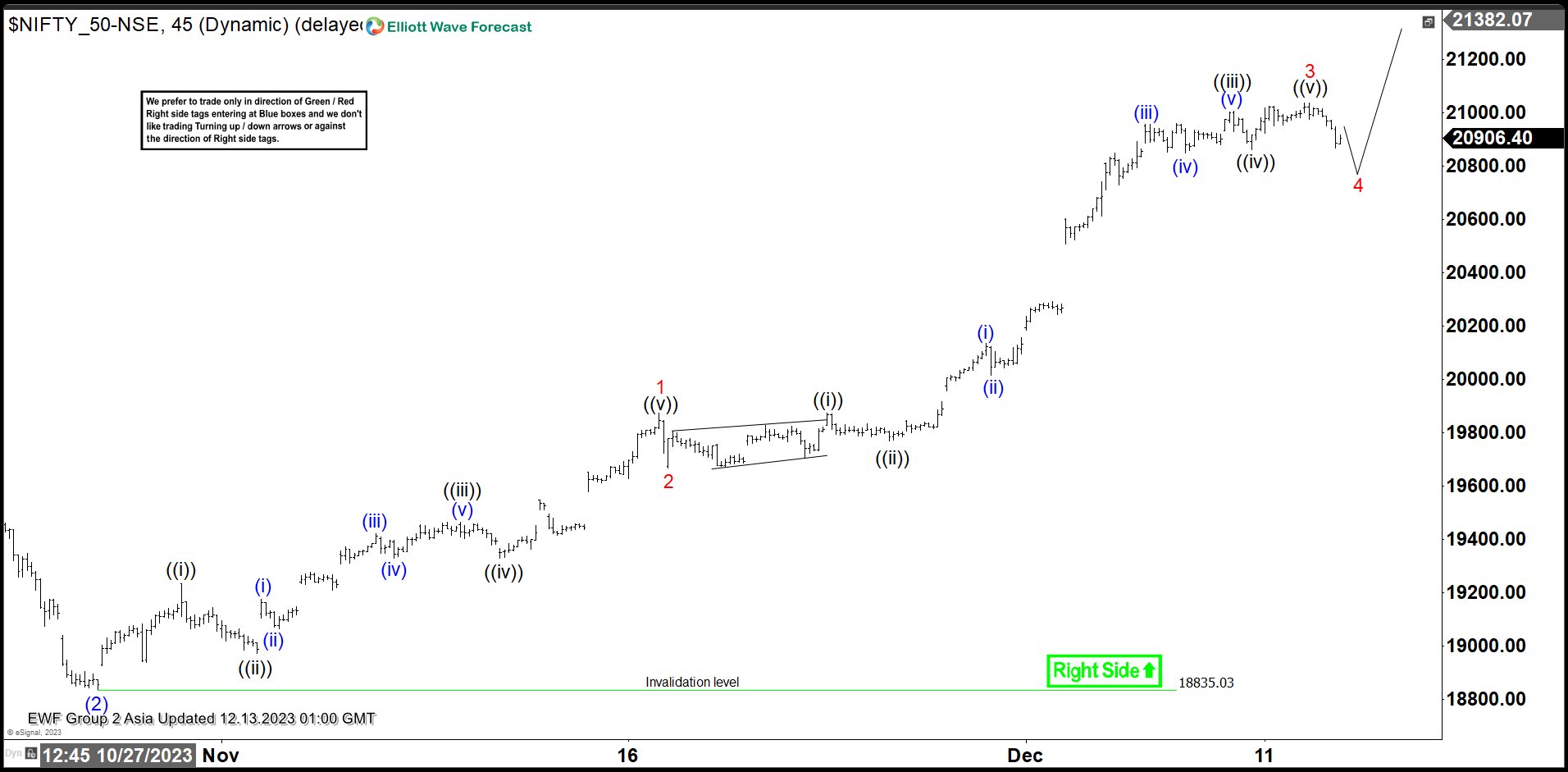

$NIFTY_50 cycle from 10.26.2023 low is in progress as a 5 waves impulse Elliott Wave structure. Up from wave (2) low, wave ((i)) ended at 19233.70 and pullback in wave ((ii)) ended at 18973.70. Index then extended higher in wave ((iii)) towards 19463.90 and wave ((iv)) pullback ended at 19329.45. Last push higher as wave ((v)) finished at completing wave 1. Wave 2 pullback was very shallow ending at 19667.45 low.

The 1 hour chart below shows the wave (2) pullback at 18837.85 and the subsequent rally higher. Up from wave (2), wave 1 ended at 119875.25 and shallow correction in wave 2 ended at 19667.45. The Index is then nesting to the upside in wave 3. Up from wave 2, wave ((i)) ended at 19875.15 and pullback in wave ((ii)) ended at 19768.85. Index then extended higher in wave ((iii)) towards 21006.10 and wave ((iv)) pullback ended at 20862.70. A slightly new high at 21037.90 ended wave ((v)) and complete wave 3. Currently, Nifty is pulling back in wave 4 and it should find support in 3, 7 or 11 swings before turning higher in wave 5. Once wave 5 is done, it should complete wave (3) in higher degree.