On 2nd August 2016, Our Strategy of the Day video presented to clients viewed the pull back in AUDCAD as a buying opportunity.

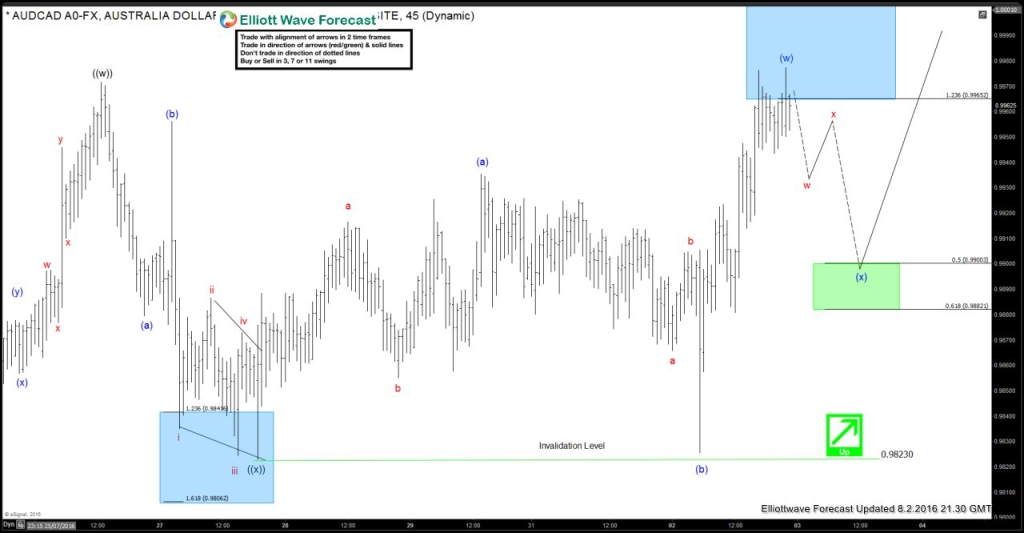

Long AUDCAD 8/02/2016

AUDCAD is showing incomplete bullish sequence from May 2016 lows & another incomplete sequence from July 21 lows which means the sequence is bullish against 0.9823 (7/27) low and against 0.9728 (7/21) low. Therefore, our strategy is to buy dips when reaches the 50-618% fib ret area (0.99-0.9882) in 3, 7 or 11 swings as far as pivot at 0.9823 (7/27) low remains intact in first degree.

Chart

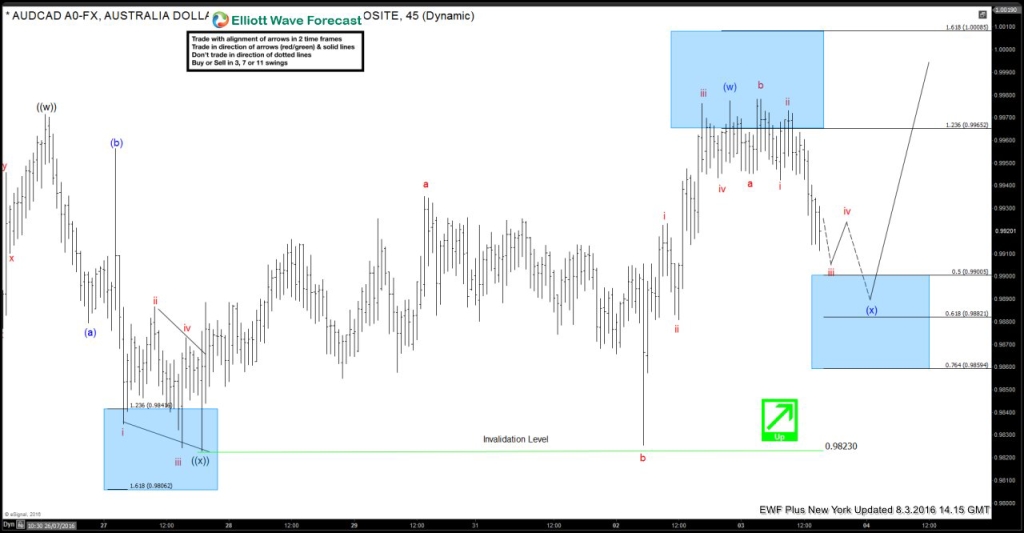

Structure of the pull back was not defined at the time of doing the video but we did get more definition going forward and chart below shows an inflection area which acted as an area of interest for the buyers.

Pair made a pull back as expected, found buyers around 0.9900 area and resumed the rally for a new high. Pair has already reached the initial target at 1.0054, the 100% extension up from 0.9823 low. While above 1.0005 low, it should ideally extend further to 1.0130 – 1.0225 area before making a larger 3 wave pull back but it’s late chasing strength at this stage of the cycles.

To access Strategy of the day and week videos, trading ideas and education, feel free to sign up for Free try us free for 14 days (available to new members only).