-

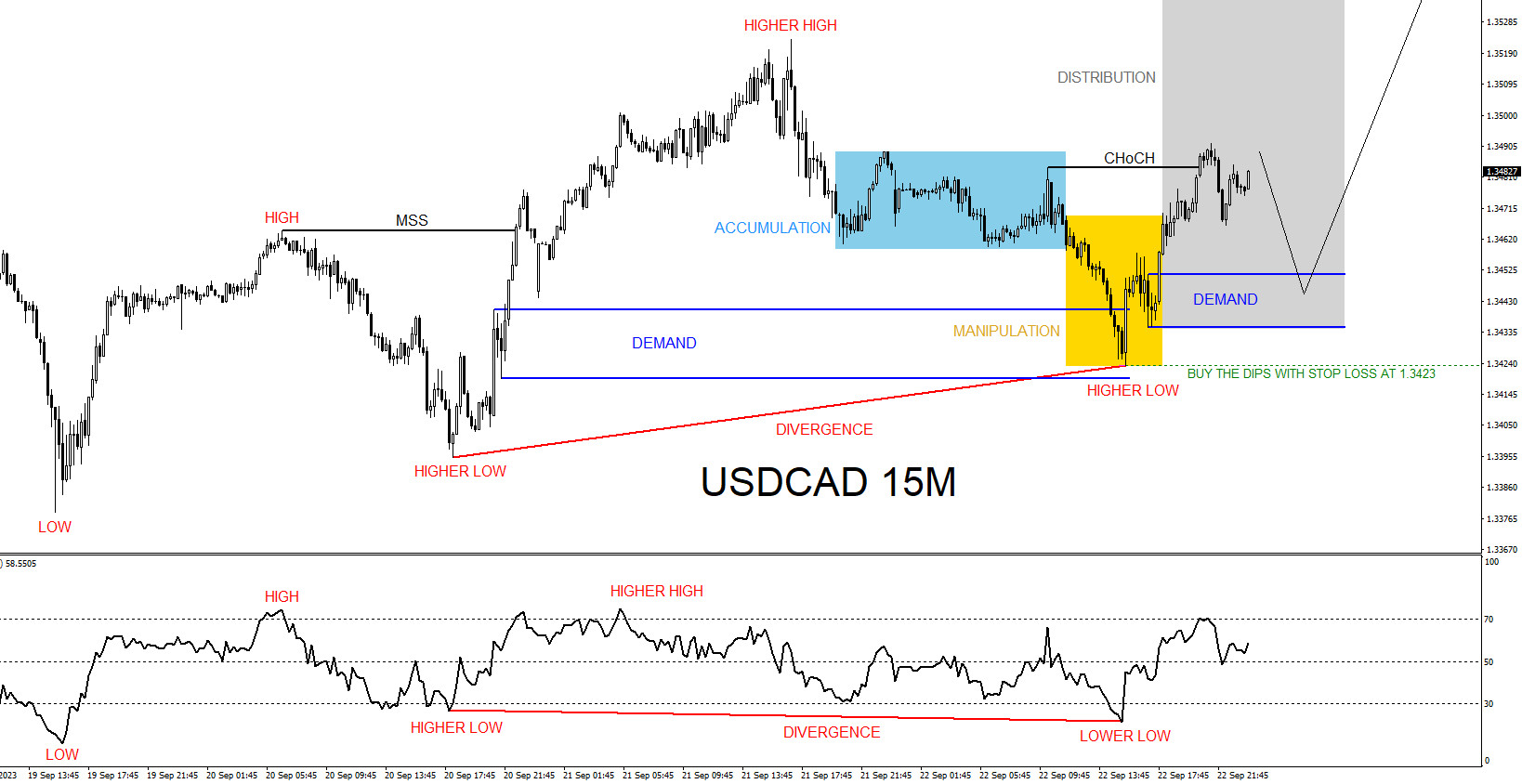

USDCAD : Catching the 80 Pip 1:4 Risk/Reward Move Higher

Read MoreOn September 24 2023 I posted on social media, @AidanFX , a USDCAD 15 Minute chart signalling for buys on a dip lower. BUY Trade Setup 1. Trending up on a higher high / higher low sequence signalling bullish bias. 2. Price has bounced off the first demand zone and a bullish divergence pattern signalling more […]

-

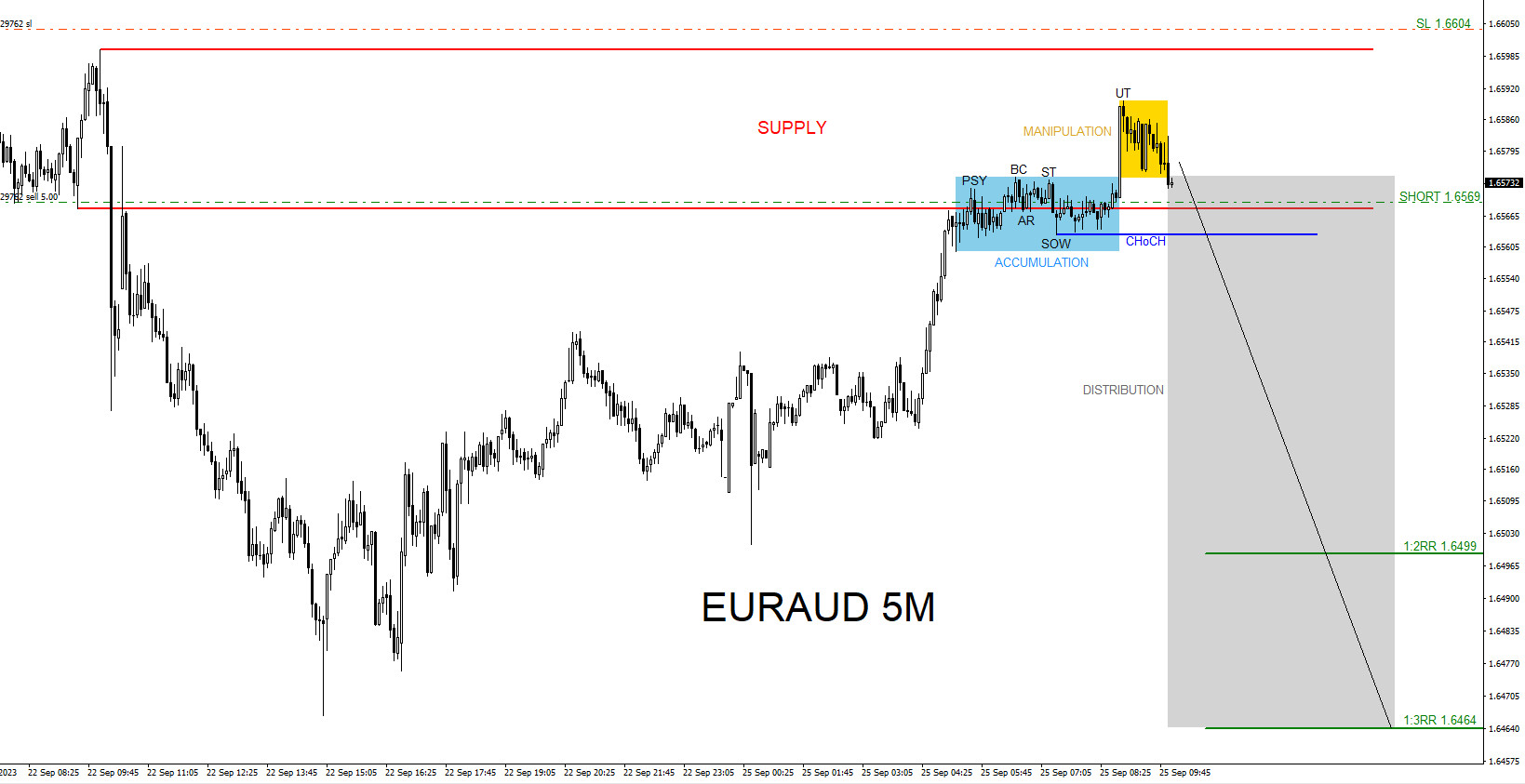

EURAUD : Sell Trade Hits Targets

Read MoreThe EURAUD pair has been on a down trend since August of 2023. We at EWF always encourage our members to trade with the trend and not against it. On September 24 2023 I posted on social media @AidanFX ” EURAUD sold at 1.6569 Stop Loss at 1.6604 Target at 1.6499.” SELL Trade Setup 1. […]

-

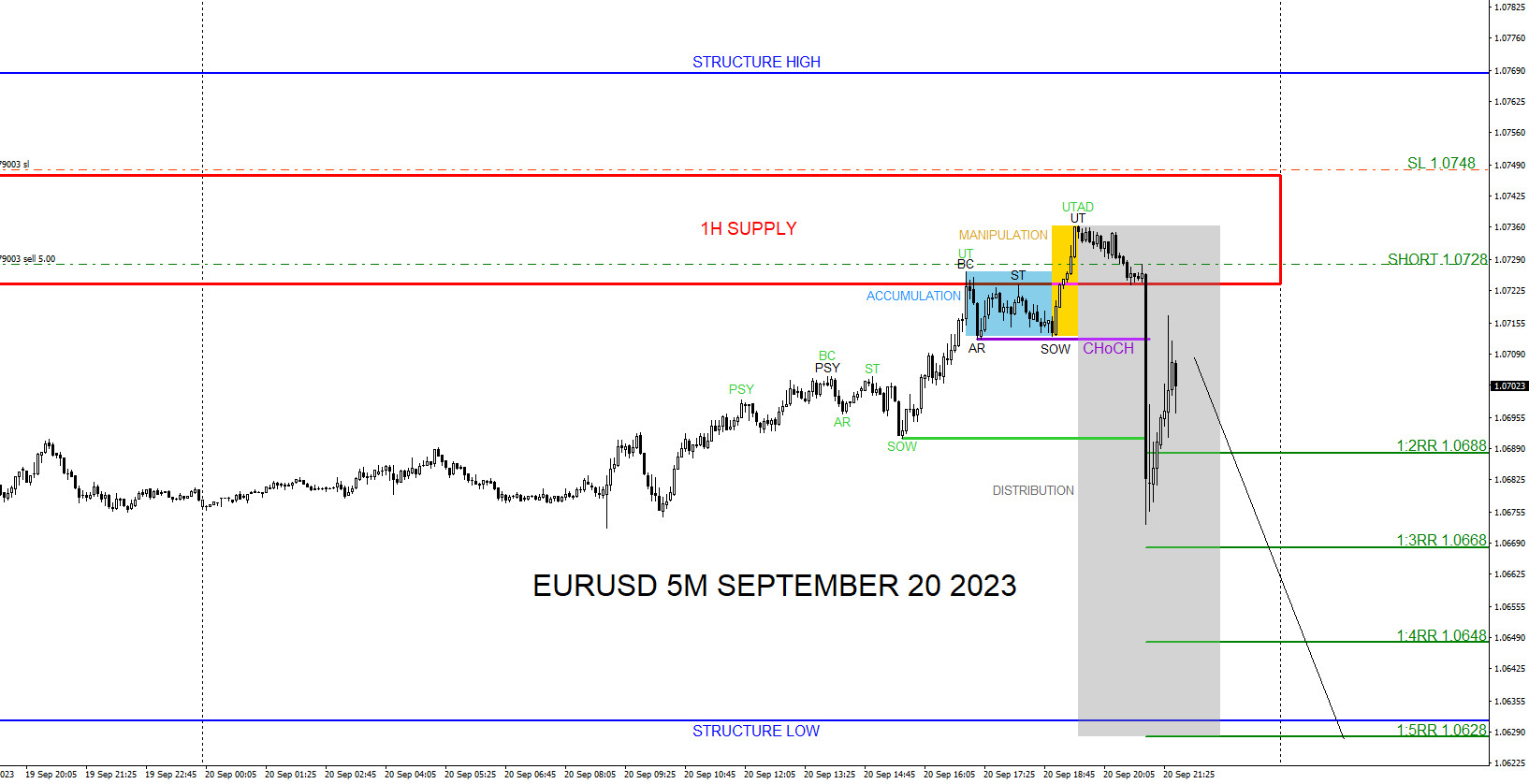

EURUSD : Catching the 100 Pip 1:5 Risk/Reward Move Lower

Read MoreThe EURUSD pair has been on a down trend since July of 2023. As the saying goes, trade with the trend and not against it. SELL Trade Setup 1. Price entered the 1 Hour supply zone area where sellers are waiting to push price lower. (Red) 2. Double bearish Wyckoff distribution schematic patterns (Green and […]

-

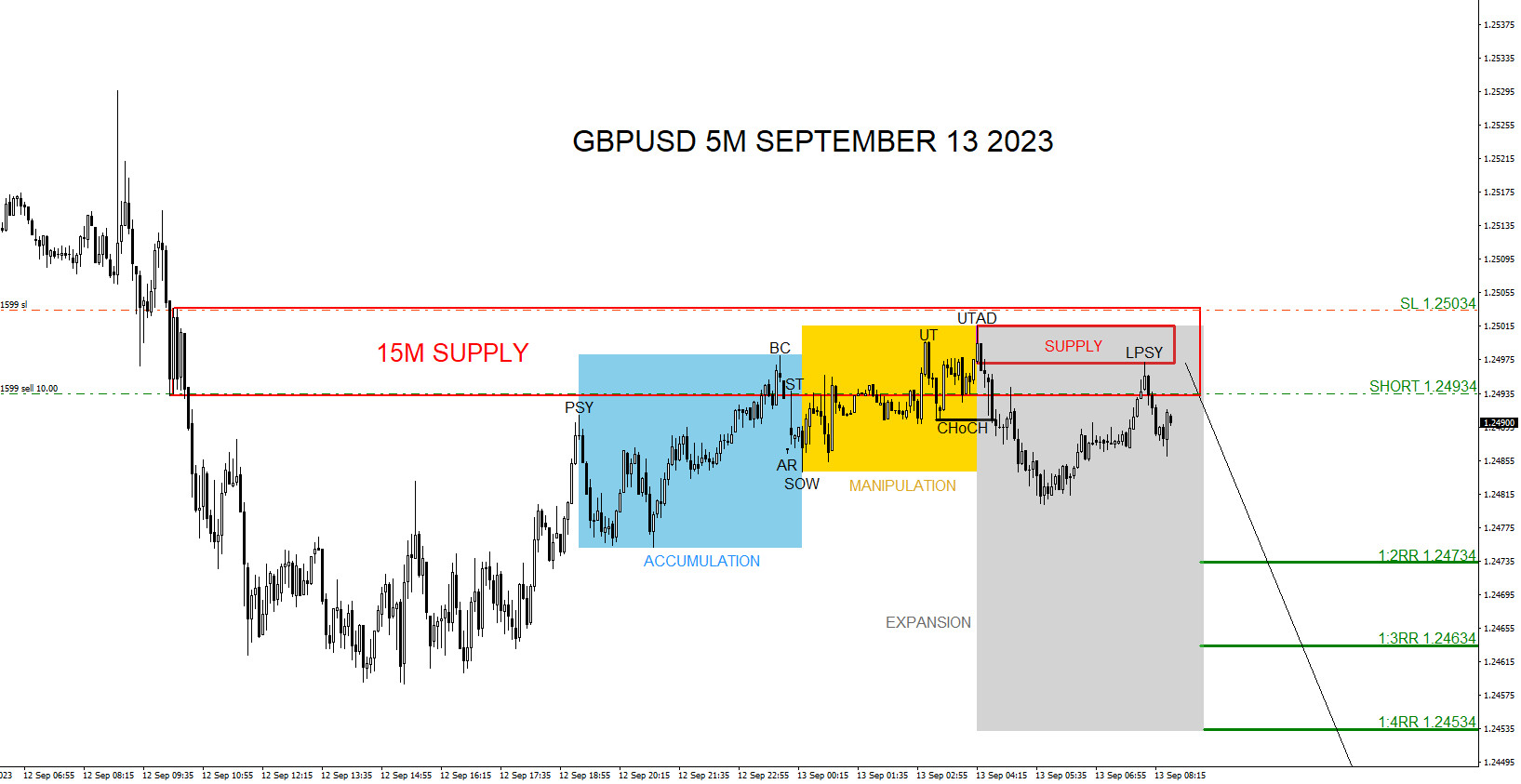

GBPUSD : Sell Trade Hits Targets

Read MoreThe GBPUSD pair has been on a down trend since July of 2023. As the saying goes, trade with the trend and not against it. SELL Trade Setup 1. Price entered the 15 minute supply zone signalling area where sellers are waiting to push price lower. (Red) 2. Price breaks below internal structure higher low […]

-

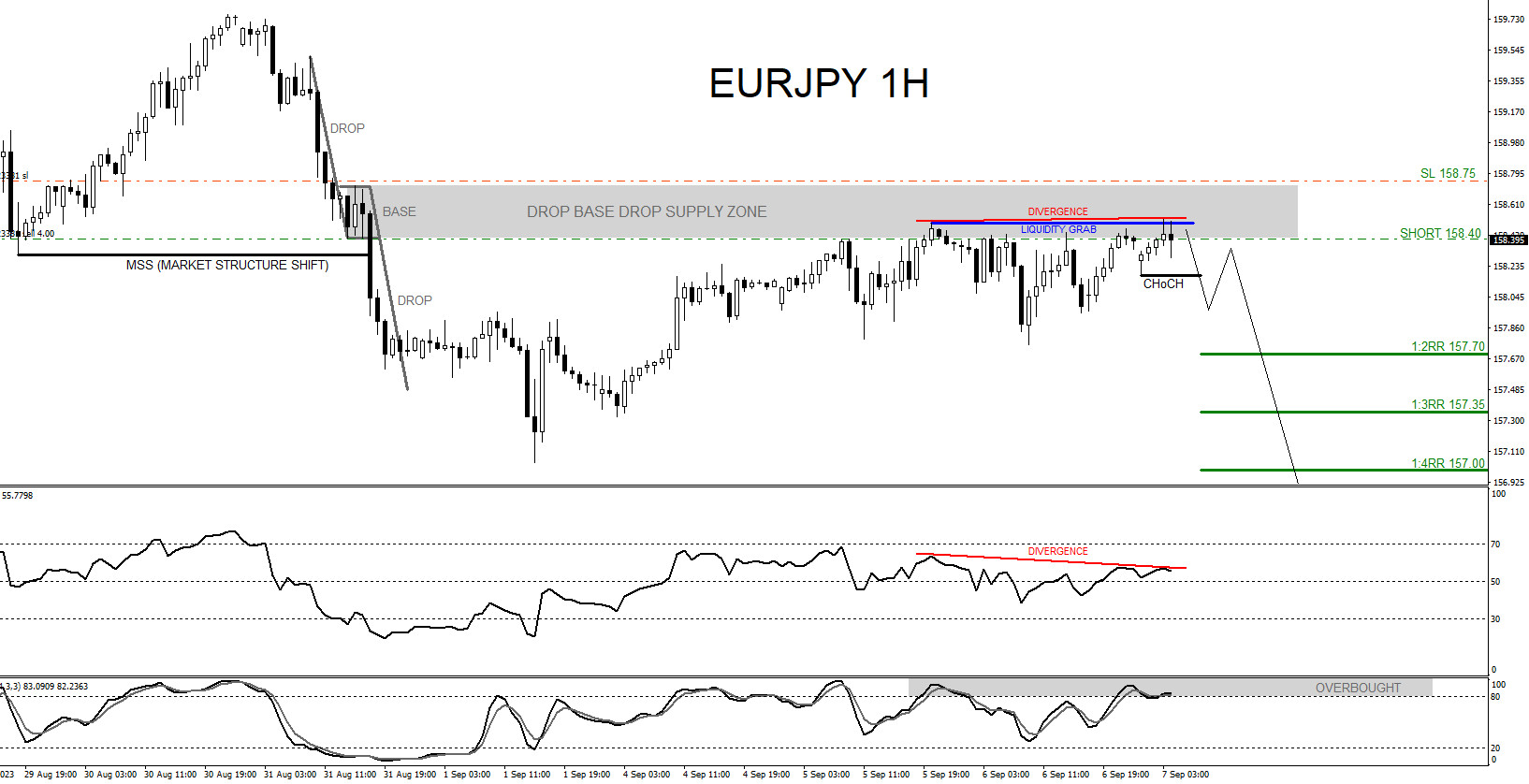

EURJPY : Sell Trade Hits Targets

Read MoreOn September 7 2023 EURJPY was showing signals that the pair would extend lower. Below I will explain the reasons why I entered SELLS. Sell Trade Setup 1. Price breaks below the internal structure higher low black line (MSS/Market Structure Shift) signalling bearish weakness. 2. Price sweeps the September 5 2023 high for a liquidity […]

-

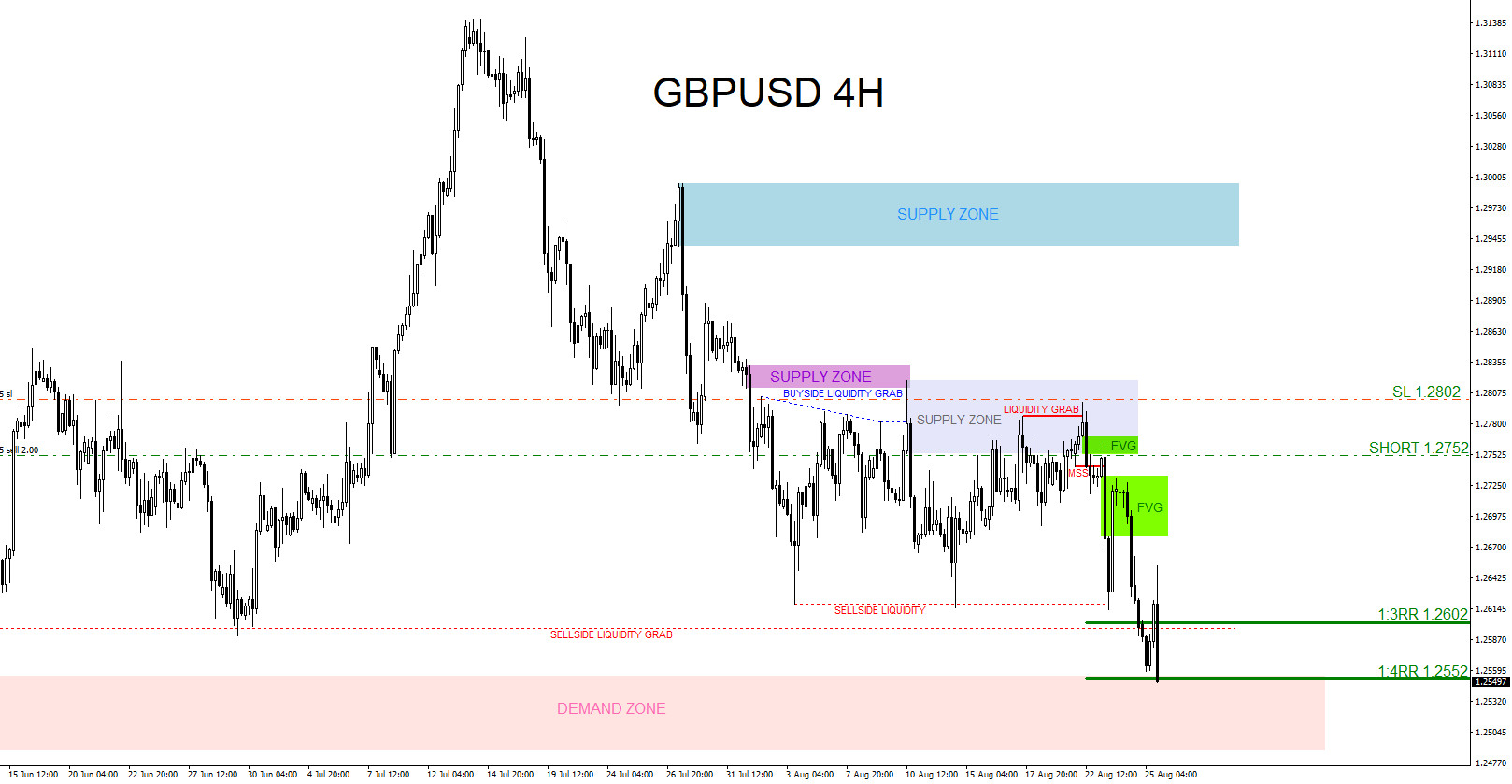

GBPUSD : Catching the 200 Pip 1:4 Risk/Reward Move Lower

Read MoreOn August 15 2023 I published an article ” GBPUSD : Trading Zones ” where I gave the area on which to look for selling opportunities. In the article I wrote where to look for sells, stop loss and target levels > “Waiting to sell in the supply zone (grey) 1.2754-1.2819 area with stops above […]