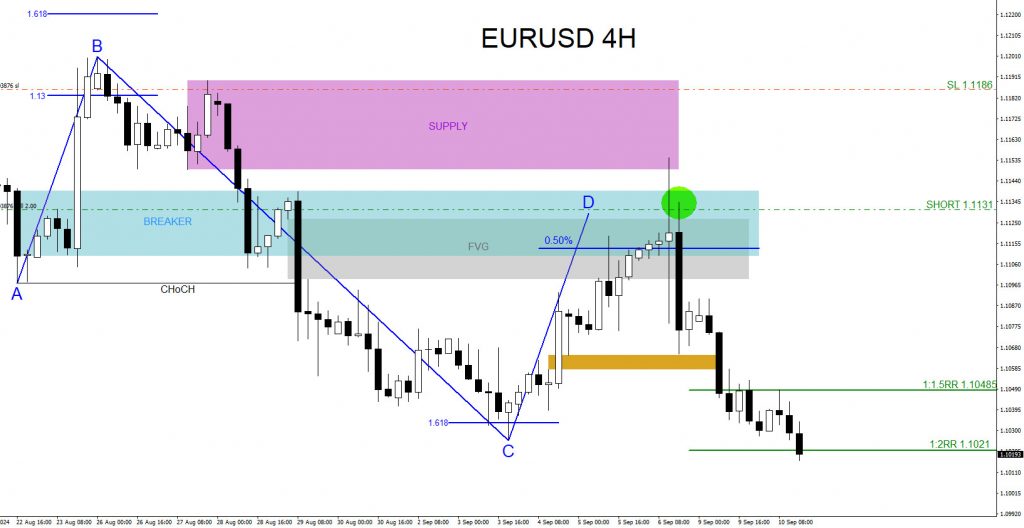

On September 6 2024 I posted on social media @AidanFX the EURUSD SELL chart. The pair entered a cluster of 4 hour bearish zones (Supply/FVG/Breaker) signalling for a possible move lower. Seeing how price pushed higher, wicked the supply zone then moved back lower and closed near the open of the 4 hour candle was a visible sign that bears/sellers were taking control. Added confirmation was the bearish reciprocal AB=CD pattern, the 4 hour candle close near the 0.50% of the pattern and candle body closing within the FVG/Breaker zones. All these combined was enough for me to squeeze the sell trigger with confidence.

EURUSD 4 Hour Chart September 6 2024 (Entry)

EURUSD 4 Hour Chart September 10 2024 (Target HIT / Trade Closed)

Entered the SELL trade September 6 2024 at 1.1131 with a 55 pip stop loss at 1.1186. On September 10 2024 EURUSD moved lower and the 1:2RR target hit at 1.1021 where I closed the sell trade for +110 pips and a +2% gain (Risking 1% on every trade).

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the EURUSD move lower.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

Back