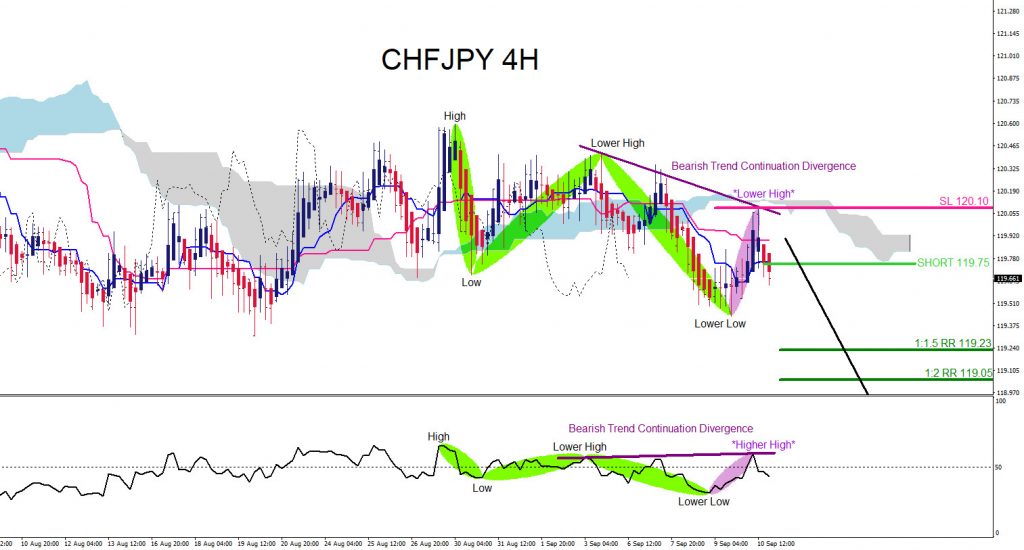

On September 12 2021 I posted on social media @AidanFX “ CHFJPY for coming trading week watch for selling opportunities as long price remains below 120.10 looking for a move lower towards 119.23 – 119.05 area. “

CHFJPY can be getting ready for a possible dip lower. In the 4 hour chart below, it is visible that the pair found a temporary top on the August 30 2021 high. The pair has since reversed lower forming a lower low/lower high sequence signalling traders the pair is on a down trend. What is also clearly visible is the pair broke below the August 27 2021 low which was the higher low of the previous bullish 3 swing sequence signalling a bearish view. A bearish trend continuation divergence pattern (purple) formed at the September 10 2021 high also signalling more downside. More added bearish sentiment is the Tenkan (blue) is below the Kijun (pink), price is below the Ichimoku cloud, the Chikou (black dotted) is below previous candles and the future Kumo cloud is bearish (grey). Watch for any selling opportunities near the 119.75 sell level with stops at 120.10. If price hits the 119.75 sell entry look for a dip lower towards the 1:1.5 RR minimum target with strong expectations for price to blow by the minimum target and dip lower to hit the 1:2 RR Target. Only time will tell what CHFJPY will do but for now we remain bearish.

CHFJPY 4 Hour Chart September 12 2021

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back