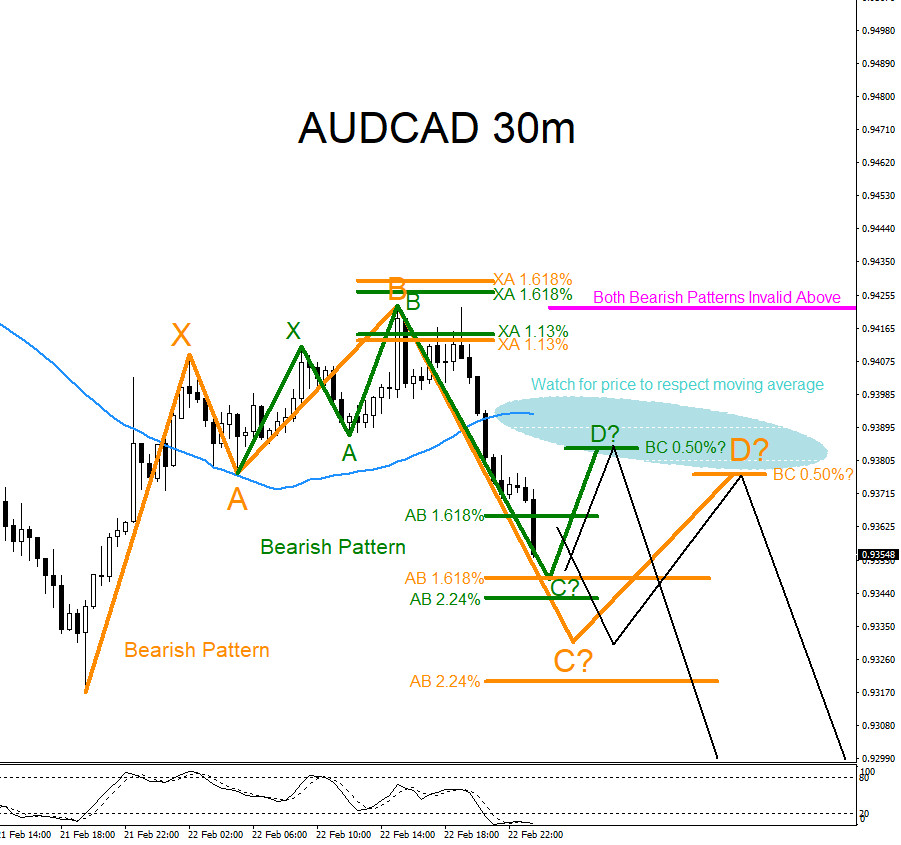

AUDCAD Technical Analysis February 24/2019

AUDCAD : Bearish market patterns can be seen on the AUDCAD 30 minute chart. In the chart below there are possible bearish patterns that can trigger SELLS if the market makes a minimal bounce higher. Both the green and orange bearish patterns triggers SELLS at the BC 0.50% Fib. retracement level so traders will need to watch if point C terminates and is followed by a bounce higher towards the point D. The first bearish pattern to watch will be the green pattern because the point C has already reached the minimum area (AB 1.618% – AB 2.24% Fib. retracement levels) where a bounce can possibly happen and if bounces higher will signal that the green point C has terminated. If the green point C clearly shows that it has terminated traders should look to SELL at the green point D (BC 0.50% Fib. retracement level) for another round lower. If the green pattern triggers the SELL and AUDCAD continues moving lower traders should next watch the possible orange bearish pattern. The bearish orange pattern will also need to terminate point C between the AB 1.618% – 2.24% Fib. retracement area and then followed by a bounce to point D (AB 0.50% level) where it can offer another SELL opportunity. Also added confirmation lower will be if price respects the 50 moving average and continues to stay below it. If looking to trade AUDCAD stops should be placed at the point B high of the green/orange bearish pattern and traders should be patient and wait for point C to terminate and bounce higher to the point D (BC 0.50% levels). Waiting to SELL/SHORT at the minimum BC 0.50% Fib. retracement level (green/orange) will offer a better risk/reward trade setup. As long as the February 22/2019 high holds AUDCAD has a strong probability of continuing lower. Only time will tell what AUDCAD will do but at least now you are aware of the possible area where the pair can reverse lower from.

AUDCAD 30 Minute Chart 2.24.2019

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back