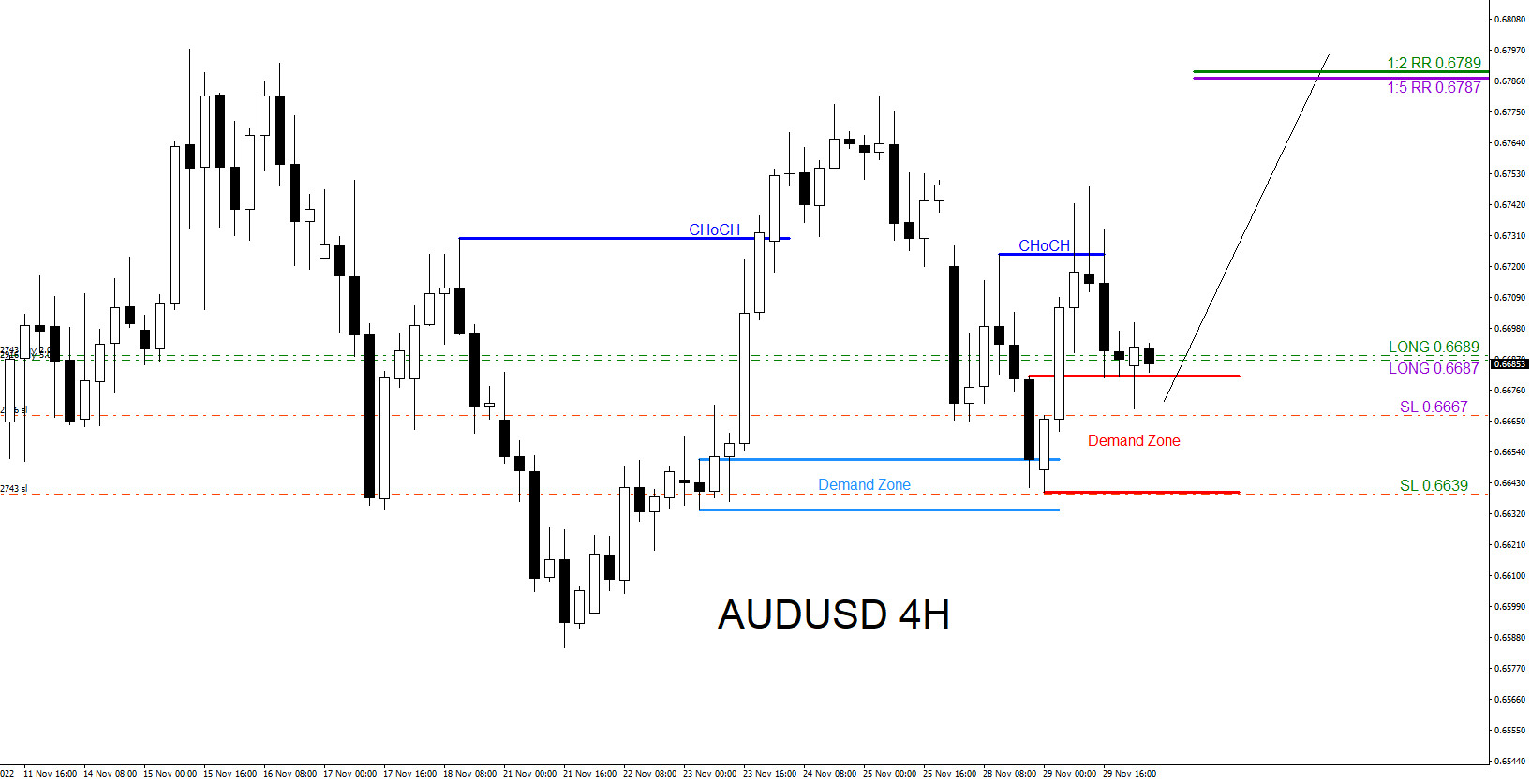

AUDUSD : Buy Trades Hits Targets

Read MoreOn November 29 2022 I posted two AUDUSD trade setups on social media @AidanFX “Market BUY AUDUSD at 0.6689 Stop Loss at 0.6639 Target at 0.6789 (1:2RR). ” and ” 2nd AUDUSD BUY at 0.6687 Stop Loss at 0.6667 Target at 0.6787 (1:5RR).” First BUY entry had a conservative wide stop and second BUY entry […]

-

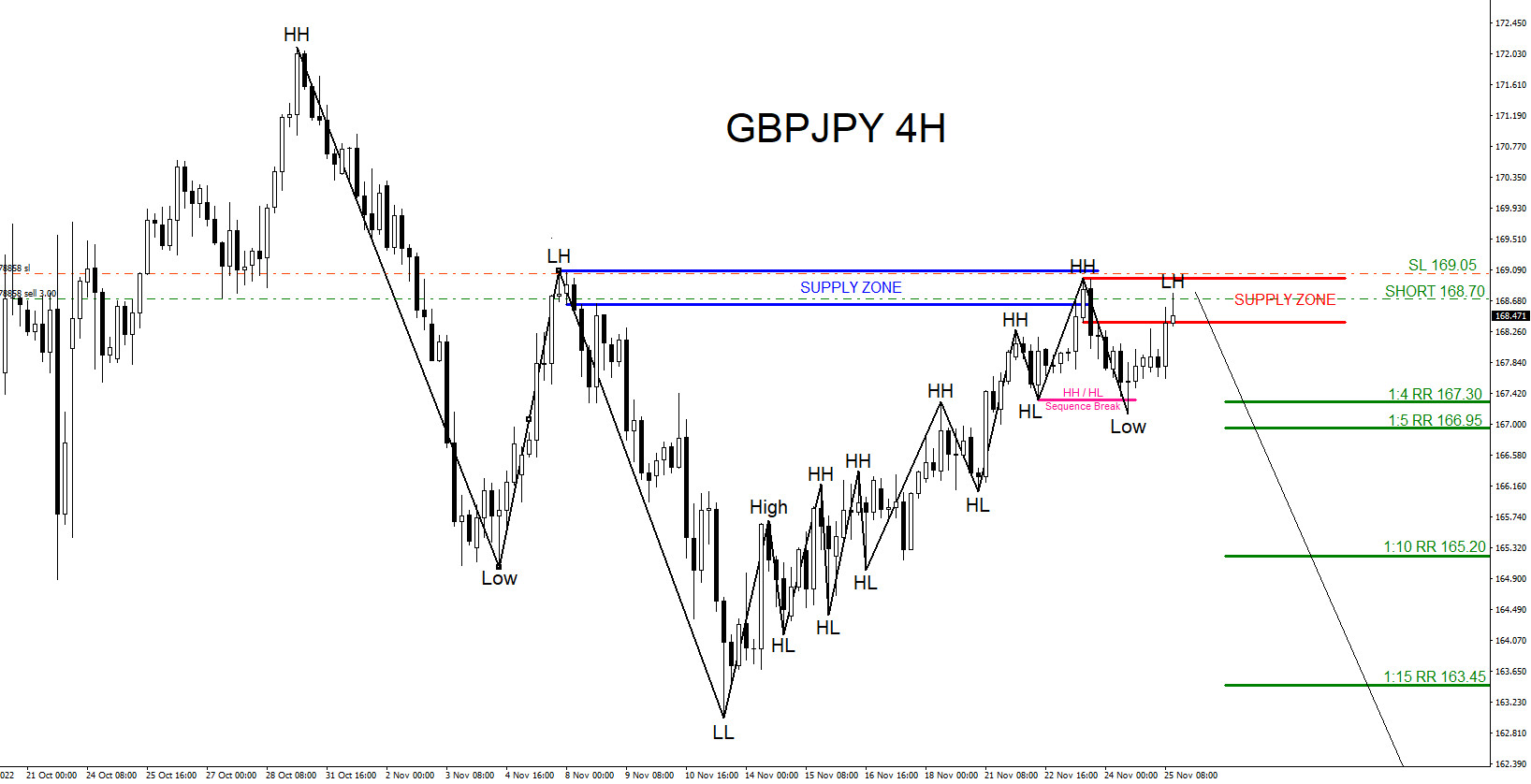

GBPJPY : Sell Trade Hits Targets

Read MoreOn Friday November 25 2022 I posted on social media @AidanFX “ GBPJPY will be watching for possible selling opportunities as long as price stays below 169.00 for a move lower towards the 167.30 – 166.95 area.” Also posted the SELL entry November 25 2022 “Sold GBPJPY at 168.70 Stop Loss 169.05 Target 166.95 (1:5RR)” […]

-

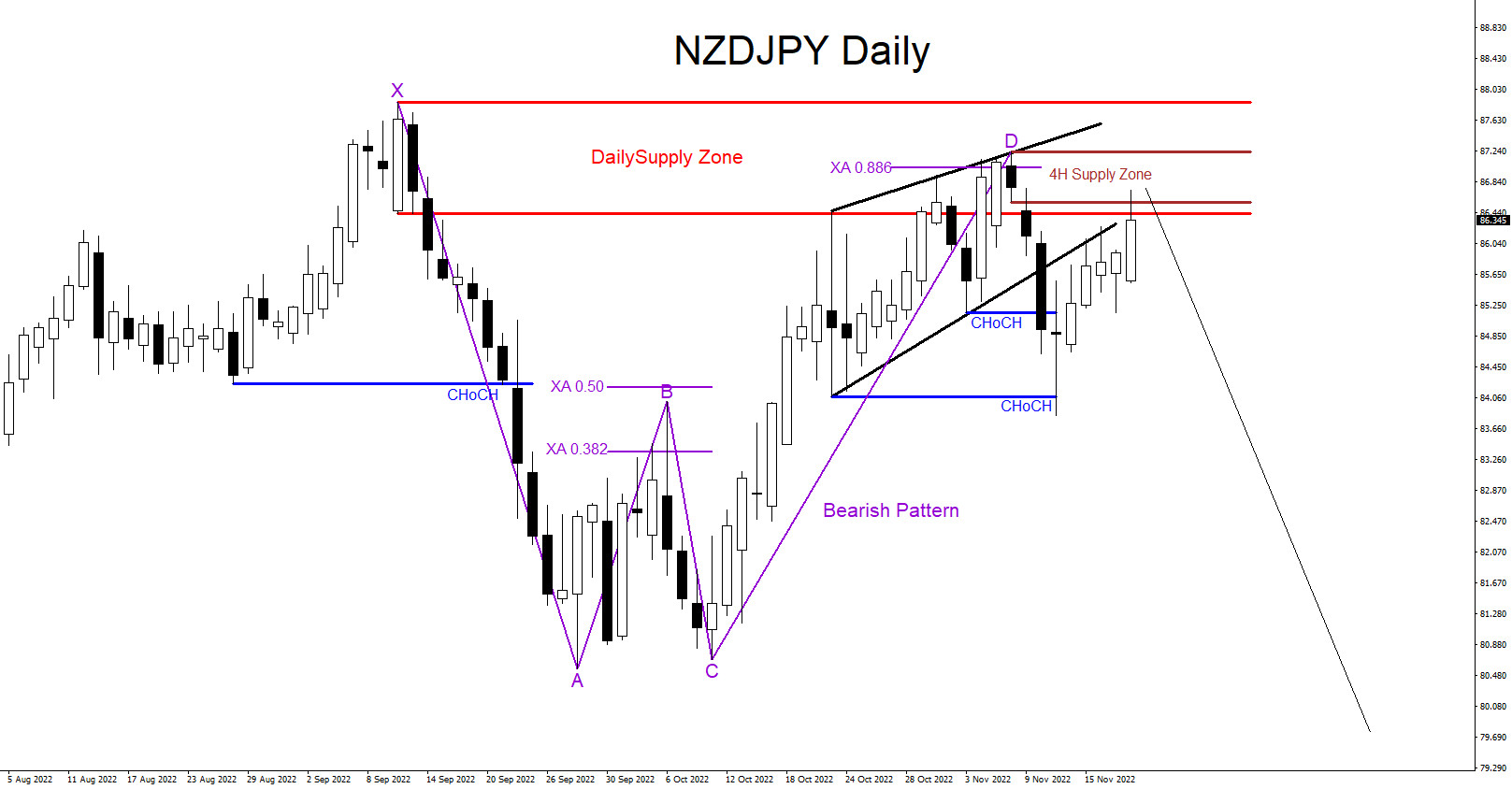

NZDJPY : Possible Move Lower?

Read MoreNZDJPY pair can be signalling for a move lower. There are visible market patterns that can be signalling for this possible scenario lower. As long as price remains below the high of the point D Bearish Pattern (Purple) we can expect the pair to reverse lower. Only time will tell what the pair will. SELL […]

-

GBPCAD : Buy Trade Hits Targets

Read MoreOn November 9 2022 I posted the GBPCAD trade setup on social media @AidanFX “ GBPCAD Watching for possible buying opportunities for a push higher towards the 1.5473-1.5533 area. ” and ” BUY GBPCAD at 1.5353 Stop Loss 1.5293 Target 1.5473 (1:2RR) 1.5533 (1:3RR) ” GBPCAD 1 Hour Chart November 9 2022 Buy Trade Setup […]

-

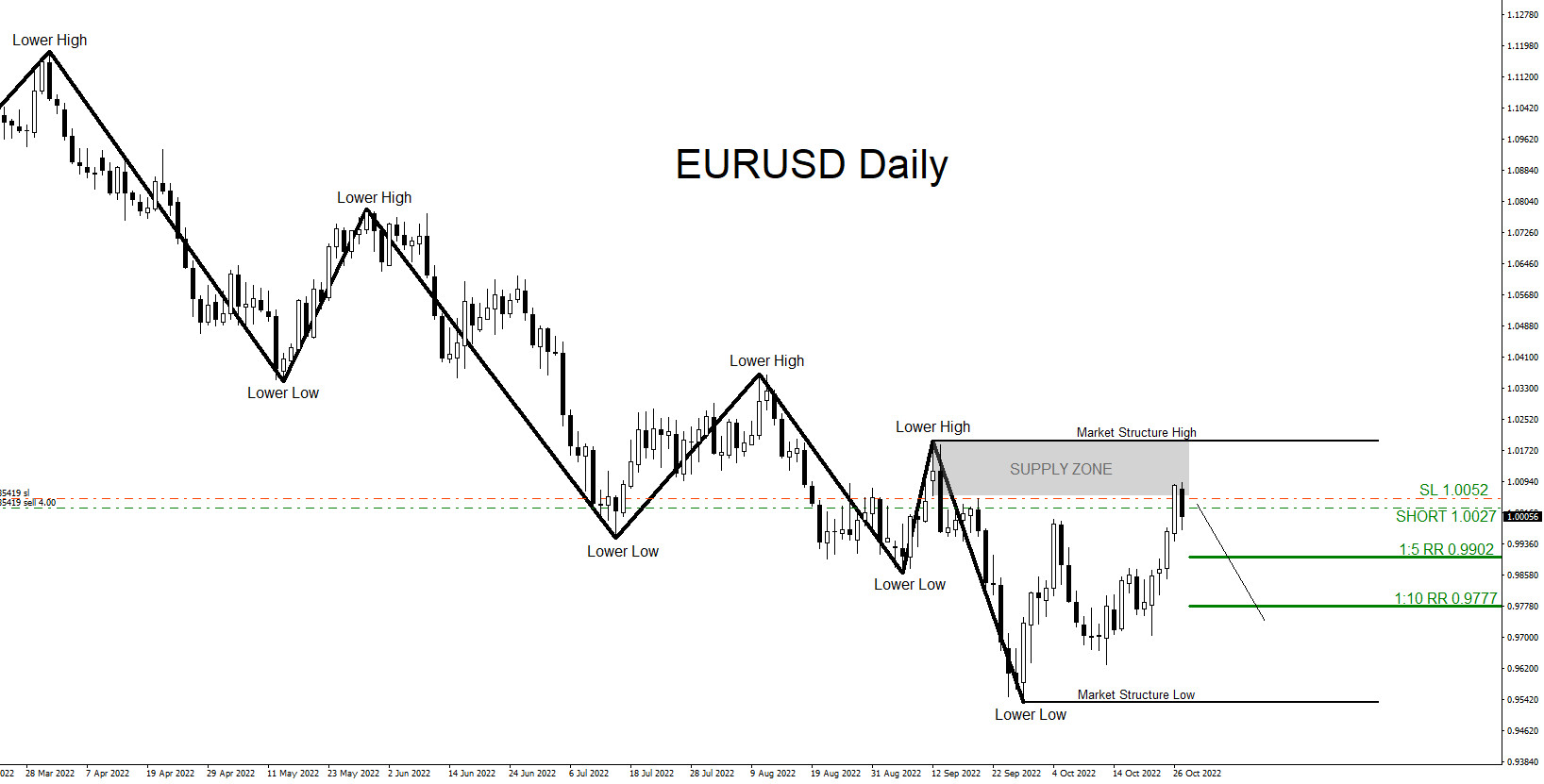

EURUSD : Higher Time Frame Analysis, Lower Time Frame Entry

Read MoreOn October 27 2022 the EURUSD pair entered a supply zone and reacted lower signalling a high probability SELL trade setup. On the daily chart, the pair has been trending lower making lower lows and lower highs. Traders should only be looking for SELL setups following the higher time frame trend and waiting for the […]

-

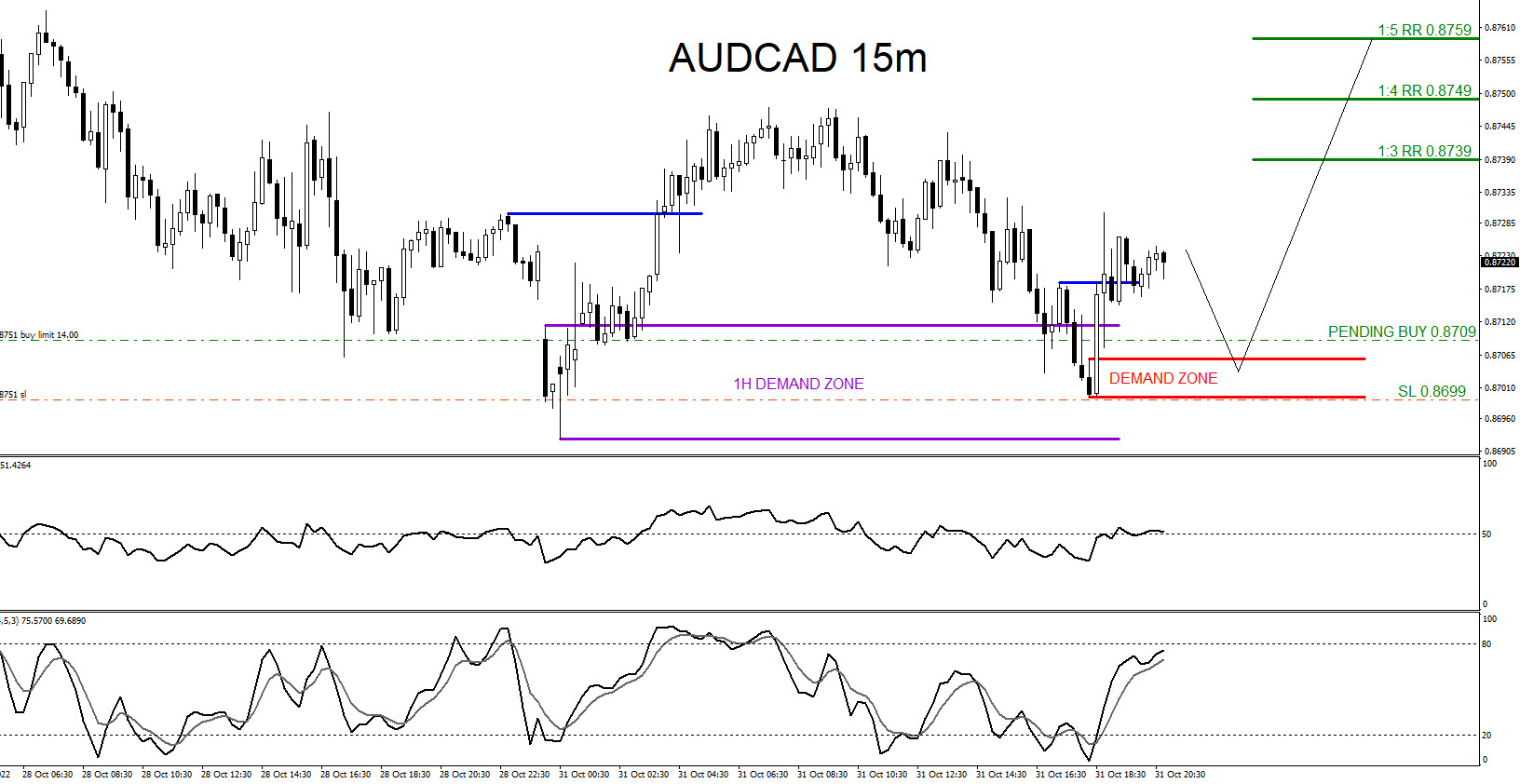

AUDCAD : Buy Trade Hits Targets

Read MoreOn October 31 2022 I posted the AUDCAD trade setup on social media @AidanFX “ LONG/BUY AUDCAD at 0.8709 Stop Loss 0.8699 TP 0.8739 (1:3RR) 0.8749 (1:4RR) 0.8759 (1:5RR)“ Buy Trade Setup 1. Price reacting higher from the 1 Hour Demand Zone signalling possible move higher (Purple) 2. Price broke above the downward Lower Low/Lower […]