EURJPY Technical Analysis

On April 14/2020 I posted on social media (Stocktwits/Twitter) @AidanFX the SELL trade setup “Sell EURJPY @ 117.67 Stop Loss @ 117.93 Target @ 117.15“

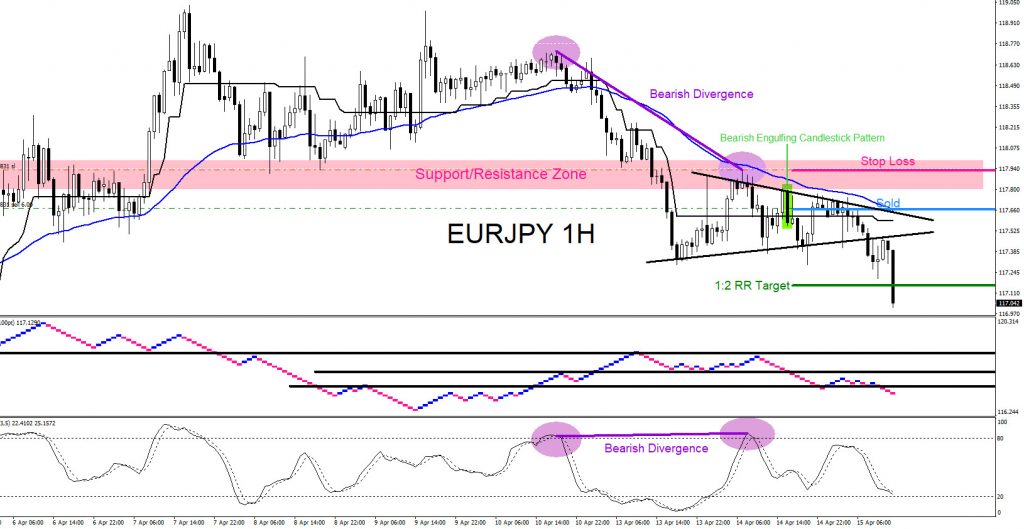

EURJPY 1 Hour Chart April 14.2020 : The chart below was also posted on social media (StockTwits/Twitter) @AidanFX April 14/2020 showing that price hit a clear Support/Resistance Zone (pink) and reacted with a move lower. Support/Resistance patterns should always be used with other technical strategies/techniques and should never be used to trade on it’s own. On the 1 hour chart there was a clear bearish trend continuation divergence pattern (purple) that formed after price respected the support/resistance zone and was followed by a bearish engulfing candlestick pattern (green) that also formed. These market patterns was enough confirmation to enter a SELL trade (light blue) and to post the SELL trade setup to the public. I called for traders on April 14/2020 to SELL at 117.67 with stops at 117.93 looking for a 1:2 RR target at 117.15.

EURJPY 1 Hour Chart April 15.2020 : Price remained trading below the 50 Moving Average (dark blue) offering more confirmation to continue holding the April 14/2020 SELL trade. On April 15/2020 the pair moves lower and hits the 1:2 RR target. Price moved below the target level and I eventually banked profits at 117.07 for +60 pips which I posted on social media -> “KA-CHING !!! $EURJPY Target HIT @ 117.15 from 117.67 and closed @ 117.07 +60 pips.” If you followed me on Twitter/Stocktwits you too could have caught the EURJPY move lower.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back