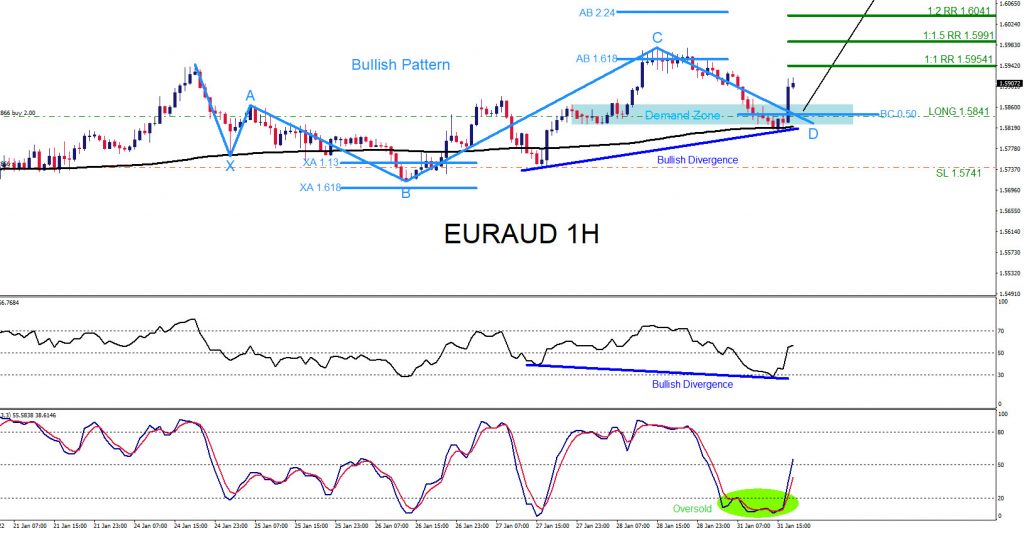

On January 31 2022 I posted on social media @AidanFX “ EURAUD Watch for buying opportunities as long as price stays above 1.5741.“

Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Head and Shoulders etc.), price action analysis (Support & Resistance, Supply & Demand Zones, Candlestick analysis etc.) and indicators (RSI, Moving Average, Stochastic etc.) are technical strategies/techniques used when trading a confluence setup. The charts below show a confluence trade setup that signals a trader on which side to take the trade.

BUY Trade Setup

1. RSI Indicator Bullish Trend Continuation Divergence (Dark Blue)

2. Price respects the Dynamic Support 200 MA (Black)

3. Price respects Demand Zone (Blue Box)

4. Bullish Market Pattern (Light Blue)

5. Stochastic Indicator in oversold levels

6. Bullish AB=CD Patterm (Pink)

EURAUD 1 Hour Chart January 31 2022

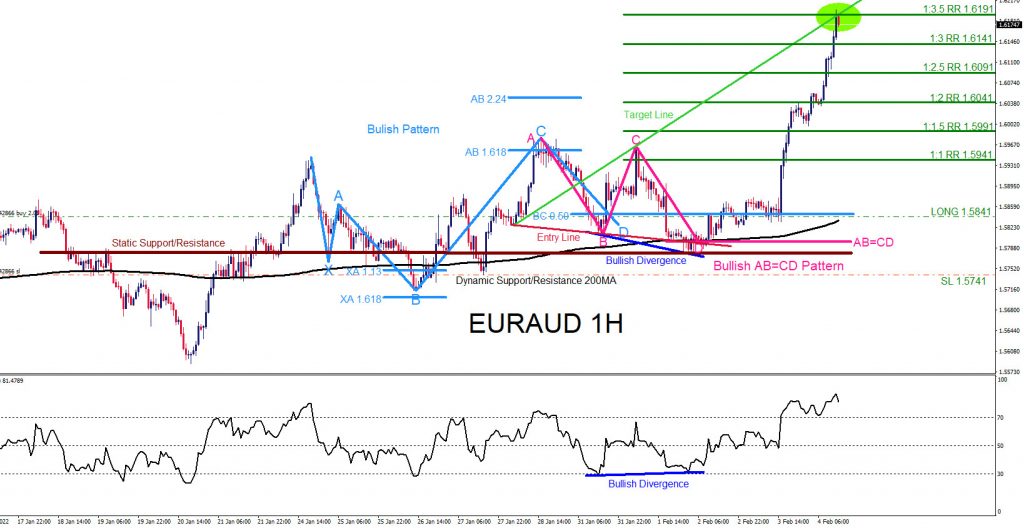

Entered the BUY trade at 1.5841 with Stop Loss at 1.5741 and Targets at the 1:1 – 1:1.5 RR minimum area. EURAUD moves higher, blows past the minimum target area and on February 4 2022 price hits the Bullish Wolfe Pattern Target Line and the 1:3.5 RR target at 1.6191 from 1.5841 for +350 pips (+3.5% gain risking 1% on every trade)

EURAUD 1 Hour Chart February 4 2022

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the EURAUD move higher. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

Back