AUDUSD Technical Analysis

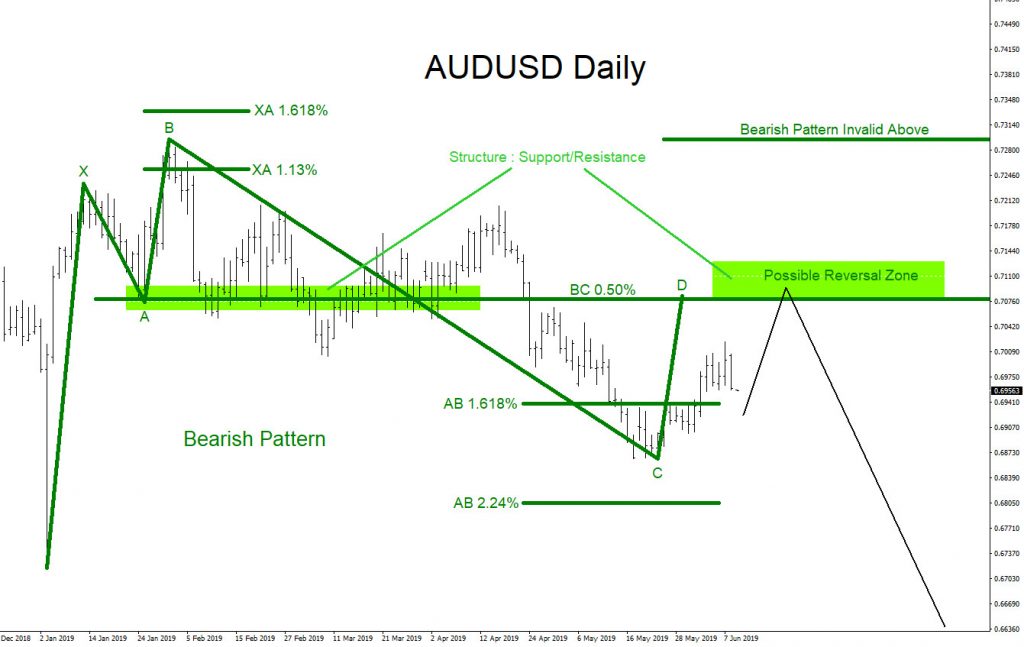

AUDUSD: On June 10/2019 I posted on Twitter @AidanFX a possible bearish market pattern. On the Daily chart AUDUSD has been trending lower since 2018 so it would only make sense to follow the trend and continue to look for possible selling opportunities. The chart below shows the possible reversal zone where AUDUSD can sell off from and where sellers/bears can be waiting to push the pair lower.

AUDUSD Daily Chart June 10/2019

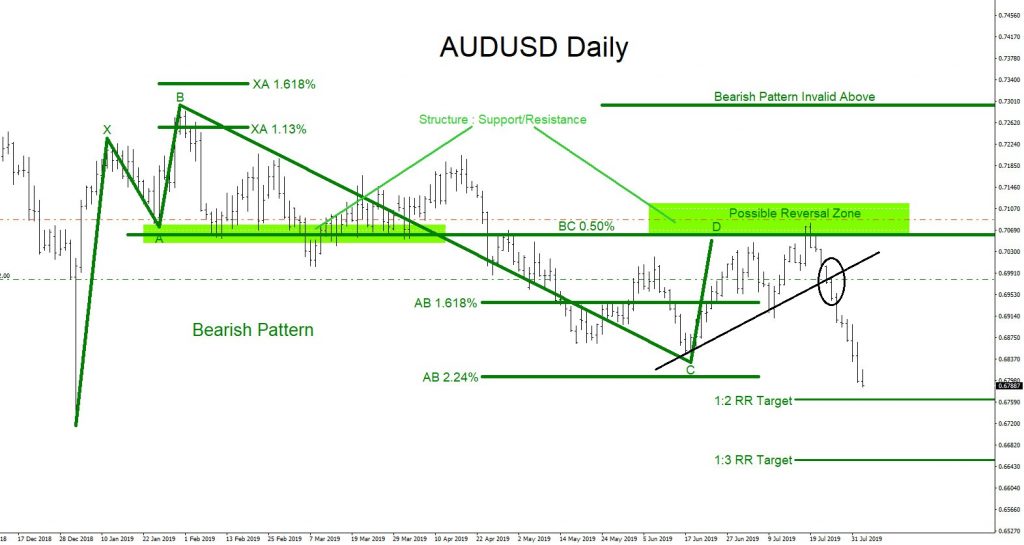

In the chart below, AUDUSD did not move higher to the reversal zone from the June 10/2019 Daily chart and instead made another push lower first. But on the push lower price stayed in the area of the AB 1.618% – 2.24% Fib. retracement levels where the point C of the green bearish pattern must terminate for the pattern to remain valid. After point C terminated the pair then pushed higher to the reversal zone and found sellers to complete the point D of the bearish pattern. The bearish market pattern triggered sells at the BC 0.50% Fib. retracement level where price was also met with a support/resistance structure to add more technical sellers to enter the market. More sellers eventually entered on the simple break below the black trend line which confirmed bears were in control. The break below the black trend line is where I entered the SELL trade with stops above the July 19/2019 high.

AUDUSD Daily Chart August 2/2019

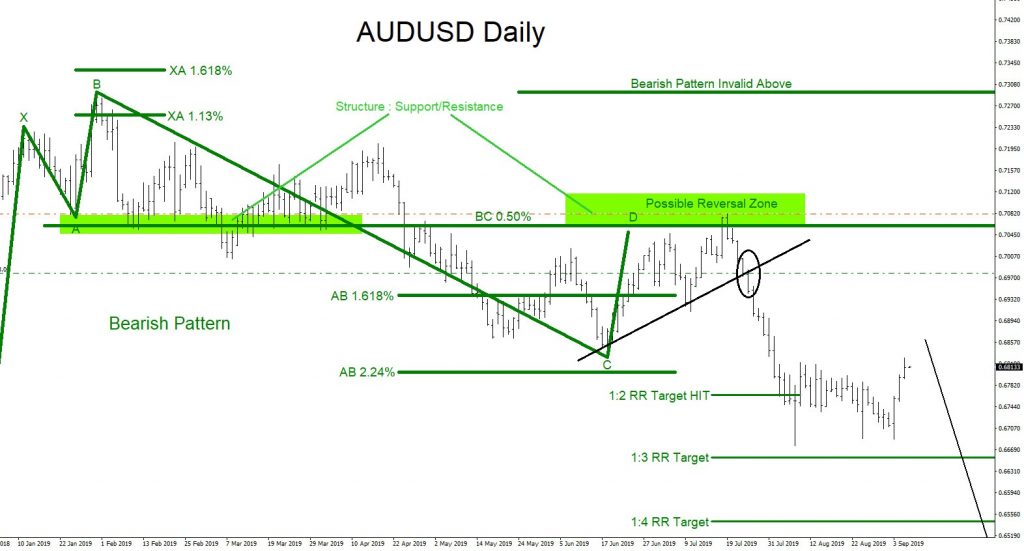

In the chart below, AUDUSD has tagged the 1:2 RR target making my trade a winner already. We continue to expect more downside to come in the following days/weeks and will need to watch and wait to see if price will tag my remaining targets. Always plan the trade and trade the plan.

AUDUSD Daily Chart September 5/2019

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back