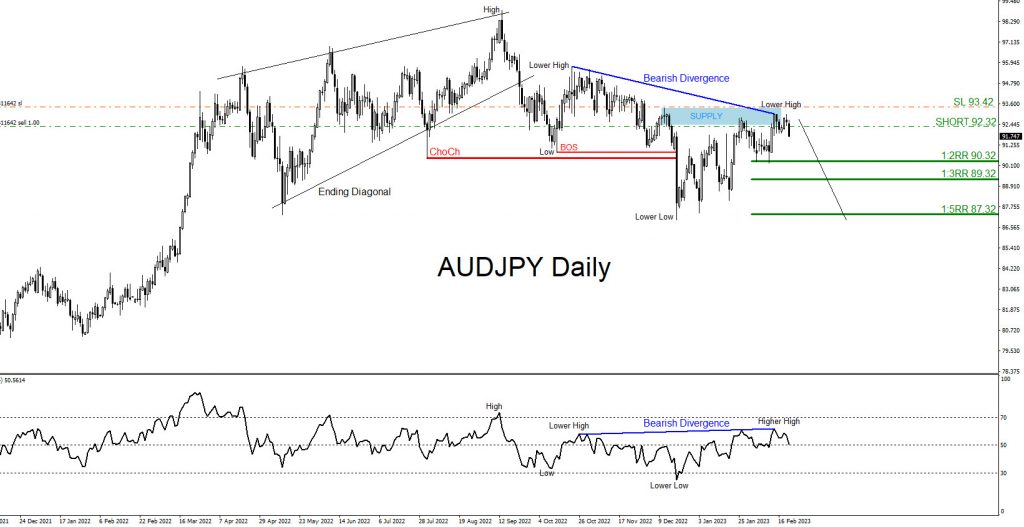

On January 31 2023 I published the article: AUDJPY : Possible Move Lower? calling for the pair to top out and reverse lower. There were several market patterns and signals calling for a move lower.

SELL Trade Setup

1. Ending diagonal pattern calling for reversal lower. (Black)

2. Price trending lower making a lower low and lower high.

3. The pair broke the previous higher high / higher low sequence signalling a change of character. (Red ChoCh)

4. After lower low forms price re-traces higher and enters the supply zone where sellers are waiting to push the pair lower. (Blue box)

5, Bearish AB=CD pattern forms with point D terminating in the supply zone adding more bearish confluence. (Purple)

6. Bearish divergence forms in the the supply zone adding more confirmation the pair will reverse and continue lower. (Dark blue)

AUDJPY Daily Chart February 22 2023

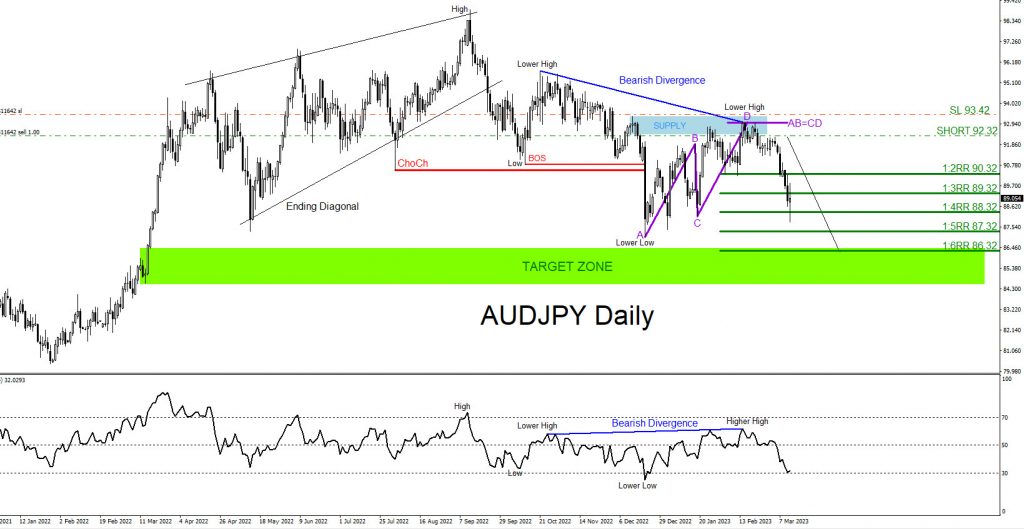

AUDJPY Daily Chart March 13 2023

*TYPO Stop Loss in the charts above should read 93.32 not 93.42*

SELL trade entered at 92.32 with Stop Loss at 93.32 and on March 13 2023 AUDJPY moved lower to the 1:4 RR target at 88.32 for a +400 pip move and a 1:4 Risk/Reward (Risking 1% on every trade) thus far. Will continue to hold position to the proposed target zone at the 1:6 RR 86.32 target with stops now lowered to 91.32 to lock in +100 pips +1%.

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the AUDJPY move lower. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

Back