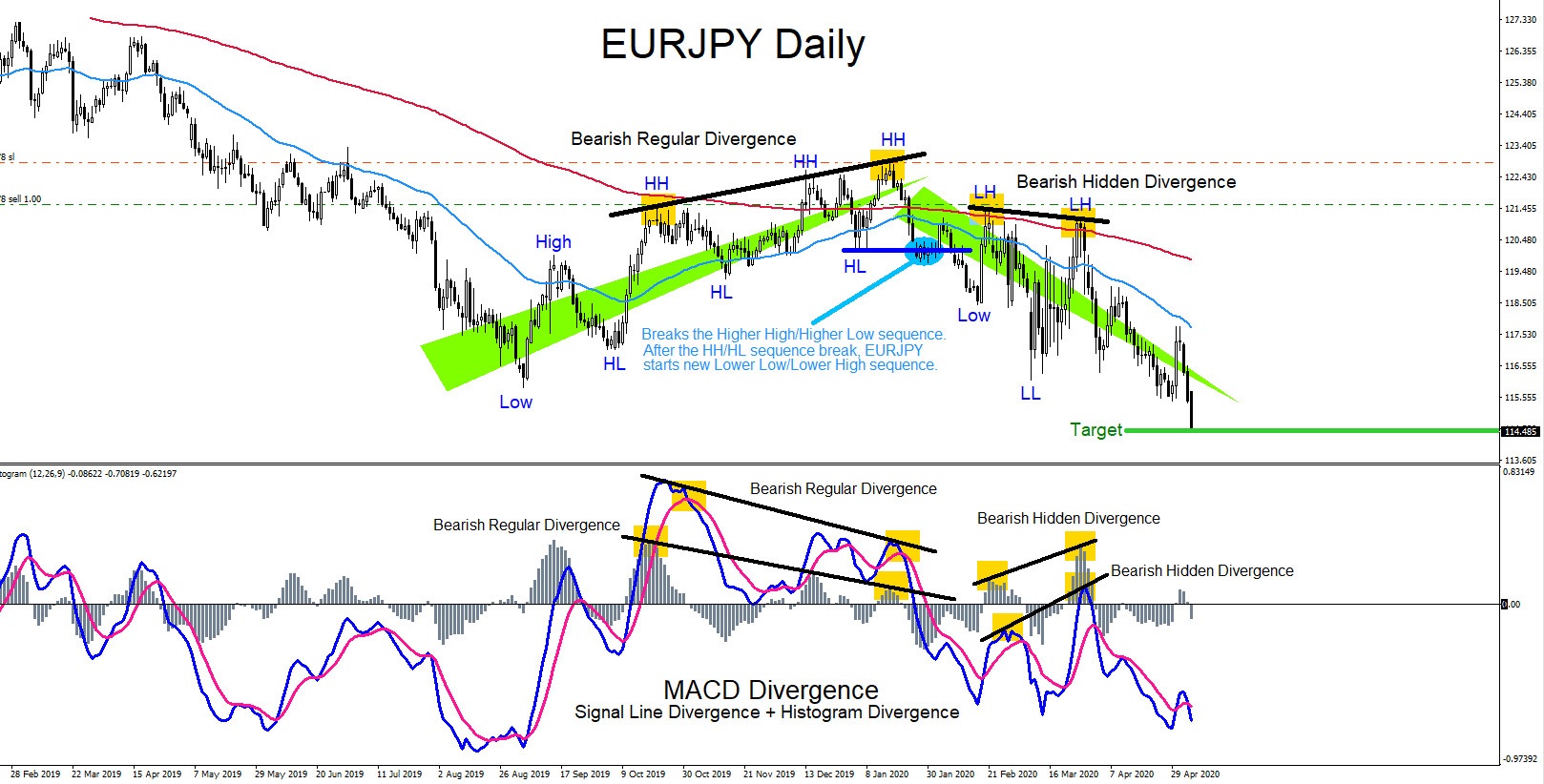

Divergence trading patterns can signal traders of possible trade setups. There are 2 types of divergence patterns, regular divergence and hidden divergence. Both patterns can signal a trader on which side to trade the market. A divergence pattern is when price is moving in one direction but the oscillator indicator is moving in a different direction. […]

-

USDCHF : Sell Trade Hits 3R Target

Read MoreOn June 25 of 2025 I posted on social media @AidanFX ” USDCHF look for sells for another continuation lower. ” Sell Setup Bearish trend continuation divergence pattern (Red). Price taps supply level and reacts with move lower (Black). The pair reacts lower in the manipulation time interval (Pink box). Price trades lower below the […]

-

EURUSD : Catching the Move Higher and Hitting 3R Target

Read MoreBefore the start of the June 16 2025 trading week we called for EURUSD to make a move higher in the blue box buy zone and showed our members the Elliott Wave bullish scenario. The EURUSD 1 Hour wave count below signalled to our members that the pair would bounce higher in the coming trading […]

-

XAUUSD : Holding Buys and Expecting a Move Higher Above 3500

Read MoreAt the moment I am holding 2 BUY entries and expecting XAUUSD to move higher above the 3500 handle. On June 3 2025 I published the trade setup article > XAUUSD : Trade Setup for a Move Higher where I called for the move higher. Let’s see if we can get a continuation push higher […]

-

Will USDJPY Move Lower?

Read MoreThe Elliott Wave chart of USDJPY below shows an a-b-c correction higher to terminate a possible blue wave (ii). As long as the blue wave (ii) terminates below 146.287 the bearish wave count is valid. Traders should be looking for only selling opportunities for the possible move lower. USDJPY 1 Hour Chart June 10 2025 […]

-

XAUUSD : Trade Setup for a Move higher

Read MoreThe XAUUSD chart below clearly shows a bounce higher from the grey demand zone bullish order block. After a clear bounce higher I posted the chart below on social media @AidanFX on May 28 2025 to buy on the retrace/correction lower. Price tapped the purple demand zone bullish order block where I entered the BUY […]

-

EURUSD : Two Sell Trades Hit Targets +8%

Read MoreOn May 1st and 2nd of 2025 I posted on social media @AidanFX the EURUSD Sell setup. EURUSD Daily Chart May 1 2025 (Sell Setup) EURUSD Daily Chart May 2 2025 (1st SELL Entry Green) EURUSD Daily Chart May 6 2025 (2nd Sell Entry Pink) EURUSD Daily Chart May 12 2025 (Targets HIT all SELL […]